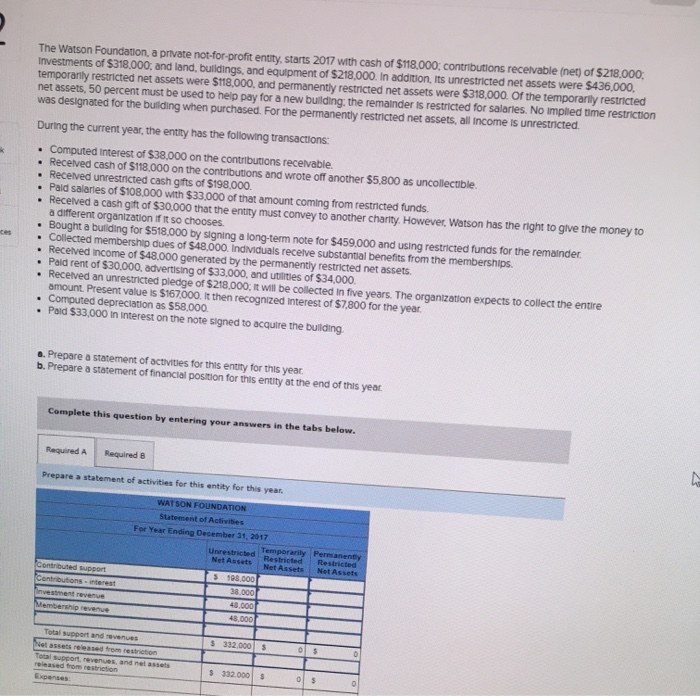

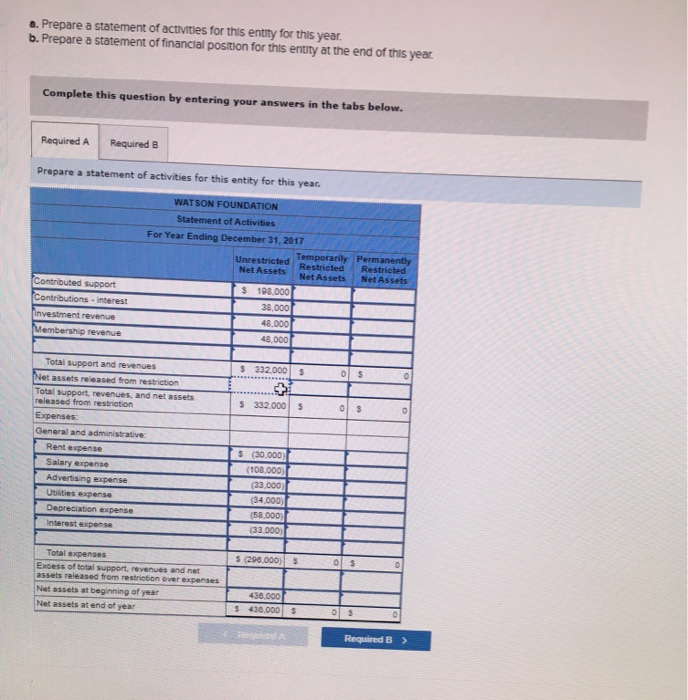

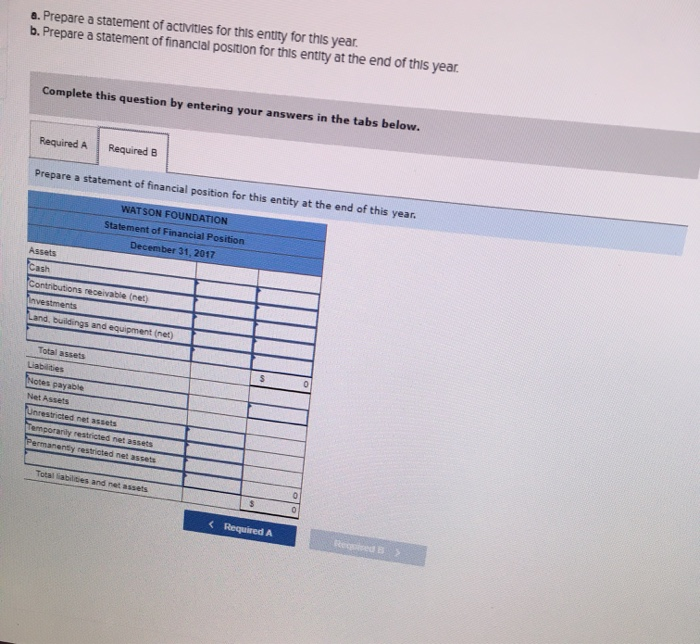

The Watson Foundation, a private not-for-profit entity, starts 2017 with cash of $118,000: contributions receivable (net) of $218.000. Investments of $318,000, and land, buildings, and equipment of $218,000. In addition, its unrestricted net assets were $436,000, temporarily restricted net assets were $118,000, and permanently restricted net assets were $318,000. Of the temporarily restricted net assets, 50 percent must be used to help pay for a new building the remainder is restricted for salaries. No implied time restriction was designated for the building when purchased. For the permanently restricted net assets, all income is unrestricted. During the current year, the entity has the following transactions: Computed Interest of $38,000 on the contributions receivable Received cash of $118.000 on the contributions and wrote off another $5.800 as uncollectible. Received unrestricted cash gifts of $198.000 Pald salaries of $108,000 with $33,000 of that amount coming from restricted funds. Received a cash gift of $30,000 that the entity must convey to another charity. However, Watson has the right to give the money to a different organization if it so chooses Bought a buliding for $518,000 by signing a long-term note for $459.000 and using restricted funds for the remainder Collected membership dues of $48.000. Individuals receive substantial benefits from the memberships Received income of $48.000 generated by the permanently restricted net assets. Pald rent of $30,000. advertising of $33.000, and utilities of $34.000 Received an unrestricted pledge of $218.000. It will be collected in five years. The organization expects to collect the entire amount Present value is $167.000. It then recognized Interest of $7.800 for the year Computed depreciation as $58.000 Paid $33,000 in Interest on the note signed to acquire the building a. Prepare a statement of activities for this entity for this year b. Prepare a statement of financial position for this entity at the end of this year. Complete this