Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are English questions here, please answer and write the details as soon as possible I will give you a like, thank you very much

There are English questions here, please answer and write the details as soon as possible I will give you a like, thank you very much

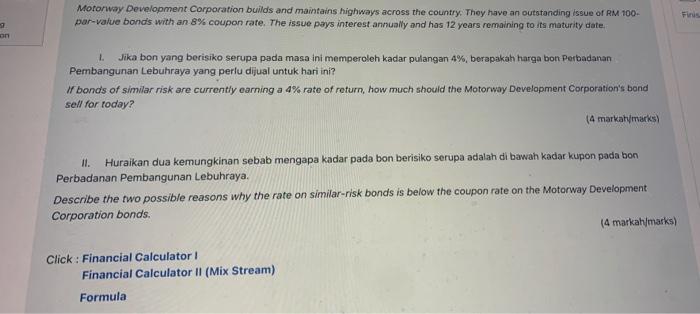

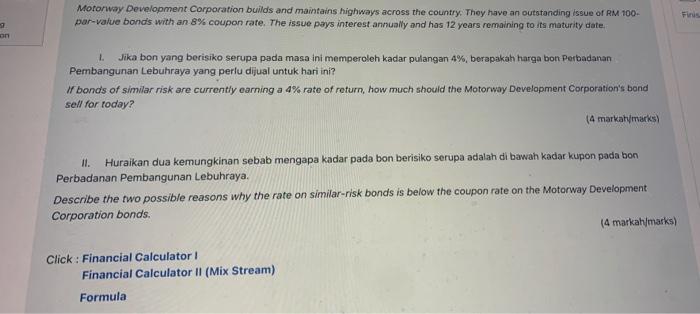

37 son Motorway Development Corporation builds and maintains highways across the country. They have an outstanding issue of RM 100- par-value bonds with an 8% coupon rate. The issue pays interest annually and has 12 years remaining to its maturity date. L. Jika bon yang berisiko serupa pada masa ini memperoleh kadar pulangan 4%, berapakah harga bon Perbadanan Pembangunan Lebuhraya yang perlu dijual untuk hari ini? If bonds of similar risk are currently earning a 4% rate of return, how much should the Motorway Development Corporation's bond sell for today? (4 markah/marks) 11. Huraikan dua kemungkinan sebab mengapa kadar pada bon berisiko serupa adalah di bawah kadar kupon pada bon Perbadanan Pembangunan Lebuhraya. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon rate on the Motorway Development Corporation bonds. Click: Financial Calculator I Financial Calculator II (Mix Stream) Formula (4 markah/marks) Finis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started