Answered step by step

Verified Expert Solution

Question

1 Approved Answer

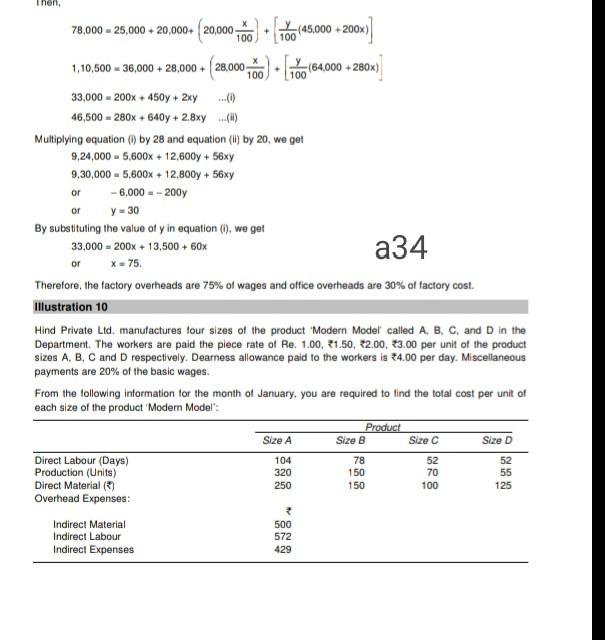

Then, 100 . 100 100 or or a34 or 78.000 - 25,000 + 20,000+ 20,000 (45,000 + 2004) 2004) 100 1,10,500 - 36,000 + 28,000

Then, 100 . 100 100 or or a34 or 78.000 - 25,000 + 20,000+ 20,000 (45,000 + 2004) 2004) 100 1,10,500 - 36,000 + 28,000 + 28,000 (64,000 + 280x) 33,000 - 200x + 450y + 2xy 46,500 - 280x + 640y + 2.8xy XW Multiplying equation (1) by 28 and equation (il) by 20, we get 9,24,000 - 5,600x + 12,600y + 56xy 9,30,000 - 5,600x + 12,800y + 56xy -6,000 - 200 y - 30 By substituting the value of y in equation (), we get 33,000 - 200x + 13,500 + 60x x - 75 Therefore, the factory overheads are 75% of wages and office overheads are 30% of factory cost. Illustration 10 Hind Private Ltd, manufactures four sizes of the product "Modern Model called A, B, C, and D in the Department. The workers are paid the plece rate of Re. 1.00, 1.50, 12.00, 13.00 per unit of the product sizes A, B, C and Drespectively. Dearness allowance paid to the workers is 24.00 per day. Miscellaneous payments are 20% of the basic wages. From the following information for the month of January, you are required to find the total cost per unit of each size of the product Modern Model: Product Size A Size B Size C Size D Direct Labour (Days) 104 52 Production (Units) 320 70 55 Direct Material() 100 Overhead Expenses: 3 Indirect Material 500 Indirect Labour 572 Indirect Expenses 429 52 78 150 150 250 125

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started