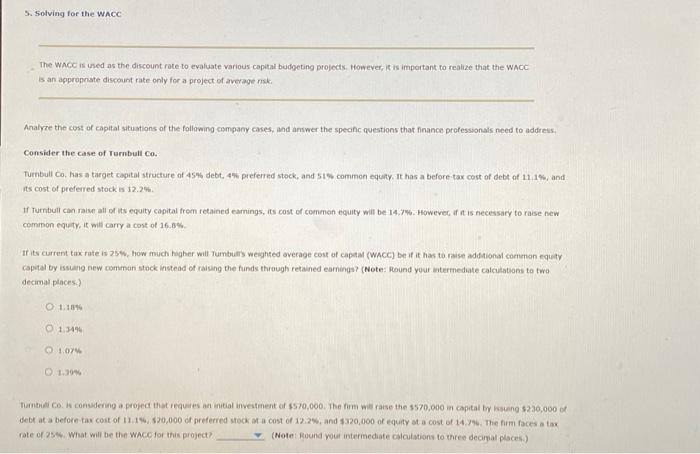

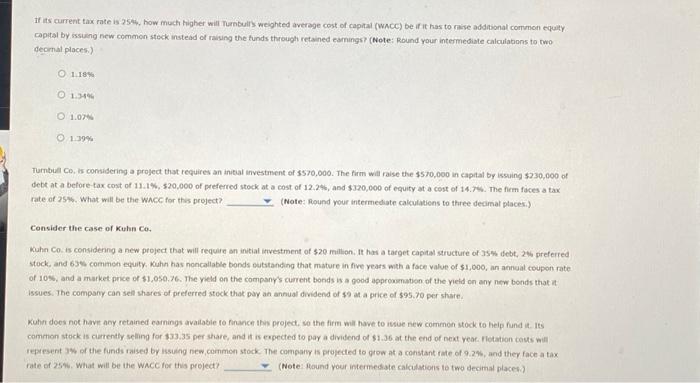

The WNCc is used as the discount rate to evaluate various capital budgeting projects. However. it is important to realize that the WAcC is an appropiste discount rate only for a project of average mak. Analyre the cost of capital situstions of the following company cases, and anwwer the spechic questions that finance professionals need to addreis. Consider the case of Turnbull Co. Turnbull Co. has a target cagital structure of 454 debt, 4% preferred stock, and 51 common equiy. It has a before tax cost of debt of 11 , 1%, and its cost of prefered stock is 12.2%. If rumbull can raise all of its equity capital frem retained eamings, its cost of comman equity will be 14,7w. Howwevec, if it is necessary to rase new comimon equty, it witl carry a cost ot 16.B\%. If its ciarent tas rate is 25%, how much hagher will Tumburis weighted ovecage cost of capaal (Whcc) be if it has ta raise addhional coemenan equity capotal by issuang new comman stock instead of raising the funds through retained eamings? (Note: pound your anterrnedate calculatons to two decimal places.) 1.344 1+30% rate of 25wi. What will be the wace for this project? (Note: Round yout interinediate calculations to thiee decimal places.) If its current tax mate is 25 his, how much higher will Turnbulls weighted average cost of capital (wacc) be if it has to misese addabonal corrumon equity captal by issuing new common steck instead of raising the funds through retained eamingst (Note: Round youn intermediate caloulations to rwo decrnal placesi) 1.18% 1.3%4 1.076 1.39% Tumbul Co, is considering a project that requires an initial investment of $570,000. The furm will raise the $570,000 in capalal by issuing 5230,000 of debt at a before-tax cont of 11.1\%,. 520,000 of preferred stock at a cost of 12.2\$6, and $320,000 of equity at a cost of 14.7\%. The firm faces a tax rate of 25\%. What will be the Whice for thes project? (Note: found your intermediate calculatiens to three detimal placesi) Consider the case of Kuhn Co. Wuhn Co. is considenng a new project that will require an initiat irvestment of 320 million. It has a target capital structure of 3 s. debt, 24 preferred stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in five years with a foce value of $1,000, an anneal coupon rate of 10ss, and a market price of $1,050.76. The yeld on the company's cumeht bonds is a good apprommation of the yield on any new bonds that it issues. The compary can sell shares of preferred stock that pay an annual dividend of $9 at a price of 595.79 per share. Kuhn does not have acy retained earnings availabile fo finance this project, so the firm wil have to issie new common stock to heip fund it. Its cometion stock is ciartently seling for $33.35 per share, and it is expected to pay a dividend of 51.36 at the end of next yeat. flotation costs nin repesent Jw of the funds taised by issuing new, common stock. The comparry is projected to grow at a constant rate of 9.27 , and they face a tax rate of 2544. What will be the Wace for this project? (Note: found your intemmestate calculakions lo two decimal place-si)