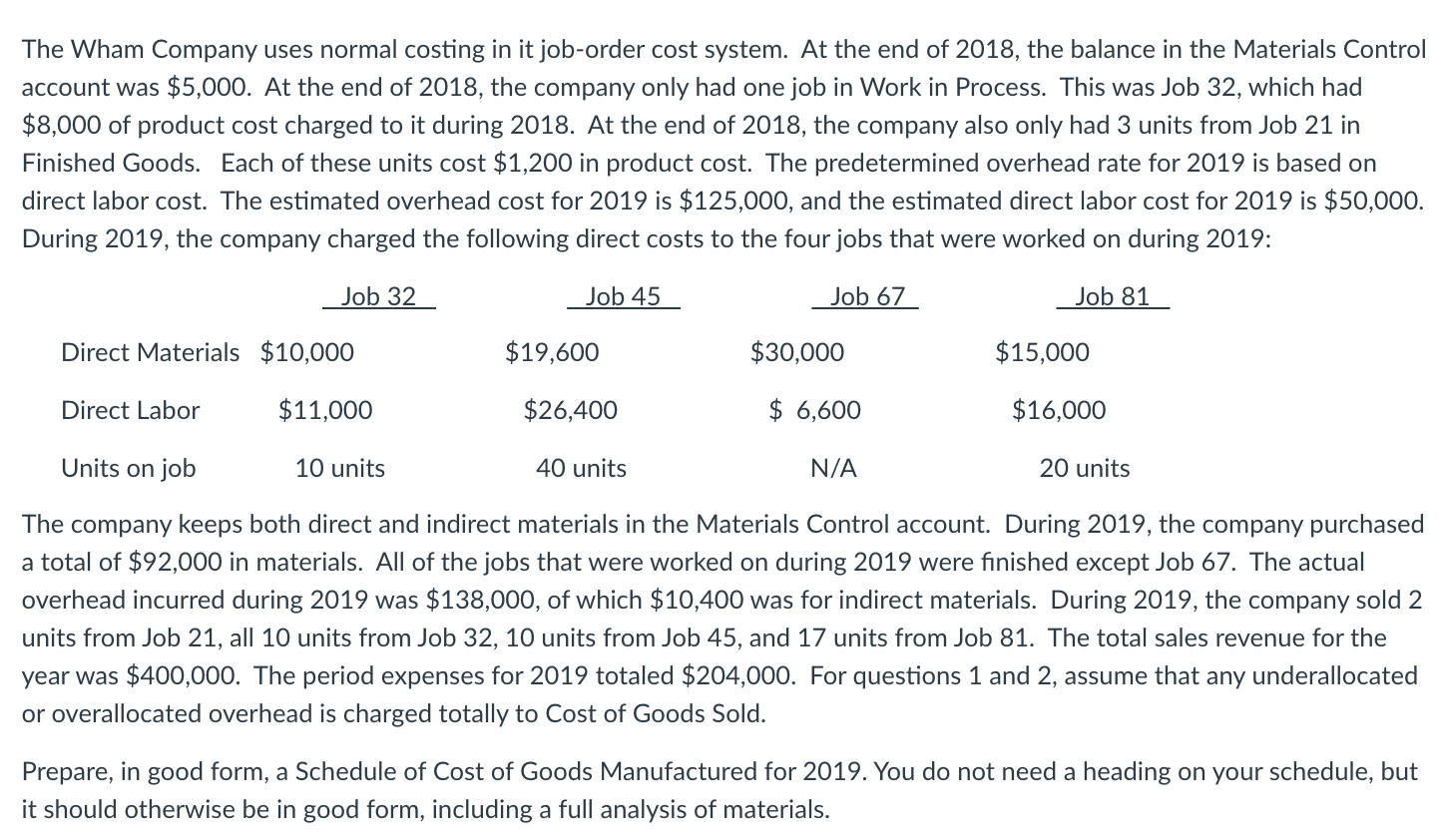

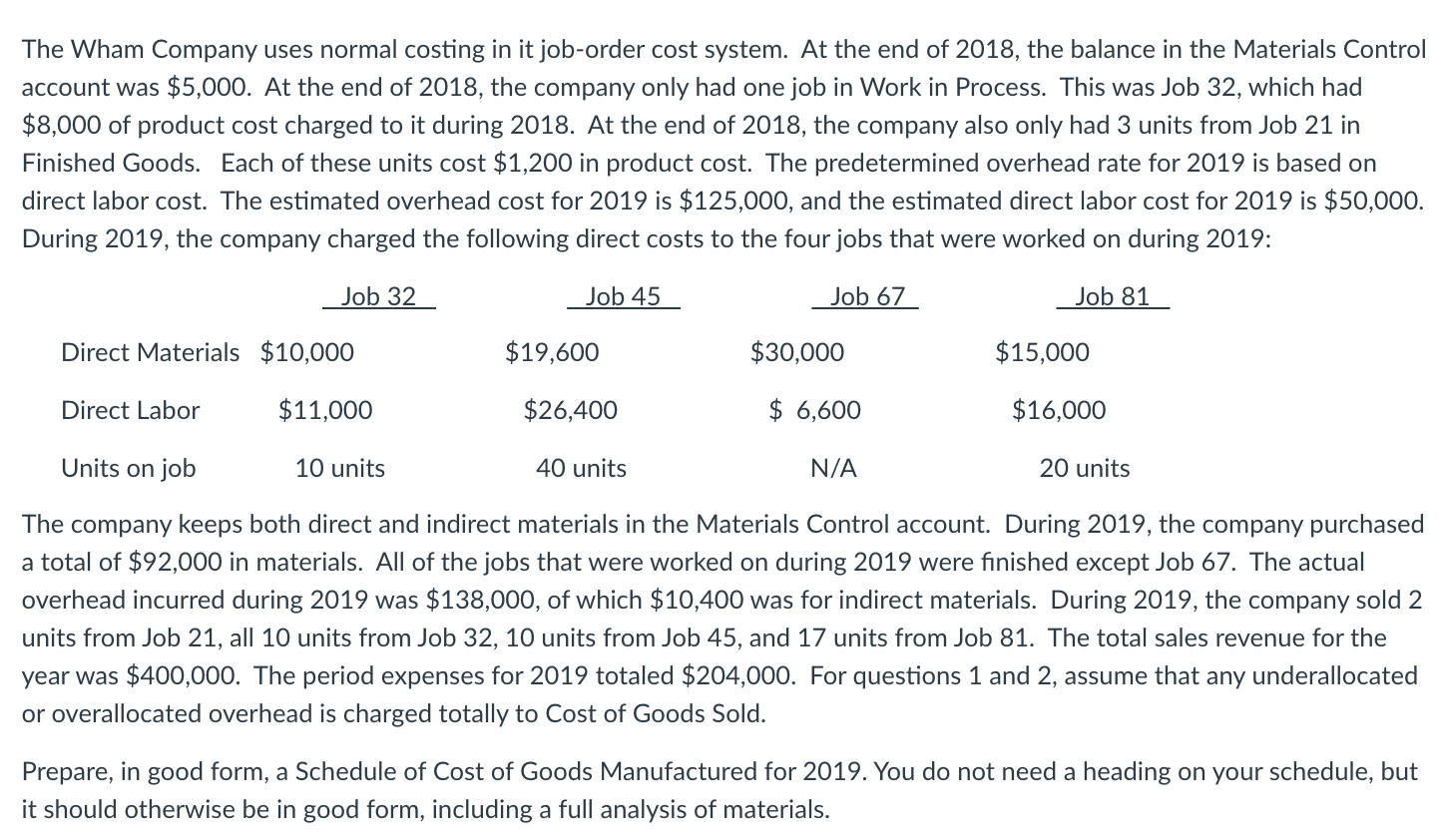

The Wham Company uses normal costing in it job-order cost system. At the end of 2018, the balance in the Materials Control account was $5,000. At the end of 2018, the company only had one job in Work in Process. This was Job 32, which had $8,000 of product cost charged to it during 2018. At the end of 2018, the company also only had 3 units from Job 21 in Finished Goods. Each of these units cost $1,200 in product cost. The predetermined overhead rate for 2019 is based on direct labor cost. The estimated overhead cost for 2019 is $125,000, and the estimated direct labor cost for 2019 is $50,000. During 2019, the company charged the following direct costs to the four jobs that were worked on during 2019:

