Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the Youngs inherited a home valued at $120,000 and gave it to a family member, but there are no legal documents to validate the transfer

the Youngs inherited a home valued at $120,000 and gave it to a family member, but there are no legal documents to validate the transfer to the Youngs. Acting as financial planner, address the situation to communicate the ethical and legal considerations

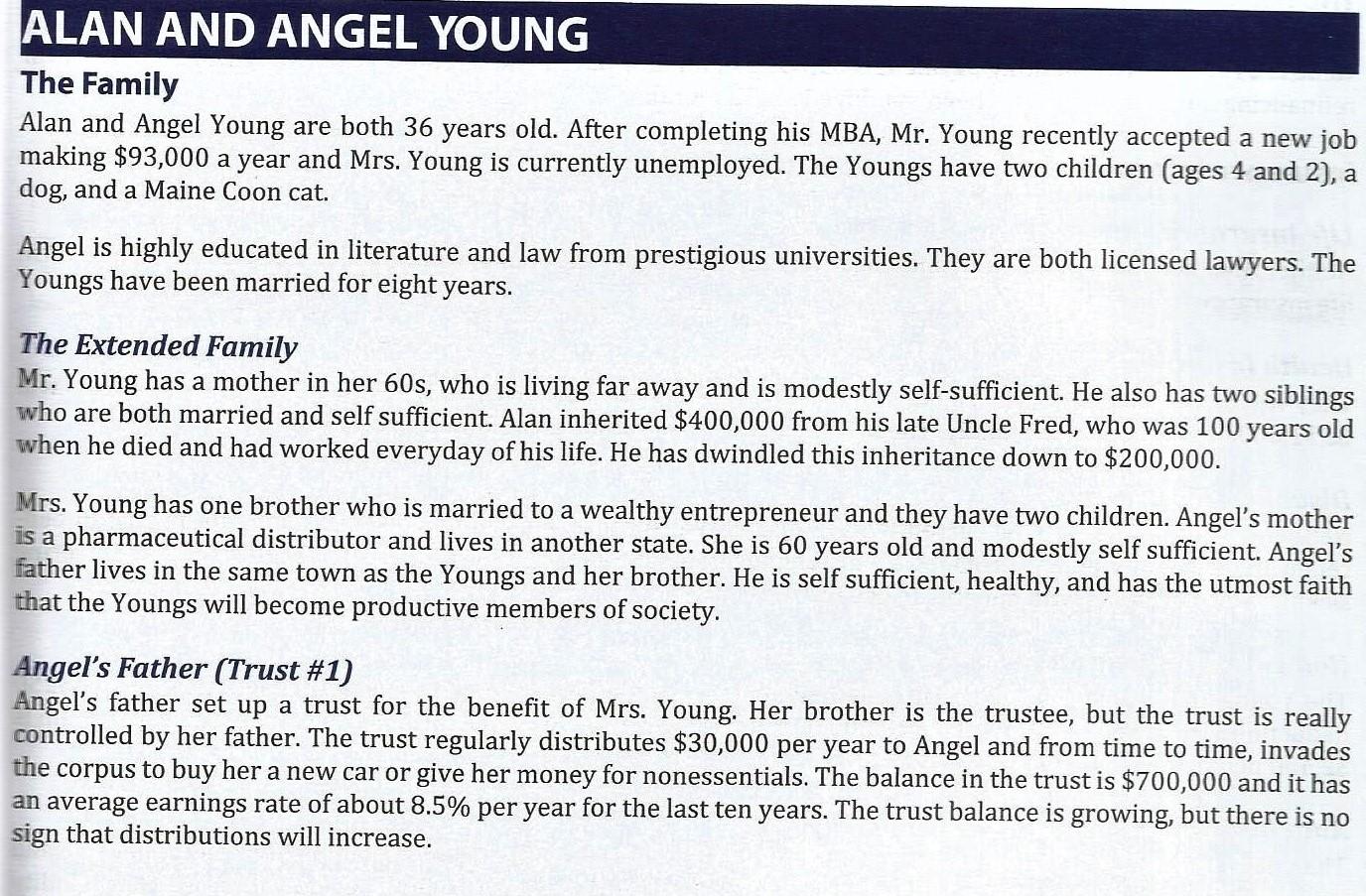

ALAN AND ANGEL YOUNG The Family Alan and Angel Young are both 36 years old. After completing his MBA, Mr. Young recently accepted a new job making $93,000 a year and Mrs. Young is currently unemployed. The Youngs have two children (ages 4 and 2), a dog, and a Maine Coon cat. Angel is highly educated in literature and law from prestigious universities. They are both licensed lawyers. The Youngs have been married for eight years. The Extended Family Mr. Young has a mother in her 60s, who is living far away and is modestly self-sufficient. He also has two siblings who are both married and self sufficient. Alan inherited $400,000 from his late Uncle Fred, who was 100 years old when he died and had worked everyday of his life. He has dwindled this inheritance down to $200,000. Mrs. Young has one brother who is married to a wealthy entrepreneur and they have two children. Angel's mother is a pharmaceutical distributor and lives in another state. She is 60 years old and modestly self sufficient. Angel's father lives in the same town as the Youngs and her brother. He is self sufficient, healthy, and has the utmost faith that the Youngs will become productive members of society. Angel's Father (Trust #1) Angel's father set up a trust for the benefit of Mrs. Young. Her brother is the trustee, but the trust is really controlled by her father. The trust regularly distributes $30,000 per year to Angel and from time to time, invades the corpus to buy her a new car or give her money for nonessentials. The balance in the trust is $700,000 and it has an average earnings rate of about 8.5% per year for the last ten years. The trust balance is growing, but there is no sign that distributions will increaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started