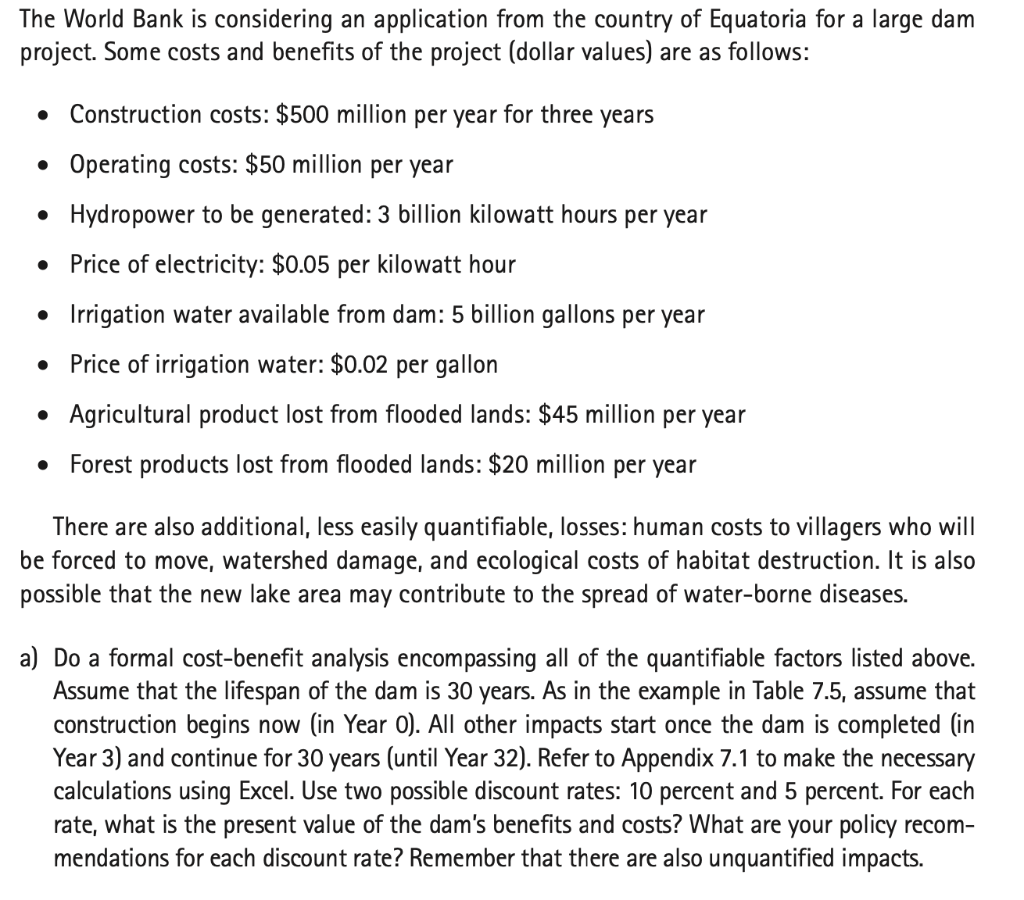

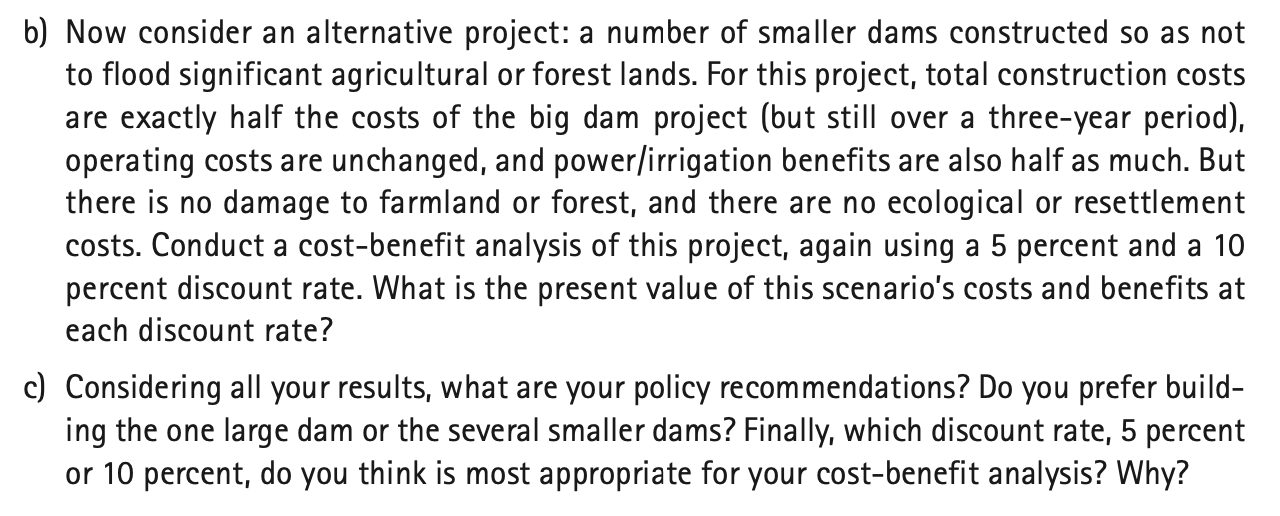

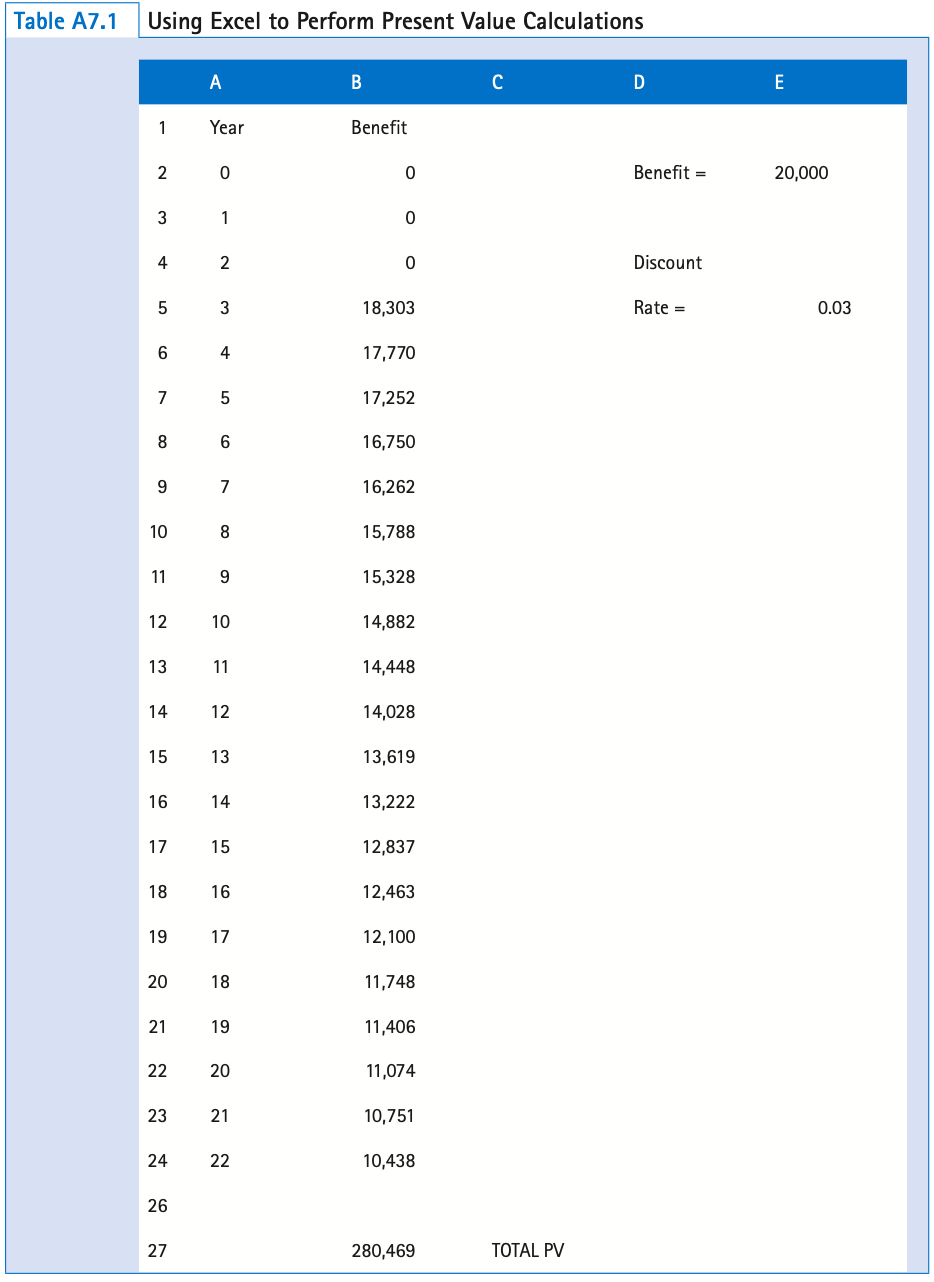

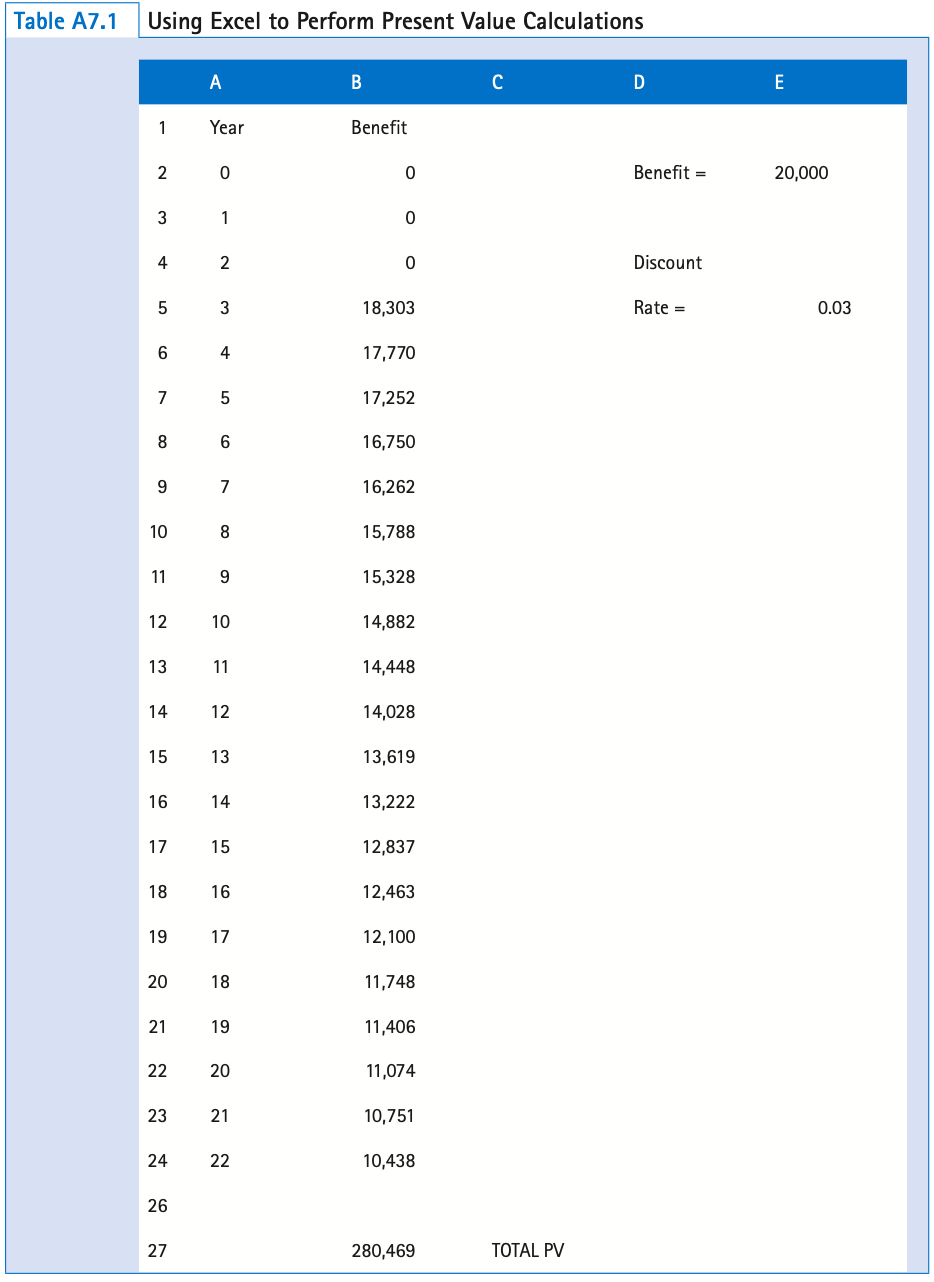

The World Bank is considering an application from the country of Equatoria for a large dam project. Some costs and benefits of the project (dollar values) are as follows: - Construction costs: $500 million per year for three years - Operating costs: \$50 million per year - Hydropower to be generated: 3 billion kilowatt hours per year - Price of electricity: $0.05 per kilowatt hour - Irrigation water available from dam: 5 billion gallons per year - Price of irrigation water: $0.02 per gallon - Agricultural product lost from flooded lands: \$45 million per year - Forest products lost from flooded lands: $20 million per year There are also additional, less easily quantifiable, losses: human costs to villagers who will be forced to move, watershed damage, and ecological costs of habitat destruction. It is also possible that the new lake area may contribute to the spread of water-borne diseases. a) Do a formal cost-benefit analysis encompassing all of the quantifiable factors listed above. Assume that the lifespan of the dam is 30 years. As in the example in Table 7.5, assume that construction begins now (in Year 