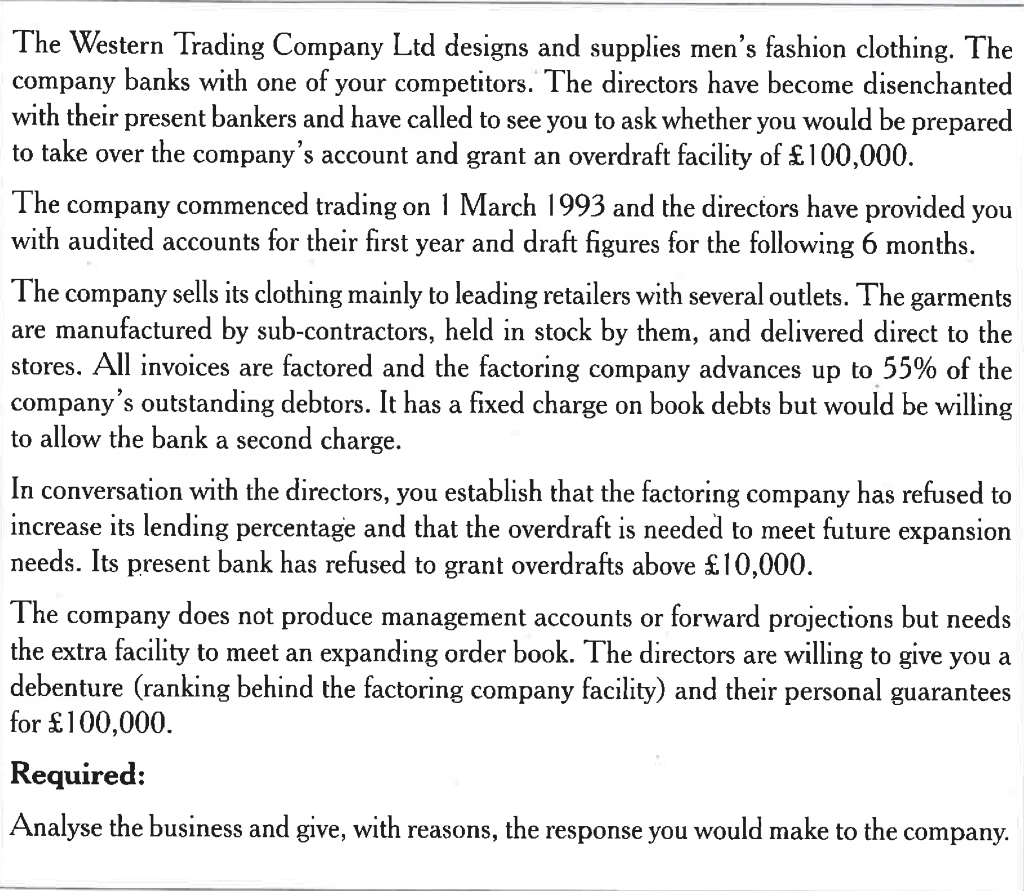

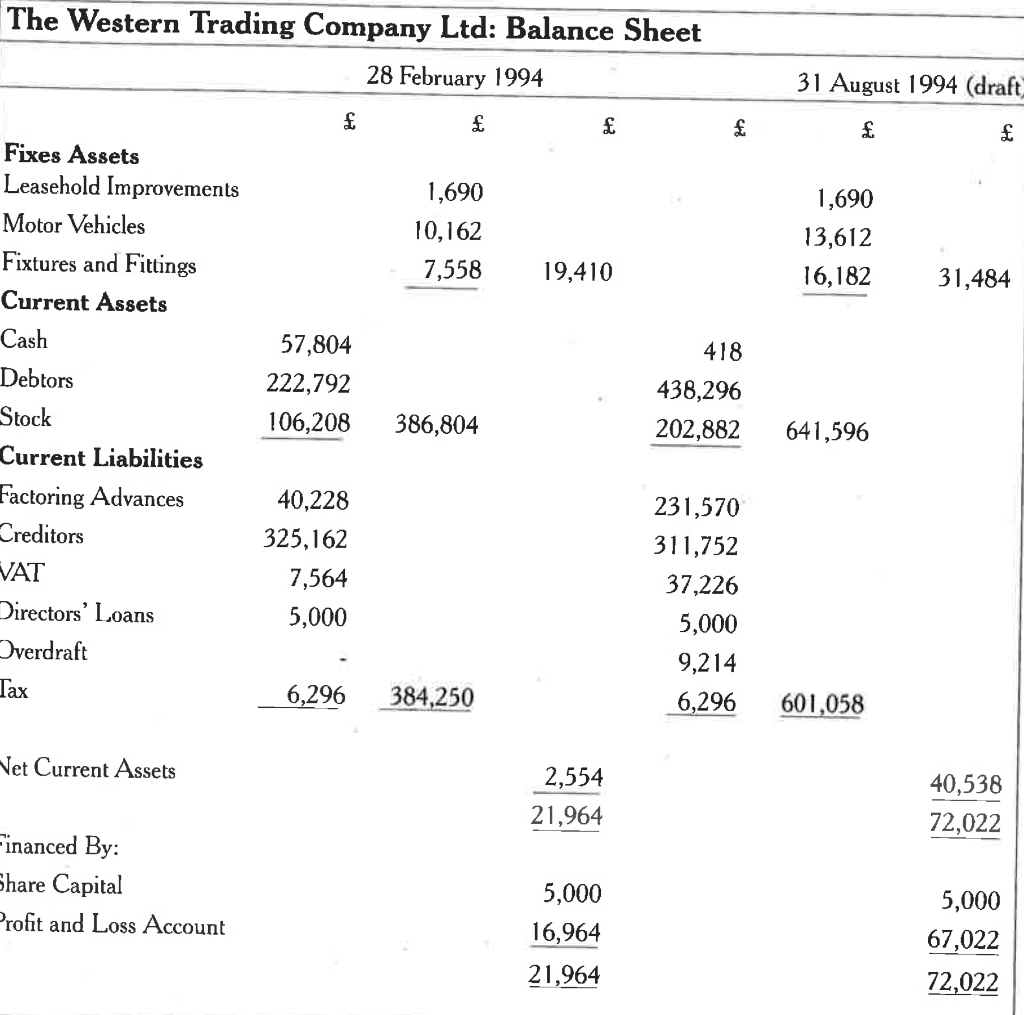

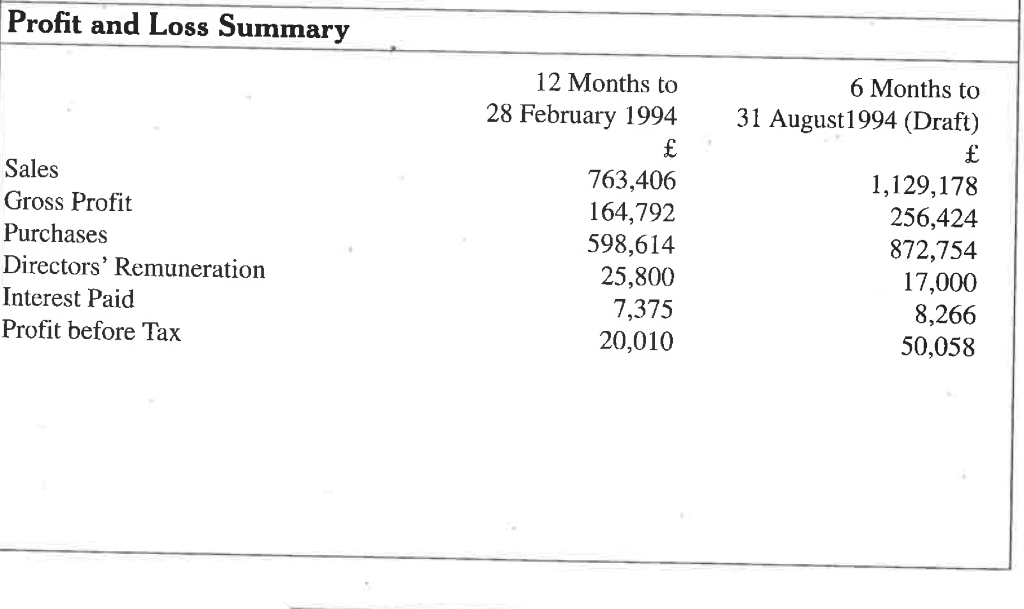

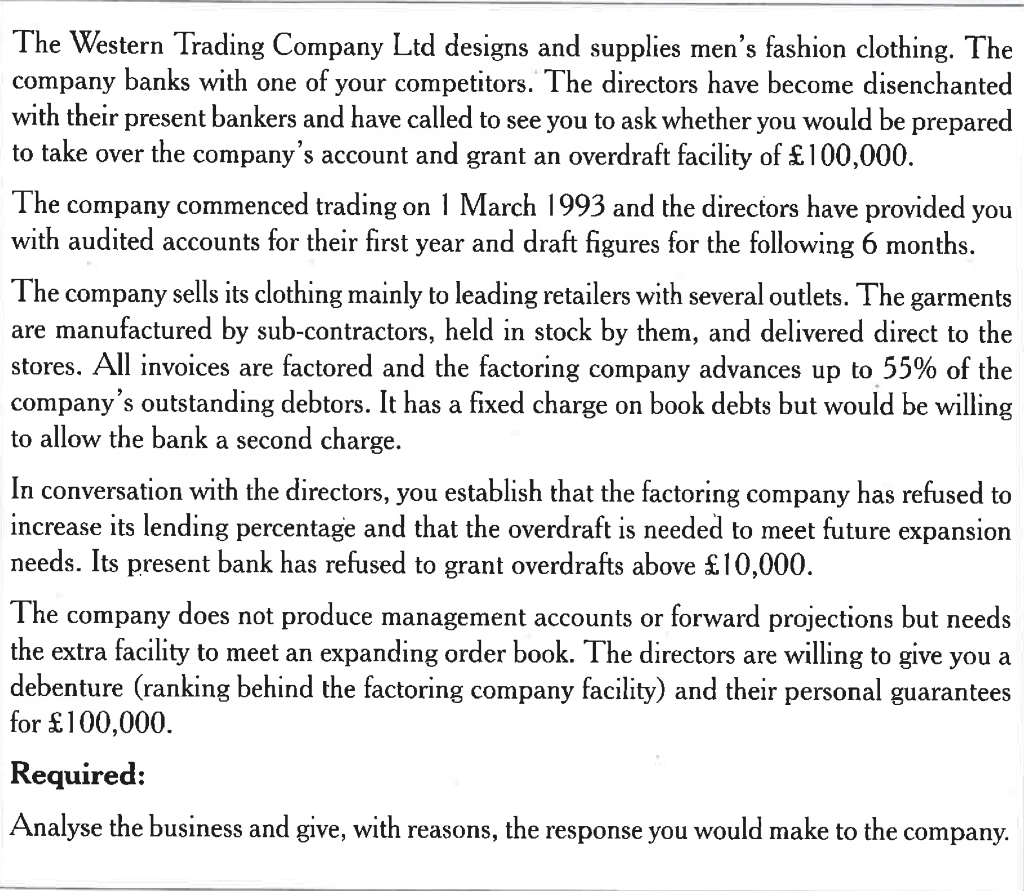

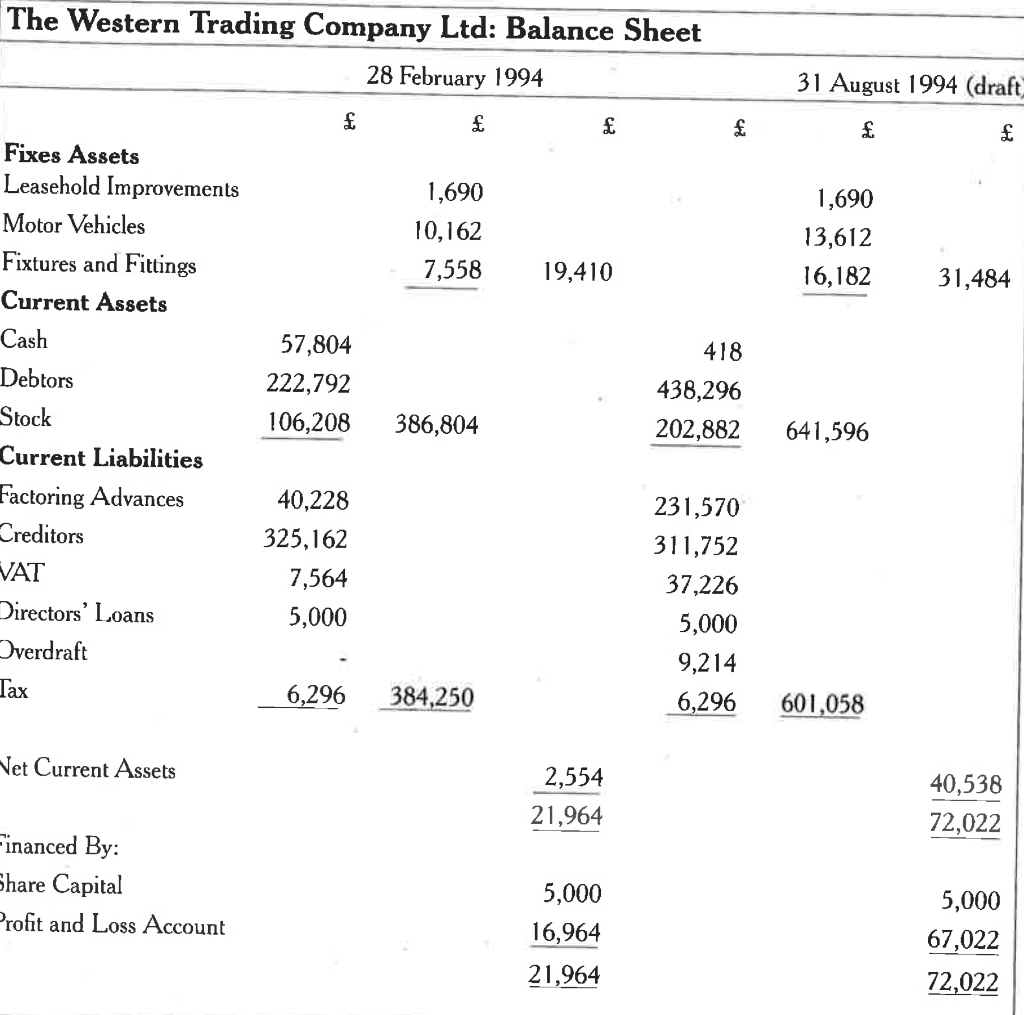

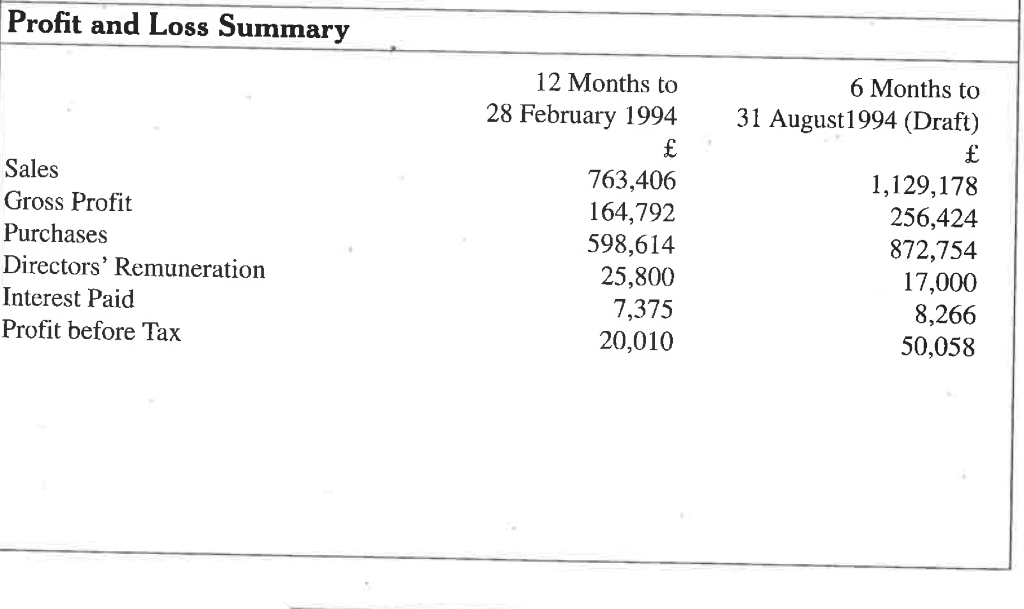

The Western Trading Company Ltd designs and supplies men's fashion clothing. The company banks with one of your competitors. The directors have become disenchanted with their present bankers and have called to see you to ask whether you would be prepared to take over the company's account and grant an overdraft facility of 100,000. The company commenced trading on 1 March 1993 and the directors have provided you with audited accounts for their first year and draft figures for the following 6 months. The company sells its clothing mainly to leading retailers with several outlets. The garments are manufactured by sub-contractors, held in stock by them, and delivered direct to the stores. All invoices are factored and the factoring company advances up to 55% of the company's outstanding debtors. It has a fixed charge on book debts but would be willing to allow the bank a second charge. In conversation with the directors, you establish that the factoring