Answered step by step

Verified Expert Solution

Question

1 Approved Answer

then mark then i each Garden Plants Plus operates a commercial plant nursery where i propagates plante for garden centers throughout the region Plants

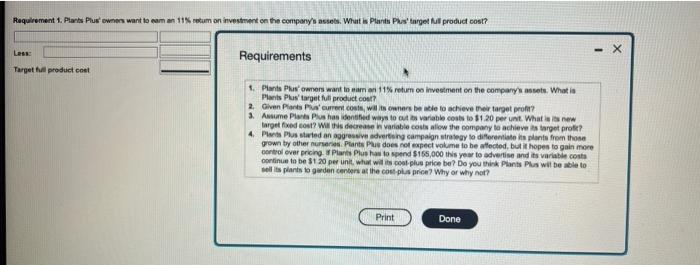

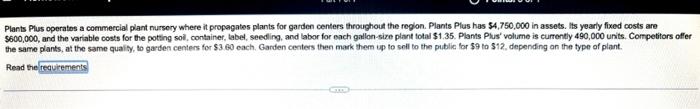

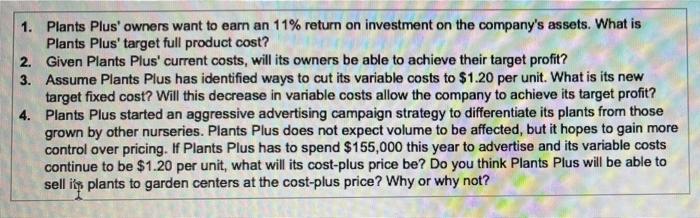

then mark then i each Garden Plants Plus operates a commercial plant nursery where i propagates plante for garden centers throughout the region Plants Plus has $4,750,000 in a yearly ads are 5000,000 and the varie ping container, label, seeding, and labor for each galon-size plant total $1.35 Plans Phu volume is currently 400,000 units. Compettors offer the w to sell to the public for $9 to $12, depending on the type of plant Read the requirements Requirement 1. Plants Plus' owners want to eam an 11% retum on investment on the company's assets. What is Plants Plus' target full product cost? Less Target full product cost Requirements 1. Plants Plus' owners want to eam an 11% return on investment on the company's assets. What is Plants Plus' target full product cost? 2. Given Plants Plus' current costs, will its owners be able to achieve their target profit? 3. Assume Plants Plus has identified ways to cut its variable costs to $1.20 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the company to achieve its target profit? 4. Plants Plus started an aggressive advertising campaign strategy to differentiate its plants from those grown by other nurseries. Plants Plus does not expect volume to be affected, but it hopes to gain more control over pricing. If Plants Plus has to spend $155,000 this year to advertise and its variable costs continue to be $1.20 per unit, what will its cost-plus price be? Do you think Plants Plus will be able to sell its plants to garden centers at the cost-plus price? Why or why not? Print Done Plants Plus operates a commercial plant nursery where it propagates plants for garden centers throughout the region. Plants Plus has $4,750,000 in assets. Its yearly fixed costs are $600,000, and the variable costs for the potting soil, container, label, seedling, and labor for each gallon-size plant total $1.35. Plants Plus' volume is currently 490,000 units. Competitors offer the same plants, at the same quality, to garden centers for $3.60 each. Garden centers then mark them up to sell to the public for $9 to $12, depending on the type of plant. Read the requirements 1. Plants Plus' owners want to earn an 11% return on investment on the company's assets. What is Plants Plus' target full product cost? 2. Given Plants Plus' current costs, will its owners be able to achieve their target profit? 3. Assume Plants Plus has identified ways to cut its variable costs to $1.20 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the company to achieve its target profit? 4. Plants Plus started an aggressive advertising campaign strategy to differentiate its plants from those grown by other nurseries. Plants Plus does not expect volume to be affected, but it hopes to gain more control over pricing. If Plants Plus has to spend $155,000 this year to advertise and its variable costs continue to be $1.20 per unit, what will its cost-plus price be? Do you think Plants Plus will be able to sell it plants to garden centers at the cost-plus price? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started