There are 3 parts to this problem. Please answer all the parts and show the detailed calculations

\

\

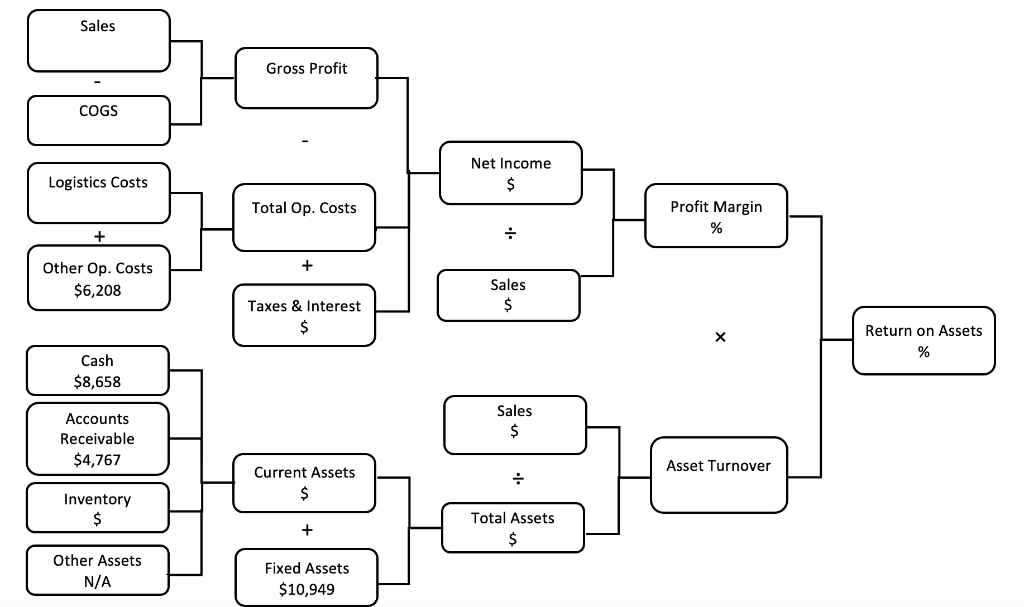

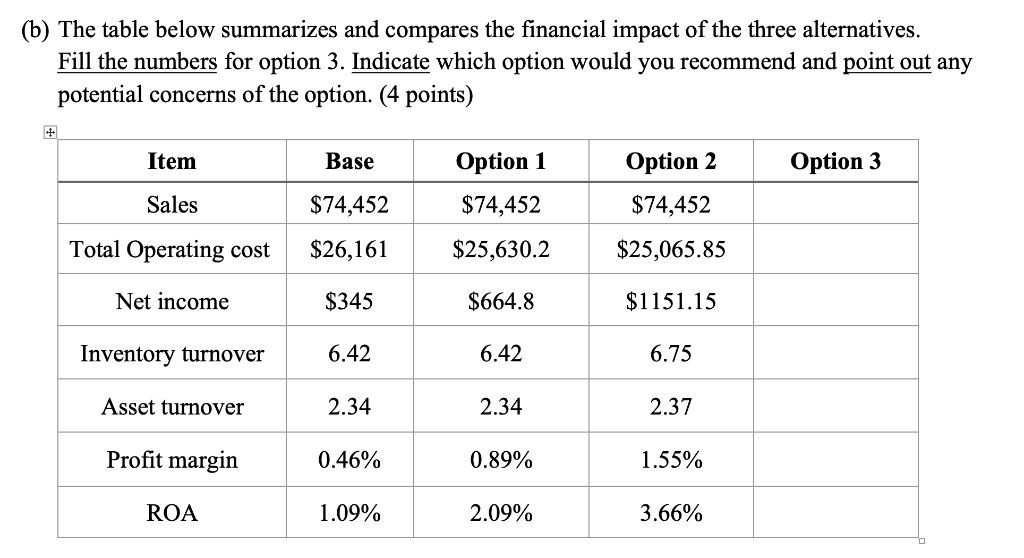

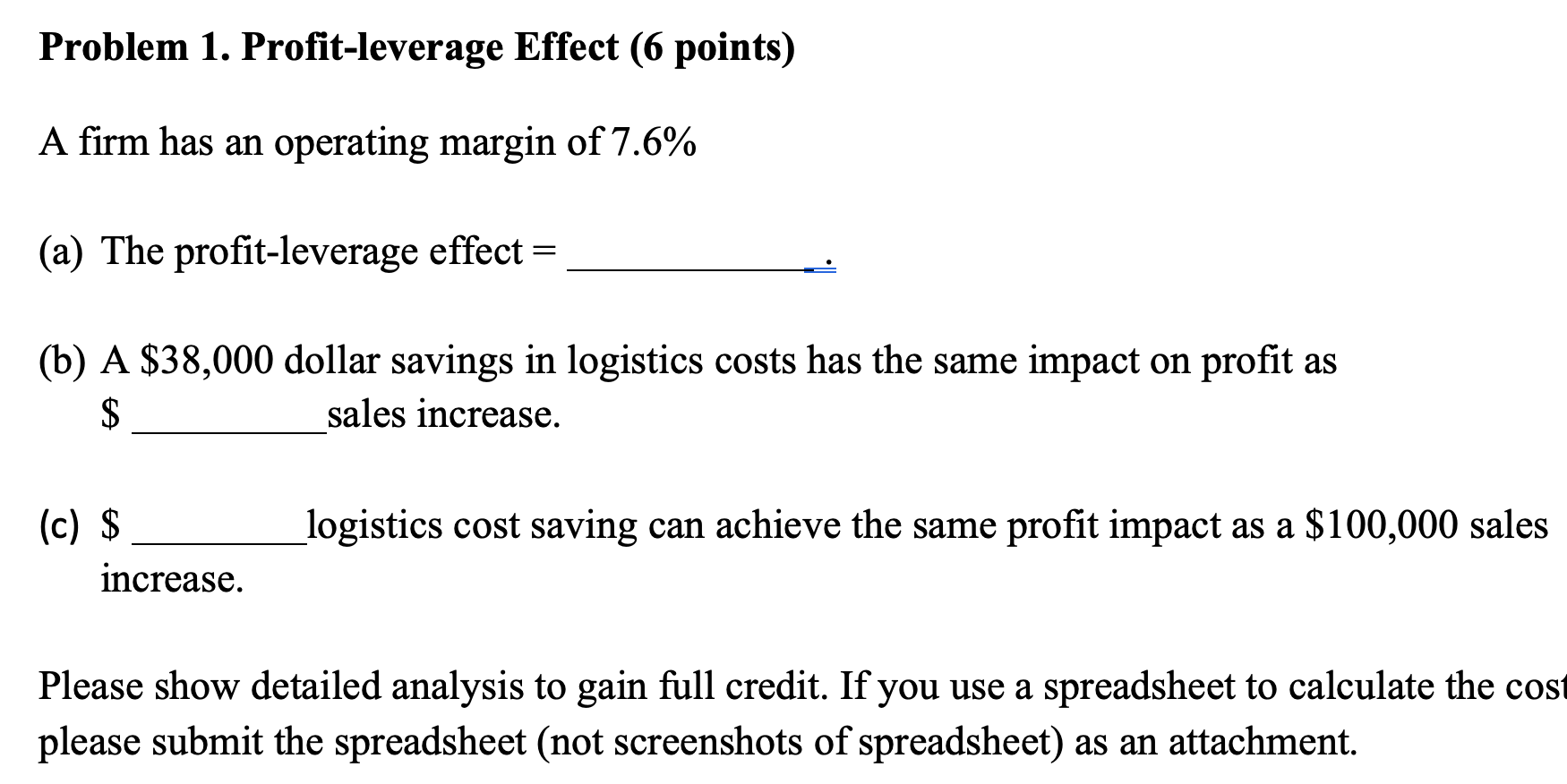

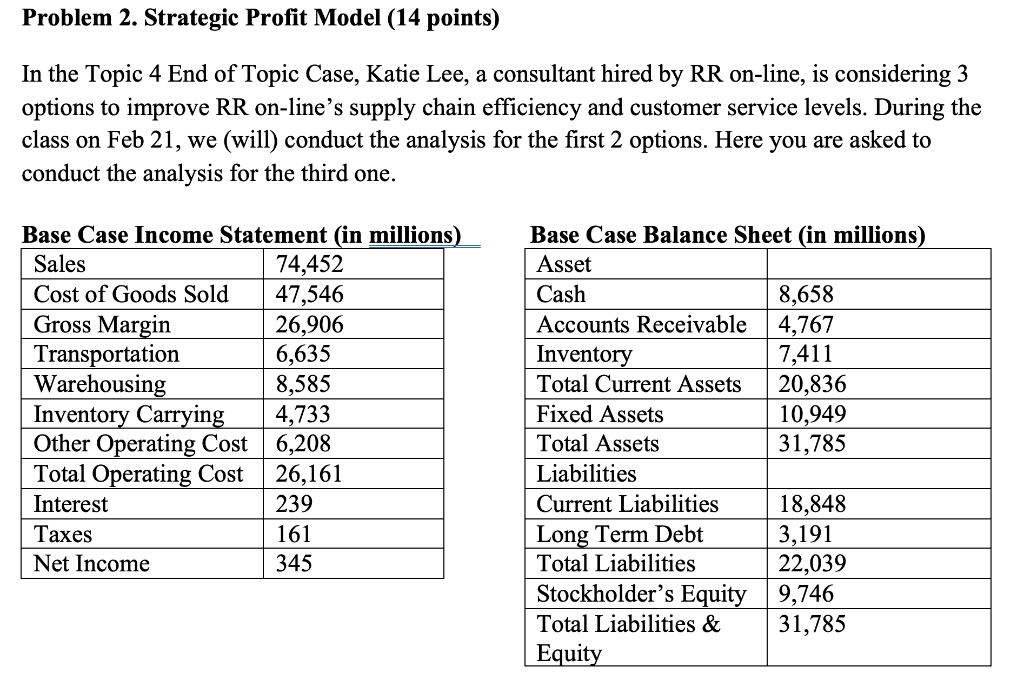

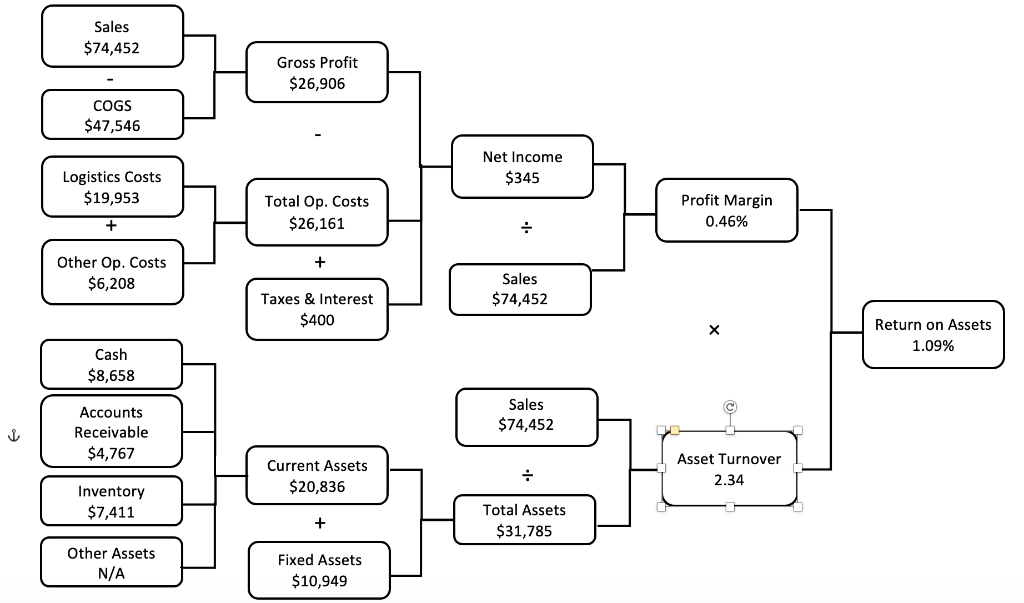

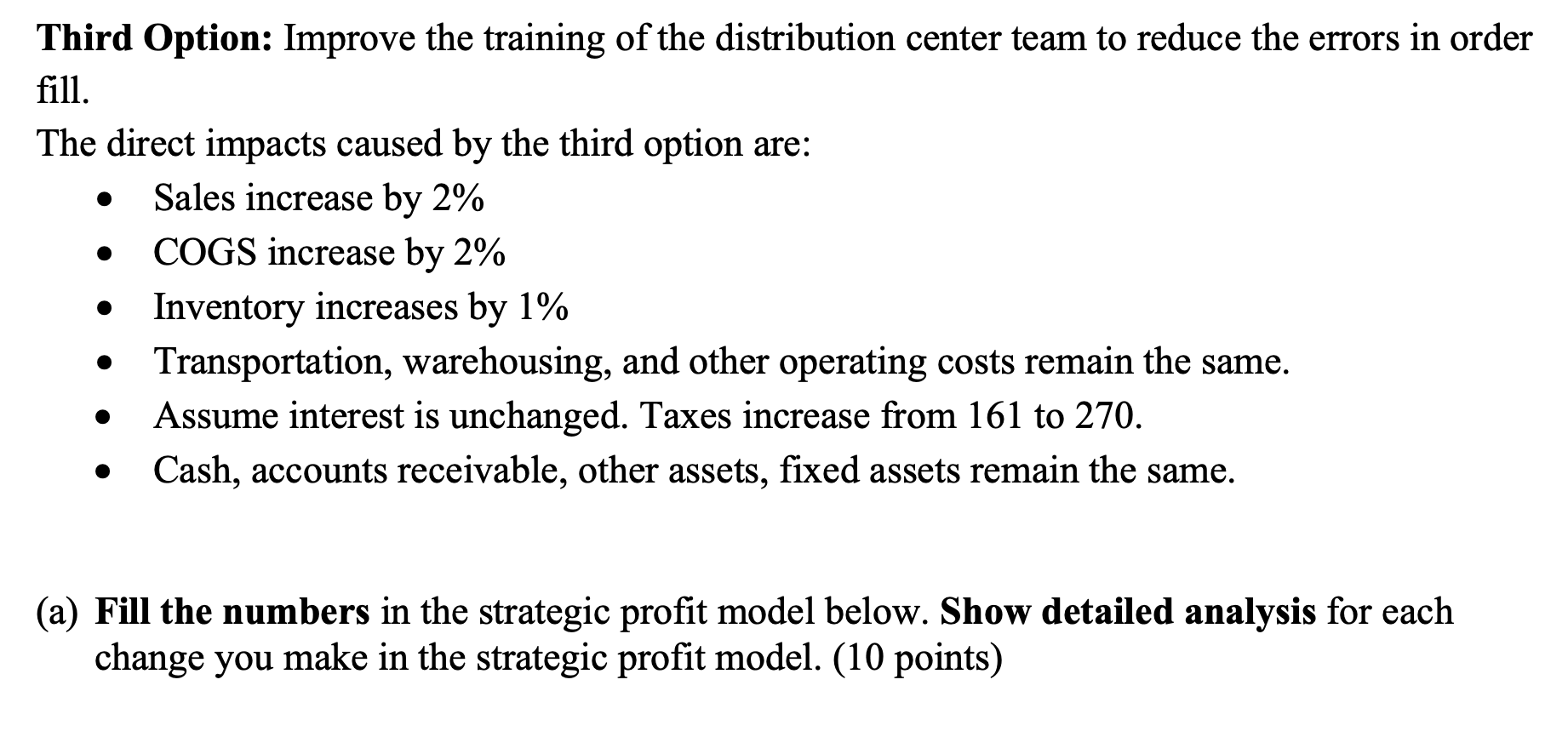

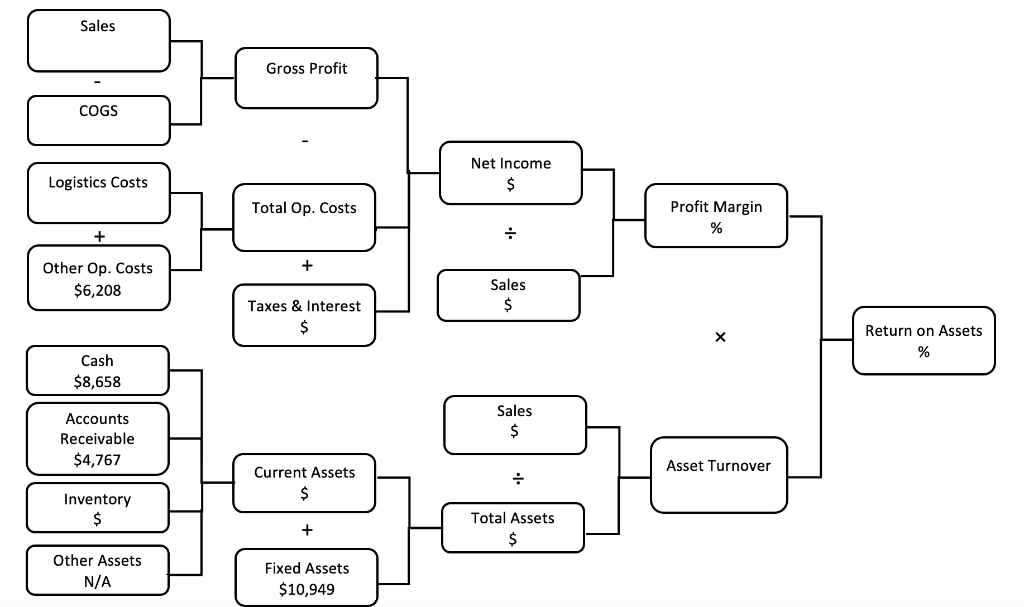

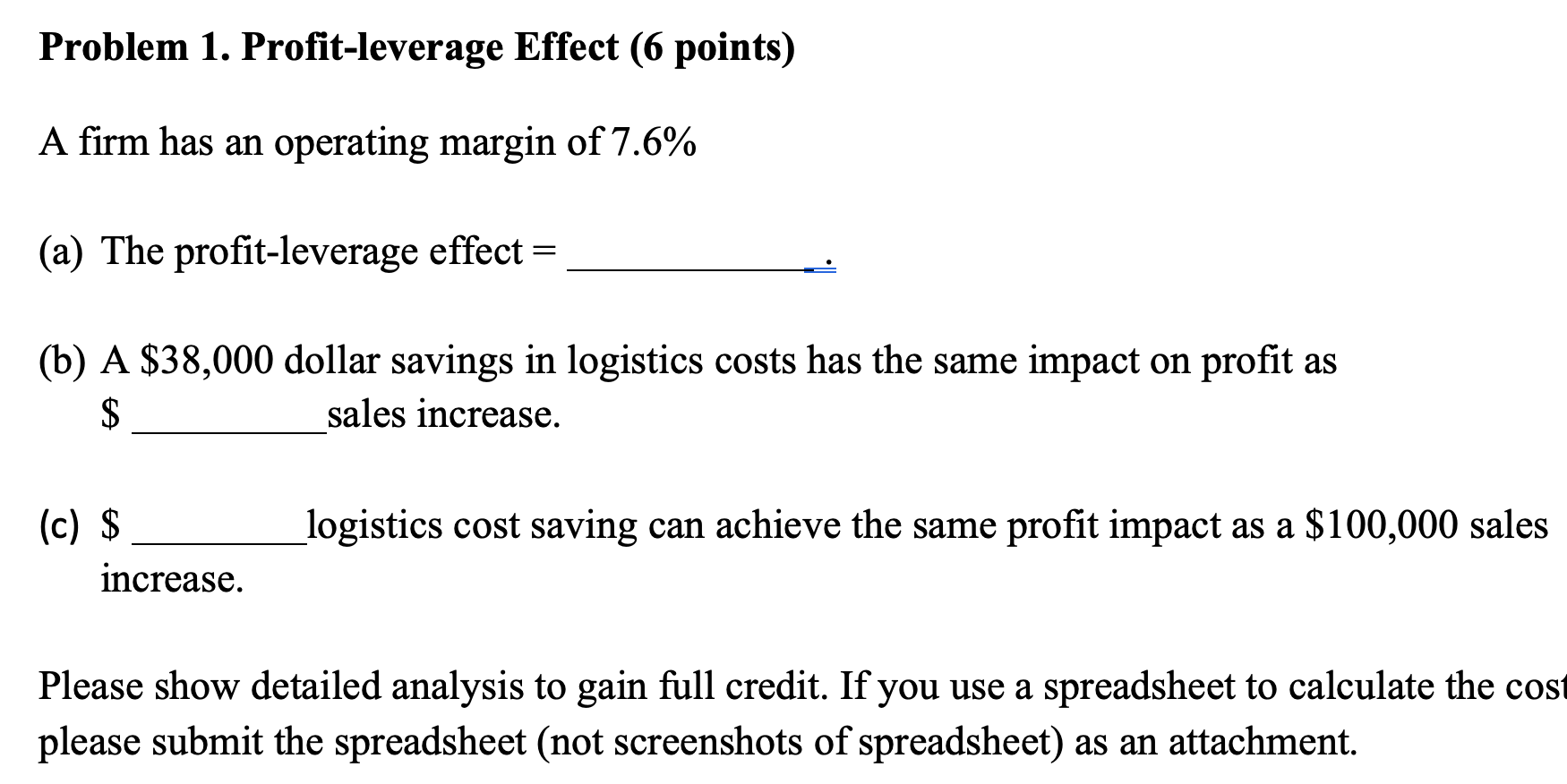

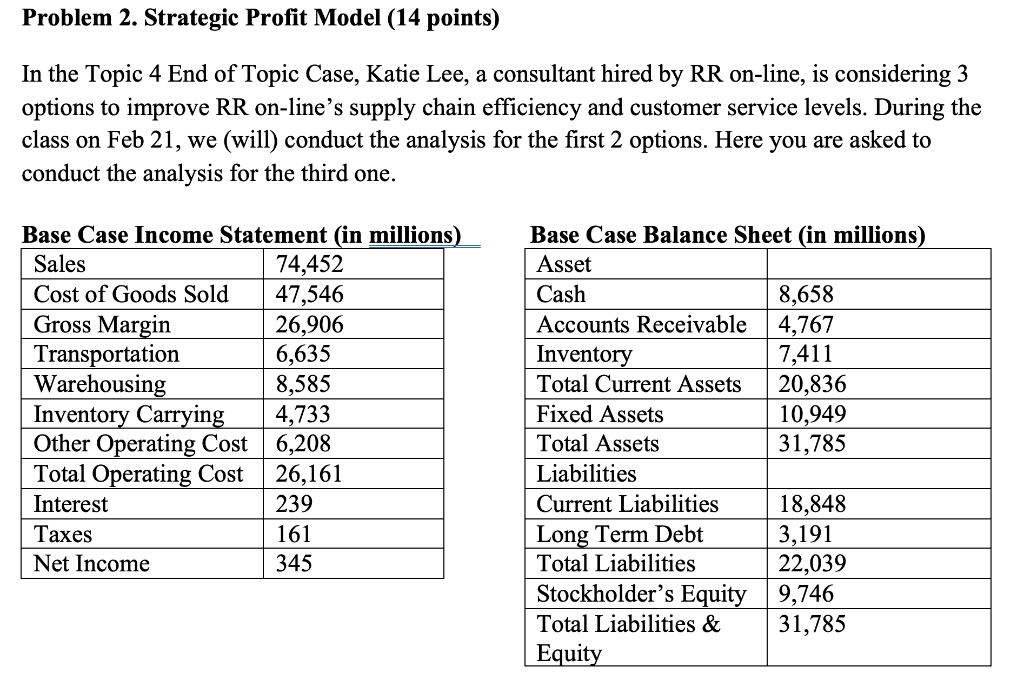

