There are no wrong answers, so give it your all. Use the solution I've provided below to solve the problem of creating a business memo. Many thanks. **************QUESTION**************** Role you are to play: analyst evaluating the investment decision for a company Audience: Capital Budgeting Committee,

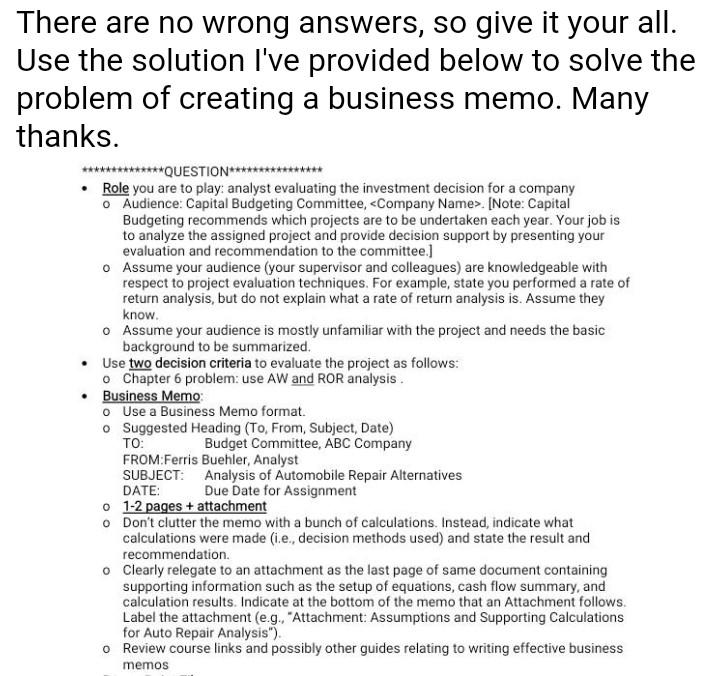

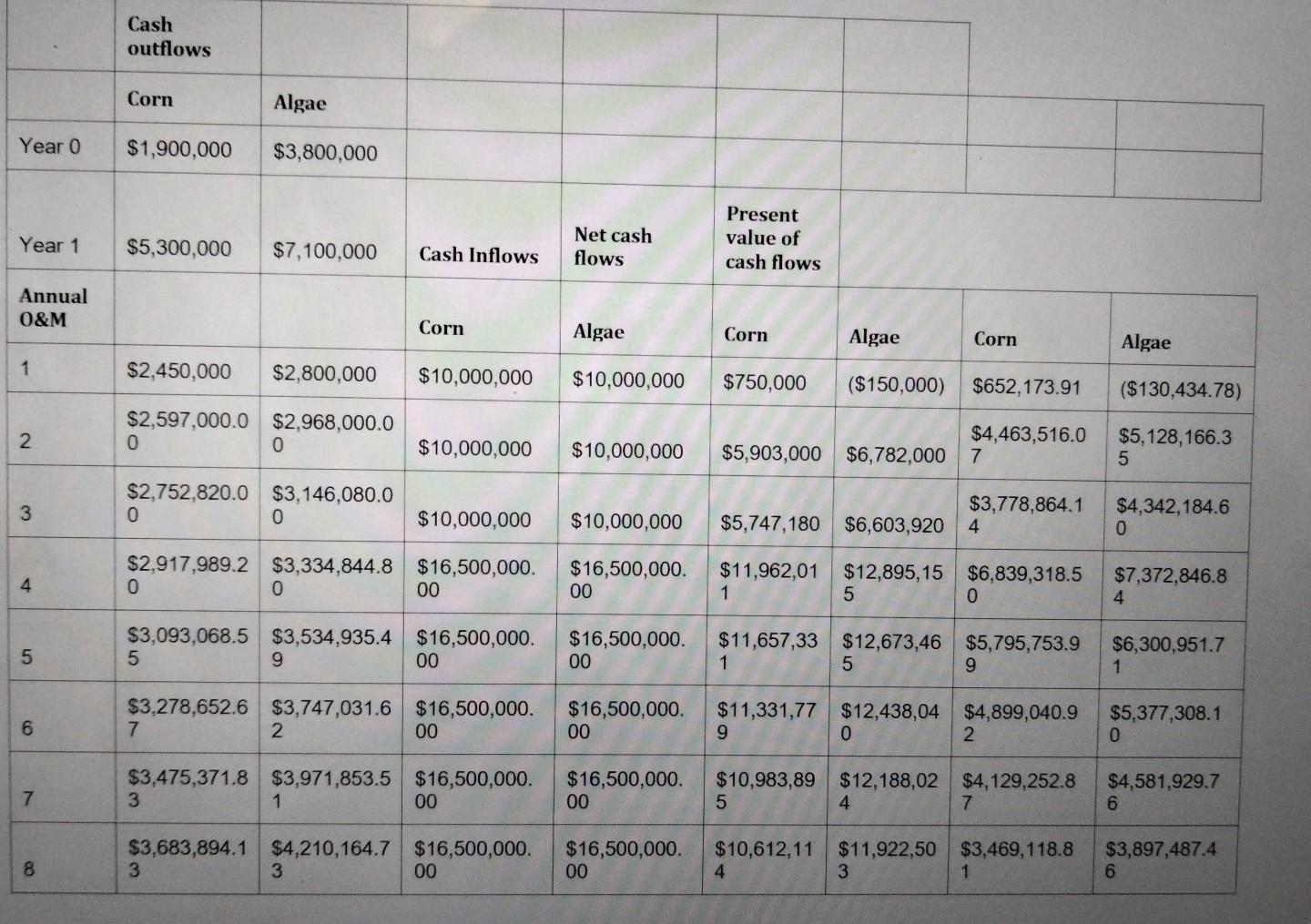

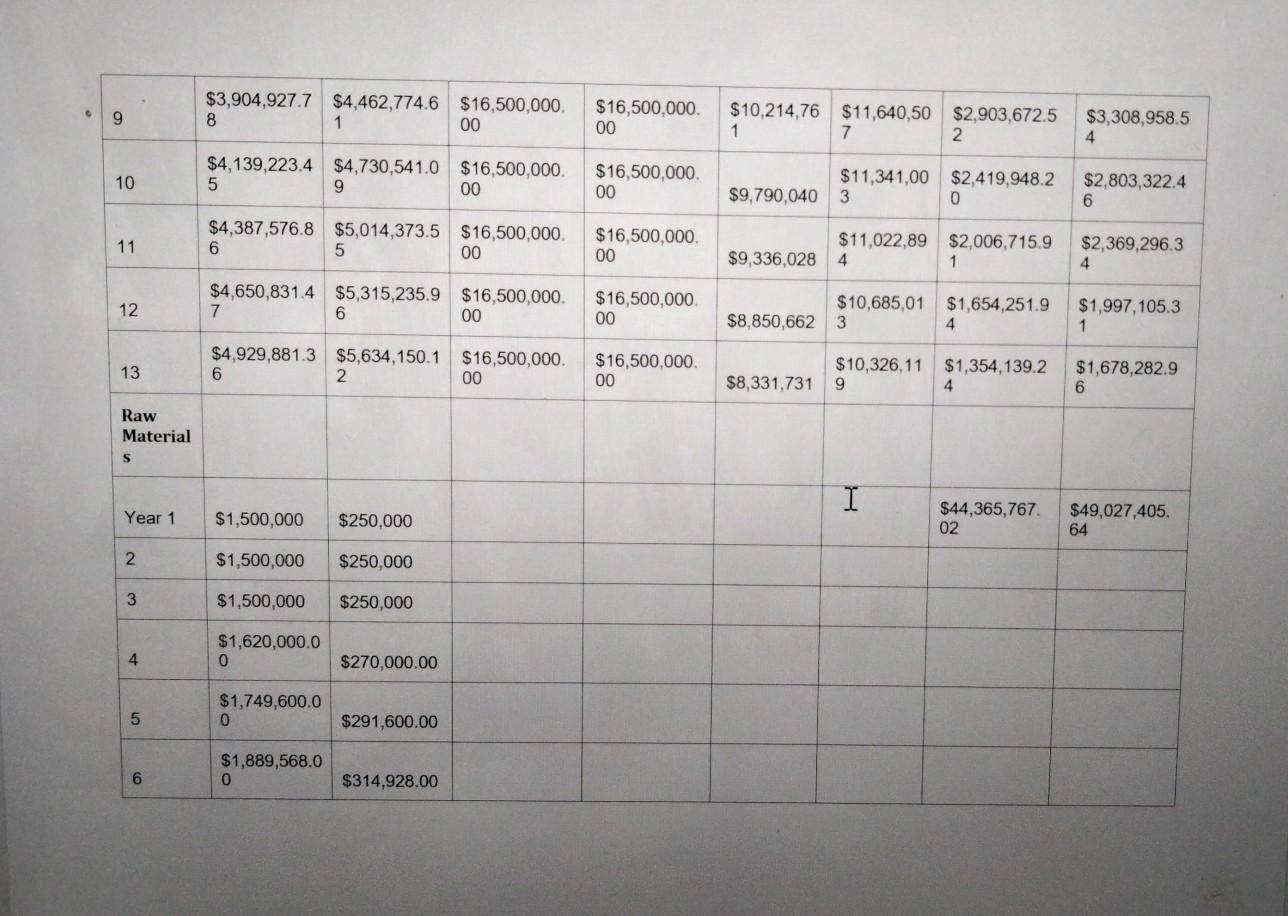

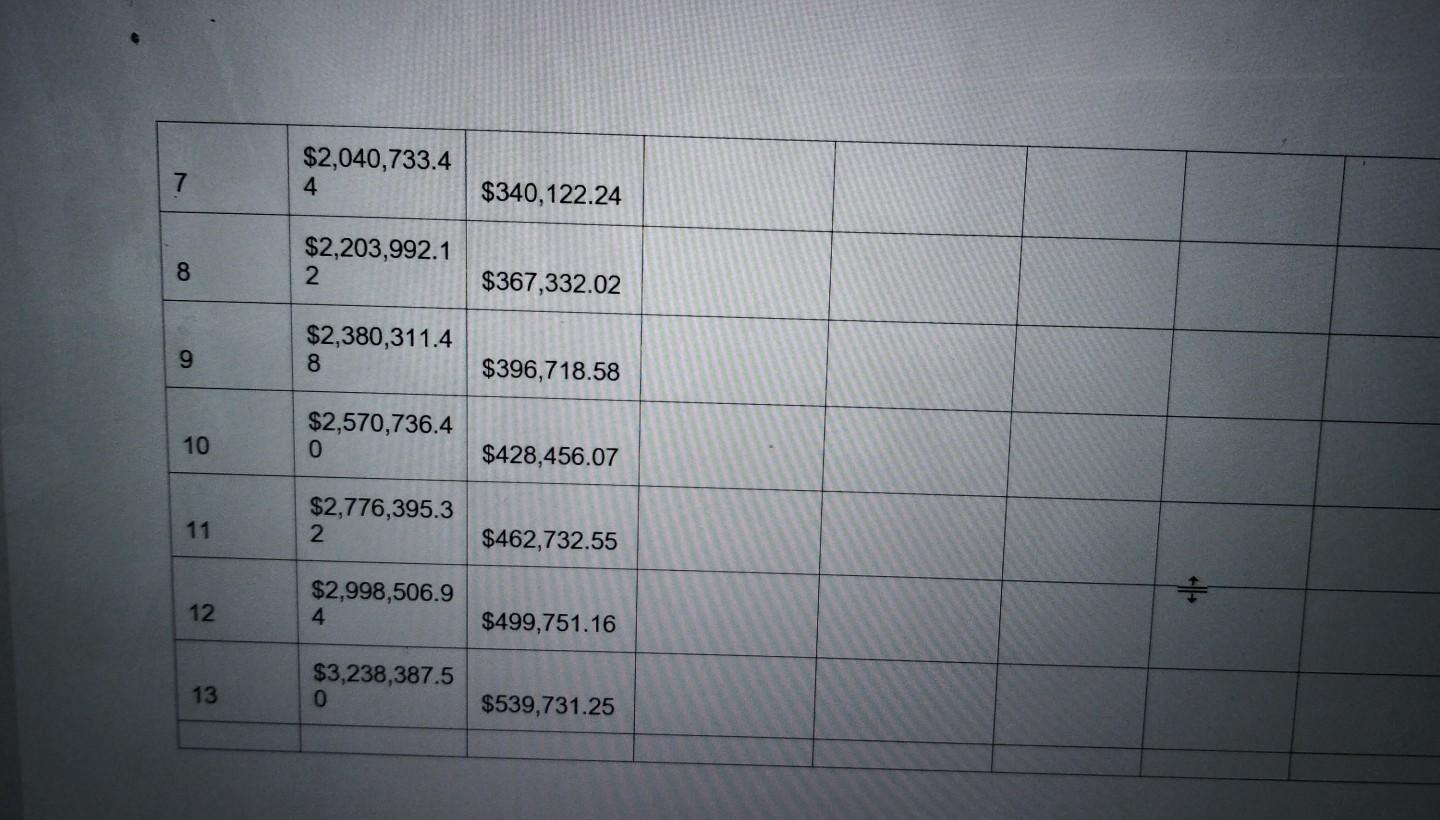

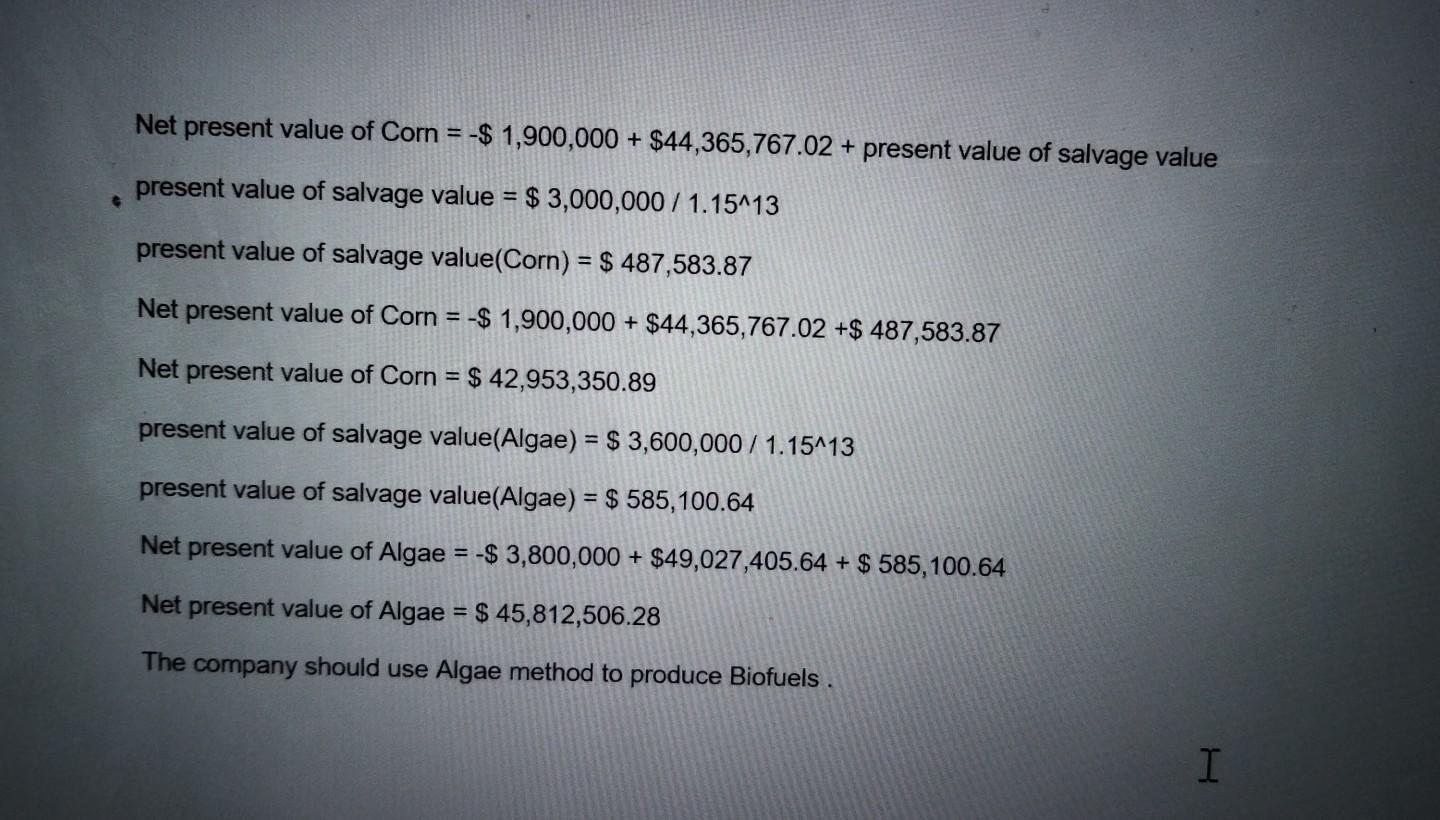

[Note: Capital Budgeting recommends which projects are to be undertaken each year. Your job is to analyze the assigned project and provide decision support by presenting your evaluation and recommendation to the committee.] o Assume your audience (your supervisor and colleagues) are knowledgeable with respect to project evaluation