0). All other impacts start once the dam is completed (in Year 3 ) and continue for 30 years (until Year 32). Refer to Appendix 7.1 to make the necessary calculations using Excel. Use two possible discount rates: 10 percent and 5 percent. For each rate, what is the present value of the dam's benefits and costs? What are your policy recommendations for each discount rate? Remember that there are also unquantified impacts. b) Now consider an alternative project: a number of smaller dams constructed so as not to flood significant agricultural or forest lands. For this project, total construction costs are exactly half the costs of the big dam project (but still over a three-year period), operating costs are unchanged, and power/irrigation benefits are also half as much. But there is no damage to farmland or forest, and there are no ecological or resettlement costs. Conduct a cost-benefit analysis of this project, again using a 5 percent and a 10 percent discount rate. What is the present value of this scenario's costs and benefits at each discount rate? c) Considering all your results, what are your policy recommendations? Do you prefer building the one large dam or the several smaller dams? Finally, which discount rate, 5 percent or 10 percent, do you think is most appropriate for your cost-benefit analysis? Why? Using Excel to Perform Present Value Calculations The World Bank is considering an application from the country of Equatoria for a large dam project. Some costs and benefits of the project (dollar values) are as follows: - Construction costs: $500 million per year for three years - Operating costs: \$50 million per year - Hydropower to be generated: 3 billion kilowatt hours per year - Price of electricity: $0.05 per kilowatt hour - Irrigation water available from dam: 5 billion gallons per year - Price of irrigation water: $0.02 per gallon - Agricultural product lost from flooded lands: \$45 million per year - Forest products lost from flooded lands: $20 million per year There are also additional, less easily quantifiable, losses: human costs to villagers who will be forced to move, watershed damage, and ecological costs of habitat destruction. It is also possible that the new lake area may contribute to the spread of water-borne diseases. a) Do a formal cost-benefit analysis encompassing all of the quantifiable factors listed above. Assume that the lifespan of the dam is 30 years. As in the example in Table 7.5, assume that construction begins now (in Year 0). All other impacts start once the dam is completed (in Year 3 ) and continue for 30 years (until Year 32). Refer to Appendix 7.1 to make the necessary calculations using Excel. Use two possible discount rates: 10 percent and 5 percent. For each rate, what is the present value of the dam's benefits and costs? What are your policy recommendations for each discount rate? Remember that there are also unquantified impacts. b) Now consider an alternative project: a number of smaller dams constructed so as not to flood significant agricultural or forest lands. For this project, total construction costs are exactly half the costs of the big dam project (but still over a three-year period), operating costs are unchanged, and power/irrigation benefits are also half as much. But there is no damage to farmland or forest, and there are no ecological or resettlement costs. Conduct a cost-benefit analysis of this project, again using a 5 percent and a 10 percent discount rate. What is the present value of this scenario's costs and benefits at each discount rate? c) Considering all your results, what are your policy recommendations? Do you prefer building the one large dam or the several smaller dams? Finally, which discount rate, 5 percent or 10 percent, do you think is most appropriate for your cost-benefit analysis? Why? Using Excel to Perform Present Value Calculations