Question

The year-end of Xakwa Mining, a business entity owned by Mr Manenzhe, is 31 December. On 1 January 2021, the statement received from the

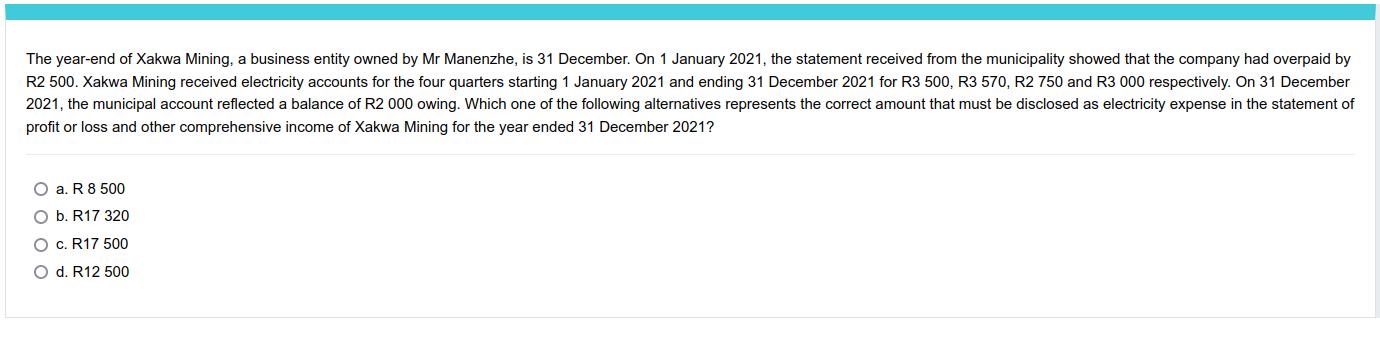

The year-end of Xakwa Mining, a business entity owned by Mr Manenzhe, is 31 December. On 1 January 2021, the statement received from the municipality showed that the company had overpaid by R2 500. Xakwa Mining received electricity accounts for the four quarters starting 1 January 2021 and ending 31 December 2021 for R3 500, R3 570, R2 750 and R3 000 respectively. On 31 December 2021, the municipal account reflected a balance of R2 000 owing. Which one of the following alternatives represents the correct amount that must be disclosed as electricity expense in the statement of profit or loss and other comprehensive income of Xakwa Mining for the year ended 31 December 2021? Oa. R 8 500 O b. R17 320 O c. R17 500 O d. R12 500

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

5 Correct option is b R 17320 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App