Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Wildflower public company limited is a fragrance and cosmetics manufacturing company registered in the French Republic. The Wildflower public company limited (France) views

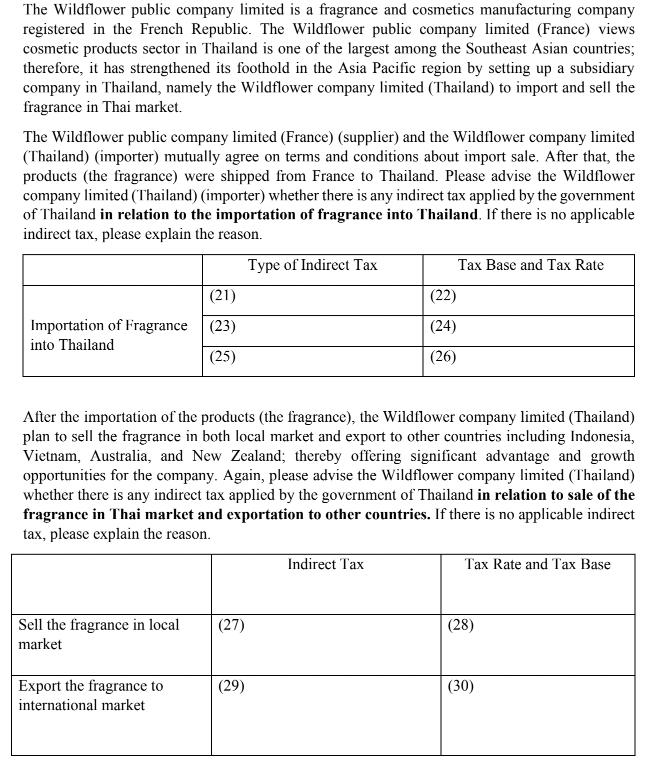

The Wildflower public company limited is a fragrance and cosmetics manufacturing company registered in the French Republic. The Wildflower public company limited (France) views cosmetic products sector in Thailand is one of the largest among the Southeast Asian countries; therefore, it has strengthened its foothold in the Asia Pacific region by setting up a subsidiary company in Thailand, namely the Wildflower company limited (Thailand) to import and sell the fragrance in Thai market. The Wildflower public company limited (France) (supplier) and the Wildflower company limited (Thailand) (importer) mutually agree on terms and conditions about import sale. After that, the products (the fragrance) were shipped from France to Thailand. Please advise the Wildflower company limited (Thailand) (importer) whether there is any indirect tax applied by the government of Thailand in relation to the importation of fragrance into Thailand. If there is no applicable indirect tax, please explain the reason. Type of Indirect Tax Importation of Fragrance into Thailand Sell the fragrance in local market (21) (23) (25) Export the fragrance to international market After the importation of the products (the fragrance), the Wildflower company limited (Thailand) plan to sell the fragrance in both local market and export to other countries including Indonesia, Vietnam, Australia, and New Zealand; thereby offering significant advantage and growth opportunities for the company. Again, please advise the Wildflower company limited (Thailand) whether there is any indirect tax applied by the government of Thailand in relation to sale of the fragrance in Thai market and exportation to other countries. If there is no applicable indirect tax, please explain the reason. (27) (29) Tax Base and Tax Rate Indirect Tax (22) (24) (26) Tax Rate and Tax Base (28) (30)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

In relation to the importation of fragrance into Thailand the Wildflower Company Limited Thailand importer is not subject to any indirect tax This is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started