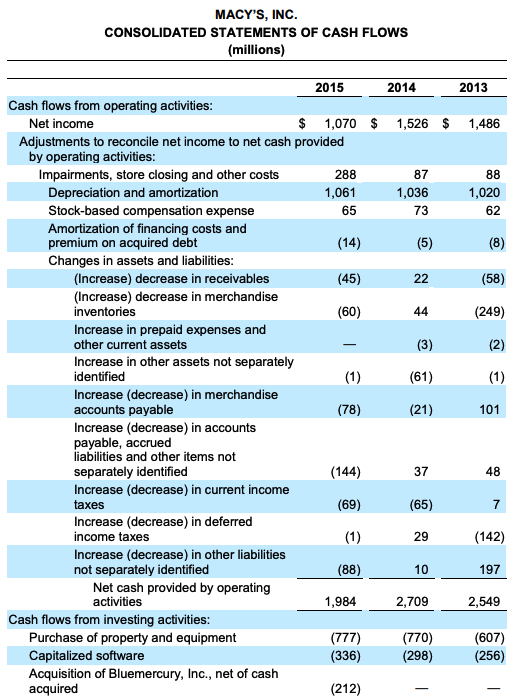

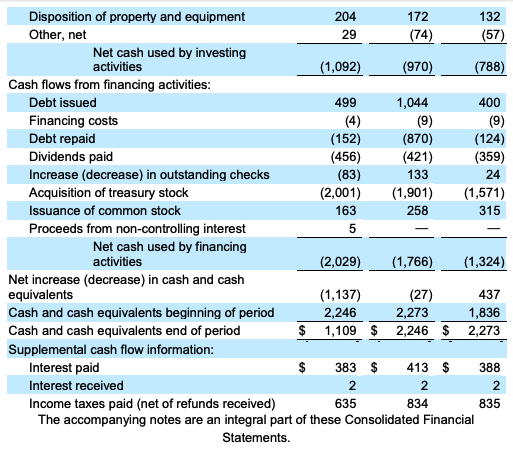

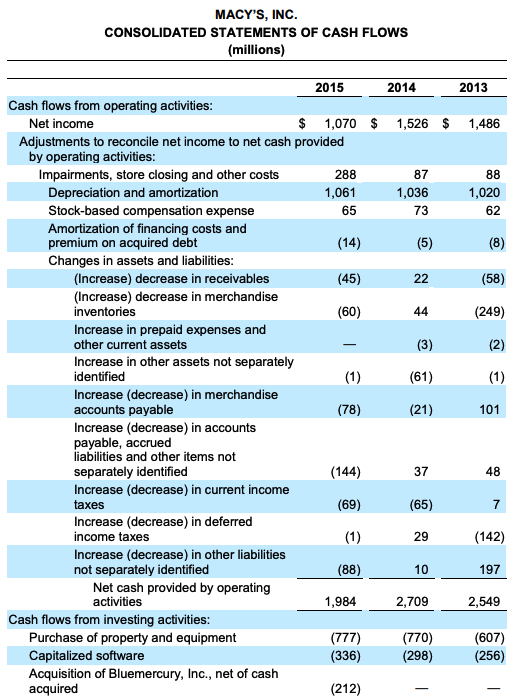

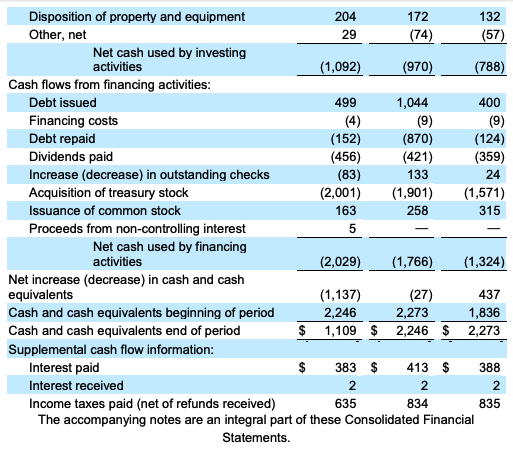

Case 1 Debt Footnote Macy's The purpose of this case is to understand how bonds are issued and how bonds are shown on the financial statements. Necessary portions of the 10-K for Macy's and a bond prospectus for a Macy bond issue are included the file, "Case 1 Reference Material." Answer the following questions using complete sentences in the spaces provided. We are focusing on the 3.45% senior note due 2021 issued December 7, 2015. Start with footnote 6, "Financing". The footnote tells us that the note was issued. 1. Copy and paste this part of the footnote here: 2. What was the principal amount of the debt? 3. What was the reason for borrowing the debt? MACY'S, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (millions) 2014 2013 1,526 $ 1,486 87 1,036 73 88 1,020 62 (5) (8) (60) 22 44 (3) (61) (58) (249) (2) 2015 Cash flows from operating activities: Net income $ 1,070 $ Adjustments to reconcile net income to net cash provided by operating activities: Impairments, store closing and other costs 288 Depreciation and amortization 1,061 Stock-based compensation expense 65 Amortization of financing costs and premium on acquired debt (14) Changes in assets and liabilities: (Increase) decrease in receivables (45) C (Increase) decrease in merchandise inventories Increase in prepaid expenses and other current assets Increase in other assets not separately identified (1) Increase (decrease) in merchandise accounts payable (78) Increase (decrease) in accounts payable, accrued liabilities and other items not separately identified (144) Increase (decrease) in current income taxes Increase (decrease) in deferred income taxes (1) Increase (decrease) in other liabilities not separately identified (88) Net cash provided by operating activities 1,984 Cash flows from investing activities: Purchase of property and equipment (777) Capitalized software (336) Acquisition of Bluemercury, Inc., net of cash acquired (212) (21) 101 48 (69) 29 (142) 10 197 2,709 2,549 (770) (298) (607) (256) 24 163 Disposition of property and equipment 204 172 132 Other, net 29 (74) (57) Net cash used by investing activities (1,092) (970) (788) Cash flows from financing activities: Debt issued 499 1,044 400 Financing costs (4) (9) (9) Debt repaid (152) (870) (124) Dividends paid (456) (421) (359) Increase (decrease) in outstanding checks (83) 133 Acquisition of treasury stock (2,001) (1,901) (1,571) Issuance of common stock 258 315 Proceeds from non-controlling interest Net cash used by financing activities (2,029) (1,766) (1,324) Net increase (decrease) in cash and cash equivalents (1,137) (27) 437 Cash and cash equivalents beginning of period 2,246 2,273 1,836 Cash and cash equivalents end of period $ 1,109 $ 2,246 $ 2,273 Supplemental cash flow information: Interest paid $ 383 $ 413 $ 388 Interest received 22 Income taxes paid (net of refunds received) 635 834 835 The accompanying notes are an integral part of these Consolidated Financial Statements. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 6. Financing The Company's debt is as follows: January 30, January 31, 2016 2015 (millions) $ - 577 $ 59 Short-term debt: 5.9% Senior notes due 2016 7.45% Senior debentures due 2016 7.5% Senior debentures due 2015 Capital lease and current portion of other long-term obligations $ 642 $ 76 $ 750 550 550 - 500 500 Long-term debt: 2.875% Senior notes due 2023 3.875% Senior notes due 2022 4.5% Senior notes due 2034 3.45% Senior notes due 2021 3.625% Senior notes due 2024 6.375% Senior notes due 2037 4.375% Senior notes due 2023 6.9% Senior debentures due 2029 6.7% Senior debentures due 2034 7.45% Senior debentures due 2017 6.65% Senior debentures due 2024 7.0% Senior debentures due 2028 6.9% Senior debentures due 2032 5.125% Senior debentures due 2042 4.3% Senior notes due 2043 6.7% Senior debentures due 2028 6.79% Senior debentures due 2027 7.875% Senior