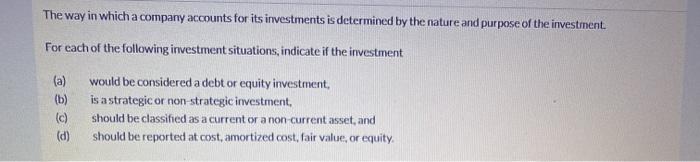

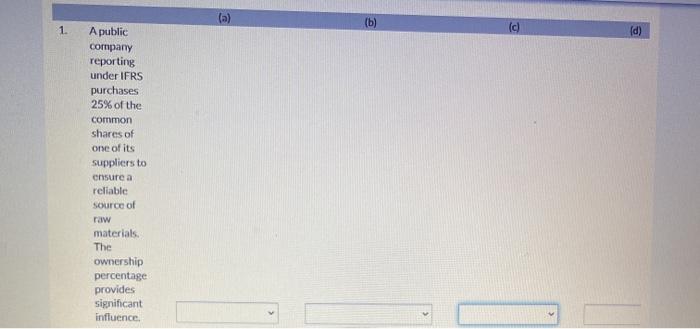

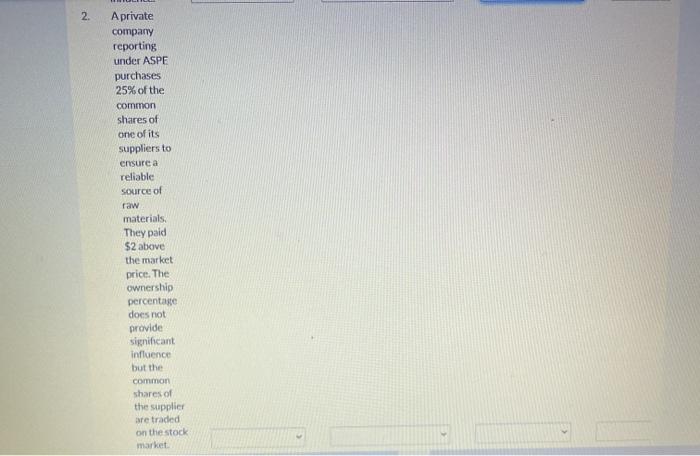

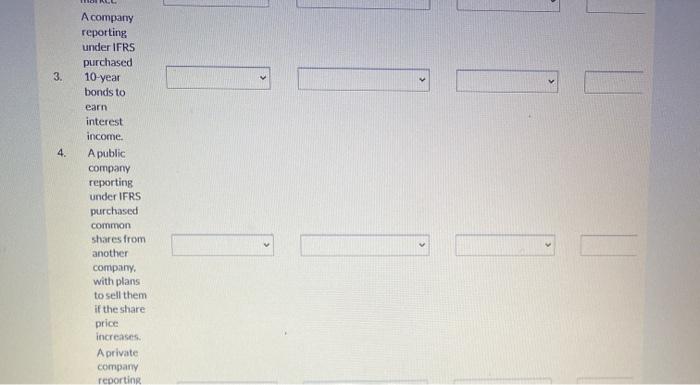

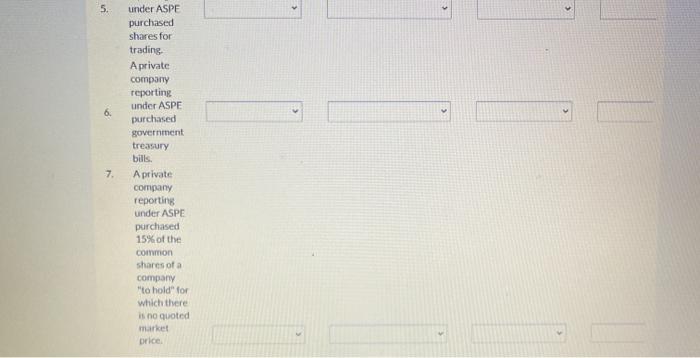

The way in which a company accounts for its investments is determined by the nature and purpose of the investment For each of the following investment situations, indicate if the investment (a) (b) (c) (d) would be considered a debt or equity investment, is a strategic or non-strategic investment should be classified as a current or a non current asset and should be reported at cost, amortized cost, fair value, or equity. 2. A private company reporting under ASPE purchases 25% of the common shares of one of its suppliers to ensure a reliable source of raw materials, They paid $2 above the market price. The ownership percentage does not provide significant Influence but the common shares of the supplier are traded on the stock market 3. 4. Acompany reporting under IFRS purchased 10-year bonds to earn interest income Apublic company reporting under IFRS purchased common shares from another company with plans to sell them if the share price increases Aprivate company reporting 5. > > 6. 7. under ASPE purchased shares for trading Aprivate company reporting under ASPE purchased government treasury bills. Aprivate company reporting under ASPE purchased 15% of the common shares of a company "to hold for which there is no quoted market price The way in which a company accounts for its investments is determined by the nature and purpose of the investment For each of the following investment situations, indicate if the investment (a) (b) (c) (d) would be considered a debt or equity investment, is a strategic or non-strategic investment should be classified as a current or a non current asset and should be reported at cost, amortized cost, fair value, or equity. 2. A private company reporting under ASPE purchases 25% of the common shares of one of its suppliers to ensure a reliable source of raw materials, They paid $2 above the market price. The ownership percentage does not provide significant Influence but the common shares of the supplier are traded on the stock market 3. 4. Acompany reporting under IFRS purchased 10-year bonds to earn interest income Apublic company reporting under IFRS purchased common shares from another company with plans to sell them if the share price increases Aprivate company reporting 5. > > 6. 7. under ASPE purchased shares for trading Aprivate company reporting under ASPE purchased government treasury bills. Aprivate company reporting under ASPE purchased 15% of the common shares of a company "to hold for which there is no quoted market price