Question

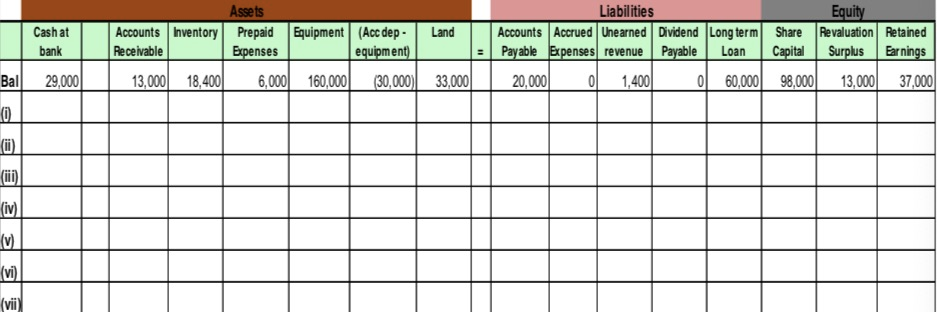

The worksheet on the next page shows the balances in the accounts of Baratheon Ltd as at 30 June 2015 before adjusting entries have been

The worksheet on the next page shows the balances in the accounts of Baratheon Ltd as at 30 June 2015 before adjusting entries have been carried out. Baratheon Ltd has a balance date of 30 June 2015.

In the spaces provided on the worksheet, prepare entries to record the adjusting entries for the year ended 30 June 2015 given below (you do not need to total the columns):

-

i A stock take reveals that $2,000 worth of inventory at cost price is missing.

-

ii The long term loan was taken out on 1 February 2015. Interest on the loan at 10% per annum is payable semi-annually on 31 July and 31 January each year.

-

iii The directors declared a dividend of 10 cents per share on each of the 98,000 shares on issue.

-

iv Employees of the Baratheon Ltd were last paid their wages of $20,000 for the five day working week ended on Friday 26 June 2015. The 30 June 2015 fell on a Tuesday (Saturday and Sunday are not working days).

-

v An annual insurance premium of $6,000 had been paid on 1 April 2015.

-

vi The equipment owned by the business has an expected life of 10 years

and an expected residual value at that time of $10,000.

-

vii The balance in the unearned revenue account relates to an amount

received from a customer in June 2014 for work to be carried out in September 2014. This work was carried out in September 2014, but nothing has been recorded related to this.

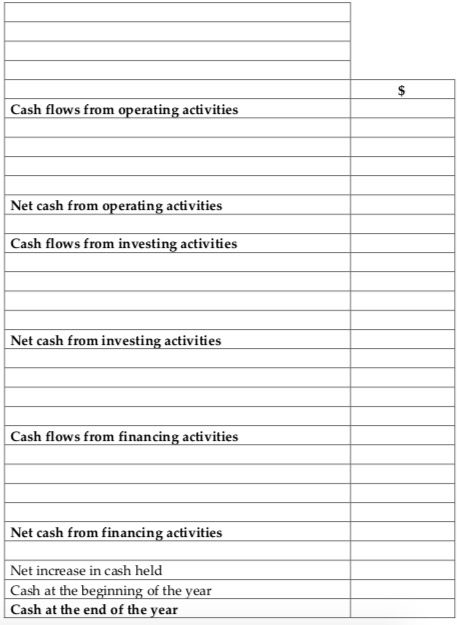

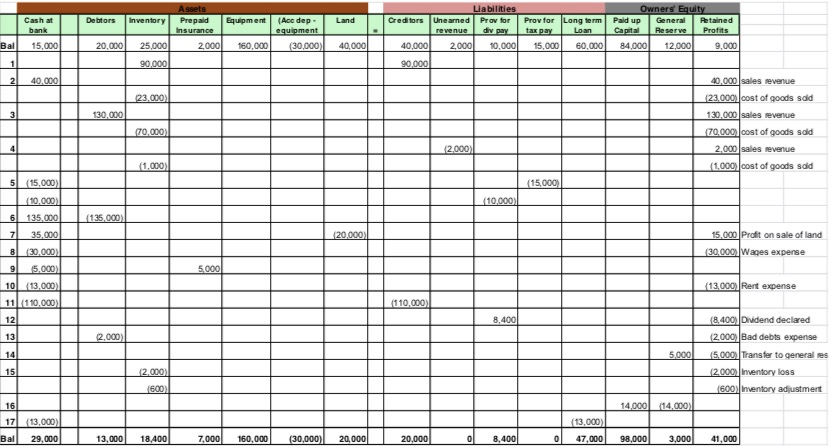

The transactions for the year ended 30 June 2015 for Daenerys Ltd have been recorded on the worksheet on the next page. Using this information, prepare the Statement of Cashflows for Daenerys Ltd, using the template below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started