Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 4 different questions. Please solve it and add the steps or excel functions used. You plan to save money for a down payment

There are 4 different questions. Please solve it and add the steps or excel functions used.

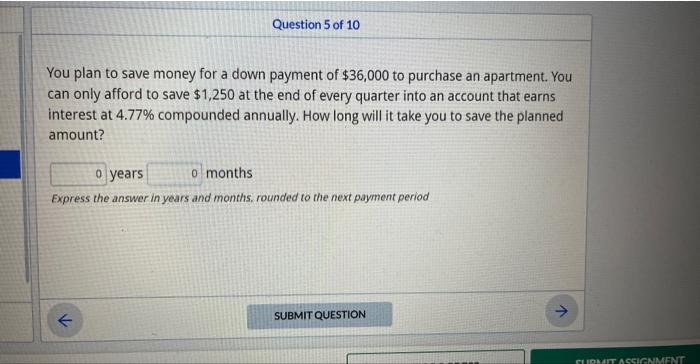

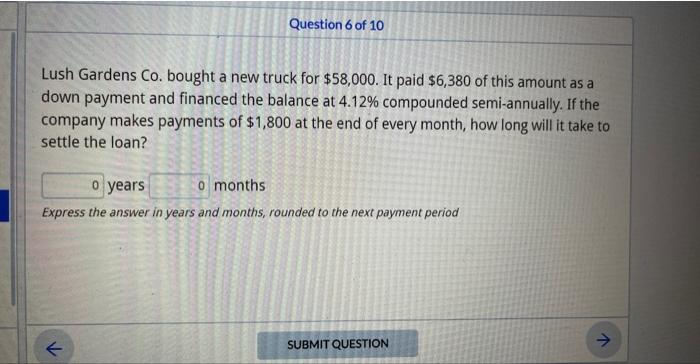

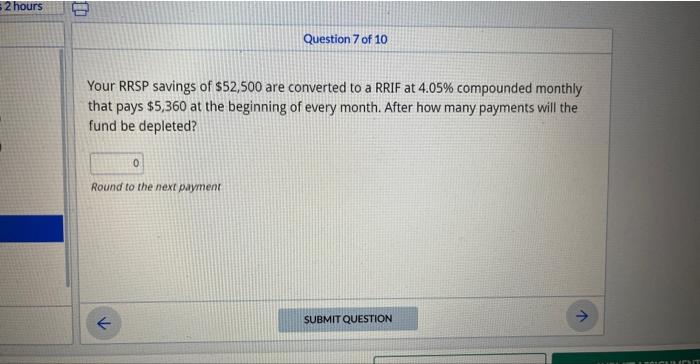

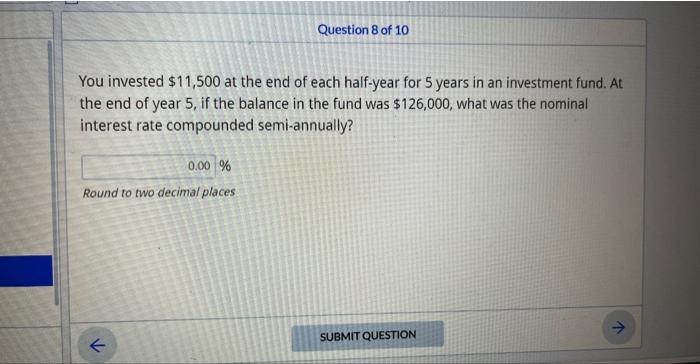

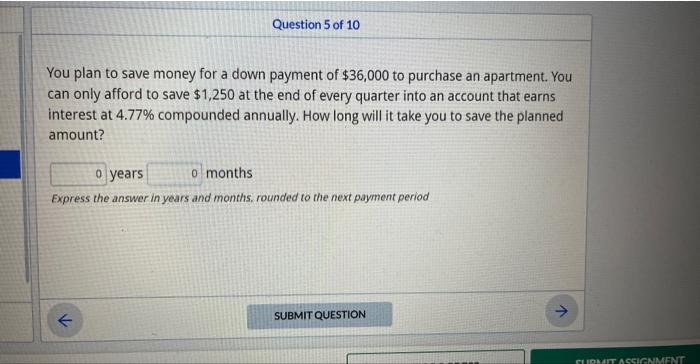

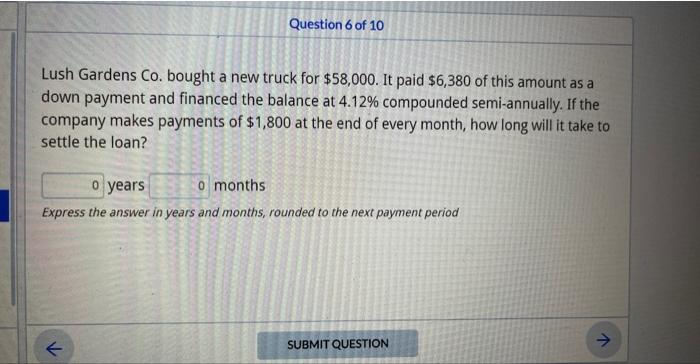

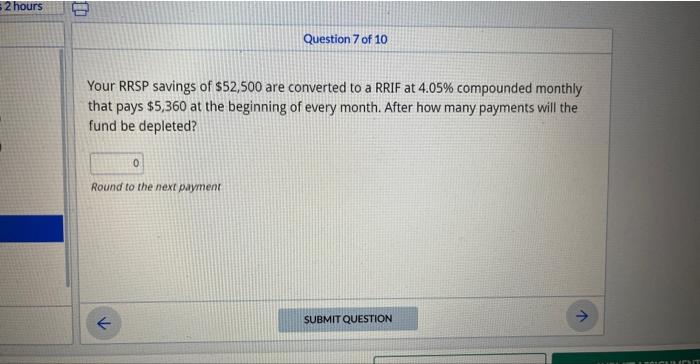

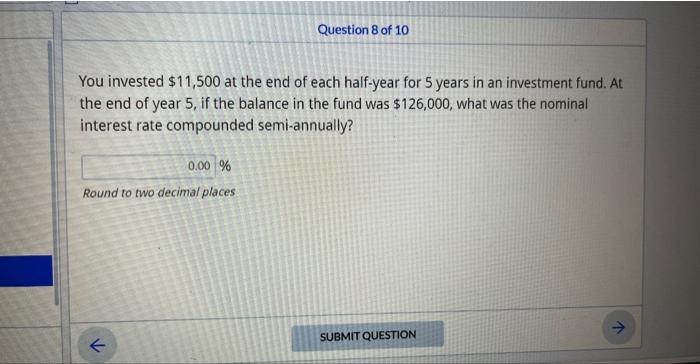

You plan to save money for a down payment of $36,000 to purchase an apartment. You can only afford to save $1,250 at the end of every quarter into an account that earns interest at 4.77% compounded annually. How long will it take you to save the planned amount? years months Express the answer in years and months, rounded to the next payment period Lush Gardens Co. bought a new truck for $58,000. It paid $6,380 of this amount as a down payment and financed the balance at 4.12% compounded semi-annually. If the company makes payments of $1,800 at the end of every month, how long will it take to settle the loan? years months Express the answer in years and months, rounded to the next payment period Your RRSP savings of $52,500 are converted to a RRIF at 4.05% compounded monthly that pays $5,360 at the beginning of every month. After how many payments will the fund be depleted? Round to the next payment You invested $11,500 at the end of each half-year for 5 years in an investment fund. At the end of year 5 , if the balance in the fund was $126,000, what was the nominal interest rate compounded semi-annually? % Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started