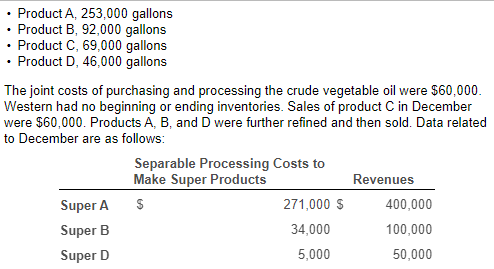

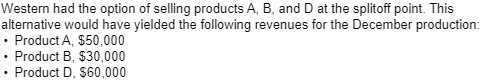

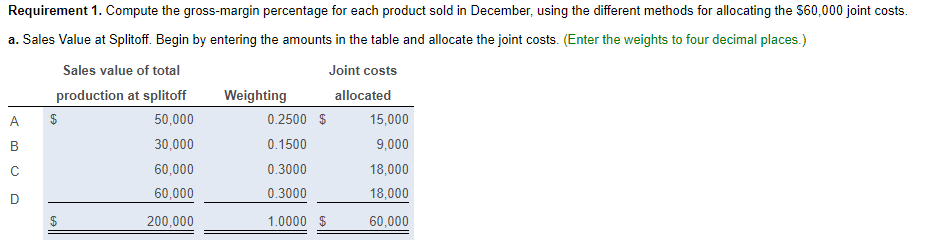

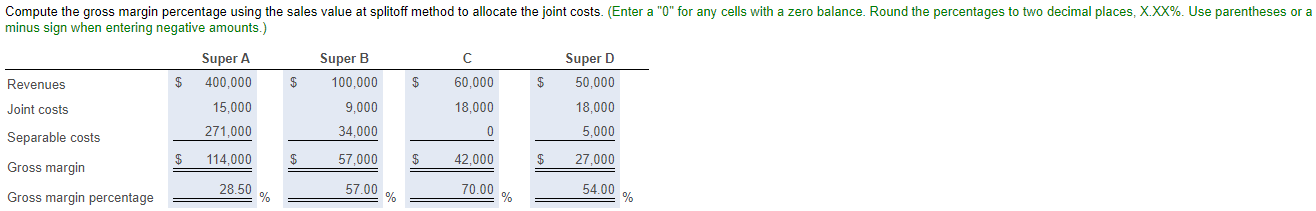

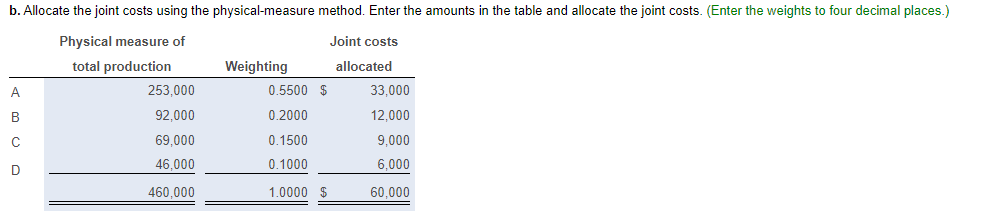

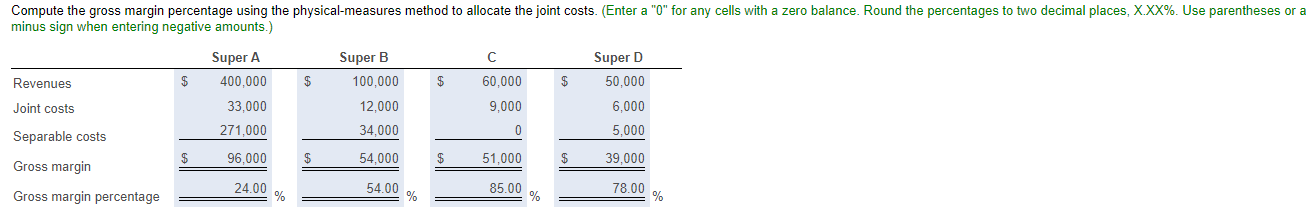

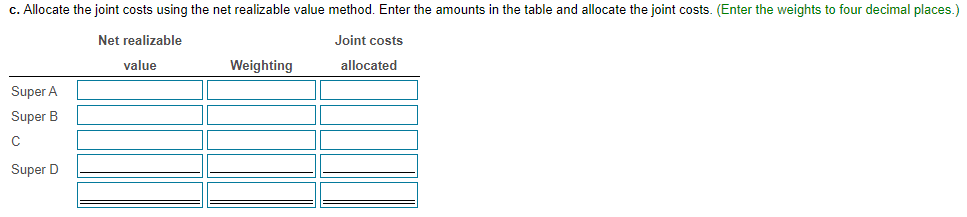

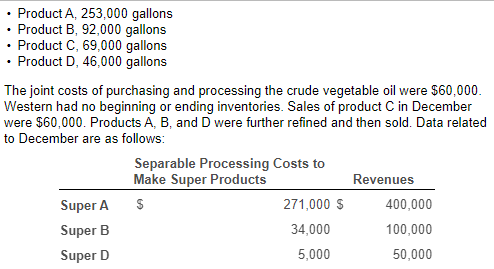

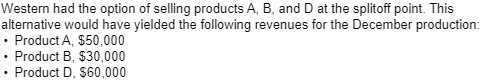

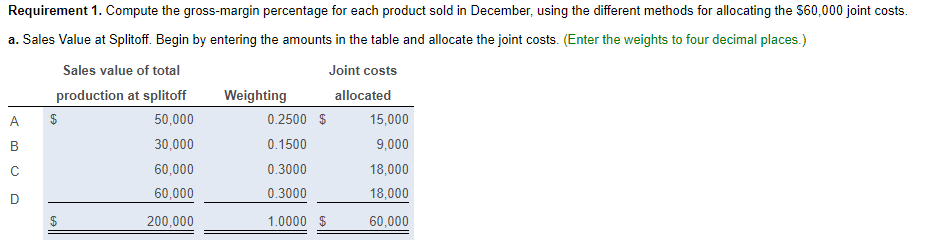

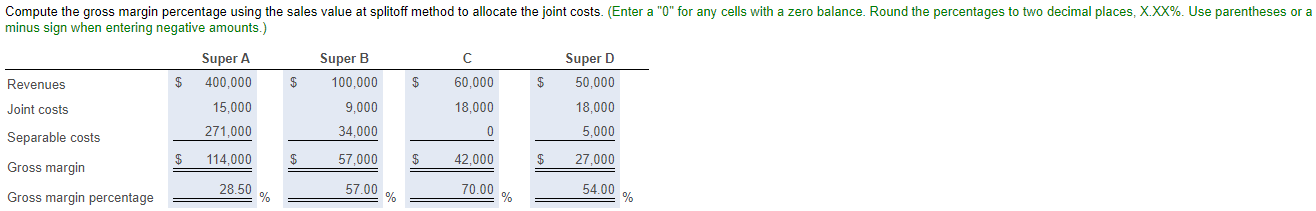

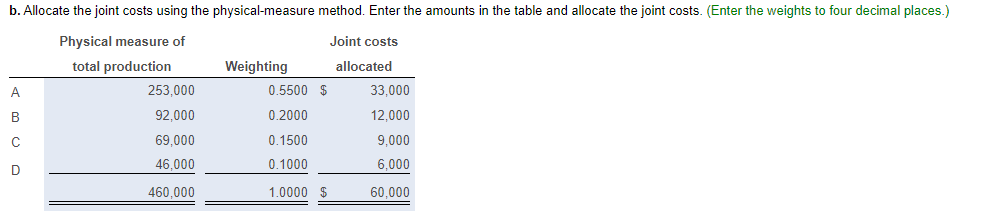

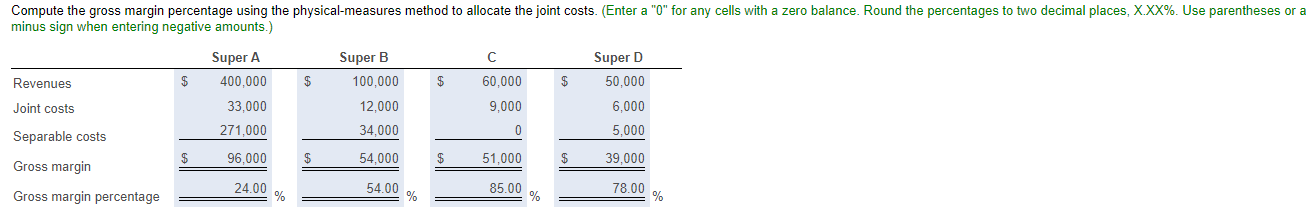

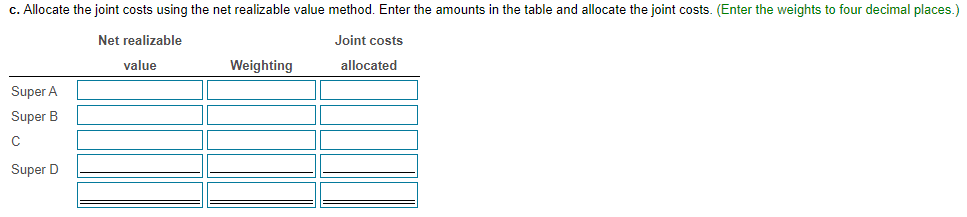

The Western Oil Company buys crude vegetable oil. Refining this oil results in four products at the splitoff point. A, B, C, and D. Product C is fully processed by the splitoff point. Products A, B, and D can individually be further refined into Super A, Super B, and Super D. In the most recent month (December), the output at the splitoff point was as follows: (Click the icon to view the information.) Product A, 253,000 gallons Product B, 92,000 gallons Product C, 69,000 gallons Product D, 46,000 gallons The joint costs of purchasing and processing the crude vegetable oil were $60,000. Western had no beginning or ending inventories. Sales of product C in December were $60,000. Products