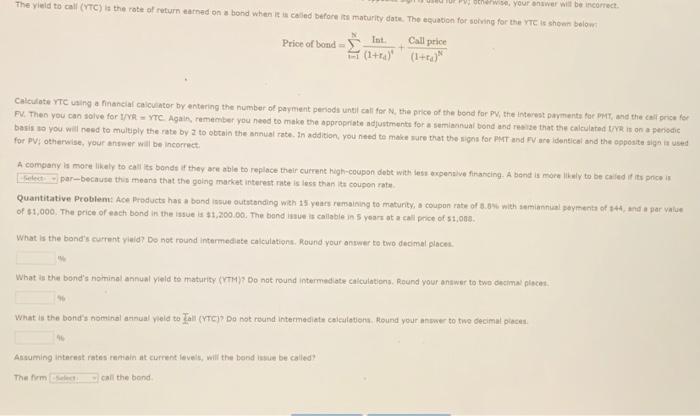

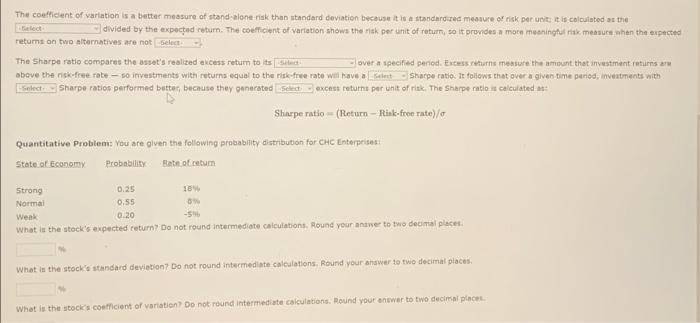

The yield to call (VTC) is the rate of returned on a bond when lettore maturity date. The gubio for solving for the shown below otherwise your answer will be incorrect Call price Price of bondint + (1+r) (1+) Calculate YTC using a financial calculator by entering the number of payment periods until call for the price of the bond for the interest payments for PM, and the call price for FV. Then you can solve for 1/2 - YTC Again, remember you need to make the appropriate adjustments for a semiannual bond and raise that the calculated t/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and are identical and the opposite sign is used for PV, otherwise your answer will be incorrect A company is more likely to call its bonde il they are able to replace their current high-coupon debt with us expensive financing. A bond is more likely to be called its price is et par--because this means that the going market interest rate is less than it coupon rate Quantitative Problem: Ace Products has a bond in outstanding with 15 years remaining to maturity, a coupon rate of 0.0% with serinnun payments of ***, and a par value of $1,000. The price of each bond in the issue 1,200.00. The band issue is callable in 5 years at a call price of 1,000. What is the band's current wald? Do not round intermediate calculations, Round your answer to two decimal places. What is the bond's nominal annual yield to maturity (TH) Do not round intermediate calculations. Round your answer to two decimal pinces, what the bond's nominal artmua leld to all (YTC)Do not round intermediate calculations, Hound your answer to two decimal pour Ansuming interest rates remain at current levels, will the band tusue be called? Therm call the bond The coefficient of variation is a better measure of stand-alone-risk than standard deviation because it is a standardized measure of risk per unit it is calculated at the Bled divided by the expected return. The coefficient of variation shows the risk per unit of return, so it provides a more meaningful measure when the expected retums on two alternatives are not select- The Sharpe ratio compares the asset's realized access return to its over a specified period. Excess returns mensure the amount that investment returns are above the risk free rabe - so investments with returns equal to the risk-free rate will have at Sharpe ratio. It follows that over a given time period, Investments with Select Sharpe ration performed butter, because they canecated Select excest returns per unit of risk. The Sharpe ratio is calculated : Sharpe ratio (Return-Rink-fron rate)/ Quantitative Problem: You are given the following probability distribution for CHC Enterprises State of Economy Probability Bateau Strong 0.25 Normal 0:55 Weak 0:20 What is the stock's expected return? Do not round intermediate calculations. Round your answer to two decimal places What is the stock's standard deviation? Do not round intermediate calculations. Round your shower to two decimal places What is the stock's coefficient of variation? Do not round Intermediate calculations. Round your answer to two decimal place