Question

The Zhang Equipment Companys machine was purchased 5 years ago for $55,000. It had an expected life of 10 years when it was bought, and

The Zhang Equipment Companys machine was purchased 5 years ago for $55,000. It had an expected life of 10 years when it was bought, and its remaining depreciation is $5,500 per year for each year of its remaining life. As older machine are robust and useful machine, this one can be sold for $20,000 at the end of its useful life.

A new high-efficiency, digital-controlled machine can be purchased for $120,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $30,000 per year. Sales revenue will not be affected. At the end of its useful life, the highefficiency machine is estimated to be sold at $10,000. MACRS depreciation will be used, and the machine will be depreciated over its 5-year property class life.

The old machine can be sold today for $35,000. The firms tax rate is 25%, and the appropriate cost of capital is 13%.

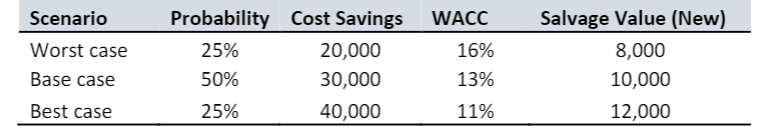

- Perform scenario analysis as follows:

What are the NPV, IRR, MIRR, payback period, and discounted payback period for each scenario? It is required to establish scenarios by using scenario manager to get credits for this problem.

Scenario WACC Worst case Base case Probability Cost Savings 25% 20,000 50% 30,000 25% 40,000 16% 13% Salvage Value (New) 8,000 10,000 12,000 Best case 11% Scenario WACC Worst case Base case Probability Cost Savings 25% 20,000 50% 30,000 25% 40,000 16% 13% Salvage Value (New) 8,000 10,000 12,000 Best case 11%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started