company has refused to increase its lending percentage and that the overdraft is needed to meet future expansion needs. Its present bank has refused to grant overdrafts above 10,000. The company does not produce management accounts or forward projections but needs the extra facility to meet an expanding order book. The directors are willing to give you a debenture (ranking behind the factoring company facility) and their personal guarantees for 100,000. Required: The Western Trading Company Ltd: Balance Sheet 28 February 1994 31 August 1994 (draft) L E Fixes Assets Leasehold Improvements Motor Vehicles Fixtures and Fittings Current Assets Cash Debtors \begin{tabular}{rrrr} 57,804 & & 418 & \\ 222,792 & & 438,296 & \\ 106,208 & 386,804 & 202,882 & 641,596 \\ \hline \end{tabular} \begin{tabular}{lrr} Stock & 106,208 & 386,804 \\ \cline { 2 - 2 } Current Liabilities & & \\ Factoring Advances & 40,228 & \\ Creditors & 325,162 & \\ VAT & 7,564 \\ Directors' Loans & 5,000 \\ Overdraft & - \\ Tax & 6,296 & \\ & & \end{tabular} 231,570 311,752 37,226 Net Current Assets 21,9642,554 72,02240,538 Financed By: Share Capital rofit and Loss Account \begin{tabular}{rr} 5,000 & 5,000 \\ 16,964 & 67,022 \\ \hline21,964 & 72,022 \\ \hline \end{tabular} Profit and Loss Summary 28 February 199431 August1994 (Draft) Sales Gross Profit Purchases Directors' Remuneration Interest Paid Profit before Tax 763,406164,792598,61425,8007,37520,0101,129,178256,424872,75417,0008,26650,058 \begin{tabular}{|lrr|} \hline Accounting Ratios & \\ \hline & 28 February 1994 & 31 August 1994 \\ Net Gearing \% (directors' loans & & \\ treated as capital) & 1.01:1 & 313 \\ Current Ratio & 0.73:1 & 1.07:1 \\ Acid Test & 107 & 0.73:1 \\ Credit Given (days) & 198 & 71 \\ Credit Taken (days) & 65 & 130 \\ Stock Turnover (days) & 21.6 & 42 \\ Gross Margin \% & 2.6, & 22.7 \\ Net Margin \% & 3.7 & 4.4 \\ Interest Cover (times) & & 7.1 \\ \hline \end{tabular} The Western Trading Company Ltd designs and supplies men's fashion clothing. The company banks with one of your competitors. The directors have become disenchanted with their present bankers and have called to see you to ask whether you would be prepared to take over the company's account and grant an overdraft facility of 100,000. The company commenced trading on 1 March 1993 and the directors have provided you with audited accounts for their first year and draft figures for