debentures due 2036 8.75% Senior debentures due 2029 8.5% Senior debentures due 2019 10.25% Senior debentures due 2021 750 550 550 500 500 500 400 400 400 300 300 300 250 250 250 200 165 108 400 400 400 300 300 300 250 250 250 200 165 108 61 61 36 577 76 7.6% Senior debentures due 2025 7.875% Senior debentures due 2030 9.5% amortizing debentures due 2021 9.75% amortizing debentures due 2021 5.9% Senior notes due 2016 8.125% Senior debentures due 2035 7.45% Senior debentures due 2016 Unamortized debt issue costs Unamortized debt discount Premium on acquired debt, using an effective interest yield of 5.415% to 6.165% Capital lease and other long-term obligations (32) (16) 59 (32) (18) 164 143 29 6,995 29 $ $ 7,233 Interest expense and premium on early retirement of debt is as follows: 2013 $ 2015 2014 (millions) 393 $ 411 $ (21) (12) 407 (15) Interest on debt Amortization of debt premium Amortization of financing costs and debt discount Interest on capitalized leases Less interest capitalized on construction Interest expense $ 363 $ 395 $ 390 Premium on early retirement of debt - $ 17 $ On November 14, 2014, the Company provided a notice of redemption related to all of the $407 million of 7.875% senior notes due 2015, as allowed under the terms of the indenture. The price for the redemption was calculated pursuant to the indenture and resulted in the recognition of additional interest expense of $17 million during 2014. This additional interest expense is presented as premium on early retirement of debt on the Consolidated Statements of Income. Future maturities of long-term debt, other than capitalized leases, are shown below: (millions) Fiscal year 2017 2018 $ 306 The following summarizes certain components of the Company's debt: Bank Credit Agreement The Company entered into a new credit agreement with certain financial institutions on May 10, 2013 providing for revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1,500 million (which may be increased to $1,750 million at the option of the Company, subject to the willingness of existing or new lenders to provide commitments for such additional financing) outstanding at any particular time. The agreement is set to expire May 10, 2018 and replaced the prior agreement which was set to expire June 20, 2015. As of January 30, 2016, and January 31, 2015, there were no revolving credit loans outstanding under this credit agreement, and there were no borrowings under the agreement throughout all of 2015 and 2014. However, there were less than $1 million of standby letters of credit outstanding at January 30, 2016 and January 31, 2015. Revolving loans under the credit agreement bear interest based on various published rates. The Company's credit agreement, which is an obligation of a 100%-owned subsidiary of Macy's, Inc. ("Parent"), is not secured. However, Parent has fully and unconditionally guaranteed this obligation, subject to specified limitations. The Company's interest coverage ratio for 2015 was 8.85 and its leverage ratio at January 30, 2016 was 2.21, in each case as calculated in accordance with the credit agreement. The credit agreement requires the Company to maintain a specified interest coverage ratio for the latest four quarters of no less than 3.25 and a specified leverage ratio as of and for the latest four quarters of no more than 3.75. The interest coverage ratio is defined as EBITDA (earnings before interest, taxes, depreciation and amortization) divided by net interest expense and the leverage ratio is defined as debt divided by EBITDA. For purposes of these calculations EBITDA is calculated as net income plus interest expense, taxes, depreciation, amortization, non-cash impairment of goodwill, intangibles and real estate, non-recurring cash charges not to exceed in the aggregate $400 million and extraordinary losses less interest income or extraordinary gains. Debt is adjusted to exclude the premium on acquired debt and net interest is adjusted to exclude the amortization of premium on acquired debt and premium