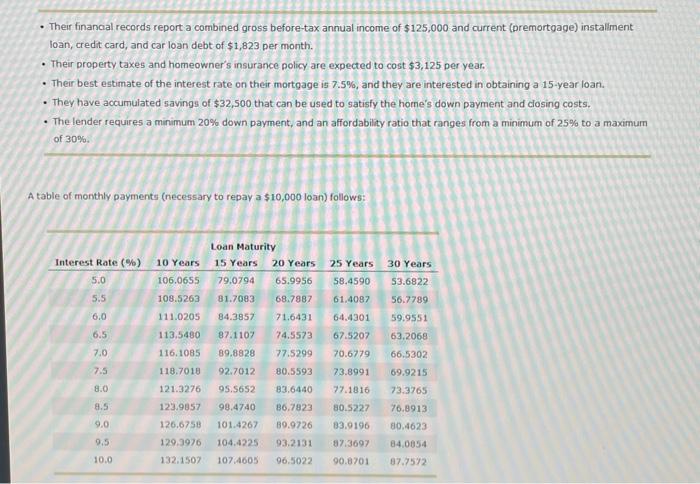

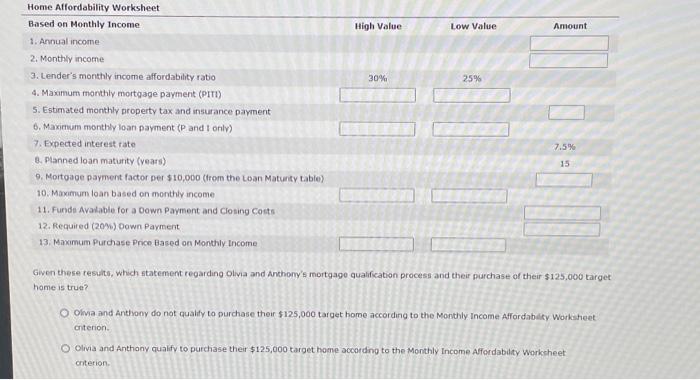

- Their financial records report a combined gross before-tax annual income of $125,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,823 per month. - Their property taxes and homeowner's insurance policy are expected to cost $3,125 per year. - Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15 -year loan. - They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs. - The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30%. A table of monthly payments (necessary to repay a $10,000 loan) follows: wen these results, which statement regarding olvia and Anthomy's mortgage qualification process and their purchase of their $125,000 target ame is true? Ohva and Anthony do not qualify to purchase their $125,000 target home according to the Monthly Income Affordabilir Works heet criterion. Oliva and Anthony qualify to purchase their $125,000 target home acoording to the Monthly Income Afordability Worksheet oriterion. - Their financial records report a combined gross before-tax annual income of $125,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,823 per month. - Their property taxes and homeowner's insurance policy are expected to cost $3,125 per year. - Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15 -year loan. - They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs. - The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30%. A table of monthly payments (necessary to repay a $10,000 loan) follows: wen these results, which statement regarding olvia and Anthomy's mortgage qualification process and their purchase of their $125,000 target ame is true? Ohva and Anthony do not qualify to purchase their $125,000 target home according to the Monthly Income Affordabilir Works heet criterion. Oliva and Anthony qualify to purchase their $125,000 target home acoording to the Monthly Income Afordability Worksheet oriterion