ther are 4 Questions p1 p2 m1 d1

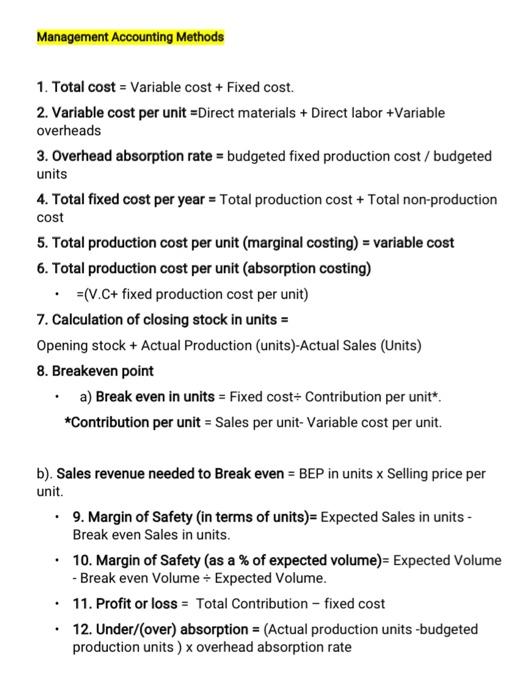

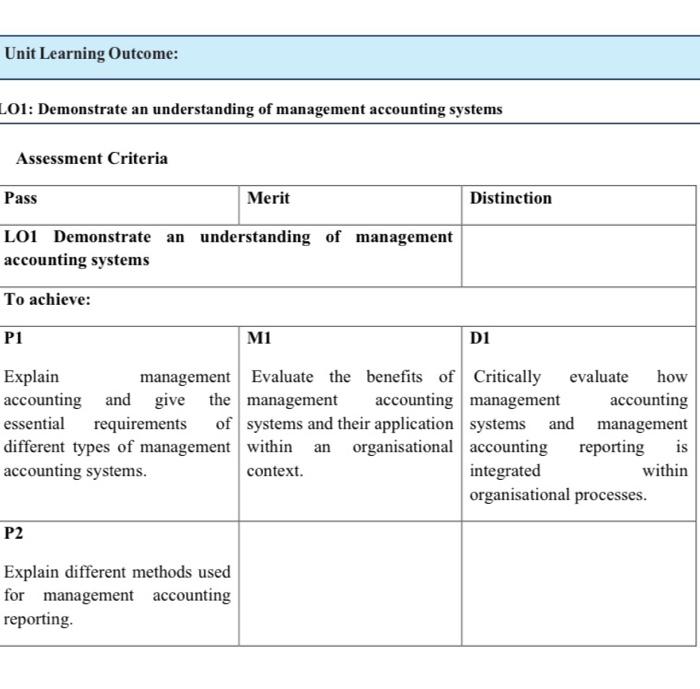

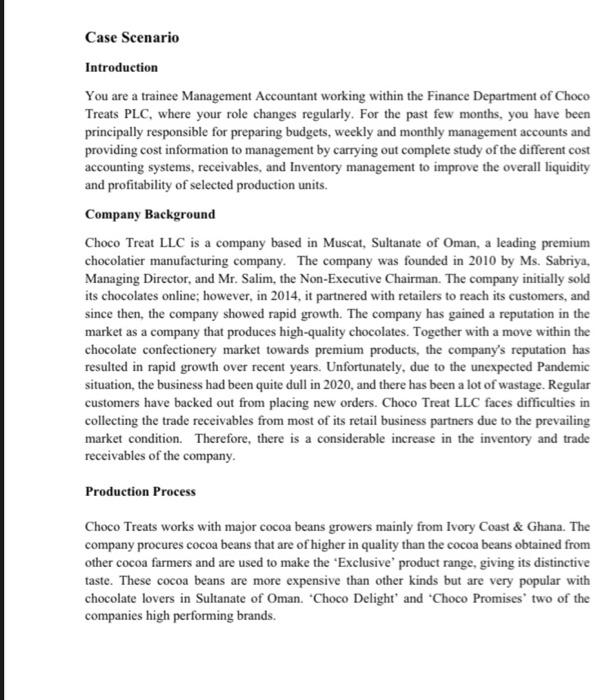

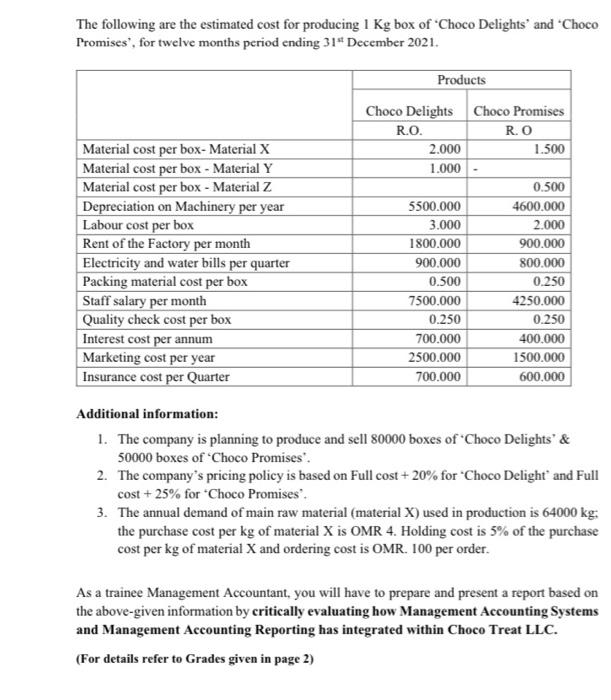

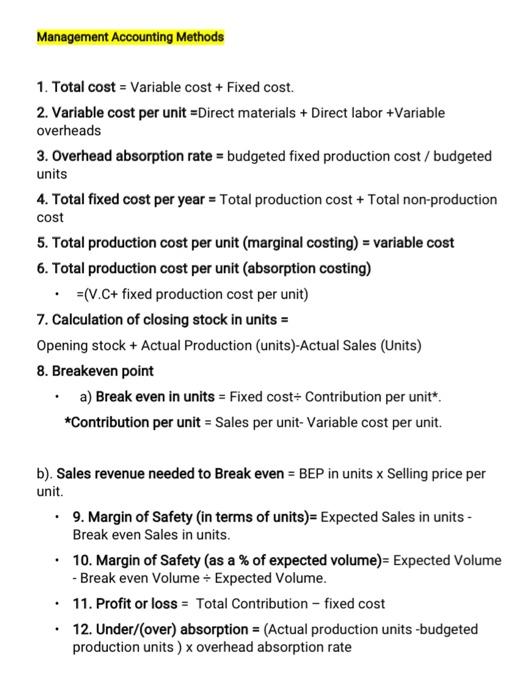

Unit Learning Outcome: LO1: Demonstrate an understanding of management accounting systems Assessment Criteria Pass Merit Distinction LOI Demonstrate an understanding of management accounting systems To achieve: P1 M1 D1 Explain management Evaluate the benefits of Critically evaluate how accounting and give the management accounting management accounting essential requirements of systems and their application systems and management different types of management within organisational accounting reporting is accounting systems. context. integrated within organisational processes. an P2 Explain different methods used for management accounting reporting The following are the estimated cost for producing 1 kg box of 'Choco Delights' and 'Choco Promises", for twelve months period ending 31 December 2021. Products Material cost per box- Material X Material cost per box - Material Y Material cost per box - Material Z Depreciation on Machinery per year Labour cost per box Rent of the Factory per month Electricity and water bills per quarter Packing material cost per box Staff salary per month Quality check cost per box Interest cost per annum Marketing cost per year Insurance cost per Quarter Choco Delights Choco Promises R.O. RO 2.000 1.500 1.000 0.500 5500.000 4600.000 3.000 2.000 1800.000 900.000 900.000 800.000 0.500 0.250 7500.000 4250.000 0.250 0.250 700.000 400.000 2500.000 1500.000 700.000 600.000 Additional information: 1. The company is planning to produce and sell 80000 boxes of 'Choco Delights' & 50000 boxes of "Choco Promises. 