on early retirement of debt. A breach of a restrictive covenant in the Company's credit agreement or the inability of the Company to maintain the financial ratios described above could result in an event of default under the credit agreement. In addition, an event of default would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the terms and conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be immediately due and payable. Moreover, most of the Company's senior notes and debentures contain cross-default provisions based on the non-payment at maturity, or other default after an applicable grace period, of any other debt, the unpaid principal amount of which is not less than $100 million that could be triggered by an event of default under the credit agreement. In such an event, the Company's senior notes and debentures that contain cross-default provisions would also be subject to acceleration. Commercial Paper The Company is a party to a $1,500 million unsecured commercial paper program. The Company may issue and sell commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-current combined borrowing availability under the bank credit agreement described above. The issuance of commercial paper will have the effect, while such commercial paper is outstanding, of reducing the Company's borrowing capacity under the bank credit agreement by an amount equal to the principal amount of such commercial paper. During 2015, the Company utilized seasonal borrowings available under this commercial paper program. The amount of borrowings under the commercial paper program increased to its highest level for 2015 of approximately $1,100 million during the fourth quarter. As of January 30, 2016, there were no remaining borrowings outstanding under the commercial paper program. The Company had no commercial paper outstanding under its commercial paper program throughout 2014. This program, which is an obligation of a 100%-owned subsidiary of Macy's, Inc., is not secured. However, Parent has fully and unconditionally guaranteed the obligations. Senior Notes and Debentures The senior notes and the senior debentures are unsecured obligations of a 100%- owned subsidiary of Macy's, Inc. and Parent has fully and unconditionally guaranteed these obligations (see Note 16, "Condensed Consolidating Financial Information"). Other Financing Arrangements At January 30, 2016 and January 31, 2015, the Company had dedicated $37 million of cash, included in prepaid expenses and other current assets, which is used to collateralize the Company's issuances of standby letters of credit. There were $21 million and $29 million of other standby letters of credit outstanding at January 30, 2016 and January 31, 2015, respectively. 424B2 1 049698d424b2.htm FINAL PROSPECTUS SUPPLEMENT Table of Contents Filed pursuant to Rule 424(b)(2) SEC File No. 333-208285 333-208285-01 CALCULATION OF REGISTRATION FEE Title of each Amount Maximum Maximum Securities to to be Offering Price Per Aggregate Amount of be Registered Registered Unit Offering Price Registration Fee (1) 3.450% Senior Notes due 2021 $500,000,000 99.899% $499,495,000 $50,300 (1) Pursuant to Rule 457(r), the total registration fee for this offering is $50,300. Table of Contents PROSPECTUS SUPPLEMENT (TO PROSPECTUS DATED DECEMBER 1, 2015) $500,000,000 Macy's Retail Holdings, Inc. 3.450% Senior Notes Due 2021 Payment of principal and interest unconditionally guaranteed by Macy's, Inc. Macy's Retail Holdings, Inc. ("Macy's Holdings") is offering $500,000,000 aggregate principal amount of its 3.450% Senior Notes due January 15, 2021, which we refer to as the "senior notes. The senior notes mature on January 15, 2021, unless earlier redeemed. Macy's Holdings will pay interest on the senior notes semi-annually in arrears on each January 15 and July 15 of each year. The first interest payment will be made on July 15, 2016. The senior notes will rank equal in right of payment to any other existing or future senior unsecured obligations of Macy's Holdings. The