Job 32 Job 45 Job 67 Job 81

Direct Materials $10,000 $19,600 $30,000 $15,000

Direct Labor $11,000 $26,400 $ 6,600 $16,000

Units on job 10 units 40 units N/A 20 units

The company keeps both direct and indirect materials in the Materials Control account. During 2019, the company purchased a total of $92,000 in materials. All of the jobs that were worked on during 2019 were finished except Job 67. The actual overhead incurred during 2019 was $138,000, of which $10,400 was for indirect materials. During 2019, the company sold 2 units from Job 21, all 10 units from Job 32, 10 units from Job 45, and 17 units from Job 81. The total sales revenue for the year was $400,000. The period expenses for 2019 totaled $204,000. For questions 1 and 2, assume that any underallocated or overallocated overhead is charged totally to Cost of Goods Sold.

Prepare, in good form, a Schedule of Cost of Goods Manufactured for 2019. You do not need a heading on your schedule, but it should otherwise be in good form, including a full analysis of materials.

Please help!

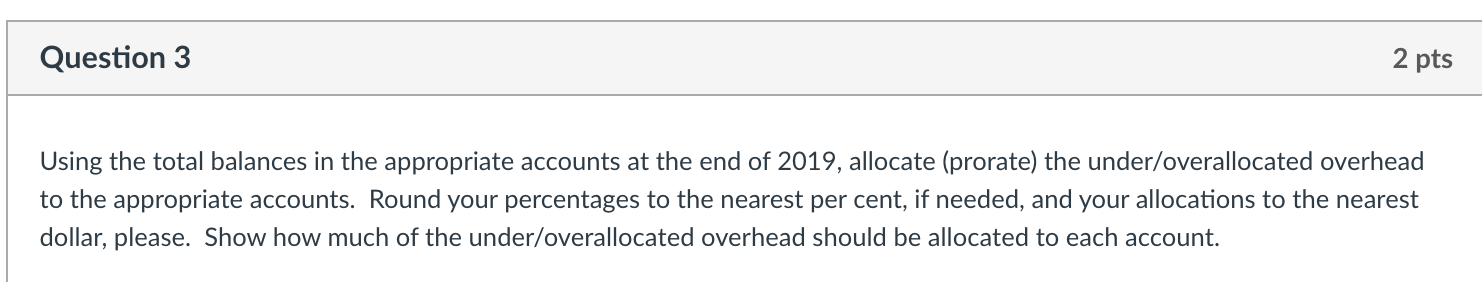

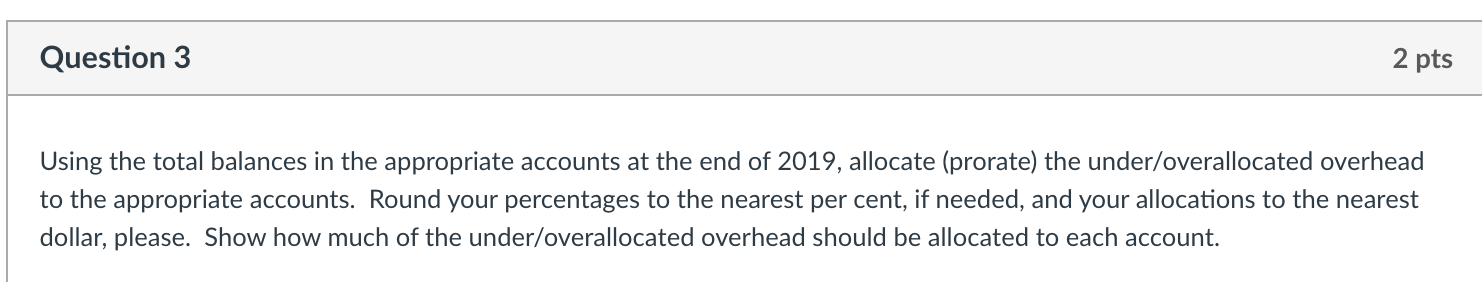

Question 3:

Using the total balances in the appropriate accounts at the end of 2019, allocate (prorate) the under/overallocated overhead to the appropriate accounts. Round your percentages to the nearest per cent, if needed, and your allocations to the nearest dollar, please. Show how much of the under/overallocated overhead should be allocated to each account.

