Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the Washi Nysret Ha Deen A s h dist TBF Vale endur TELLOWS AND H ERE NYESTE POSTER bir SEDUR. awari EN HIRO ALL N

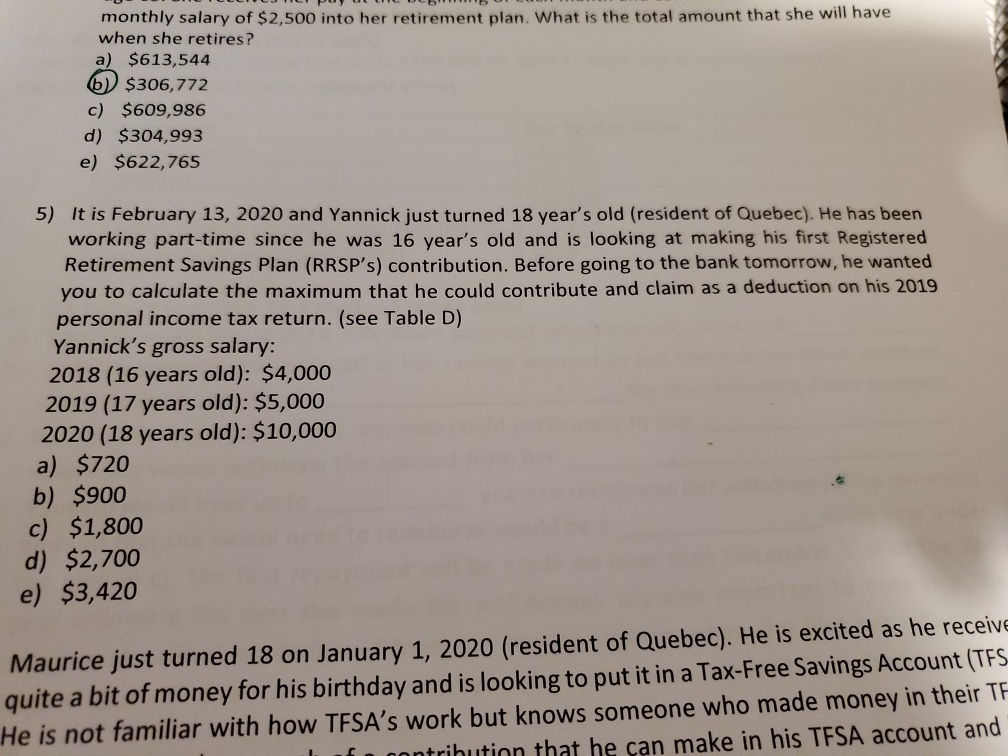

the Washi Nysret Ha Deen A s h dist TBF Vale endur TELLOWS AND H ERE NYESTE POSTER bir SEDUR. awari EN HIRO ALL N D AWNIKIWA EMAZERE FOR S WEIMAN WWW.FRAMLANAN www . LE PE CARE monthly salary of $2,500 into her retirement plan. What is the total amount that she will have when she retires? a) $613,544 6) $306,772 c) $609,986 d) $304,993 e) $622,765 5) It is February 13, 2020 and Yannick just turned 18 year's old (resident of Quebec). He has been working part-time since he was 16 year's old and is looking at making his first Registered Retirement Savings Plan (RRSP's) contribution. Before going to the bank tomorrow, he wanted you to calculate the maximum that he could contribute and claim as a deduction on his 2019 personal income tax return. (see Table D) Yannick's gross salary: 2018 (16 years old): $4,000 2019 (17 years old): $5,000 2020 (18 years old): $10,000 a) $720 b) $900 c) $1,800 d) $2,700 e) $3,420 Maurice just turned 18 on January 1, 2020 (resident of Quebec). He is excited as he receive quite a bit of money for his birthday and is looking to put it in a Tax-Free Savings Account (TFS He is not familiar with how TFSA's work but knows someone who made money in their TF lu o nntribution that he can make in his TESA account and the Washi Nysret Ha Deen A s h dist TBF Vale endur TELLOWS AND H ERE NYESTE POSTER bir SEDUR. awari EN HIRO ALL N D AWNIKIWA EMAZERE FOR S WEIMAN WWW.FRAMLANAN www . LE PE CARE monthly salary of $2,500 into her retirement plan. What is the total amount that she will have when she retires? a) $613,544 6) $306,772 c) $609,986 d) $304,993 e) $622,765 5) It is February 13, 2020 and Yannick just turned 18 year's old (resident of Quebec). He has been working part-time since he was 16 year's old and is looking at making his first Registered Retirement Savings Plan (RRSP's) contribution. Before going to the bank tomorrow, he wanted you to calculate the maximum that he could contribute and claim as a deduction on his 2019 personal income tax return. (see Table D) Yannick's gross salary: 2018 (16 years old): $4,000 2019 (17 years old): $5,000 2020 (18 years old): $10,000 a) $720 b) $900 c) $1,800 d) $2,700 e) $3,420 Maurice just turned 18 on January 1, 2020 (resident of Quebec). He is excited as he receive quite a bit of money for his birthday and is looking to put it in a Tax-Free Savings Account (TFS He is not familiar with how TFSA's work but knows someone who made money in their TF lu o nntribution that he can make in his TESA account and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started