Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The ZA Mortgage Company is issuing a CMO with three tranches. The A tranche will consist of $18,000 with a coupon of 8.00%. The B

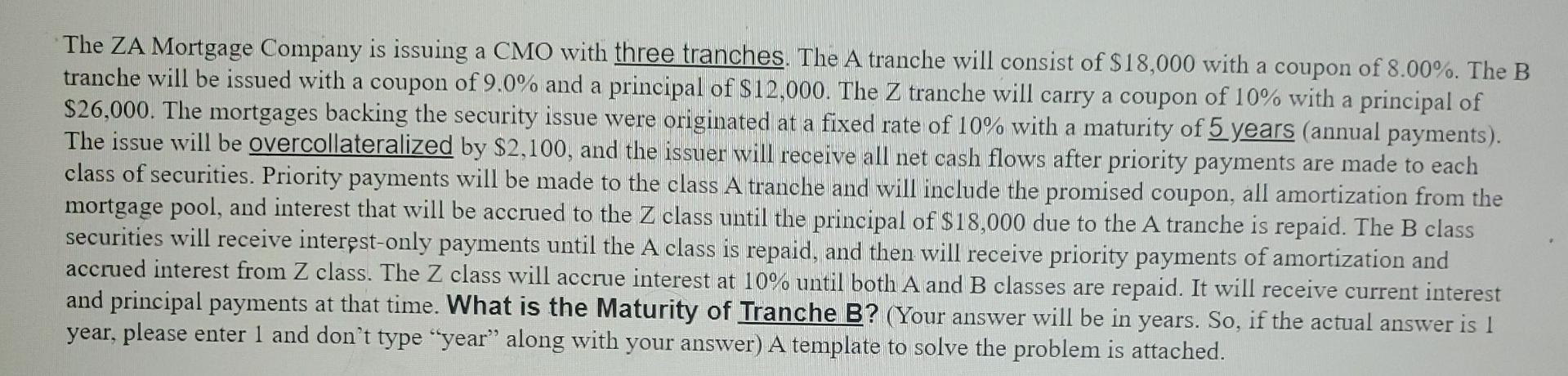

The ZA Mortgage Company is issuing a CMO with three tranches. The A tranche will consist of $18,000 with a coupon of 8.00%. The B tranche will be issued with a coupon of 9.0% and a principal of $12,000. The Z tranche will carry a coupon of 10% with a principal of $26,000. The mortgages backing the security issue were originated at a fixed rate of 10% with a maturity of 5 years (annual payments). The issue will be overcollateralized by $2,100, and the issuer will receive all net cash flows after priority payments are made to each class of securities. Priority payments will be made to the class A tranche and will include the promised coupon, all amortization from the mortgage pool, and interest that will be accrued to the Z class until the principal of $18,000 due to the A tranche is repaid. The B class securities will receive interest-only payments until the A class is repaid, and then will receive priority payments of amortization and accrued interest from Z class. The Z class will accrue interest at 10% until both A and B classes are repaid. It will receive current interest and principal payments at that time. What is the Maturity of Tranche B? (Your answer will be in years. So, if the actual answer is 1 year, please enter 1 and don't type "year" along with your answer) A template to solve the problem is attached. The ZA Mortgage Company is issuing a CMO with three tranches. The A tranche will consist of $18,000 with a coupon of 8.00%. The B tranche will be issued with a coupon of 9.0% and a principal of $12,000. The Z tranche will carry a coupon of 10% with a principal of $26,000. The mortgages backing the security issue were originated at a fixed rate of 10% with a maturity of 5 years (annual payments). The issue will be overcollateralized by $2,100, and the issuer will receive all net cash flows after priority payments are made to each class of securities. Priority payments will be made to the class A tranche and will include the promised coupon, all amortization from the mortgage pool, and interest that will be accrued to the Z class until the principal of $18,000 due to the A tranche is repaid. The B class securities will receive interest-only payments until the A class is repaid, and then will receive priority payments of amortization and accrued interest from Z class. The Z class will accrue interest at 10% until both A and B classes are repaid. It will receive current interest and principal payments at that time. What is the Maturity of Tranche B? (Your answer will be in years. So, if the actual answer is 1 year, please enter 1 and don't type "year" along with your answer) A template to solve the problem is attached

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started