guarantee will rank equal in right of payment to all other existing and future senior unsecured obligations of Macy's, Inc. Macy's Holdings may redeem the senior notes at any time at the redemption price set forth herein. Upon the occurrence of both i) a change of control of Macy's, Inc. and (ii) within a specified period in relation to the change of control, the senior notes being downgraded by at least two of Fitch Ratings, Inc., Moody's Investors Service, Inc. and Standard & Poor's Ratings Services and being rated below an investment grade rating by at least two of such rating agencies, Macy's Holdings will be required to make an offer to purchase the senior notes at 101% of their principal amount. On and after December 15, 2020, Macy's Holdings may redeem the senior notes at par, plus accrued and unpaid interest. Investing in the senior notes involves risks. See the "Risk Factors" section in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015. Senior Notes Per Note Total 99.899% $499,495,000 Initial public offering price (1) Underwriting discounts and commissions Proceeds to Macy's Holdings (1) 0.600% 99.299% $ 3,000,000 $496,495,000 (1) Plus accrued interest, if any, from December 10, 2015. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the senior notes in book-entry form only through the facilities of The Depository Trust Company for the accounts of its participants, including Clearstream Banking, societe anonyme, and Euroclear Bank S.A./N.V., as operator of the Euroclear System, against payment in New York, New York on December 10, 2015. Joint Book-Running Managers BofA Merrill Lynch Goldman, Sachs & Co. Credit Suisse US Bancorp Co-Managers J.P. Morgan Wells Fargo Securities BNY Mellon Capital Markets, LLC Loop Capital Markets Ramirez & Co., Inc. Citigroup Fifth Third Securities MUFG PNC Capital Markets LLC Standard Chartered Bank The Williams Capital Group, L.P. The date of this prospectus supplement is December 7, 2015. Table of Contents TABLE OF CONTENTS PROSPECTUS SUPPLEMENT Page S-1 S-3 SUMMARY USE OF PROCEEDS DESCRIPTION OF NOTES U.S. FEDERAL INCOME TAX CONSIDERATIONS UNDERWRITING EXPERTS LEGAL MATTERS S-4 S-22 S-27 S-32 S-32 PROSPECTUS Page ABOUT THIS PROSPECTUS WHERE YOU CAN FIND MORE INFORMATION INCORPORATION BY REFERENCE FORWARD-LOOKING STATEMENTS DESCRIPTION OF DEBT SECURITIES DESCRIPTION OF MACY'S CAPITAL STOCK DESCRIPTION OF DEPOSITARY SHARES DESCRIPTION OF WARRANTS DESCRIPTION OF PURCHASE CONTRACTS DESCRIPTION OF UNITS RATIO OF EARNINGS TO FIXED CHARGES USE OF PROCEEDS CERTAIN LEGAL MATTERS EXPERTS will rank equal in right of payment to all other existing and future senior unsecured obligations of Macy's, Inc. Optional Redemption Macy's Holdings may, at its option, at any time in whole or from time to time in part, prior to December 15, 2020 (one month prior to the maturity date (the "Par Call Date")) redeem the senior notes at the redemption prices described in this prospectus supplement, plus accrued interest to the date of redemption. At any time on and after the Par Call Date, Macy's Holdings may, at its option, redeem the senior notes in whole or from time to time in part at a redemption price equal to 100% of the principal amount of the senior notes to be redeemed plus accrued and unpaid interest on the senior notes to be redeemed to the date of redemption. Change of Control Upon the occurrence of both (i) a change of control of Macy's, Inc. and (ii) within a specified period in relation to the change of control, the senior notes being downgraded by at least two of Fitch Ratings, Inc., Moody's Investors Service, Inc. and Standard & Poor's Ratings Services and being rated below an investment grade rating by at least two of such rating agencies, Macy's Holdings will be required to make an offer to purchase the senior notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the date of repurchase. See "Description of NotesChange of Control." Case 1 Debt Footnote Macy's The purpose of this case is to understand how bonds are issued and how bonds are shown on the financial statements. Necessary portions of the 10-K for Macy's and a bond prospectus for a Macy bond issue are included the file, "Case 1 Reference Material." Answer the following questions using complete sentences in the spaces provided. We are focusing on the 3.45% senior note due 2021 issued December 7, 2015. Start with footnote 6, "Financing". The footnote tells us that the note was issued. 