Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ther Fed creates a lower and upper bound for the federal funds rate and the incentives that drive financial institutions to move the federal funds

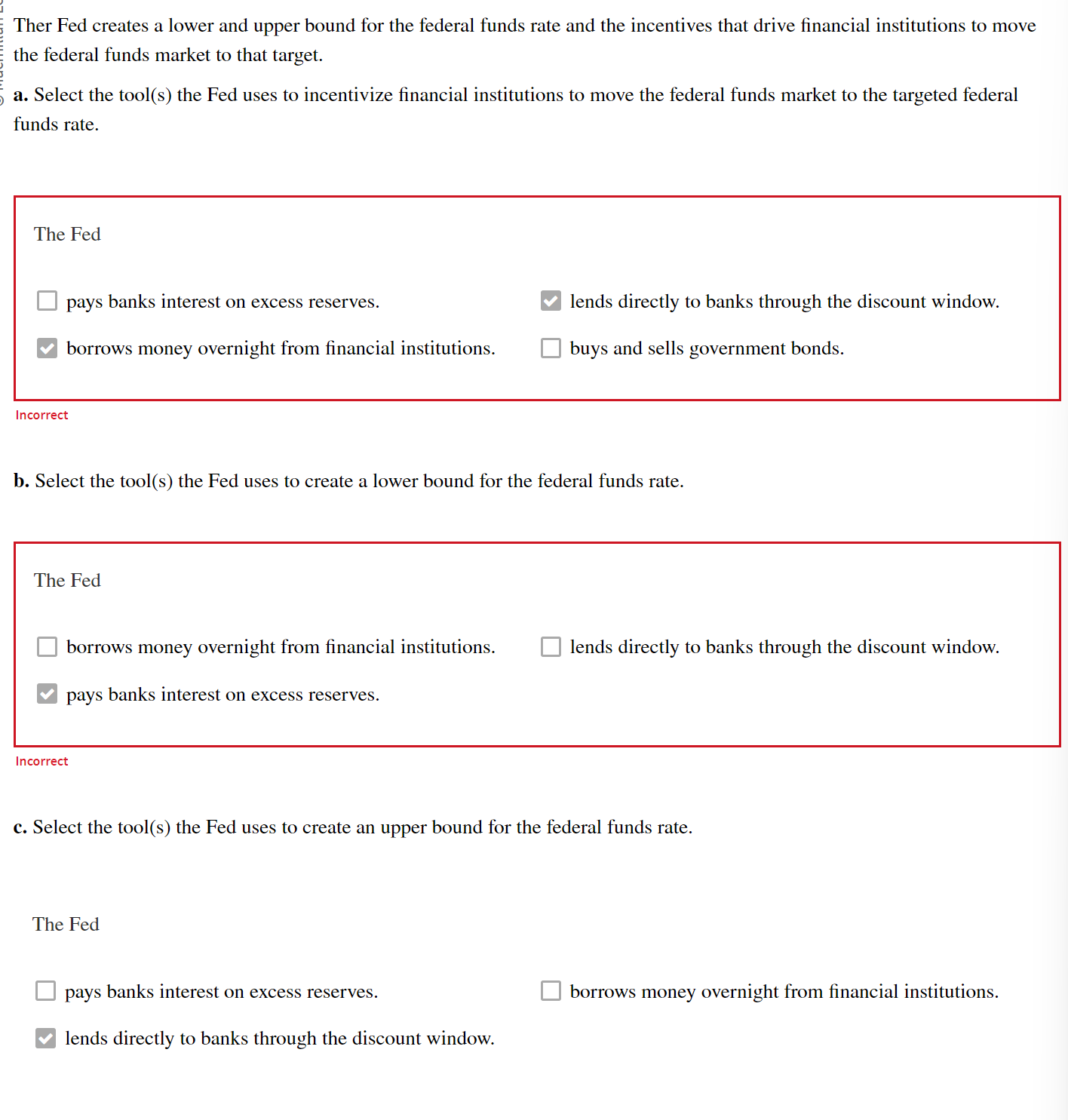

Ther Fed creates a lower and upper bound for the federal funds rate and the incentives that drive financial institutions to move the federal funds market to that target. a. Select the tool(s) the Fed uses to incentivize financial institutions to move the federal funds market to the targeted federal funds rate. The Fed pays banks interest on excess reserves. borrows money overnight from financial institutions. lends directly to banks through the discount window. buys and sells government bonds. Incorrect b. Select the tool(s) the Fed uses to create a lower bound for the federal funds rate. The Fed borrows money overnight from financial institutions. pays banks interest on excess reserves. lends directly to banks through the discount window. Incorrect c. Select the tool(s) the Fed uses to create an upper bound for the federal funds rate. The Fed pays banks interest on excess reserves. borrows money overnight from financial institutions. lends directly to banks through the discount window

Ther Fed creates a lower and upper bound for the federal funds rate and the incentives that drive financial institutions to move the federal funds market to that target. a. Select the tool(s) the Fed uses to incentivize financial institutions to move the federal funds market to the targeted federal funds rate. The Fed pays banks interest on excess reserves. borrows money overnight from financial institutions. lends directly to banks through the discount window. buys and sells government bonds. Incorrect b. Select the tool(s) the Fed uses to create a lower bound for the federal funds rate. The Fed borrows money overnight from financial institutions. pays banks interest on excess reserves. lends directly to banks through the discount window. Incorrect c. Select the tool(s) the Fed uses to create an upper bound for the federal funds rate. The Fed pays banks interest on excess reserves. borrows money overnight from financial institutions. lends directly to banks through the discount window Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started