Answered step by step

Verified Expert Solution

Question

1 Approved Answer

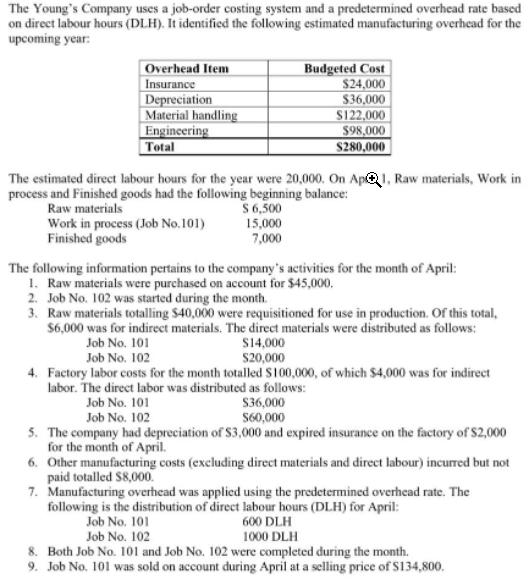

The Young's Company uses a job-order costing system and a predetermined overhead rate based on direct labour hours (DLH). It identified the following estimated

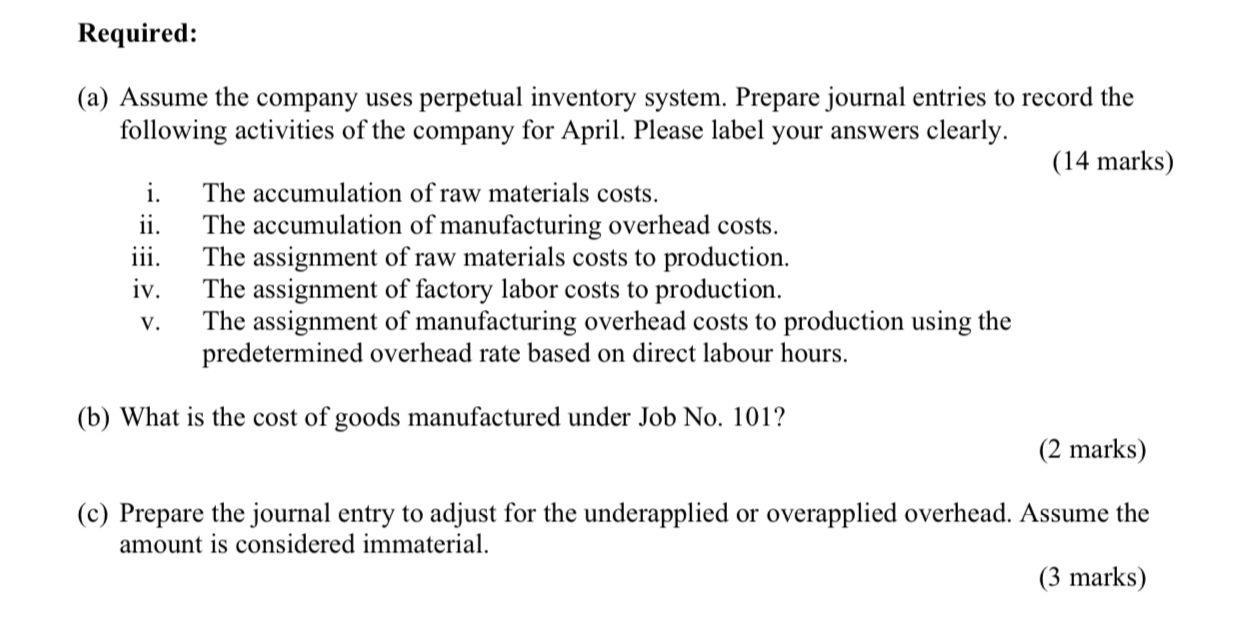

The Young's Company uses a job-order costing system and a predetermined overhead rate based on direct labour hours (DLH). It identified the following estimated manufacturing overhead for the upcoming year: Overhead Item Insurance Depreciation Material handling Engineering Total Budgeted Cost $24,000 $36,000 S122,000 $98,000 S280,000 The estimated direct labour hours for the year were 20,000. On APQ1, Raw materials, Work in process and Finished goods had the following beginning balance: Raw materials Work in process (Job No. 101) Finished goods S6,500 15,000 7,000 The following information pertains to the company's activities for the month of April: 1. Raw materials were purchased on account for $45,000, 2. Job No. 102 was started during the month. 3. Raw materials totalling $40,000 were requisitioned for use in production. Of this total, $6,000 was for indirect materials. The direct materials were distributed as follows: S14,000 S20,000 Job No. 101 Job No. 102 4. Factory labor costs for the month totalled S100,000, of which $4,000 was for indirect labor. The direct labor was distributed as follows: Job No. 101 S36,000 Job No. 102 S60,000 5. The company had depreciation of S3,000 and expired insurance on the factory of $2,000 for the month of April. 6. Other manufacturing costs (excluding direct materials and direct labour) incurred but not paid totalled S8,000. 7. Manufacturing overhead was applied using the predetermined overhead rate. The following is the distribution of direct labour hours (DLH) for April: Job No. 101 600 DLH 1000 DLH Job No. 102 8. Both Job No. 101 and Job No. 102 were completed during the month. 9. Job No. 101 was sold on account during April at a selling price of S134,800. Required: (a) Assume the company uses perpetual inventory system. Prepare journal entries to record the following activities of the company for April. Please label your answers clearly. (14 marks) The accumulation of raw materials costs. The accumulation of manufacturing overhead costs. The assignment of raw materials costs to production. iv. ii. iii. The assignment of factory labor costs to production. The assignment of manufacturing overhead costs to production using the predetermined overhead rate based on direct labour hours. V. (b) What is the cost of goods manufactured under Job No. 101? (2 marks) (c) Prepare the journal entry to adjust for the underapplied or overapplied overhead. Assume the amount is considered immaterial. (3 marks)

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Working notes Estimated manufacturing cost Estimated direct labor hours 280000 a 20000 b 1400 ab Pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started