1. Copy and paste this part of the footnote here: 2. What was the principal amount of the debt? 3. What was the reason for borrowing the debt? MACY'S, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (millions) 2014 2013 1,526 $ 1,486 87 1,036 73 88 1,020 62 (5) (8) (60) 22 44 (3) (61) (58) (249) (2) 2015 Cash flows from operating activities: Net income $ 1,070 $ Adjustments to reconcile net income to net cash provided by operating activities: Impairments, store closing and other costs 288 Depreciation and amortization 1,061 Stock-based compensation expense 65 Amortization of financing costs and premium on acquired debt (14) Changes in assets and liabilities: (Increase) decrease in receivables (45) C (Increase) decrease in merchandise inventories Increase in prepaid expenses and other current assets Increase in other assets not separately identified (1) Increase (decrease) in merchandise accounts payable (78) Increase (decrease) in accounts payable, accrued liabilities and other items not separately identified (144) Increase (decrease) in current income taxes Increase (decrease) in deferred income taxes (1) Increase (decrease) in other liabilities not separately identified (88) Net cash provided by operating activities 1,984 Cash flows from investing activities: Purchase of property and equipment (777) Capitalized software (336) Acquisition of Bluemercury, Inc., net of cash acquired (212) (21) 101 48 (69) 29 (142) 10 197 2,709 2,549 (770) (298) (607) (256) 24 163 Disposition of property and equipment 204 172 132 Other, net 29 (74) (57) Net cash used by investing activities (1,092) (970) (788) Cash flows from financing activities: Debt issued 499 1,044 400 Financing costs (4) (9) (9) Debt repaid (152) (870) (124) Dividends paid (456) (421) (359) Increase (decrease) in outstanding checks (83) 133 Acquisition of treasury stock (2,001) (1,901) (1,571) Issuance of common stock 258 315 Proceeds from non-controlling interest Net cash used by financing activities (2,029) (1,766) (1,324) Net increase (decrease) in cash and cash equivalents (1,137) (27) 437 Cash and cash equivalents beginning of period 2,246 2,273 1,836 Cash and cash equivalents end of period $ 1,109 $ 2,246 $ 2,273 Supplemental cash flow information: Interest paid $ 383 $ 413 $ 388 Interest received 22 Income taxes paid (net of refunds received) 635 834 835 The accompanying notes are an integral part of these Consolidated Financial Statements. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 6. Financing The Company's debt is as follows: January 30, January 31, 2016 2015 (millions) $ - 577 $ 59 Short-term debt: 5.9% Senior notes due 2016 7.45% Senior debentures due 2016 7.5% Senior debentures due 2015 Capital lease and current portion of other long-term obligations $ 642 $ 76 $ 750 550 550 - 500 500 Long-term debt: 2.875% Senior notes due 2023 3.875% Senior notes due 2022 4.5% Senior notes due 2034 3.45% Senior notes due 2021 3.625% Senior notes due 2024 6.375% Senior notes due 2037 4.375% Senior notes due 2023 6.9% Senior debentures due 2029 6.7% Senior debentures due 2034 7.45% Senior debentures due 2017 6.65% Senior debentures due 2024 7.0% Senior debentures due 2028 6.9% Senior debentures due 2032 5.125% Senior debentures due 2042 4.3% Senior notes due 2043 6.7% Senior debentures due 2028 6.79% Senior debentures due 2027 7.875% Senior debentures due 2036 8.75% Senior debentures due 2029 8.5% Senior debentures due 2019 10.25% Senior debentures due 2021 750 550 550 500 500 500 400 400 400 300 300 300 250 250 250 200 165 108 400 400 400 300 300 300 250 250 250 200 165 108 61 61 36 577 76 7.6% Senior debentures