Answered step by step

Verified Expert Solution

Question

1 Approved Answer

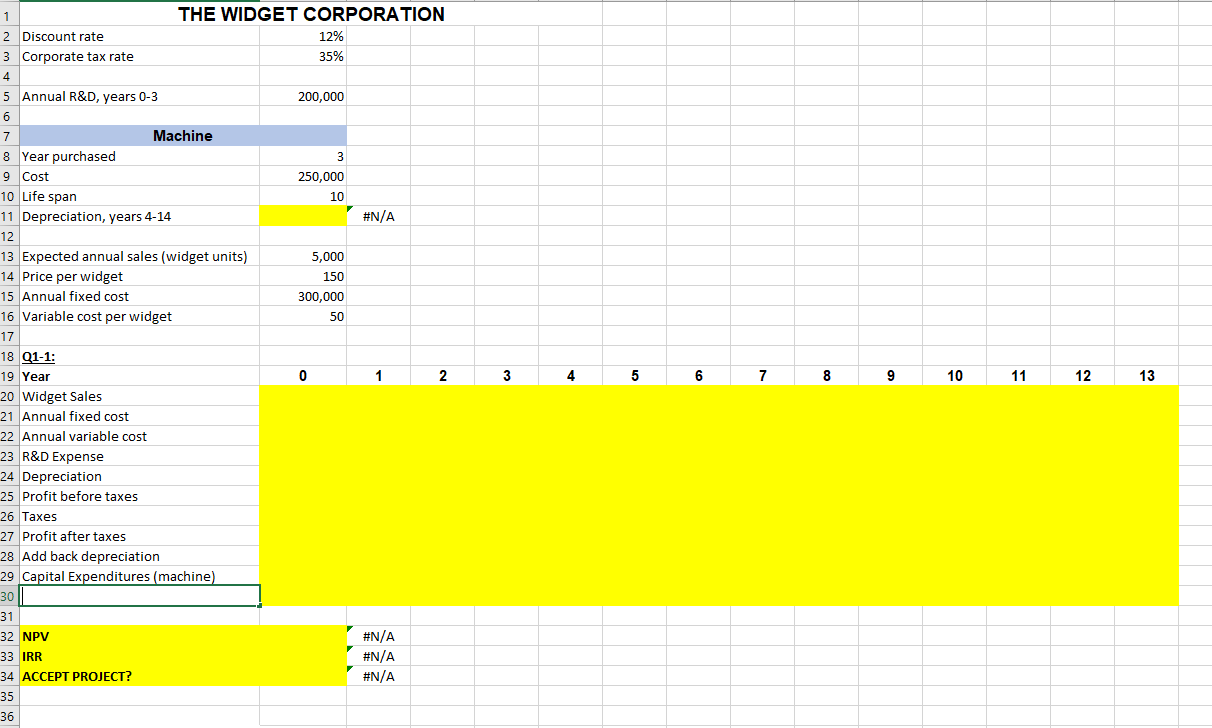

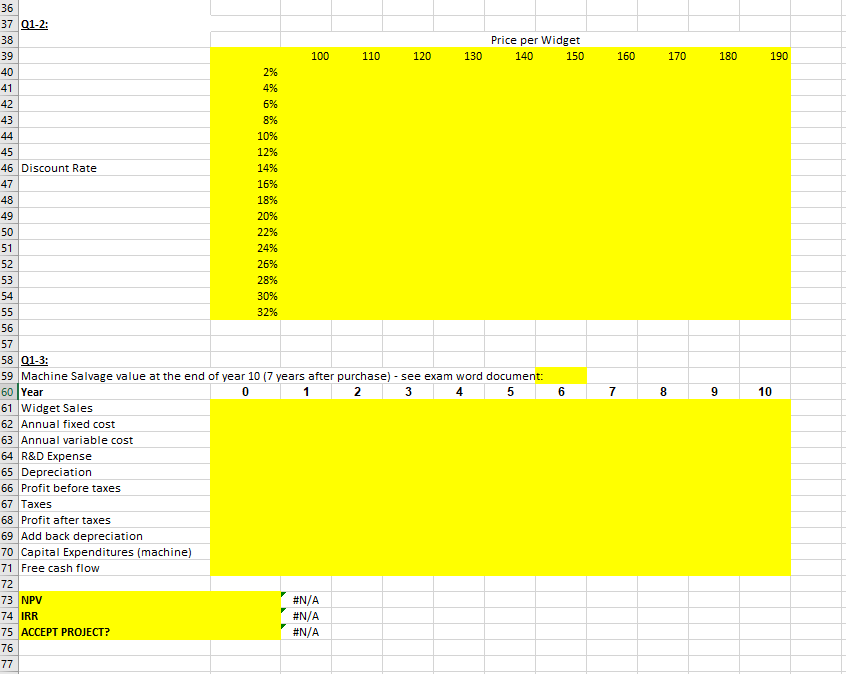

The Widget Corporation is considering manufacturing a special type of widget. The chief financial analyst of the company presented the following calculation for the special

The Widget Corporation is considering manufacturing a special type of widget. The chief financial analyst of the company presented the following calculation for the special widget:

- R&D: $200,000 annually today and in each of the next three years (years 0,,3)

- Production and Sales: Can only begin year 4, after an appropriate machine is purchased.

- Expected life span of project: 10 years from purchase of the machine in year 3.

- Investment in machinery: $250,000 (at t=3); expected life span of the machine 10 years; the machine will produce in years 4, 5, 13. The machine is depreciated to 0 using straight line depreciation over the 10 years.

- Expected annual sales: 5,000 widgets at $150 per widget

- Fixed Costs: $300,000 annually

- Variable Costs: $50 per widget.

The Widgets discount rate is 12%, the corporate rate is 35%. Assume that at the end of the project (i.e. after year 13) the new technology for producing widgets will have been superseded by other technologies and therefore the machine has no value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started