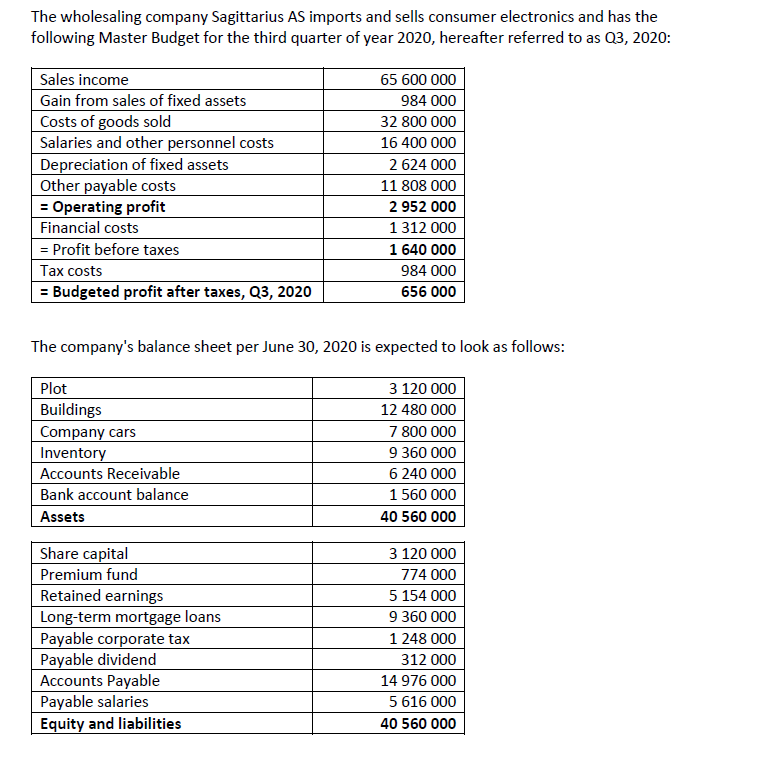

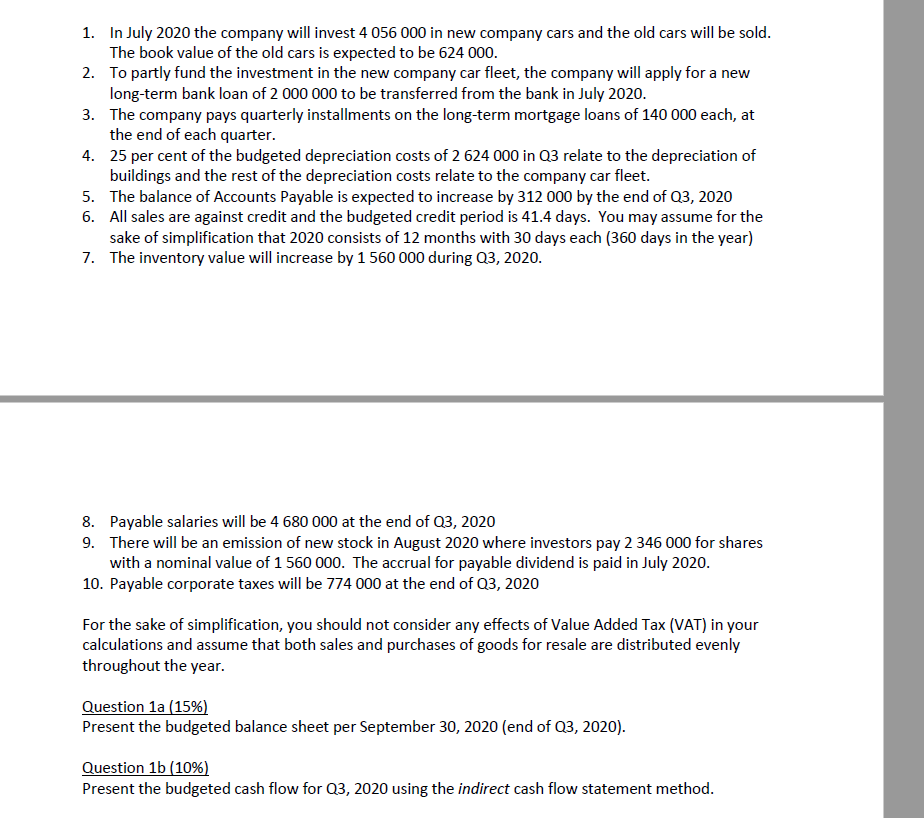

The wholesaling company Sagittarius AS imports and sells consumer electronics and has the following Master Budget for the third quarter of year 2020, hereafter referred to as 03, 2020: Sales income Gain from sales of fixed assets Costs of goods sold Salaries and other personnel costs Depreciation of fixed assets Other payable costs = Operating profit Financial costs = Profit before taxes Tax costs = Budgeted profit after taxes, Q3, 2020 65 600 000 984 000 32 800 000 16 400 000 2624 000 11 808 000 2 952 000 1 312 000 1 640 000 984 000 656 000 The company's balance sheet per June 30, 2020 is expected to look as follows: Plot Buildings Company cars Inventory Accounts Receivable Bank account balance Assets 3 120 000 12 480 000 7 800 000 9 360 000 6 240 000 1 560 000 40 560 000 Share capital Premium fund Retained earnings Long-term mortgage loans Payable corporate tax Payable dividend Accounts Payable Payable salaries Equity and liabilities 3 120 000 774 000 5 154 000 9 360 000 1 248 000 312 000 14 976 000 5 616 000 40 560 000 1. In July 2020 the company will invest 4 056 000 in new company cars and the old cars will be sold. The book value of the old cars is expected to be 624 000. 2. To partly fund the investment in the new company car fleet, the company will apply for a new long-term bank loan of 2 000 000 to be transferred from the bank in July 2020. 3. The company pays quarterly installments on the long-term mortgage loans of 140 000 each, at the end of each quarter. 4. 25 per cent of the budgeted depreciation costs of 2 624 000 in Q3 relate to the depreciation of buildings and the rest of the depreciation costs relate to the company car fleet. 5. The balance of Accounts Payable is expected to increase by 312 000 by the end of Q3, 2020 6. All sales are against credit and the budgeted credit period is 41.4 days. You may assume for the sake of simplification that 2020 consists of 12 months with 30 days each (360 days in the year) 7. The inventory value will increase by 1 560 000 during 03, 2020. 8. Payable salaries will be 4 680 000 at the end of Q3, 2020 9. There will be an emission of new stock in August 2020 where investors pay 2 346 000 for shares with a nominal value of 1 560 000. The accrual for payable dividend is paid in July 2020. 10. Payable corporate taxes will be 774 000 at the end of Q3, 2020 For the sake of simplification, you should not consider any effects of Value Added Tax (VAT) in your calculations and assume that both sales and purchases of goods for resale are distributed evenly throughout the year. Question 1a (15%) Present the budgeted balance sheet per September 30, 2020 (end of Q3, 2020). Question 1b (10%) Present the budgeted cash flow for Q3, 2020 using the indirect cash flow statement method