due 2025 7.875% Senior debentures due 2030 9.5% amortizing debentures due 2021 9.75% amortizing debentures due 2021 5.9% Senior notes due 2016 8.125% Senior debentures due 2035 7.45% Senior debentures due 2016 Unamortized debt issue costs Unamortized debt discount Premium on acquired debt, using an effective interest yield of 5.415% to 6.165% Capital lease and other long-term obligations (32) (16) 59 (32) (18) 164 143 29 6,995 29 $ $ 7,233 Interest expense and premium on early retirement of debt is as follows: 2013 $ 2015 2014 (millions) 393 $ 411 $ (21) (12) 407 (15) Interest on debt Amortization of debt premium Amortization of financing costs and debt discount Interest on capitalized leases Less interest capitalized on construction Interest expense $ 363 $ 395 $ 390 Premium on early retirement of debt - $ 17 $ On November 14, 2014, the Company provided a notice of redemption related to all of the $407 million of 7.875% senior notes due 2015, as allowed under the terms of the indenture. The price for the redemption was calculated pursuant to the indenture and resulted in the recognition of additional interest expense of $17 million during 2014. This additional interest expense is presented as premium on early retirement of debt on the Consolidated Statements of Income. Future maturities of long-term debt, other than capitalized leases, are shown below: (millions) Fiscal year 2017 2018 $ 306 The following summarizes certain components of the Company's debt: Bank Credit Agreement The Company entered into a new credit agreement with certain financial institutions on May 10, 2013 providing for revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1,500 million (which may be increased to $1,750 million at the option of the Company, subject to the willingness of existing or new lenders to provide commitments for such additional financing) outstanding at any particular time. The agreement is set to expire May 10, 2018 and replaced the prior agreement which was set to expire June 20, 2015. As of January 30, 2016, and January 31, 2015, there were no revolving credit loans outstanding under this credit agreement, and there were no borrowings under the agreement throughout all of 2015 and 2014. However, there were less than $1 million of standby letters of credit outstanding at January 30, 2016 and January 31, 2015. Revolving loans under the credit agreement bear interest based on various published rates. The Company's credit agreement, which is an obligation of a 100%-owned subsidiary of Macy's, Inc. ("Parent"), is not secured. However, Parent has fully and unconditionally guaranteed this obligation, subject to specified limitations. The Company's interest coverage ratio for 2015 was 8.85 and its leverage ratio at January 30, 2016 was 2.21, in each case as calculated in accordance with the credit agreement. The credit agreement requires the Company to maintain a specified interest coverage ratio for the latest four quarters of no less than 3.25 and a specified leverage ratio as of and for the latest four quarters of no more than 3.75. The interest coverage ratio is defined as EBITDA (earnings before interest, taxes, depreciation and amortization) divided by net interest expense and the leverage ratio is defined as debt divided by EBITDA. For purposes of these calculations EBITDA is calculated as net income plus interest expense, taxes, depreciation, amortization, non-cash impairment of goodwill, intangibles and real estate, non-recurring cash charges not to exceed in the aggregate $400 million and extraordinary losses less interest income or extraordinary gains. Debt is adjusted to exclude the premium on acquired debt and net interest is adjusted to exclude the amortization of premium on acquired debt and premium on early retirement of debt. A breach of a restrictive covenant in the Company's credit agreement or the inability of the Company to maintain the financial ratios described above could result in an event of default under the credit agreement. In addition, an event of default