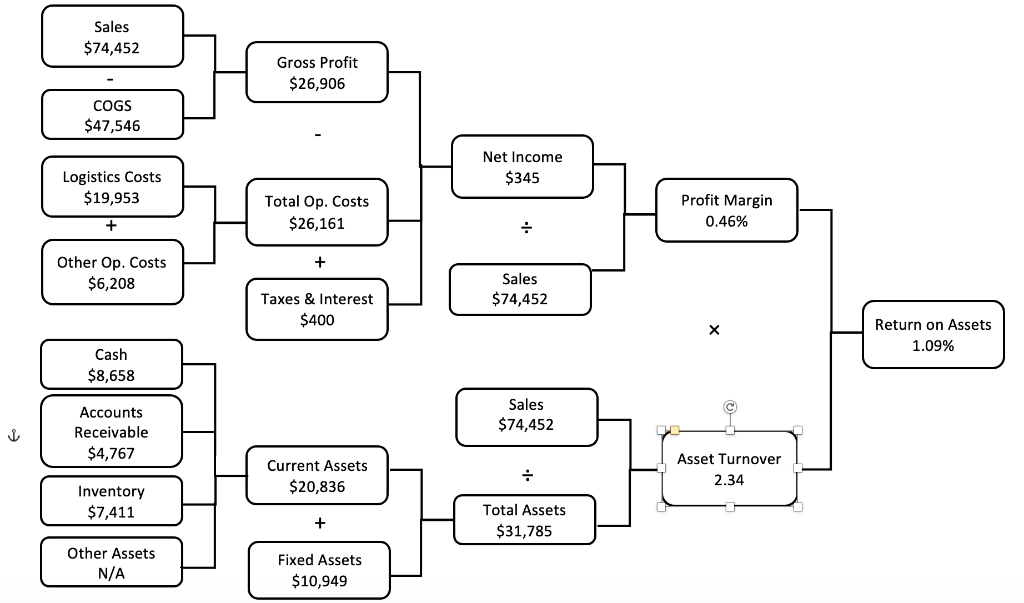

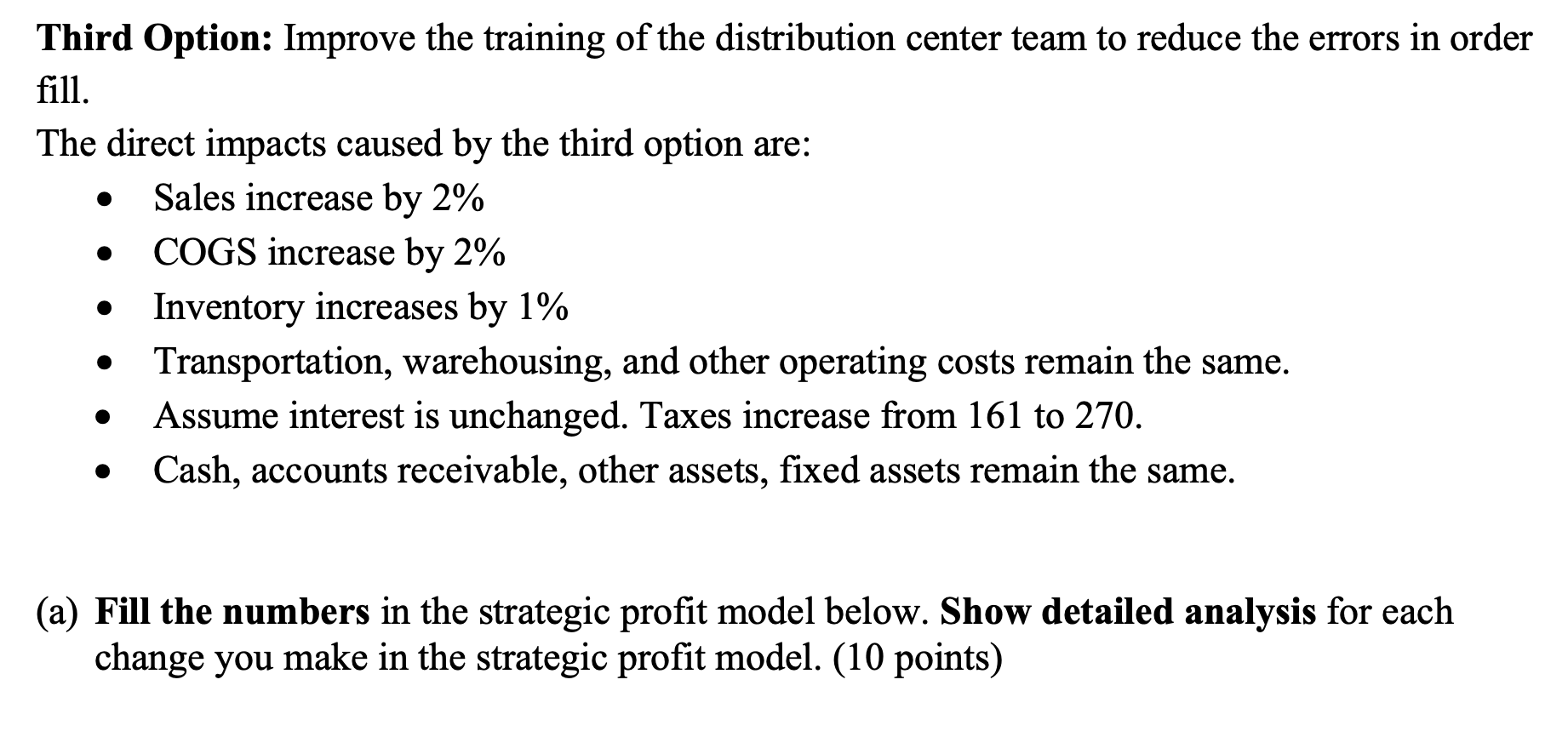

Problem 1. Profit-leverage Effect (6 points) A firm has an operating margin of 7.6% (a) The profit-leverage effect = (b) A $38,000 dollar savings in logistics costs has the same impact on profit as $ sales increase. logistics cost saving can achieve the same profit impact as a $100,000 sales (c) $ increase. Please show detailed analysis to gain full credit. If you use a spreadsheet