the following 6 months. The company sells its clothing mainly to leading retailers with several outlets. The garments are manufactured by sub-contractors, held in stock by them, and delivered direct to the stores. All invoices are factored and the factoring company advances up to 55% of the company's outstanding debtors. It has a fixed charge on book debts but would be willing to allow the bank a second charge. In conversation with the directors, you establish that the factoring company has refused to increase its lending percentage and that the overdraft is needed to meet future expansion needs. Its present bank has refused to grant overdrafts above 10,000. The company does not produce management accounts or forward projections but needs the extra facility to meet an expanding order book. The directors are willing to give you a debenture (ranking behind the factoring company facility) and their personal guarantees for 100,000. Required: The Western Trading Company Ltd: Balance Sheet 28 February 1994 31 August 1994 (draft) L E Fixes Assets Leasehold Improvements Motor Vehicles Fixtures and Fittings Current Assets Cash Debtors \begin{tabular}{rrrr} 57,804 & & 418 & \\ 222,792 & & 438,296 & \\ 106,208 & 386,804 & 202,882 & 641,596 \\ \hline \end{tabular} \begin{tabular}{lrr} Stock & 106,208 & 386,804 \\ \cline { 2 - 2 } Current Liabilities & & \\ Factoring Advances & 40,228 & \\ Creditors & 325,162 & \\ VAT & 7,564 \\ Directors' Loans & 5,000 \\ Overdraft & - \\ Tax & 6,296 & \\ & & \end{tabular} 231,570 311,752 37,226 Net Current Assets 21,9642,554 72,02240,538 Financed By: Share Capital rofit and Loss Account \begin{tabular}{rr} 5,000 & 5,000 \\ 16,964 & 67,022 \\ \hline21,964 & 72,022 \\ \hline \end{tabular} Profit and Loss Summary 28 February 199431 August1994 (Draft) Sales Gross Profit Purchases Directors' Remuneration Interest Paid Profit before Tax 763,406164,792598,61425,8007,37520,0101,129,178256,424872,75417,0008,26650,058 \begin{tabular}{|lrr|} \hline Accounting Ratios & \\ \hline & 28 February 1994 & 31 August 1994 \\ Net Gearing \% (directors' loans & & \\ treated as capital) & 1.01:1 & 313 \\ Current Ratio & 0.73:1 & 1.07:1 \\ Acid Test & 107 & 0.73:1 \\ Credit Given (days) & 198 & 71 \\ Credit Taken (days) & 65 & 130 \\ Stock Turnover (days) & 21.6 & 42 \\ Gross Margin \% & 2.6, & 22.7 \\ Net Margin \% & 3.7 & 4.4 \\ Interest Cover (times) & & 7.1 \\ \hline \end{tabular}