Question

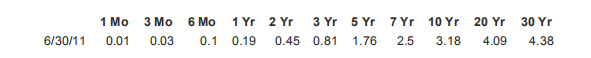

The yield curve on June 30th, 2011 was A bet that does not use insights from the concept of duration Suppose that, on June 30th,

The yield curve on June 30th, 2011 was

A bet that does not use insights from the concept of duration

Suppose that, on June 30th, you bet that the 30 year ZCB yield would become even lower by September 30th and so you purchase 1000 USD worth of 30 year ZCB.

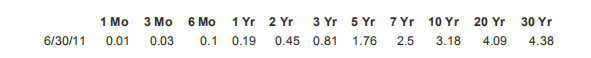

How much money do you make or loose if you resell the bond on September 30th, 2011 and if the yield curve winds up as

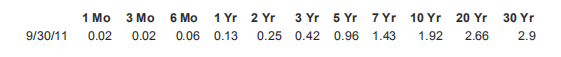

How much money do you make or loose if you resell the bond on September 30th, 2011 and if all yields wind up are 2% higher than in the previous table:

Why are you loosing money under this alternative scenario?

A bet that uses insights from the concept of duration

Now let us use the insight of immunization to construct a portfolio that will make money in both the actual and the alternative scenario shown above.Suppose that, in addition to buying 1000 USD worth of 30 year ZCB, you also short 5 year ZCB.

Use the concept of duration to answer the following question:

How much 5 year ZCB do you have to short to create a portfolio that would have the following property: in response to a 1% increase in interest rate, the amount of money you loose on your long position is approximately equal to the amount you would gain on

your short position?

With this portfolio, how much money do you make or loose in the two scenarios if, on September 30th, 2011, you re-sell the 30 year ZCB and close your short position

in the 5 year ZCB?

Can you find a scenario for the yield curve on September 30th that would make you loose money?

1 Mo 0.01 3 Mo 0.03 6 Mo 0.1 1 Yr 2 Yr 0.19 0.45 3 Yr 5 Yr 0.81 1.76 7 Yr 10 Yr 2.5 3.18 20 Yr 4.09 30 Yr 4.38 6/30/11 1 Mo 0.01 3 Mo 0.03 6 Mo 0.1 1 Yr 2 Yr 0.19 0.45 3 Yr 5 Yr 0.81 1.76 7 Yr 10 Yr 2.5 3.18 20 Yr 4.09 30 Yr 4.38 6/30/11 6 Mo 1 Mo 0.02 3 Mo 0.02 1 Yr 2 Yr 0.13 0.25 3 Yr 5 Yr 7 Yr 10 Yr 0.42 0.96 1.43 1.92 20 Yr 2.66 30 Yr 2.9 9/30/11 0.06 7 Yr 20 Yr 1 Mo 2.02 3 Mo 2.02 6 Mo 2.06 1 Yr 2 Yr 2.13 2.25 3 Yr 5 Yr 2.42 2.96 10 Yr 3.92 30 Yr 4.9 9/30/11 3.43 4.66 1 Mo 0.01 3 Mo 0.03 6 Mo 0.1 1 Yr 2 Yr 0.19 0.45 3 Yr 5 Yr 0.81 1.76 7 Yr 10 Yr 2.5 3.18 20 Yr 4.09 30 Yr 4.38 6/30/11 1 Mo 0.01 3 Mo 0.03 6 Mo 0.1 1 Yr 2 Yr 0.19 0.45 3 Yr 5 Yr 0.81 1.76 7 Yr 10 Yr 2.5 3.18 20 Yr 4.09 30 Yr 4.38 6/30/11 6 Mo 1 Mo 0.02 3 Mo 0.02 1 Yr 2 Yr 0.13 0.25 3 Yr 5 Yr 7 Yr 10 Yr 0.42 0.96 1.43 1.92 20 Yr 2.66 30 Yr 2.9 9/30/11 0.06 7 Yr 20 Yr 1 Mo 2.02 3 Mo 2.02 6 Mo 2.06 1 Yr 2 Yr 2.13 2.25 3 Yr 5 Yr 2.42 2.96 10 Yr 3.92 30 Yr 4.9 9/30/11 3.43 4.66Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started