A, B, and D were further refined and then sold. Data related to December are as follows: Separable Processing Costs to Make Super Products Revenues Super A $ 271,000 $ 400,000 Super B 34,000 100,000 Super D 5,000 50,000 Western had the option of selling products A, B, and D at the splitoff point. This alternative would have yielded the following revenues for the December production: Product A, $50,000 Product B, $30,000 Product D, 560,000 . Requirement 1. Compute the gross-margin percentage for each product sold in December, using the different methods for allocating the $60,000 joint costs. a. Sales Value at Splitoff. Begin by entering the amounts in the table and allocate the joint costs. (Enter the weights to four decimal places.) Sales value of total Joint costs production at splitoff Weighting allocated $ 50,000 0.2500 $ 15,000 B 30,000 0.1500 9,000 60,000 0.3000 18,000 60,000 0.3000 18,000 A D EA 200,000 1.0000 $ 60,000 Compute the gross margin percentage using the sales value at splitoff method to allocate the joint costs. (Enter a "0" for any cells with a zero balance. Round the percentages to two decimal places, X.XX%. Use parentheses or a minus sign when entering negative amounts.) Super B 100,000 Super A 400,000 15,000 Super D 50,000 Revenues $ $ $ 60.000 $ Joint costs 9,000 18,000 18,000 271,000 34,000 0 5,000 Separable costs 114.000 $ 57,000 $ 42,000 $ 27,000 Gross margin 28.50 57.00 70.00 54.00 Gross margin percentage % % % b. Allocate the joint costs using the physical-measure method. Enter the amounts in the table and allocate the joint costs. (Enter the weights to four decimal places.) Joint costs Physical measure of total production 253,000 92,000 Weighting 0.5500 $ allocated 33,000 A B 0.2000 12,000 C 69,000 0.1500 9.000 46.000 0.1000 6.000 D 460,000 1.0000 $ 60.000 Compute the gross margin percentage using the physical-measures method to allocate the joint costs. (Enter a "0" for any cells with a zero balance. Round the percentages to two decimal places, X.XX%. Use parentheses or a minus sign when entering negative amounts.) Super A Super B Super D Revenues 400,000 $ 100,000 60.000 50,000 Joint costs 33,000 12.000 9,000 6,000 Separable costs 271,000 34.000 5,000 96,000 $ Gross margin 54,000 51,000 39,000 Gross margin percentage 24.00 54.00 85.00 78.00 % % % c. Allocate the joint costs using the net realizable value method. Enter the amounts in the table and allocate the joint costs. (Enter the weights to four decimal places.) Net realizable Joint costs allocated value Weighting Super A Super B Super D