question by entering your answers in the tabs below. Required A Required Prepare a statement of activities for this entity for this year. WATSON FOUNDATION Statement of Activities For Year Ending December 31, 2017 Temporarily Permanently Net Assets NetAssets Net Assets 5 108.000 Contributed support Cartoons rest 38.000 48.000 Membership revenue 48.000 3320005 Total support and revenues estrelased to restriction To controvers and news 332.000 05 a. Prepare a statement of activities for this entity for this year. b. Prepare a statement of financial position for this entity at the end of this year. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a statement of activities for this entity for this year. WATSON FOUNDATION Statement of Activities For Year Ending December 31, 2017 Temporarily Permanently UnrestrictedRestrictedRestricted Net Assets AssetsNet Assets s 198.000 38.000 48.000 48,000 Contributed support Contributions interest Investment revenue Membership revenue 3 3 0 3 0 332.000 2 332000 3 3 0 Total support and revenues Net assets released from restriction Total support, revenues, and net assets released from restriction Expenses General and administrative Rent expense s Salary expense Advertising expense Utilities expense Depreciation expense interest expense (30,000 (108.000) (3.000) (34,000) (58.000; ( 33.000 5 (200.000) 3 Total expenses Excess of total support, revenues and net assets released from restriction over expenses Net assets at beginning of year Net assets at end of year 436,000 430,000 $ R Required B > a. Prepare a statement of activities for this entity for this year. b. Prepare a statement of financial position for this entity at the end of this year. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a statement of financial position for this entity at the end of this year. WATSON FOUNDATION Statement of Financial Position December 31, 2017 Assets Contributions receivable (net) Investments Land, buildings and equipment (net) Total assets Liabilities Notes payable Net Assets Unrestricted net assets Temporarily restricted net assets Permanently restricted net assets Total abilities and not assets