Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there are 3 relevant risk factors to consider, GNP growth, interest rates, and market returns. You are examining two stocks, Mars and Venus. Stock

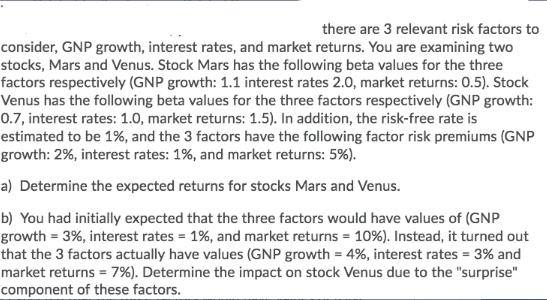

there are 3 relevant risk factors to consider, GNP growth, interest rates, and market returns. You are examining two stocks, Mars and Venus. Stock Mars has the following beta values for the three factors respectively (GNP growth: 1.1 interest rates 2.0, market returns: 0.5). Stock Venus has the following beta values for the three factors respectively (GNP growth: 0.7, interest rates: 1.0, market returns: 1.5). In addition, the risk-free rate is estimated to be 1%, and the 3 factors have the following factor risk premiums (GNP growth: 2%, interest rates: 1%, and market returns: 5%). a) Determine the expected returns for stocks Mars and Venus. b) You had initially expected that the three factors would have values of (GNP growth = 3%, interest rates = 1%, and market returns = 10%). Instead, it turned out that the 3 factors actually have values (GNP growth = 4%, interest rates = 3% and market returns = 7%). Determine the impact on stock Venus due to the "surprise" component of these factors.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the expected returns for stocks Mars and Venus we can use the Arbitrage Pricing Theor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started