Question: there are 3 approaches to solve this. Future Value isnt one of them. any help on what the 3 approaches are? i also need it

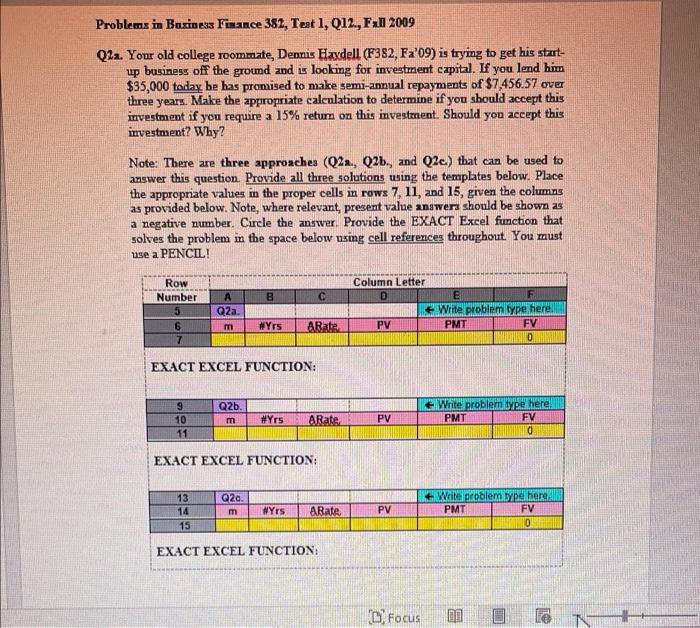

Problems in Business Finance 382, Test 1, Q12, Fall 2009 Q2a. Your old college roommate, Dennis Haydell (F382, Fa'09) is trying to get his start- up business off the ground and is looking for investment capital. If you lend him $35,000 today he has promised to make semi-annual repayments of $7,456.57 over three years. Make the appropriate calculation to determine if you should accept this investment if you require a 15% return on this investment. Should you accept this investment? Why? Note: There are three approaches (Q2a., Q2b., and Q2e.) that can be used to answer this question. Provide all three solutions using the templates below. Place the appropriate values in the proper cells in rows 7, 11, and 15, given the columns as provided below. Note, where relevant, present value answers should be shown as a negative number. Circle the answer. Provide the EXACT Excel function that solves the problem in the space below using cell references throughout. You must use a PENCIL! Row Column Letter D Number A B C E F 5 Q2a. Write problem type here.. PMT m #Yrs ABate PV FV 7 0 EXACT EXCEL FUNCTION: 9 Q2b. Write problem type here! PMT 10 m #Yrs FV PV 11 0 EXACT EXCEL FUNCTION: 13 Q20. Write problem type here. PMT 14 m PV FV 15 10 EXACT EXCEL FUNCTION: 6 ARate #Yrs ABate Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts