Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Theo and Gina have a small beekeeping and honey business in Kpiti. The following assets are owned as at 1 April 2019 and are

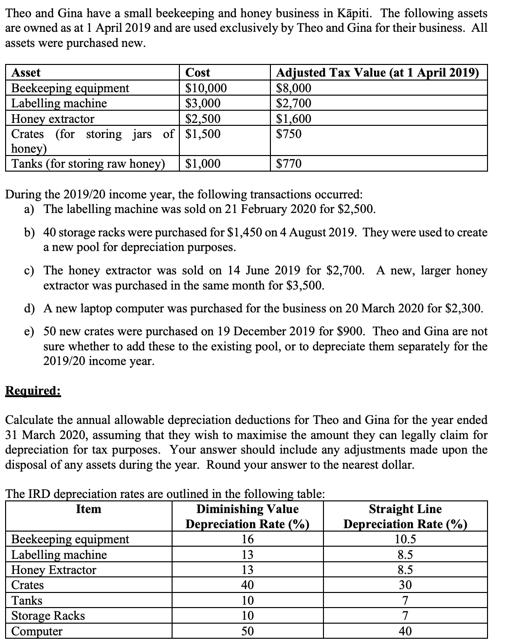

Theo and Gina have a small beekeeping and honey business in Kpiti. The following assets are owned as at 1 April 2019 and are used exclusively by Theo and Gina for their business. All assets were purchased new. Asset Beekeeping equipment Labelling machine Cost $10,000 $3,000 $2,500 Honey extractor Crates (for storing jars of $1,500 honey) Tanks (for storing raw honey) $1,000 During the 2019/20 income year, the following transactions occurred: a) The labelling machine was sold on 21 February 2020 for $2,500. b) 40 storage racks were purchased for $1,450 on 4 August 2019. They were used to create a new pool for depreciation purposes. Adjusted Tax Value (at 1 April 2019) $8,000 $2,700 $1,600 $750 $770 c) The honey extractor was sold on 14 June 2019 for $2,700. A new, larger honey extractor was purchased in the same month for $3,500. d) A new laptop computer was purchased for the business on 20 March 2020 for $2,300. e) 50 new crates were purchased on 19 December 2019 for $900. Theo and Gina are not sure whether to add these to the existing pool, or to depreciate them separately for the 2019/20 income year. Required: Calculate the annual allowable depreciation deductions for Theo and Gina for the year ended 31 March 2020, assuming that they wish to maximise the amount they can legally claim for depreciation for tax purposes. Your answer should include any adjustments made upon the disposal of any assets during the year. Round your answer to the nearest dollar. Beekeeping equipment Labelling machine Honey Extractor Crates Tanks Storage Racks Computer The IRD depreciation rates are outlined in the following table: Item Diminishing Value Depreciation Rate (%) 16 13 13 40 10 10 50 Straight Line Depreciation Rate (%) 10.5 8.5 8.5 30 7 7 40

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer a b c d e f g Purchase date Asset Sold in the same year Tax value Time DV Depreciation as per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started