The work above is what I have so far. I am stuck on the blank parts and am looking for someone to check my work thus far.

The work above is what I have so far. I am stuck on the blank parts and am looking for someone to check my work thus far.

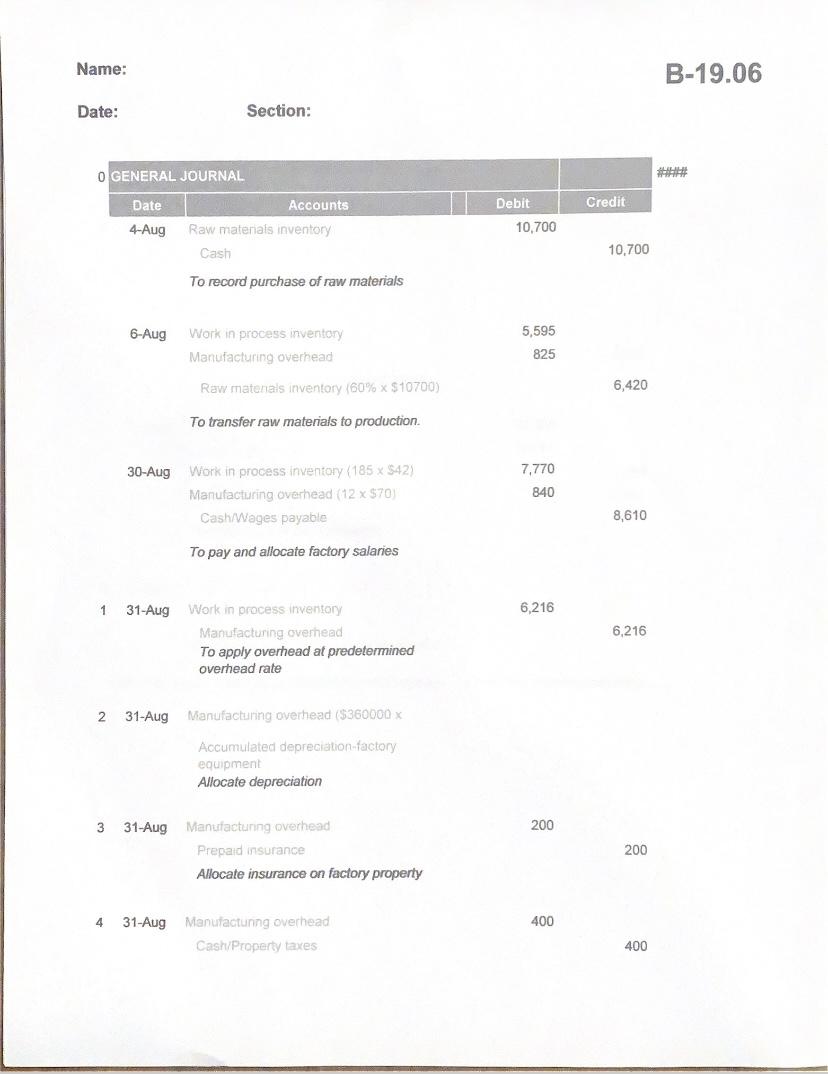

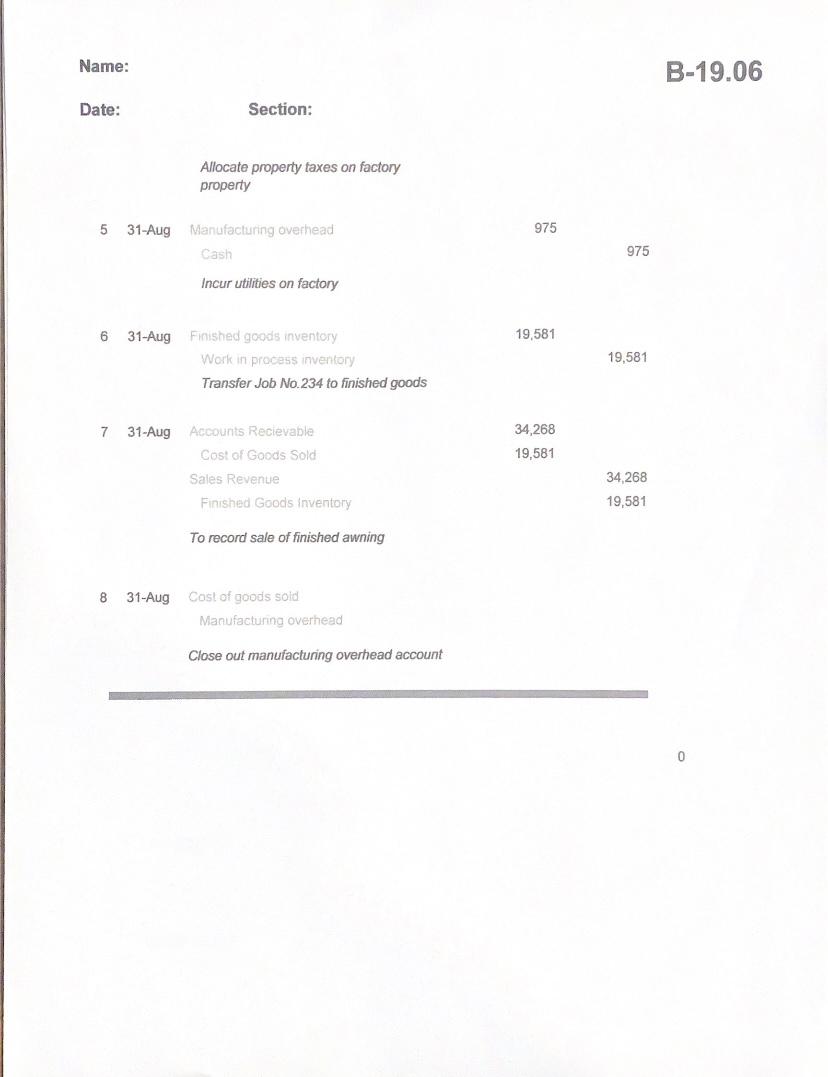

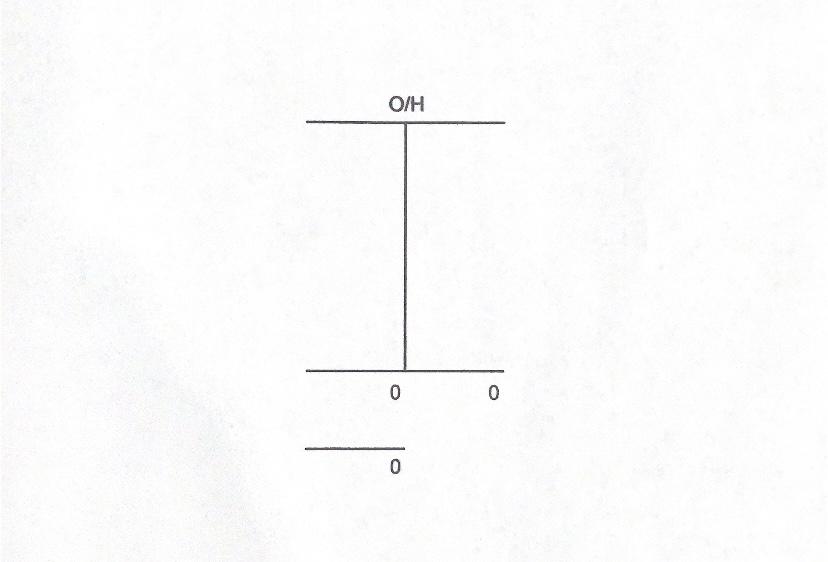

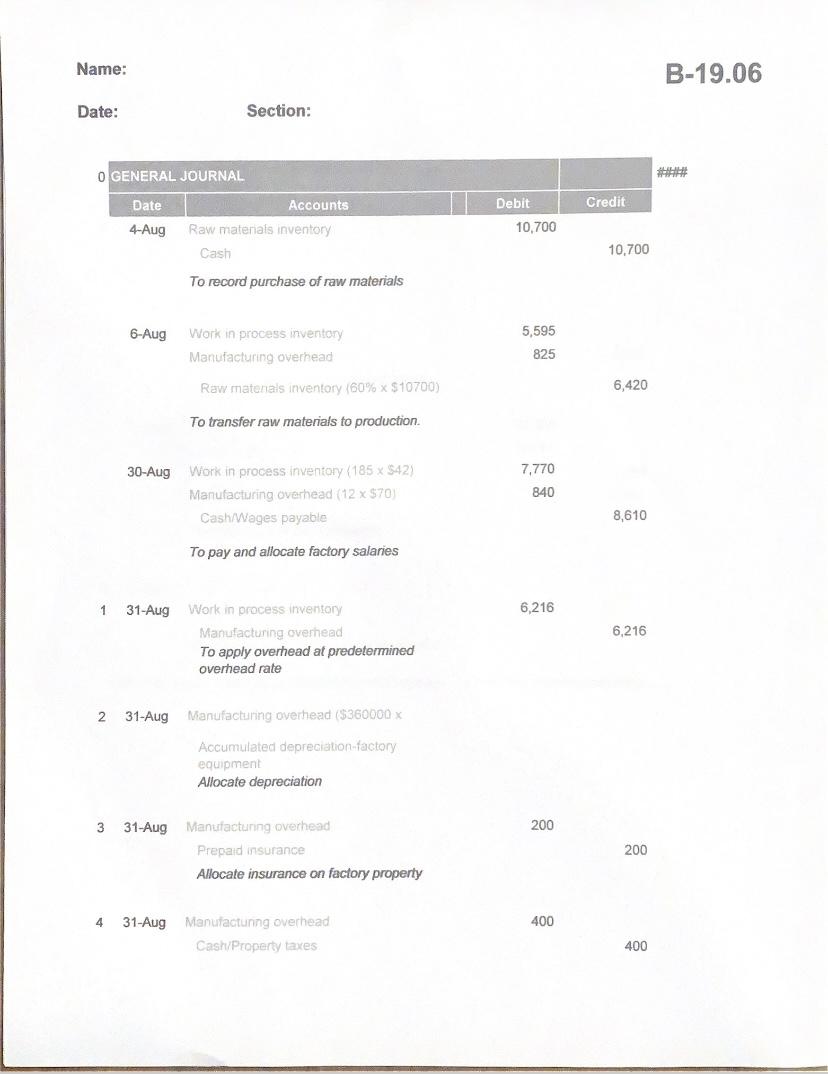

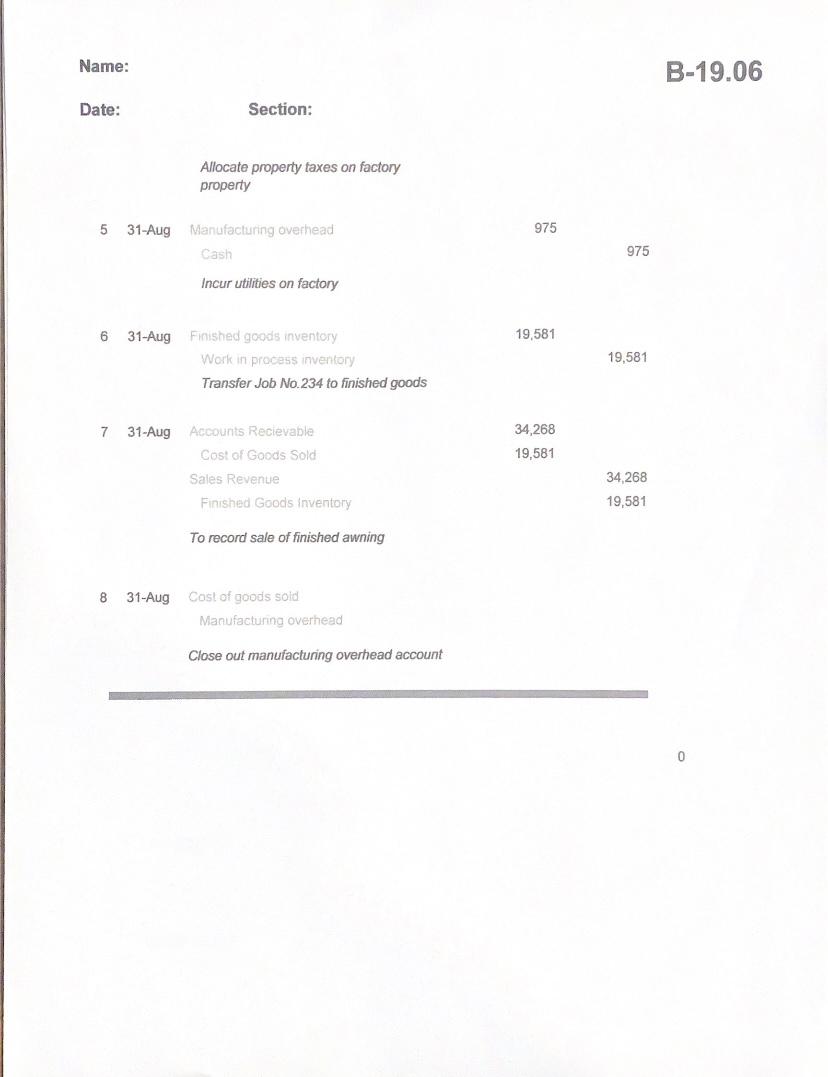

0 0 0 Name: B-19.06 Date: Section: O GENERAL JOURNAL Date Debit Credit 4-Aug Accounts Raw materials inventory Cash 10,700 10,700 To record purchase of raw materials 6-Aug 5,595 Work in process inventory Manufacturing overhead 825 Raw matenals inventory 60% x $10700) 6,420 To transfer raw materials to production 30-Aug Work in process inventory (185 x $42) Manufacturing overhead (12 x $70) Cash/Wages payable 7,770 840 8,610 To pay and allocate factory salaries 1 31-Aug 6,216 6.216 Work in process inventary Manufacturing overhead To apply overhead at predetermined overhead rate 2 31-Aug Manufacturing overhead ($360000 x Accumulated depreciation factory equipment Allocate depreciation 3 31-Aug 200 Manufacturing overhead Prepaid insurance Allocate insura on factory property 200 4 400 31-Aug Manufactunng overhead Cash/Property taxes 400 Name: B-19.06 Date: Section: Allocate property taxes on factory property 975 5 31-Aug Manufacturing overhead Cash 975 Incur utilities on factory 6 31-Aug 19,581 Finished goods inventory Work in process inventory Transfer Job No. 234 to finished goods 19,581 7 31-Aug 34,268 Accounts Recievable Cost of Goods Sold 19,581 Sales Revenue 34,268 19,581 Finished Goods Inventory To record sale of finished awning 8 31-Aug Cost of goods sold Manufacturing overhead Close out manufacturing overhead account 0 Assignment Instructions: Cool Sun produces awnings and screens. Cool Sun uses job order costing. Prepare journal entries to reflect the transactions. Memo entries are already included. (HINT: Calculate the manufacturing overhead costs for one month only). The transactions can be found on the "problem" worksheet. On the "worksheet" tab, prepare the journal entries for the Month of August only Submission Instructions: You will make the changes to the file that you have downloaded to your device. When you have completed the project, please re-name your file "FirstNameLastName- Mid_Week4_Project" and upload to the appropriate area in Blackboard (for example: SusanSmith- Mid_Week4_Project). Submit your completed document using the file attach tool in the assignment area Due Date: Wednesday of Week 4 by 11:59 pm Points: 20 Points: Each input (accounts name and amount) are worth 0.75 points Aug. 4, 2022 Purchased fabric and aluminum to be used in the manufacturing process. The purchase price was $10,700 and was paid with cash. Aug. 6, 2022 Transferred 60% of the raw materials purchased on August 4 into production for Job No. 234. (Of the total transferred, $825 is indirect material). Aug. 30, 2022 Labor costs for Job No. 234 for production workers include 185 hours at $42 per hour. Labor costs for general maintenance workers include 12 hours at $70 an hour. Aug. 31, 2022 Aug. 31, 2022 Factory overhead is applied at 80% of the direct labor cost. Depreciation on the factory equipment is determined using the straight-line method. The equipment was purchased nine years ago for $360,000. It has a 15-year life and no salvage value, The company purchased a one-year property insurance policy for the factory and equipment for $2,400 on January 1. The policy premium was originally debited to Prepaid Insurance. Aug. 31, 2022 Aug 31, 2022 Property Taxes on the factory are $4,800 for the year. Aug. 31, 2022 Factory utilities are $975 for the month of August. Aug 31, 2022 Transferred Job No. 234 with total assigned costs to finished goods. Aug. 31, 2022 Sold and delivered the completed Job No. 234 to a customer for a 75% markup over cost, on account Close out the manufacturing overhead account. Aug. 31, 2022

The work above is what I have so far. I am stuck on the blank parts and am looking for someone to check my work thus far.

The work above is what I have so far. I am stuck on the blank parts and am looking for someone to check my work thus far.