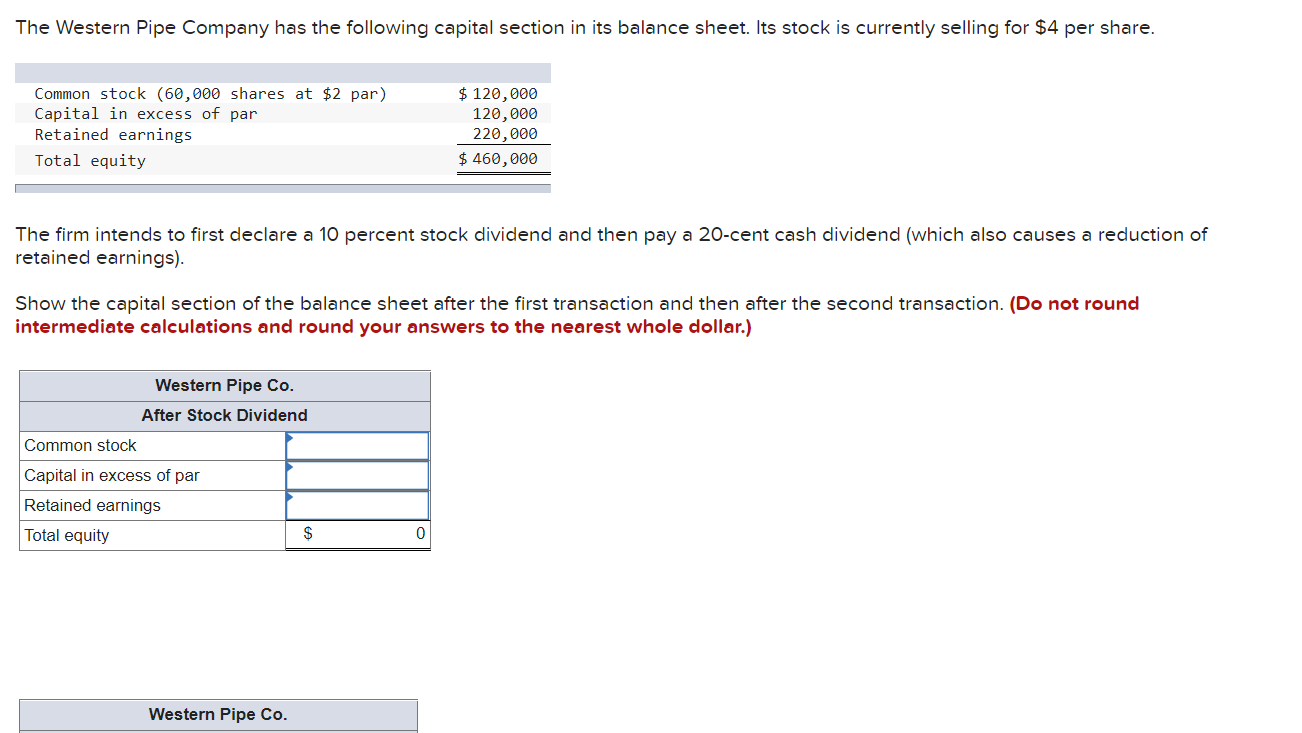

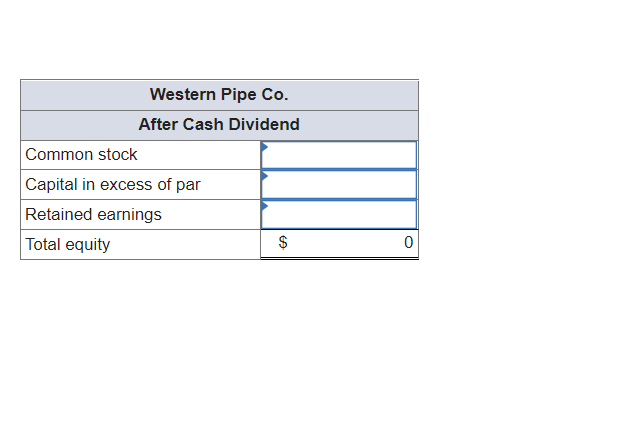

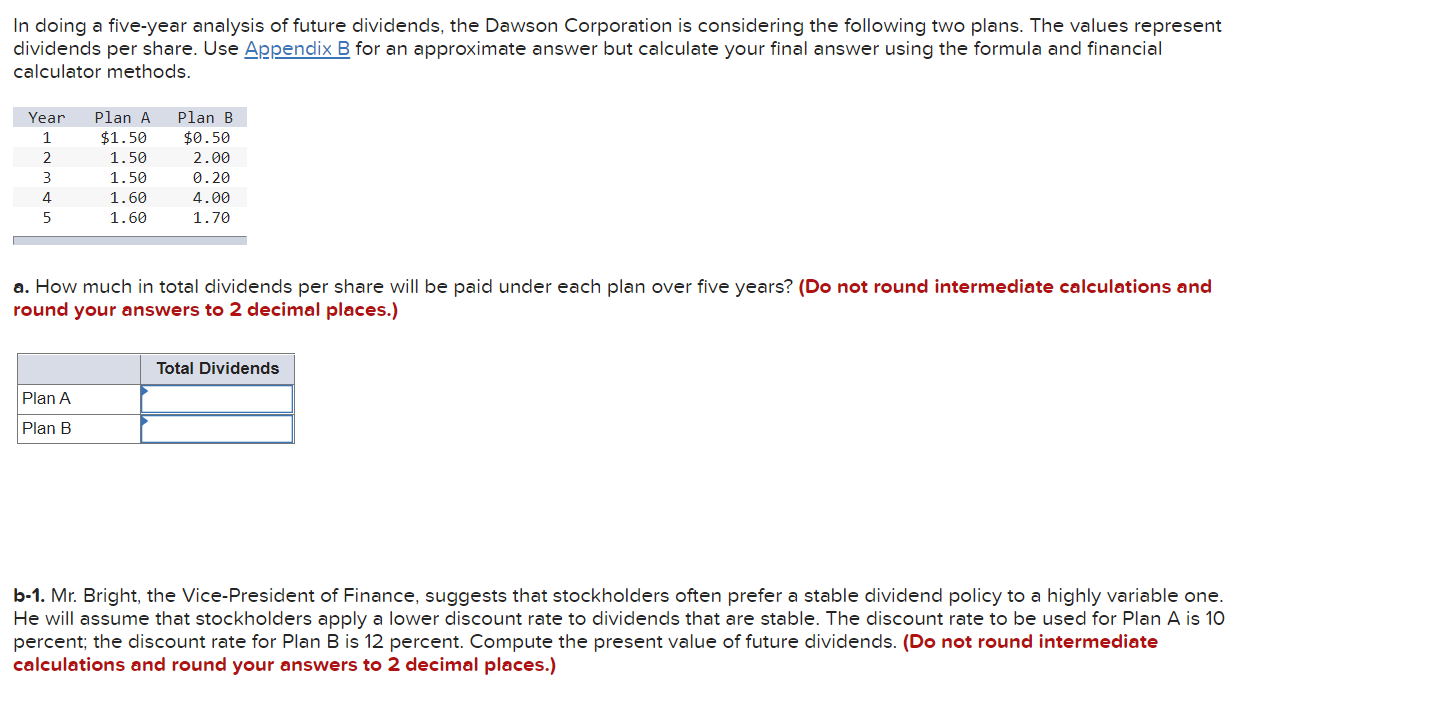

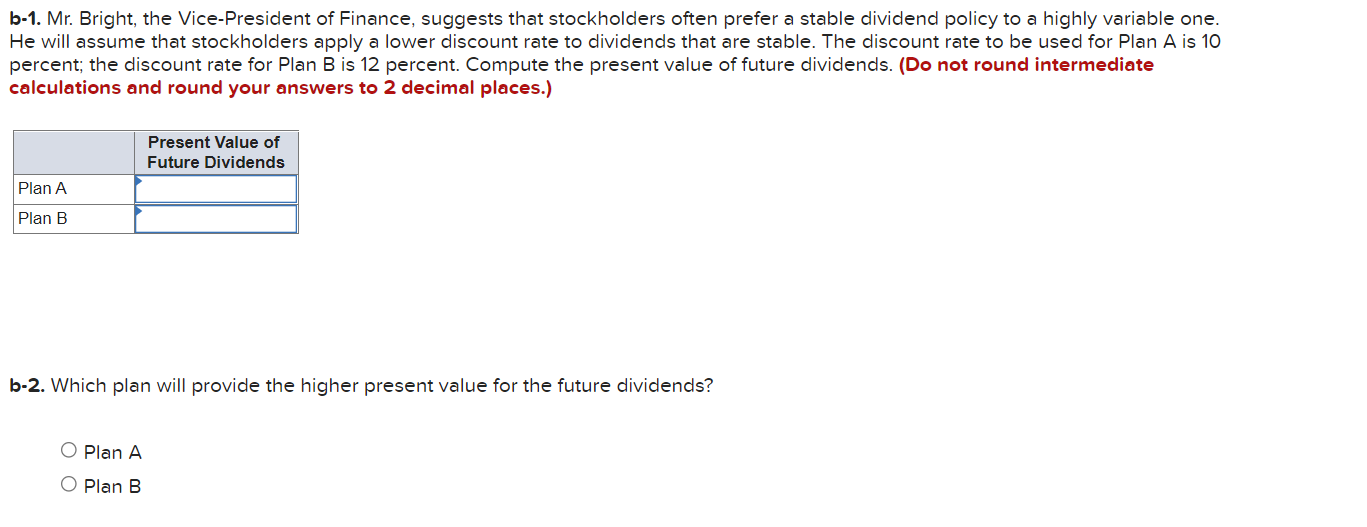

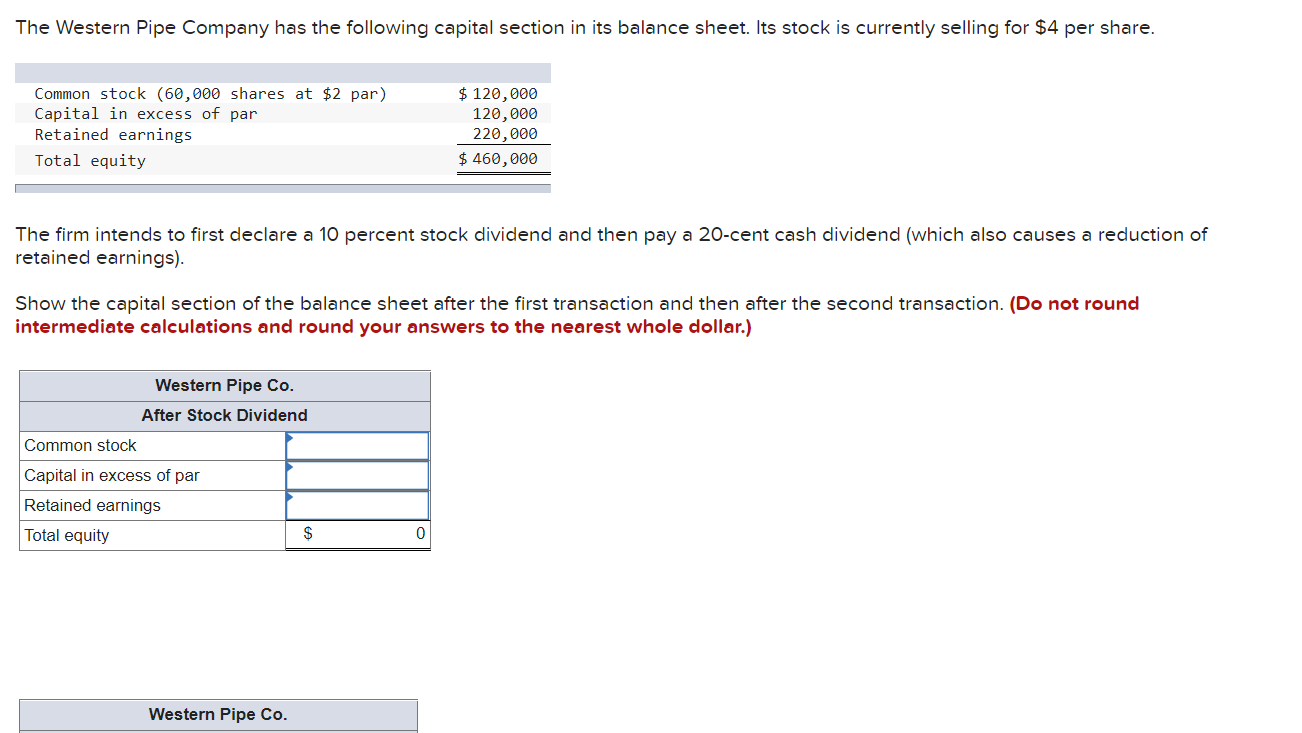

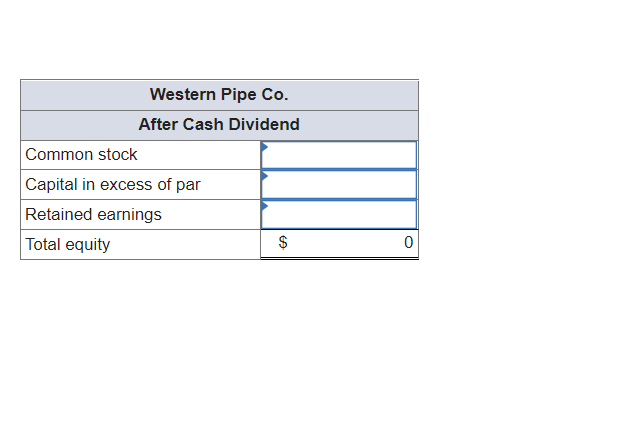

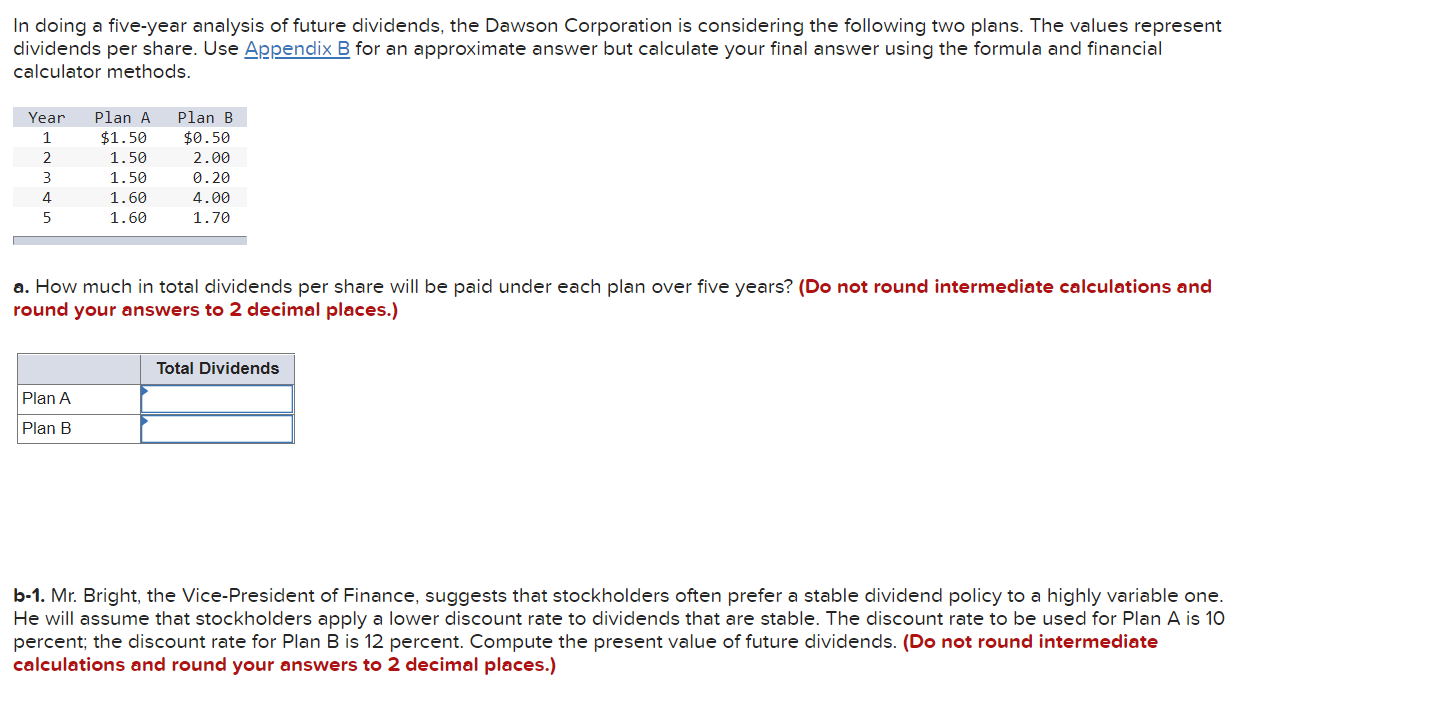

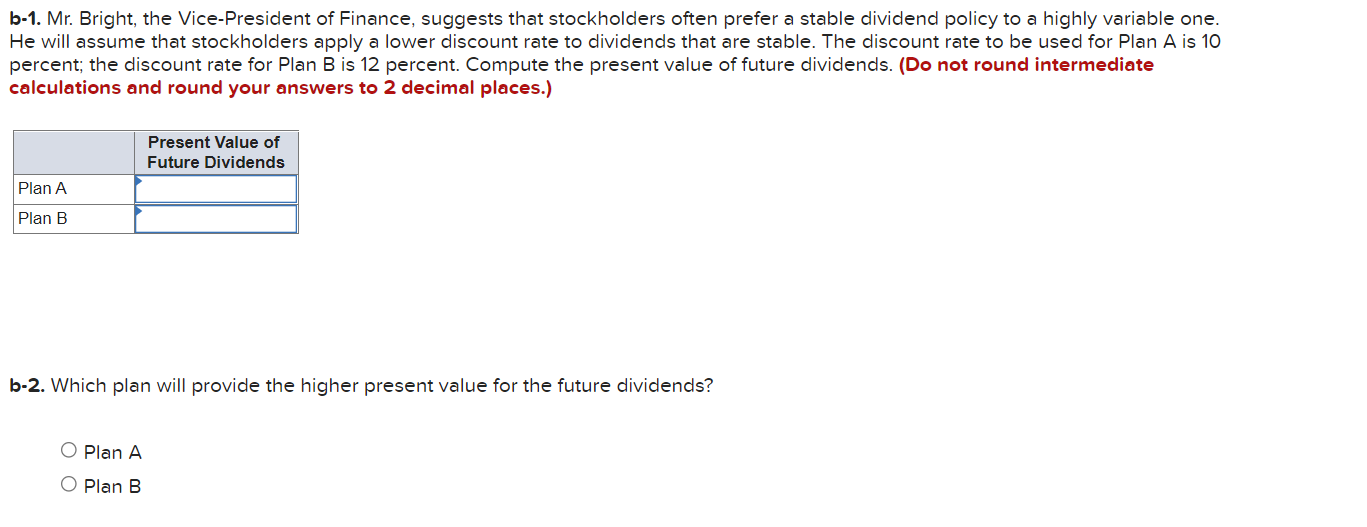

The Western Pipe Company has the following capital section in its balance sheet. Its stock is currently selling for $4 per share. Common stock (60,000 shares at $2 par) Capital in excess of par Retained earnings Total equity $ 120,000 120,000 220,000 $ 460,000 The firm intends to first declare a 10 percent stock dividend and then pay a 20-cent cash dividend (which also causes a reduction of retained earnings). Show the capital section of the balance sheet after the first transaction and then after the second transaction. (Do not round intermediate calculations and round your answers to the nearest whole dollar.) Western Pipe Co. After Stock Dividend Common stock Capital in excess of par Retained earnings Total equity $ 0 Western Pipe Co. Western Pipe Co. After Cash Dividend Common stock Capital in excess of par Retained earnings Total equity $ 0 In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Plan A $1.50 1.50 1.50 1.60 1.60 Plan B $0.50 2.00 0.20 4.00 1.70 a. How much in total dividends per share will be paid under each plan over five years? (Do not round intermediate calculations and round your answers to 2 decimal places.) Total Dividends Plan A Plan B b-1. Mr. Bright, the Vice-President of Finance, suggests that stockholders often prefer a stable dividend policy to a highly variable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 10 percent; the discount rate for Plan B is 12 percent. Compute the present value of future dividends. (Do not round intermediate calculations and round your answers to 2 decimal places.) b-1. Mr. Bright, the Vice-President of Finance, suggests that stockholders often prefer a stable dividend policy to a highly variable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 10 percent; the discount rate for Plan B is 12 percent. Compute the present value of future dividends. (Do not round intermediate calculations and round your answers to 2 decimal places.) Present Value of Future Dividends Plan A Plan B b-2. Which plan will provide the higher present value for the future dividends? O Plan A O Plan B