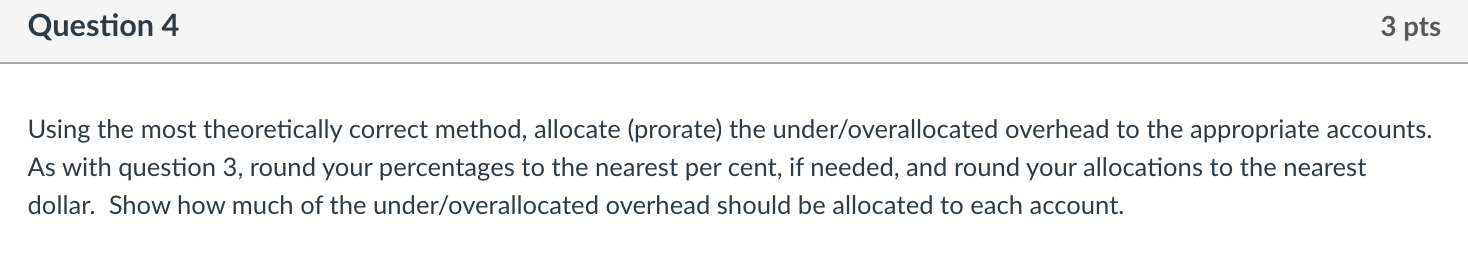

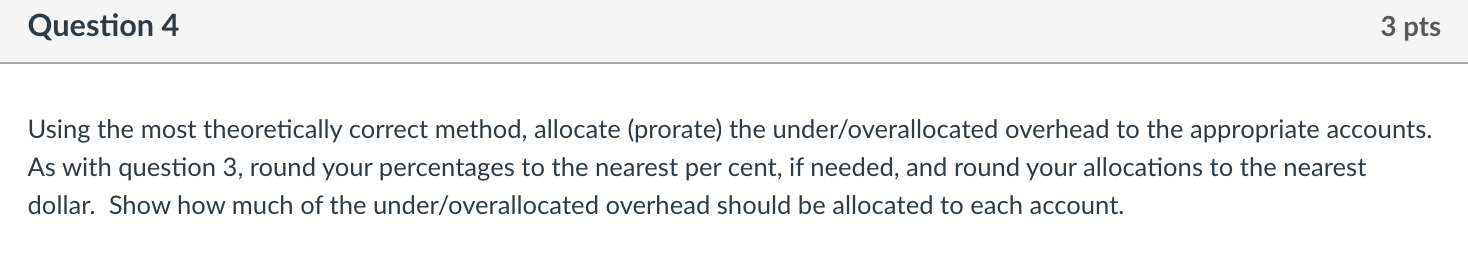

Question 4:

Using the most theoretically correct method, allocate (prorate) the under/overallocated overhead to the appropriate accounts. As with question 3, round your percentages to the nearest per cent, if needed, and round your allocations to the nearest dollar. Show how much of the under/overallocated overhead should be allocated to each account.

Question 5:

Using your proration in question 4, how much total overhead would be charged to WIP (Job 67) after adjusting overhead based on the proration?

Question 6:

If the company used ACTUAL costing based on a full year, compute the actual overhead rate for 2019. Please show me the numbers that you use to compute the rate.

Question 7:

Using your rate from question 6, how much actual overhead would be charged to WIP (Job 67)?

Question 8:

Are your answers in question 5 and question 7 the same? Should they be the same?

