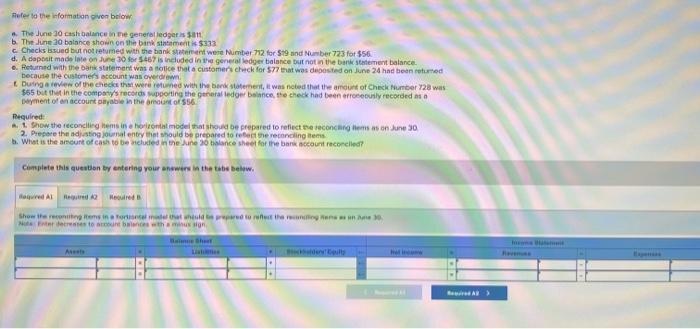

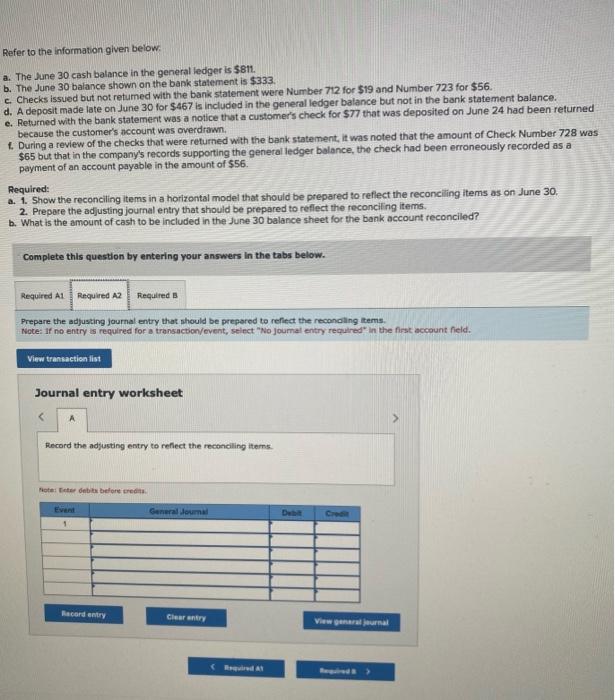

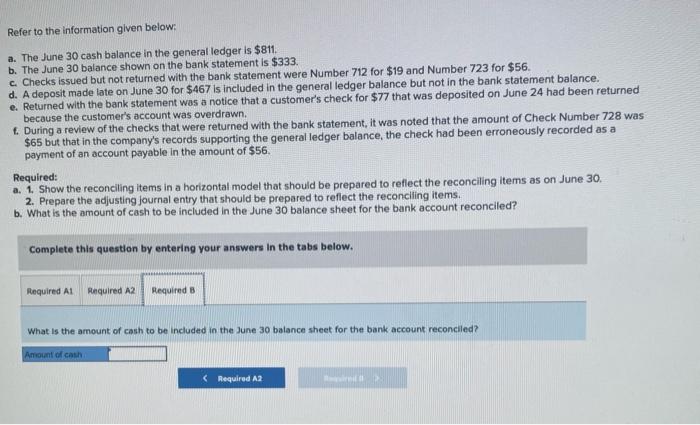

Thefer lo the informaton pion bsione a. The June 30 ctsf baiance vo pe qenerbl ledger ins 1 til. b. The dure 30 botance shown on the birk stantmenit is 5373 c. Checks bsued but nod retumed with the bank shathreth were Nurmber 712 for 579 and Mumber 733 fat 556 . bocause the custtimets account was owerg tevel. Pechulred Cumplete this austbon br entering your dnowers in the kibs belown Refer to the information given below: a. The June 30 cash balance in the general ledger is $811. b. The June 30 balance shown on the bank statement is $333. c. Checks issued but not retumed with the bank statement were Number 712 for $19 and Number 723 for $56. d. A deposit made late on June 30 for $467 is included in the general ledger balance but not in the bank statement balance. d. Returned with the bank statement was a notice that a customer's check for $77 that was deposited on June 24 had been returned because the customer's account was overdrawn. f. During a review of the checks that were returned with the bank statement, it was noted that the amount of Check Number 728 was $65 but that in the company's records supporting the general ledger bolance, the check had been erroneously recorded as a payment of an account payable in the amount of $56. Required: a. 1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on June 30 . 2. Prepare the adjusting journal entry that should be prepared to reflect the reconciling items. b. What is the amount of cash to be included in the June 30 balance sheet for the bank account reconciled? Complete this question by entering your answers in the tabs below. Prepare the adfusting journal entry that should be preperod to refiect the reconalling items. Prepare the adjusting journal entry that should be preperod to refied the reconaling tiems. Notry is required for a transacbon/event, seiect "No joumal entry required" in the first account field. Journal entry worksheet fiecord the adjusting entry to refiect the rectenciling iterris Motat Trter debik beffort tredat. Refer to the information given below: 3. The June 30 cash balance in the general ledger is $811. b. The June 30 balance shown on the bank statement is $333. c. Checks issued but not returned with the bank statement were Number 712 for $19 and Number 723 for $56. d. A deposit made late on June 30 for $467 is included in the general ledger balance but not in the bank statement balance. e. Aeturned with the bank statement was a notice that a customer's check for $77 that was deposited on June 24 had been returned because the customer's account was overdrawn. f. During a review of the checks that were returned with the bank statement, it was noted that the amount of Check Number 728 was $65 but that in the company's records supporting the general ledger balance, the check had been erroneously recorded as a payment of an account payable in the amount of $56. Required: a. 1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on June 30 . 2. Prepare the adjusting journal entry that should be prepared to reflect the reconciling items. b. What is the amount of cash to be included in the June 30 balance sheet for the bank account reconciled? Complete this question by entering your answers In the tabs below. What is the amount of cash to be included in the June 30 balance sheet for the bank account reconciled