would occur under the credit agreement if any indebtedness of the Company in excess of an aggregate principal amount of $150 million becomes due prior to its stated maturity or the holders of such indebtedness become able to cause it to become due prior to its stated maturity. Upon the occurrence of an event of default, the lenders could, subject to the terms and conditions of the credit agreement, elect to declare the outstanding principal, together with accrued interest, to be immediately due and payable. Moreover, most of the Company's senior notes and debentures contain cross-default provisions based on the non-payment at maturity, or other default after an applicable grace period, of any other debt, the unpaid principal amount of which is not less than $100 million that could be triggered by an event of default under the credit agreement. In such an event, the Company's senior notes and debentures that contain cross-default provisions would also be subject to acceleration. Commercial Paper The Company is a party to a $1,500 million unsecured commercial paper program. The Company may issue and sell commercial paper in an aggregate amount outstanding at any particular time not to exceed its then-current combined borrowing availability under the bank credit agreement described above. The issuance of commercial paper will have the effect, while such commercial paper is outstanding, of reducing the Company's borrowing capacity under the bank credit agreement by an amount equal to the principal amount of such commercial paper. During 2015, the Company utilized seasonal borrowings available under this commercial paper program. The amount of borrowings under the commercial paper program increased to its highest level for 2015 of approximately $1,100 million during the fourth quarter. As of January 30, 2016, there were no remaining borrowings outstanding under the commercial paper program. The Company had no commercial paper outstanding under its commercial paper program throughout 2014. This program, which is an obligation of a 100%-owned subsidiary of Macy's, Inc., is not secured. However, Parent has fully and unconditionally guaranteed the obligations. Senior Notes and Debentures The senior notes and the senior debentures are unsecured obligations of a 100%- owned subsidiary of Macy's, Inc. and Parent has fully and unconditionally guaranteed these obligations (see Note 16, "Condensed Consolidating Financial Information"). Other Financing Arrangements At January 30, 2016 and January 31, 2015, the Company had dedicated $37 million of cash, included in prepaid expenses and other current assets, which is used to collateralize the Company's issuances of standby letters of credit. There were $21 million and $29 million of other standby letters of credit outstanding at January 30, 2016 and January 31, 2015, respectively. 424B2 1 049698d424b2.htm FINAL PROSPECTUS SUPPLEMENT Table of Contents Filed pursuant to Rule 424(b)(2) SEC File No. 333-208285 333-208285-01 CALCULATION OF REGISTRATION FEE Title of each Amount Maximum Maximum Securities to to be Offering Price Per Aggregate Amount of be Registered Registered Unit Offering Price Registration Fee (1) 3.450% Senior Notes due 2021 $500,000,000 99.899% $499,495,000 $50,300 (1) Pursuant to Rule 457(r), the total registration fee for this offering is $50,300. Table of Contents PROSPECTUS SUPPLEMENT (TO PROSPECTUS DATED DECEMBER 1, 2015) $500,000,000 Macy's Retail Holdings, Inc. 3.450% Senior Notes Due 2021 Payment of principal and interest unconditionally guaranteed by Macy's, Inc. Macy's Retail Holdings, Inc. ("Macy's Holdings") is offering $500,000,000 aggregate principal amount of its 3.450% Senior Notes due January 15, 2021, which we refer to as the "senior notes. The senior notes mature on January 15, 2021, unless earlier redeemed. Macy's Holdings will pay interest on the senior notes semi-annually in arrears on each January 15 and July 15 of each year. The first interest payment will be made on July 15, 2016. The senior notes will rank