Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Wilmont Chemical Corporation produced a variety of industrial products, including a specialty chemical called SC. SC was packaged and sold by the company

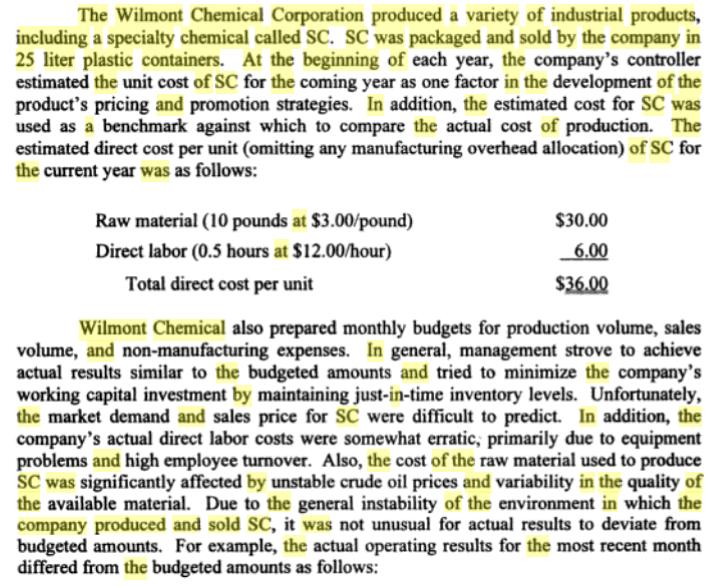

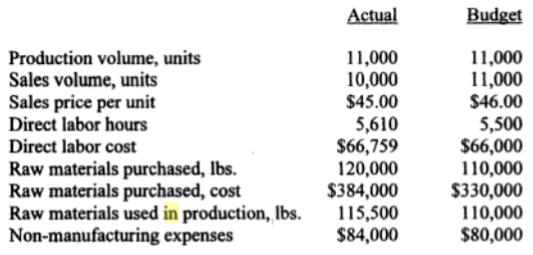

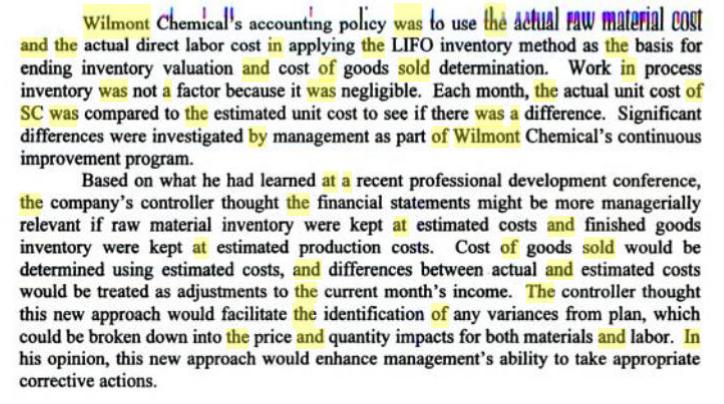

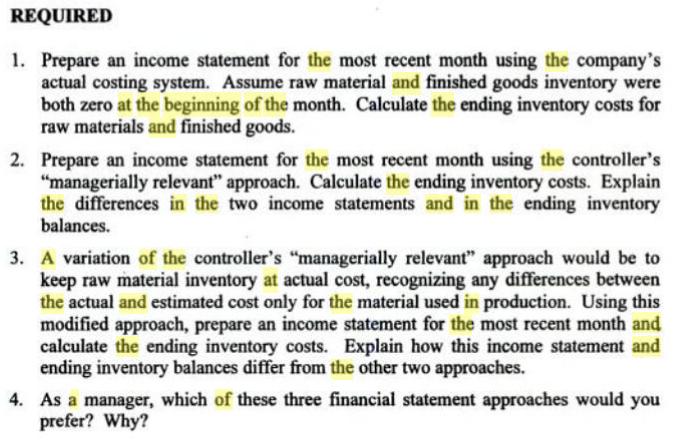

The Wilmont Chemical Corporation produced a variety of industrial products, including a specialty chemical called SC. SC was packaged and sold by the company in 25 liter plastic containers. At the beginning of each year, the company's controller estimated the unit cost of SC for the coming year as one factor in the development of the product's pricing and promotion strategies. In addition, the estimated cost for SC was used as a benchmark against which to compare the actual cost of production. The estimated direct cost per unit (omitting any manufacturing overhead allocation) of SC for the current year was as follows: Raw material (10 pounds at $3.00/pound) $30.00 Direct labor (0.5 hours at $12.00/hour) 6.00 Total direct cost per unit $36.00 Wilmont Chemical also prepared monthly budgets for production volume, sales volume, and non-manufacturing expenses. In general, management strove to achieve actual results similar to the budgeted amounts and tried to minimize the company's working capital investment by maintaining just-in-time inventory levels. Unfortunately, the market demand and sales price for SC were difficult to predict. In addition, the company's actual direct labor costs were somewhat erratic, primarily due to equipment problems and high employee turnover. Also, the cost of the raw material used to produce SC was significantly affected by unstable crude oil prices and variability in the quality of the available material. Due to the general instability of the environment in which the company produced and sold SC, it was not unusual for actual results to deviate from budgeted amounts. For example, the actual operating results for the most recent month differed from the budgeted amounts as follows: Actual Budget Production volume, units Sales volume, units Sales price per unit Direct labor hours 11,000 10,000 $45.00 11,000 11,000 $46.00 Direct labor cost Raw materials purchased, Ibs. Raw materials purchased, cost Raw materials used in production, Ibs. Non-manufacturing expenses 5,610 $66,759 120,000 $384,000 115,500 $84,000 5,500 $66,000 110,000 $330,000 110,000 $80,000 Wilmont Chemical's accounting policy was to use the actiulal FAW material cost and the actual direct labor cost in applying the LIFO inventory method as the basis for ending inventory valuation and cost of goods sold determination. Work in process inventory was not a factor because it was negligible. Each month, the actual unit cost of SC was compared to the estimated unit cost to see if there was a difference. Significant differences were investigated by management as part of Wilmont Chemical's continuous improvement program. Based on what he had learned at a recent professional development conference, the company's controller thought the financial statements might be more managerially relevant if raw material inventory were kept at estimated costs and finished goods inventory were kept at estimated production costs. Cost of goods sold would be determined using estimated costs, and differences between actual and estimated costs would be treated as adjustments to the current month's income. The controller thought this new approach would facilitate the identification of any variances from plan, which could be broken down into the price and quantity impacts for both materials and labor. In his opinion, this new approach would enhance management's ability to take appropriate corrective actions. REQUIRED 1. Prepare an income statement for the most recent month using the company's actual costing system. Assume raw material and finished goods inventory were both zero at the beginning of the month. Calculate the ending inventory costs for raw materials and finished goods. 2. Prepare an income statement for the most recent month using the controller's "managerially relevant" approach. Calculate the ending inventory costs. Explain the differences in the two income statements and in the ending inventory balances. 3. A variation of the controller's "managerially relevant" approach would be to keep raw material inventory at actual cost, recognizing any differences between the actual and estimated cost only for the material used in production. Using this modified approach, prepare an income statement for the most recent month and calculate the ending inventory costs. Explain how this income statement and ending inventory balances differ from the other two approaches. 4. As a manager, which of these three financial statement approaches would you prefer? Why?

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

As a manager of the three financial statement approaches I would prefer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started