to calculate the cost please submit the spreadsheet (not screenshots of spreadsheet) as an attachment. Problem 2. Strategic Profit Model (14 points) In the Topic 4 End of Topic Case, Katie Lee, a consultant hired by RR on-line, is considering 3 options to improve RR on-line's supply chain efficiency and customer service levels. During the class on Feb 21, we (will) conduct the analysis for the first 2 options. Here you are asked to conduct the analysis for the third one. Base Case Income Statement (in millions) Sales 74,452 Cost of Goods Sold 47,546 Gross Margin 26,906 Transportation 6,635 Warehousing 8,585 Inventory Carrying 4,733 Other Operating Cost 6,208 Total Operating Cost 26,161 Interest 239 Taxes 161 Net Income 345 Base Case Balance Sheet (in millions) Asset Cash 8,658 Accounts Receivable 4,767 Inventory 7,411 Total Current Assets 20,836 Fixed Assets 10,949 Total Assets 31,785 Liabilities Current Liabilities 18,848 Long Term Debt 3,191 Total Liabilities 22,039 Stockholder's Equity 9,746 Total Liabilities & 31,785 Equity Sales $74,452 Gross Profit $26,906 COGS $47,546 Net Income $345 Logistics Costs $19,953 Total Op. Costs $26,161 Profit Margin 0.46% + + Other Op. Costs $6,208 Sales $74,452 Taxes & Interest $400 Return on Assets 1.09% Cash $8,658 Sales $74,452 Accounts Receivable $4,767 1 Current Assets $20,836 : Asset Turnover 2.34 Inventory $7,411 + Total Assets $31,785 Other Assets