there are 13 journal entries. please do everything

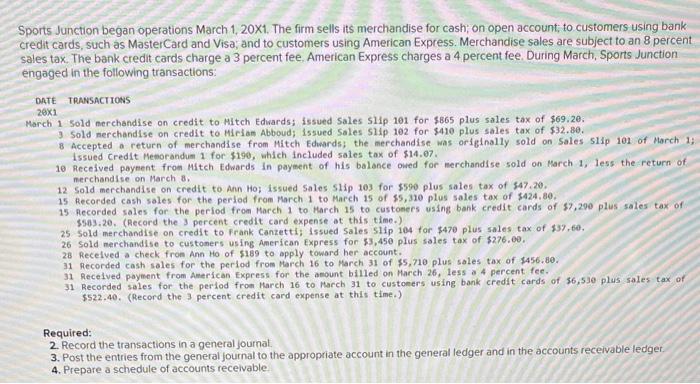

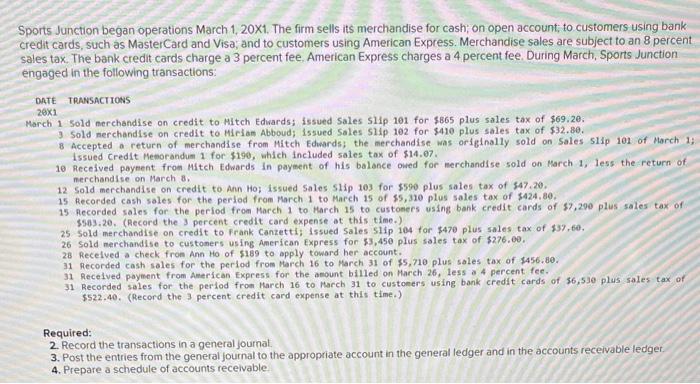

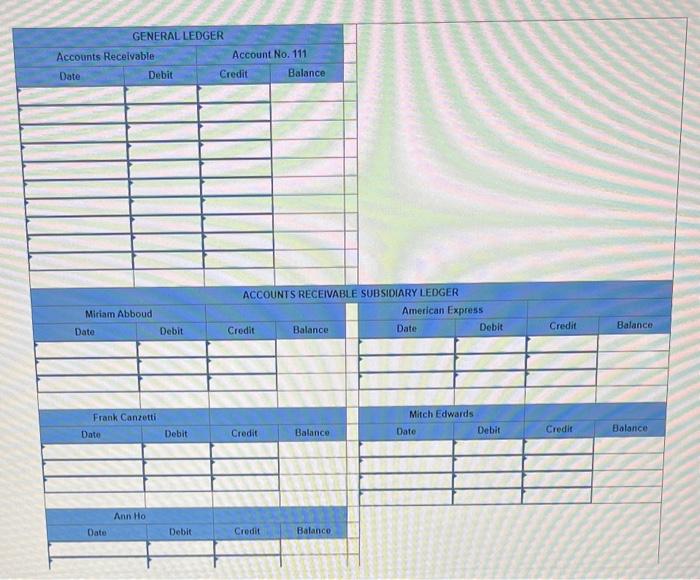

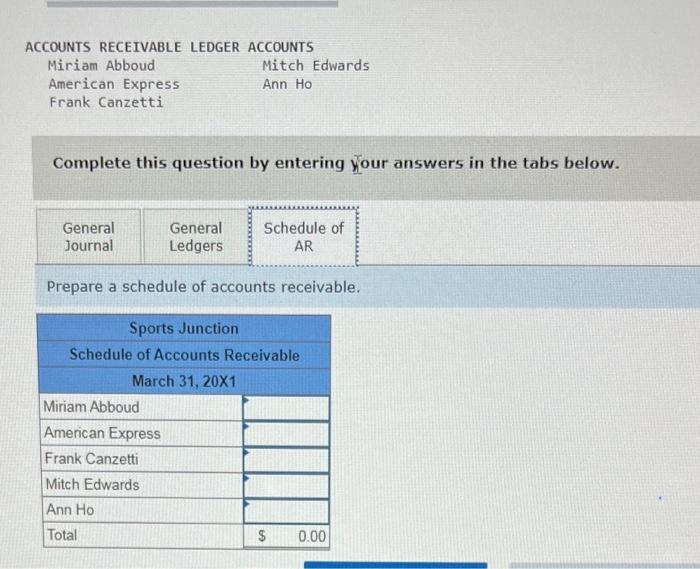

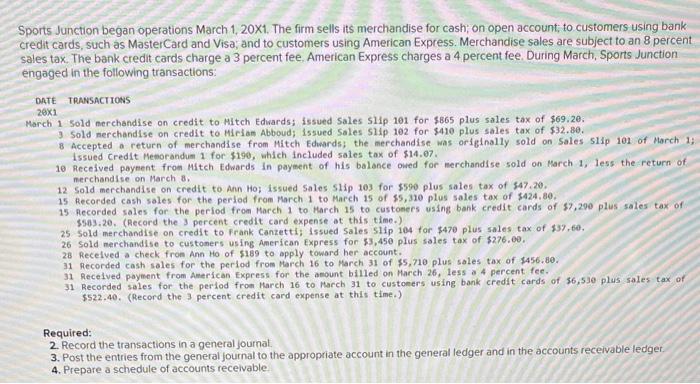

Sports Junction began operations March 1, 20x1. The firm sells its merchandise for cash; on open account; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. Merchandise sales are subject to an 8 percent sales tax. The bank credit cards charge a 3 percent fee, American Express charges a 4 percent fee. During March, Sports Junction engaged in the following transactions: DMTE TRANSACTIONS 201 March 1 5old nerchandise on credit to Mitch Edwards; issued Sales 5lip 101 for \$3865 plus sales tax of \$69.20: 3 Sold nerchandise on credit to Mirian Abboud; 1ssued Sales 5lip 102 for \$410 plus sales tax of $32.89. 8 Accepted a return of merchandise from Mitch Edwards; the merchandise was originally sold on Sales slip 101 of March 1; 1ssued Credit Menorandum 1 for $190, which included sales tax of \$14.07. 10 Received paynent from Mitch Edwards In payment of his balance owed for merchandise sold on March 1, less the return of merchandise on March 8 . 12 Sold merchandise on credit to Ann Ho; issued 5ales 511p103 for $590 plus sales tax of $47.20. 15 Recorded cash sales for the perlod from March 1 to March 15 of 55,310 plus sales tax of $424,80. 15 Recorded sales for the period from March 1 to Harch 15 to custoners using bank eredit cards of $7, 200 plus sales tax of \$503.20. (Record the 3 percent credit card expense at this time.) 25 Sold merchandise on credit to Frank Canzetti; 1ssued 5ales 511 p 104 for $470 plus sales tax of $39, 60. 26 Sold merchandise to custoners using American Express for \$3,450 plus sales tax of $276.00. 28 Recelved a check fron Ann Ho of 5189 to apply toward her account. 31 Recorded cash sales for the perlod from March 16 to March 31 of $5,710 plus sales tax of $456.80. 31 Recelved payment from American Express for the asount billed on Harch 26 , less a 4 percent fee. 31 Recorded sales for the perlod from March 16 to March 31 to custoners using bank creditt cards of 36,530 plus sales tax of $522.40. (Record the 3 percent credit card expense at this time.) Requited: 2. Record the transactions in a general journal. 3. Post the entries from the general journal to the appropriate account in the general ledger and in the accounts receivable ledger. 4. Prepare a schedule of accounts recelvable. ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Complete this question by entering your answers in the tabs below. Prepare a schedule of accounts receivable