Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The XYZ , Inc. now has 1 5 0 , 0 0 0 shares outstanding with a market price of $ 1 2 per share.

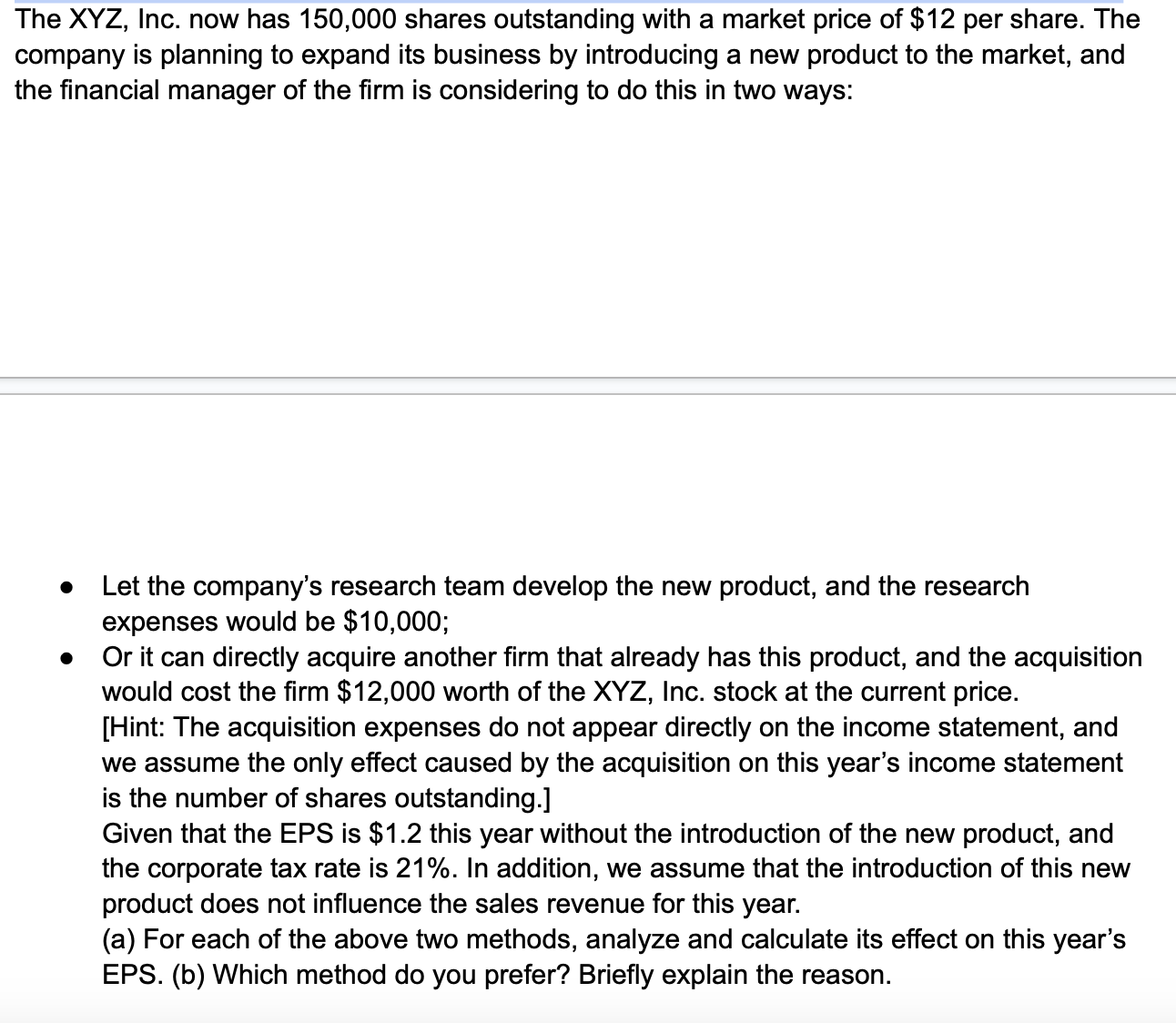

The XYZ Inc. now has shares outstanding with a market price of $ per share. The company is planning to expand its business by introducing a new product to the market, and the financial manager of the firm is considering to do this in two ways: Let the company's research team develop the new product, and the research expenses would be $; Or it can directly acquire another firm that already has this product, and the acquisition would cost the firm $ worth of the Inc. stock at the current price. Hint: The acquisition expenses do not appear directly on the income statement, and we assume the only effect caused by the acquisition on this year's income statement is the number of shares outstanding. Given that the EPS is $ this year without the introduction of the new product, and the corporate tax rate is In addition, we assume that the introduction of this new product does not influence the sales revenue for this year. a For each of the above two methods, analyze and calculate its effect on this year's EPS. b Which method do you prefer? Briefly explain the reason.

The XYZ Inc. now has shares outstanding with a market price of $ per share. The

company is planning to expand its business by introducing a new product to the market, and

the financial manager of the firm is considering to do this in two ways:

Let the company's research team develop the new product, and the research

expenses would be $;

Or it can directly acquire another firm that already has this product, and the acquisition

would cost the firm $ worth of the Inc. stock at the current price.

Hint: The acquisition expenses do not appear directly on the income statement, and

we assume the only effect caused by the acquisition on this year's income statement

is the number of shares outstanding.

Given that the EPS is $ this year without the introduction of the new product, and

the corporate tax rate is In addition, we assume that the introduction of this new

product does not influence the sales revenue for this year.

a For each of the above two methods, analyze and calculate its effect on this year's

EPS. b Which method do you prefer? Briefly explain the reason.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started