N/A Fixed Assets $10,949 . Third Option: Improve the training of the distribution center team to reduce the errors in order fill. The direct impacts caused by the third option are: Sales increase by 2% COGS increase by 2% Inventory increases by 1% Transportation, warehousing, and other operating costs remain the same. Assume interest is unchanged. Taxes increase from 161 to 270. Cash, accounts receivable, other assets, fixed assets remain the same. . . . - (a) Fill the numbers in the strategic profit model below. Show detailed analysis for each change you make in the strategic profit model. (10 points) Sales Gross Profit COGS 2006 Logistics Costs Net Income $ Total Op. Costs Profit Margin % + Other Op. Costs $6,208 Sales $ Taxes & Interest $ X Return on Assets % Cash $8,658 Sales $ Accounts Receivable $4,767 Asset Turnover Current Assets $ . Inventory $ + Total Assets $ Other Assets N/A Fixed Assets $10,949 (b) The table below summarizes and compares the financial impact of the three alternatives. Fill the numbers for option 3. Indicate which option would you recommend and point out any potential concerns of the option. (4 points) Item Base Option 1 Option 3 Option 2 $74,452 Sales $74,452 $74,452 Total Operating cost $26,161 $25,630.2 $25,065.85 Net income $345 $664.8 $1151.15 Inventory turnover 6.42 6.42 6.75 Asset turnover 2.34 2.34 2.37 Profit margin 0.46% 0.89% 1.55% ROA 1.09% 2.09% 3.66%

\

\