The Wham Company uses normal costing in it job-order cost system. At the end of 2018, the balance in the Materials Control account was $5,000. At the end of 2018, the company only had one job in Work in Process. This was Job 32, which had $8,000 of product cost charged to it during 2018. At the end of 2018, the company also only had 3 units from Job 21 in Finished Goods. Each of these units cost $1,200 in product cost. The predetermined overhead rate for 2019 is based on direct labor cost. The estimated overhead cost for 2019 is $125,000, and the estimated direct labor cost for 2019 is $50,000. During 2019, the company charged the following direct costs to the four jobs that were worked on during 2019: Job 32 Job 45 Job 67 Job 81 Direct Materials $10,000 $19,600 $30,000 $15,000 Direct Labor $11,000 $26,400 $ 6,600 $16,000 Units on job 10 units 40 units N/A 20 units The company keeps both direct and indirect materials in the Materials Control account. During 2019, the company purchased a total of $92,000 in materials. All of the jobs that were worked on during 2019 were finished except Job 67. The actual overhead incurred during 2019 was $138,000, of which $10,400 was for indirect materials. During 2019, the company sold 2 units from Job 21, all 10 units from Job 32, 10 units from Job 45, and 17 units from Job 81. The total sales revenue for the year was $400,000. The period expenses for 2019 totaled $204,000. For questions 1 and 2, assume that any underallocated or overallocated overhead is charged totally to Cost of Goods Sold. Prepare, in good form, a Schedule of Cost of Goods Manufactured for 2019. You do not need a heading on your schedule, but it should otherwise be in good form, including a full analysis of materials. Question 3 2 pts Using the total balances in the appropriate accounts at the end of 2019, allocate (prorate) the under/overallocated overhead to the appropriate accounts. Round your percentages to the nearest per cent, if needed, and your allocations to the nearest dollar, please. Show how much of the under/overallocated overhead should be allocated to each account. Question 4 3 pts Using the most theoretically correct method, allocate (prorate) the under/overallocated overhead to the appropriate accounts. As with question 3, round your percentages to the nearest per cent, if needed, and round your allocations to the nearest dollar. Show how much of the under/overallocated overhead should be allocated to each account. Question 8 2 pts Are your answers in question 5 and question 7 the same? Should they be the same? The Wham Company uses normal costing in it job-order cost system. At the end of 2018, the balance in the Materials Control account was $5,000. At the end of 2018, the company only had one job in Work in Process. This was Job 32, which had $8,000 of product cost charged to it during 2018. At the end of 2018, the company also only had 3 units from Job 21 in Finished Goods. Each of these units cost $1,200 in product cost. The predetermined overhead rate for 2019 is based on direct labor cost. The estimated overhead cost for 2019 is $125,000, and the estimated direct labor cost for 2019 is $50,000. During 2019, the company charged the following direct costs to the four jobs that were worked on during 2019: Job 32 Job 45 Job 67 Job 81 Direct Materials $10,000 $19,600 $30,000 $15,000 Direct Labor $11,000 $26,400 $ 6,600 $16,000 Units on job 10 units 40 units N/A 20 units The company keeps both direct and indirect materials in the Materials Control account. During 2019, the company purchased a total of $92,000 in materials. All of the jobs that were worked on during 2019 were finished except Job 67. The actual overhead incurred during 2019 was $138,000, of which $10,400 was for indirect materials. During 2019, the company sold 2 units from Job 21, all 10 units from Job 32, 10 units from Job 45, and 17 units from Job 81. The total sales revenue for the year was $400,000. The period expenses for 2019 totaled $204,000. For questions 1 and 2, assume that any underallocated or overallocated overhead is charged totally to Cost of Goods Sold. Prepare, in good form, a Schedule of Cost of Goods Manufactured for 2019. You do not need a heading on your schedule, but it should otherwise be in good form, including a full analysis of materials. Question 3 2 pts Using the total balances in the appropriate accounts at the end of 2019, allocate (prorate) the under/overallocated overhead to the appropriate accounts. Round your percentages to the nearest per cent, if needed, and your allocations to the nearest dollar, please. Show how much of the under/overallocated overhead should be allocated to each account. Question 4 3 pts Using the most theoretically correct method, allocate (prorate) the under/overallocated overhead to the appropriate accounts. As with question 3, round your percentages to the nearest per cent, if needed, and round your allocations to the nearest dollar. Show how much of the under/overallocated overhead should be allocated to each account. Question 8 2 pts Are your answers in question 5 and question 7 the same? Should they be the same