equal in right of payment to any other existing or future senior unsecured obligations of Macy's Holdings. The guarantee will rank equal in right of payment to all other existing and future senior unsecured obligations of Macy's, Inc. Macy's Holdings may redeem the senior notes at any time at the redemption price set forth herein. Upon the occurrence of both i) a change of control of Macy's, Inc. and (ii) within a specified period in relation to the change of control, the senior notes being downgraded by at least two of Fitch Ratings, Inc., Moody's Investors Service, Inc. and Standard & Poor's Ratings Services and being rated below an investment grade rating by at least two of such rating agencies, Macy's Holdings will be required to make an offer to purchase the senior notes at 101% of their principal amount. On and after December 15, 2020, Macy's Holdings may redeem the senior notes at par, plus accrued and unpaid interest. Investing in the senior notes involves risks. See the "Risk Factors" section in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015. Senior Notes Per Note Total 99.899% $499,495,000 Initial public offering price (1) Underwriting discounts and commissions Proceeds to Macy's Holdings (1) 0.600% 99.299% $ 3,000,000 $496,495,000 (1) Plus accrued interest, if any, from December 10, 2015. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the senior notes in book-entry form only through the facilities of The Depository Trust Company for the accounts of its participants, including Clearstream Banking, societe anonyme, and Euroclear Bank S.A./N.V., as operator of the Euroclear System, against payment in New York, New York on December 10, 2015. Joint Book-Running Managers BofA Merrill Lynch Goldman, Sachs & Co. Credit Suisse US Bancorp Co-Managers J.P. Morgan Wells Fargo Securities BNY Mellon Capital Markets, LLC Loop Capital Markets Ramirez & Co., Inc. Citigroup Fifth Third Securities MUFG PNC Capital Markets LLC Standard Chartered Bank The Williams Capital Group, L.P. The date of this prospectus supplement is December 7, 2015. Table of Contents TABLE OF CONTENTS PROSPECTUS SUPPLEMENT Page S-1 S-3 SUMMARY USE OF PROCEEDS DESCRIPTION OF NOTES U.S. FEDERAL INCOME TAX CONSIDERATIONS UNDERWRITING EXPERTS LEGAL MATTERS S-4 S-22 S-27 S-32 S-32 PROSPECTUS Page ABOUT THIS PROSPECTUS WHERE YOU CAN FIND MORE INFORMATION INCORPORATION BY REFERENCE FORWARD-LOOKING STATEMENTS DESCRIPTION OF DEBT SECURITIES DESCRIPTION OF MACY'S CAPITAL STOCK DESCRIPTION OF DEPOSITARY SHARES DESCRIPTION OF WARRANTS DESCRIPTION OF PURCHASE CONTRACTS DESCRIPTION OF UNITS RATIO OF EARNINGS TO FIXED CHARGES USE OF PROCEEDS CERTAIN LEGAL MATTERS EXPERTS will rank equal in right of payment to all other existing and future senior unsecured obligations of Macy's, Inc. Optional Redemption Macy's Holdings may, at its option, at any time in whole or from time to time in part, prior to December 15, 2020 (one month prior to the maturity date (the "Par Call Date")) redeem the senior notes at the redemption prices described in this prospectus supplement, plus accrued interest to the date of redemption. At any time on and after the Par Call Date, Macy's Holdings may, at its option, redeem the senior notes in whole or from time to time in part at a redemption price equal to 100% of the principal amount of the senior notes to be redeemed plus accrued and unpaid interest on the senior notes to be redeemed to the date of redemption. Change of Control Upon the occurrence of both (i) a change of control of Macy's, Inc. and (ii) within a specified period in relation to the change of control, the senior notes being downgraded by at least two of Fitch Ratings, Inc., Moody's Investors Service, Inc. and Standard & Poor's Ratings Services and being rated below an investment grade rating by at least two of such rating agencies, Macy's Holdings will be required to make an offer to purchase the senior notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the date of repurchase. See "Description of NotesChange of Control