Answered step by step

Verified Expert Solution

Question

1 Approved Answer

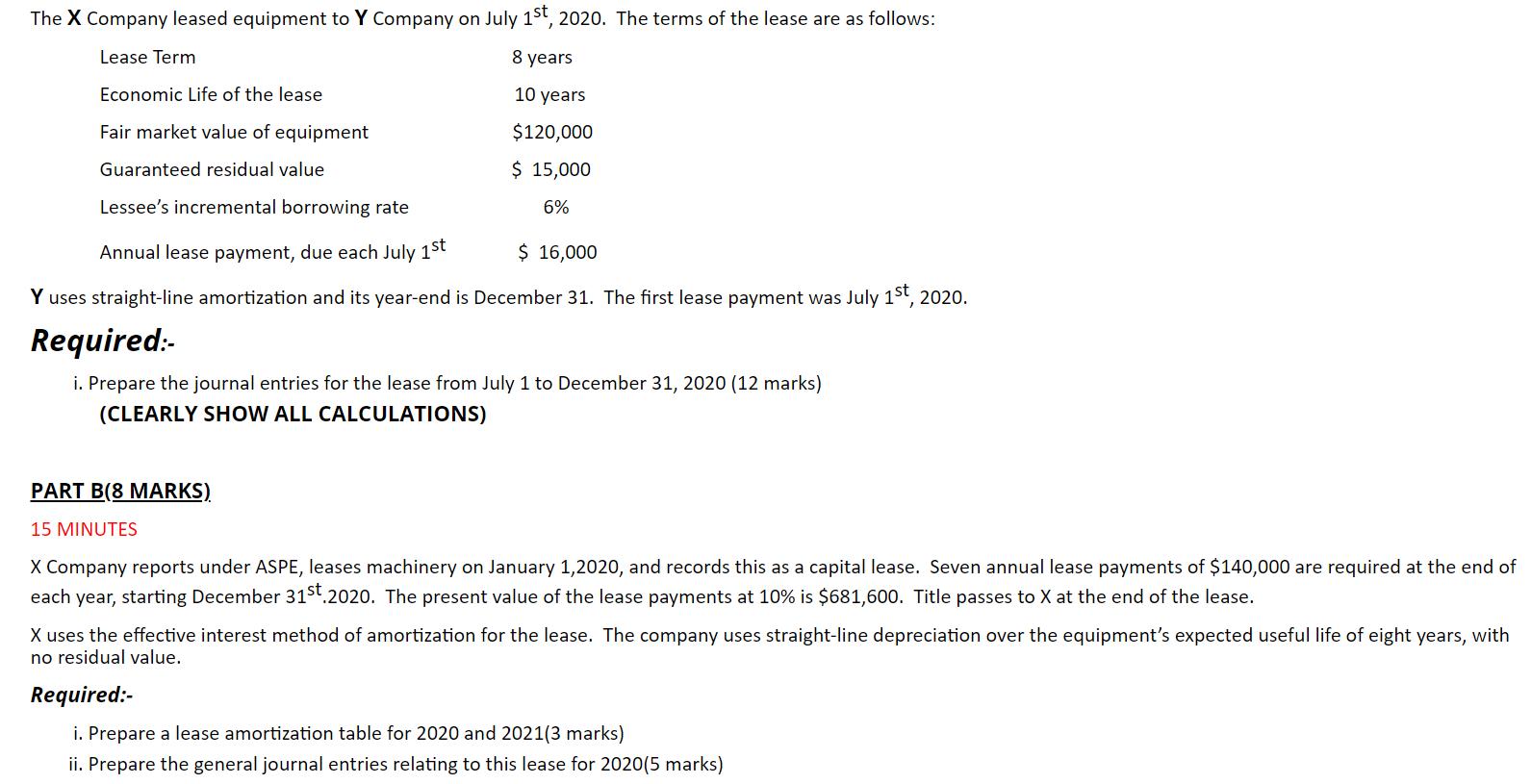

The X Company leased equipment to Y Company on July 1st, 2020. The terms of the lease are as follows: Lease Term 8 years

The X Company leased equipment to Y Company on July 1st, 2020. The terms of the lease are as follows: Lease Term 8 years 10 years $120,000 $ 15,000 6% Economic Life of the lease Fair market value of equipment Guaranteed residual value Lessee's incremental borrowing rate Annual lease payment, due each July 1st $ 16,000 Y uses straight-line amortization and its year-end is December 31. The first lease payment was July 1st, 2020. Required:- i. Prepare the journal entries for the lease from July 1 to December 31, 2020 (12 marks) (CLEARLY SHOW ALL CALCULATIONS) PART B(8 MARKS) 15 MINUTES X Company reports under ASPE, leases machinery on January 1,2020, and records this as a capital lease. Seven annual lease payments of $140,000 are required at the end of each year, starting December 31st.2020. The present value of the lease payments at 10% is $681,600. Title passes to X at the end of the lease. X uses the effective interest method of amortization for the lease. The company uses straight-line depreciation over the equipment's expected useful life of eight years, with no residual value. Required:- i. Prepare a lease amortization table for 2020 and 2021(3 marks) ii. Prepare the general journal entries relating to this lease for 2020(5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 WN 062715000 558 1600016000 114685 PRESENT VALUE OF LEASE APYMENT FALIR VALUE 120000 SINCE PV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started