2. The company's pricing policy is based on Full cost + 20% for Choco Delight and Full cost + 25% for Choco Promises. 3. The annual demand of main raw material (material X) used in production is 64000 kg: the purchase cost per kg of material X is OMR 4. Holding cost is 5% of the purchase cost per kg of material X and ordering cost is OMR. 100 per order. As a trainee Management Accountant, you will have to prepare and present a report based on the above-given information by critically evaluating how Management Accounting Systems and Management Accounting Reporting has integrated within Choco Treat LLC. (For details refer to Grades given in page 2) Management Accounting Methods 1. Total cost = Variable cost + Fixed cost. 2. Variable cost per unit Direct materials + Direct labor +Variable overheads 3. Overhead absorption rate = budgeted fixed production cost / budgeted units 4. Total fixed cost per year = Total production cost + Total non-production cost 5. Total production cost per unit (marginal costing) = variable cost 6. Total production cost per unit (absorption costing) =(V.C+ fixed production cost per unit) 7. Calculation of closing stock in units = Opening stock + Actual Production (units)-Actual Sales (Units) 8. Breakeven point a) Break even in units - Fixed cost Contribution per unit*. *Contribution per unit = Sales per unit-Variable cost per unit. b). Sales revenue needed to Break even = BEP in units x Selling price per unit. 9. Margin of Safety (in terms of units)= Expected Sales in units - Break even Sales in units. 10. Margin of Safety (as a % of expected volume)= Expected Volume - Break even Volume + Expected Volume. . 11. Profit or loss - Total Contribution - fixed cost 12. Under/Cover) absorption = (Actual production units -budgeted production units) x overhead absorption rate

ther are 4 Questions p1 p2 m1 d1

ther are 4 Questions p1 p2 m1 d1