Answered step by step

Verified Expert Solution

Question

1 Approved Answer

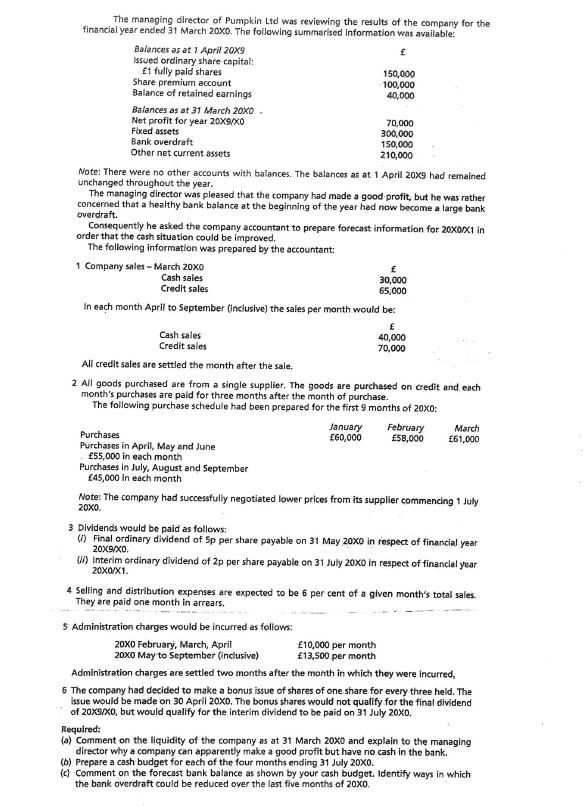

The managing director of Pumpkin Ltd was reviewing the results of the company for the financial year ended 31 March 20X0. The following summarised

The managing director of Pumpkin Ltd was reviewing the results of the company for the financial year ended 31 March 20X0. The following summarised information was available: Balances as at 1 April 20X9 Issued ordinary share capital: 1 fully paid shares Share premium account Balance of retained earnings Balances as at 31 March 20X0. Net profit for year 20X9/X0 Fixed assets Bank overdraft Other net current assets Note: There were no other accounts with balances. The balances as at 1 April 20x9 had remained unchanged throughout the year. The managing director was pleased that the company had made a good-profit, but he was rather concerned that a healthy bank balance at the beginning of the year had now become a large bank overdraft. 1 Company sales - March 20x0 Cash sales Credit sales Consequently he asked the company accountant to prepare forecast information for 20X0/X1 in order that the cash situation could be improved. The following information was prepared by the accountant: Cash sales Credit sales All credit sales are settled the month after the sale. 30,000 65,000 In each month April to September (inclusive) the sales per month would be: 40,000 70,000 150,000 100,000 40,000 Purchases Purchases in April, May and June 55,000 in each month Purchases in July, August and September 45,000 In each month 70,000 300,000 150,000 210,000 2 All goods purchased are from a single supplier. The goods are purchased on credit and each month's purchases are paid for three months after the month of purchase. The following purchase schedule had been prepared for the first 9 months of 20X0: January 60,000 5 Administration charges would be incurred as follows: 20X0 February, March, April 20X0 May to September (inclusive) February 58,000 Note: The company had successfully negotiated lower prices from its supplier commencing 1 July 20x0. March 61,000 3 Dividends would be paid as follows: (1) Final ordinary dividend of 5p per share payable on 31 May 20X0 in respect of financial year 20x9/x0. 10,000 per month 13,500 per month (i) Interim ordinary dividend of 2p per share payable on 31 July 20X0 in respect of financial year 20X0/X1. 4 Selling and distribution expenses are expected to be 6 per cent of a given month's total sales. They are paid one month in arrears. Administration charges are settled two months after the month in which they were incurred, 6 The company had decided to make a bonus issue of shares of one share for every three held. The issue would be made on 30 April 20X0. The bonus shares would not qualify for the final dividend of 20XS/X0, but would qualify for the interim dividend to be paid on 31 July 20X0. Required: (a) Comment on the liquidity of the company as at 31 March 20X0 and explain to the managing director why a company can apparently make a good profit but have no cash in the bank. (b) Prepare a cash budget for each of the four months ending 31 July 20X0. (c) Comment on the forecast bank balance as shown by your cash budget. Identify ways in which the bank overdraft could be reduced over the last five months of 20X0.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Currently the company is facing a cash crunch as it is having bank overdraft of GBP 150000 wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started