There are 3 seperate questions here. thanks to whoever can help

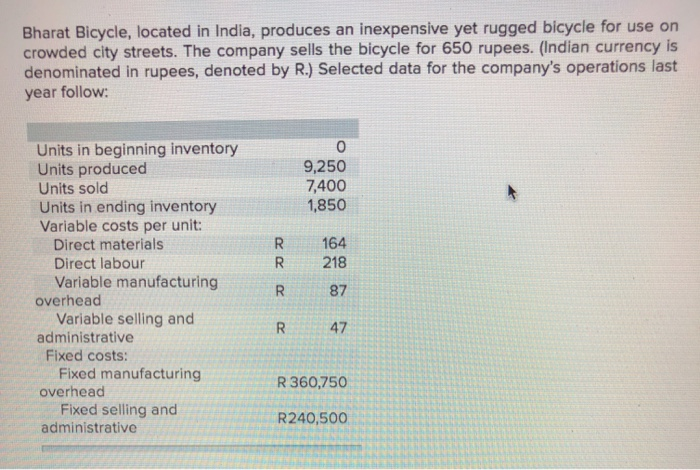

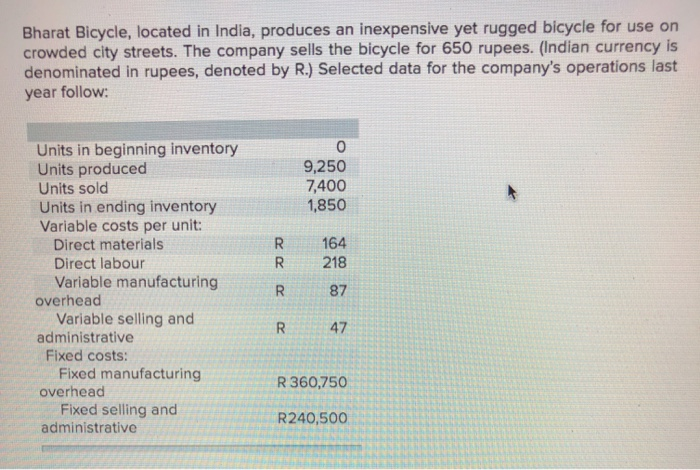

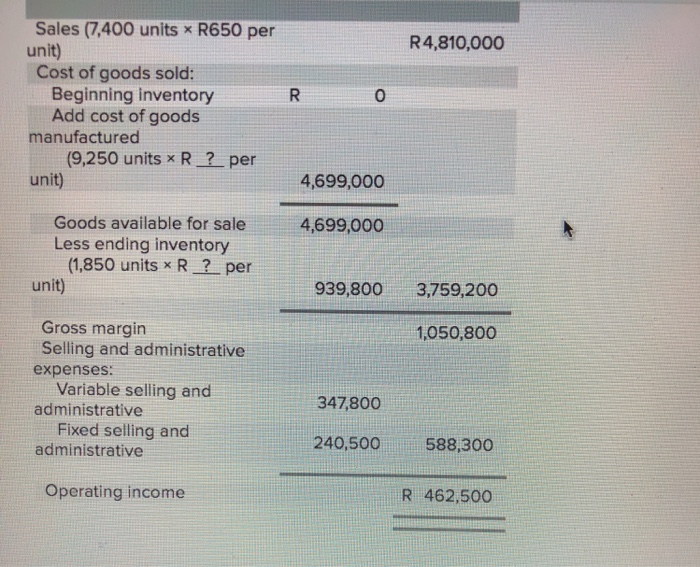

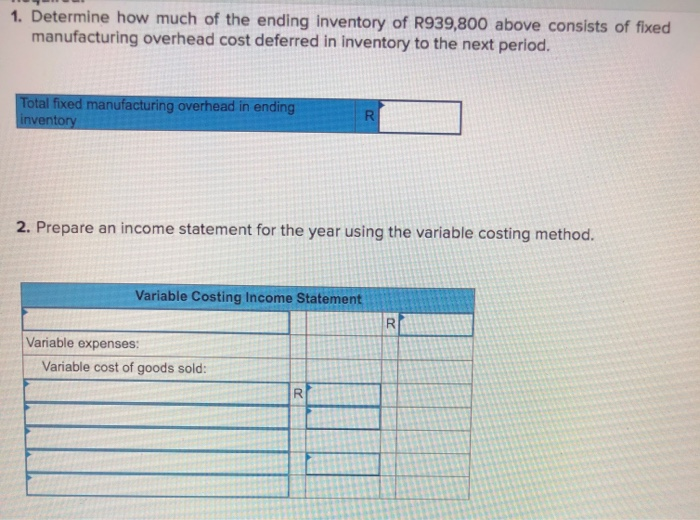

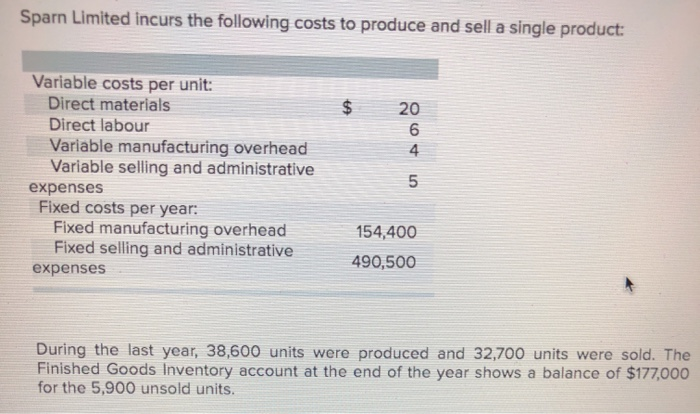

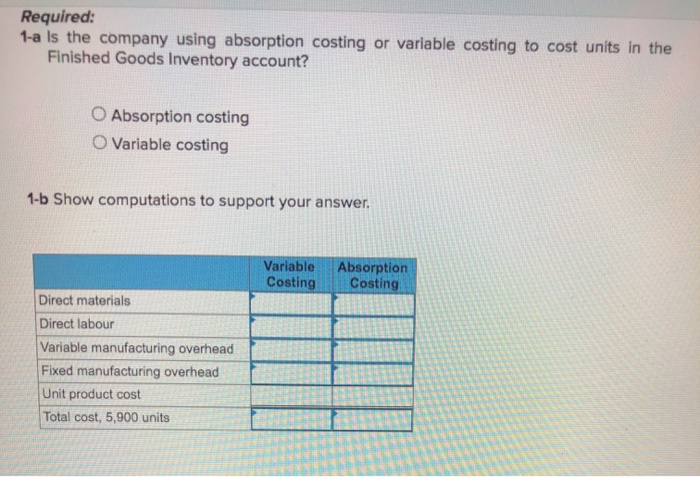

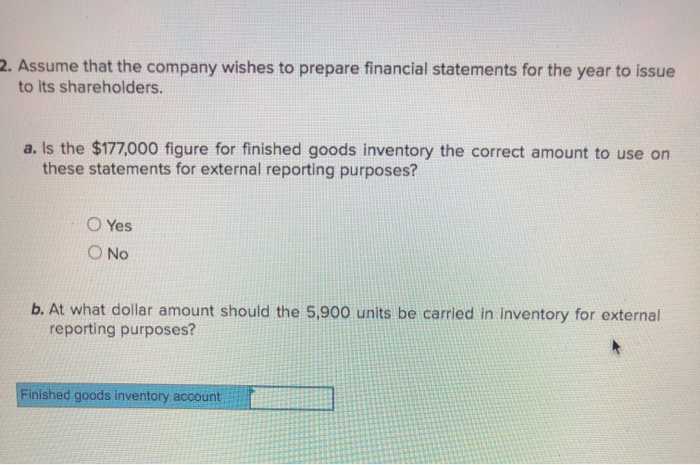

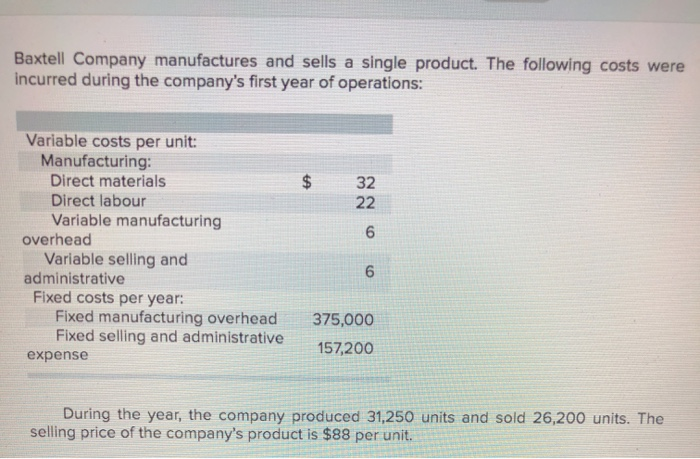

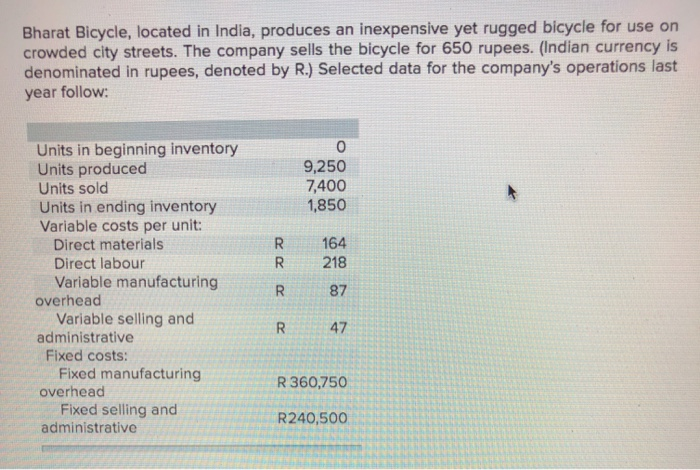

Bharat Bicycle, located in India, produces an inexpensive yet rugged bicycle for use on crowded city streets. The company sells the bicycle for 650 rupees. (Indian currency is denominated in rupees, denoted by R.) Selected data for the company's operations last year follow: 0 9,250 7,400 1,850 R R 164 218 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs: Fixed manufacturing overhead Fixed selling and administrative R 87 R 47 R 360,750 R240,500 R4,810,000 R O Sales (7,400 units * R650 per unit) Cost of goods sold: Beginning inventory Add cost of goods manufactured (9,250 units x R_? per unit) 4,699,000 4,699,000 Goods available for sale Less ending inventory (1,850 units x R ? per unit) 939,800 3,759,200 1,050,800 Gross margin Selling and administrative expenses: Variable selling and administrative Fixed selling and administrative 347,800 240,500 588,300 Operating income R 462,500 1. Determine how much of the ending inventory of R939,800 above consists of fixed manufacturing overhead cost deferred in inventory to the next period. Total fixed manufacturing overhead in ending inventory R 2. Prepare an income statement for the year using the variable costing method. Variable Costing Income Statement R Variable expenses Variable cost of goods sold: R Sparn Limited incurs the following costs to produce and sell a single product: $ 20 6 4 Variable costs per unit: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses LO 154,400 490,500 During the last year, 38,600 units were produced and 32,700 units were sold. The Finished Goods Inventory account at the end of the year shows a balance of $177,000 for the 5,900 unsold units. Required: 1-a is the company using absorption costing or variable costing to cost units in the Finished Goods Inventory account? Absorption costing O Variable costing 1-b Show computations to support your answer. Variable Costing Absorption Costing Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Total cost, 5,900 units 2. Assume that the company wishes to prepare financial statements for the year to issue to its shareholders. a. Is the $177,000 figure for finished goods inventory the correct amount to use on these statements for external reporting purposes? O Yes O No b. At what dollar amount should the 5,900 units be carried in Inventory for external reporting purposes? Finished goods inventory account Baxtell Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: $ 32 22 6 Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense 6 375,000 157,200 During the year, the company produced 31,250 units and sold 26,200 units. The selling price of the company's product is $88 per unit. Required: 1. Assume that the company uses absorption costing. a. Compute the unit product cost. Unit product cost b. Prepare an income statement for the year. Absorption Costing Income Statement Cost of goods sold: 2. Assume that the company uses variable costing. a. Compute the unit product cost. 2. Assume that the company uses variable costing. a. Compute the unit product cost. Unit product cost b. Prepare an income statement for the year. Variable Costing Income Statement Variable expenses: Variable cost of goods sold: Variable cost of goods sold Fixed expenses