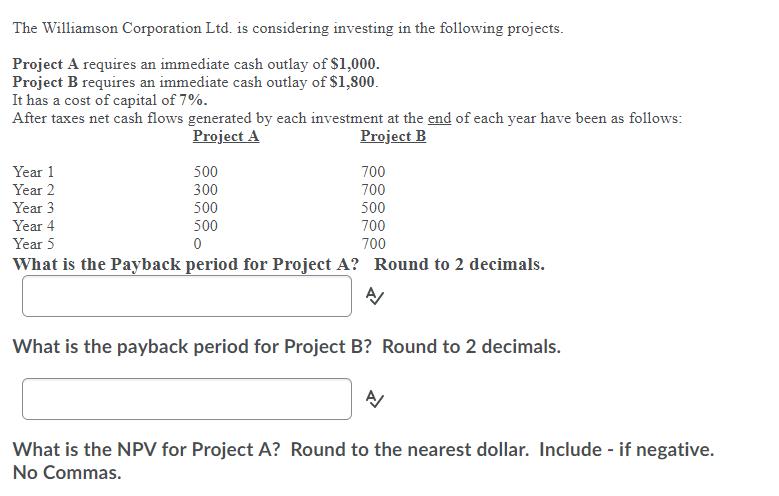

The Williamson Corporation Ltd. is considering investing in the following projects. Project A requires an immediate cash outlay of $1,000. Project B requires an

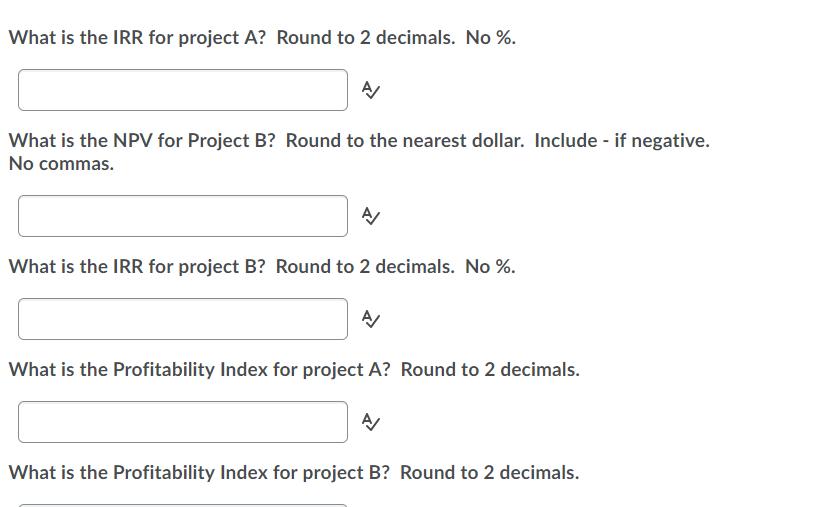

The Williamson Corporation Ltd. is considering investing in the following projects. Project A requires an immediate cash outlay of $1,000. Project B requires an immediate cash outlay of $1,800. It has a cost of capital of 7%. After taxes net cash flows generated by each investment at the end of each year have been as follows: Project A Project B Year 1 500 700 Year 2 300 700 Year 3 500 500 Year 4 500 700 Year 5 0 700 What is the Payback period for Project A? Round to 2 decimals. A What is the payback period for Project B? Round to 2 decimals. A/ What is the NPV for Project A? Round to the nearest dollar. Include - if negative. No Commas. What is the IRR for project A? Round to 2 decimals. No %. A/ What is the NPV for Project B? Round to the nearest dollar. Include - if negative. No commas. A/ What is the IRR for project B? Round to 2 decimals. No %. A/ What is the Profitability Index for project A? Round to 2 decimals. A/ What is the Profitability Index for project B? Round to 2 decimals. Regardless of your answers above, if project A had a PI of 1.50 and project B was 1.85, according to capital rationing, which project would you choose? A or B. Type in A or B just like this. A/

Step by Step Solution

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

O Payback period is the time required to receve initial investment from annual ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started