techniques. For example, state you performed a rate of return analysis, but do not explain what a rate of return analysis is. Assume they know. o Assume your audience is mostly unfamiliar with the project and needs the basic background to be summarized. Use two decision criteria to evaluate the project as follows: o Chapter 6 problem: use AW and ROR analysis. Business Memo o Use a Business Memo format. o Suggested Heading (To, From, Subject, Date) Budget Committee, ABC Company FROM:Ferris Buehler, Analyst SUBJECT: Analysis of Automobile Repair Alternatives DATE: Due Date for Assignment o 1-2 pages + attachment o Don't clutter the memo with a bunch of calculations. Instead, indicate what calculations were made (i.e., decision methods used) and state the result and recommendation. o Clearly relegate to an attachment as the last page of same document containing supporting information such as the setup of equations, cash flow summary, and calculation results. Indicate at the bottom of the memo that an Attachment follows. Label the attachment (e.g., "Attachment: Assumptions and Supporting Calculations for Auto Repair Analysis"). o Review course links and possibly other guides relating to writing effective business memos TO: Cash outflows Corn Algae Year 0 $1,900,000 $3,800,000 Year 1 $5,300,000 $7,100,000 Present value of cash flows Net cash flows Cash Inflows Annual O&M Corn Algae Corn Algae Corn Algae 1 $2,450,000 $2,800,000 $10,000,000 $10,000,000 $750,000 ($150,000) $652,173.91 ($130,434.78) $2,597,000.0 $2,968,000.0 0 0 2 $10,000,000 $10,000,000 $5,903,000 $4,463,516.0 $6,782,000 7 $5,128,166.3 5 $2,752,820.0 $3,146,080.0 0 0 3 $10,000,000 $10,000,000 $5,747,180 $6,603,920 $3,778,864.1 4 $4,342,184.6 0 $2,917,989.2 $3,334,844.8 $16,500,000. 0 0 00 4 $16,500,000 00 $11,962,01 $12,895,15 $6,839,318.5 1 5 0 $7,372,846.8 4 5 $3,093,068.5 $3,534,935.4 $16,500,000. 5 9 00 $16,500,000 00 $11,657,33 $12,673,46 $5,795,753.9 1 5 9 $6,300,951.7 1 $3,278,652.6 $3,747,031.6 $16,500,000. 7 2 00 6 $16,500,000 00 $11,331,77 9 $12,438,04 $4,899,040.9 0 2 $5,377,308.1 0 7 $3,475,371.8 $3,971,853.5 $16,500,000. 3 1 00 $16,500,000 00 $10,983,89 5 $12,188,02 $4,129,252.8 4 7 $4,581,929.7 6 $3,683,894.1 $4,210,164.7 $16,500,000. 3 3 00 $16,500,000 00 $10,612,11 $11,922,50 $3,469,118.8 4 3 1 $3,897,487.4 6 8 $3,904,927.7 $4,462,774.6 $16,500,000 8 1 00 9 $16,500,000. 00 $10,214,76 $11,640,50 $2,903,672.5 1 7 2 $3,308,958.5 4 $4,139,223.4 $4,730,541.0 $16,500,000 5 9 00 10 $16,500,000 00 $9,790,040 $11,341,00 $2,419,948.2 3 0 $2,803,322.4 6 11 $4,387,576.8 $5,014,373.5 $16,500,000 6 5 00 $16,500,000 00 $11,022,89 $2,006,715.9 4 1 $9,336,028 $2,369,296.3 4. 12 $4,650,831.4 $5,315,235.9 $16,500,000. 7 6 00 $16,500,000 00 $10,685,01 $1,654,251.9 3 4 $8,850,662 $1,997,105.3 1 $4,929,881.3 $5,634,150.1 6 2 13 $16,500,000 00 $16,500,000 00 $8,331,731 $10,326,11 9 $1,354,139.2 4 $1,678,282.9 6 Raw Material S I Year 1 $1,500,000 $250,000 $44,365,767 02 $49,027,405. 64 2 $1,500,000 $250,000 3 $1,500,000 $250,000 $1,620,000.0 0 4 $270,000.00 $1,749,600.0 0 5 $291,600.00 $1,889,568.0 0 6 $314,928.00 $2,040,733.4 4 7 $340,122.24 $2,203,992.1 2 8 $367,332.02 $2,380,311.4 8 9 $396,718.58 10 $2,570,736.4 0 $428,456.07 $2,776,395.3 2 11 $462,732.55 $2,998,506.9 4 + 12 $499,751.16 13 $3,238,387.5 0 $539,731.25 Net present value of Corn = -$ 1,900,000 + $44,365,767.02 + present value of salvage value present value of salvage value = - $ 3,000,000 / 1.15413 present value of salvage value(Corn) = $ 487,583.87 Net present value of Corn = -$ 1,900,000 + $44,365,767.02 +$ 487,583.87 Net present value of Corn = $ 42,953,350.89 present value of salvage value(Algae) = $ 3,600,000 / 1.15413 = present value of salvage value(Algae) = $ 585,100.64 Net present value of Algae = -$ 3,800,000 + $49,027,405.64 + $ 585,100.64 Net present value of Algae = $ 45,812,506.28 The company should use Algae method to produce Biofuels. I There are no wrong answers, so give it your all. Use the solution I've provided below to solve the problem of creating a business memo. Many thanks. **************QUESTION**************** Role you are to play: analyst evaluating the investment decision for a company Audience: Capital Budgeting Committee, [Note: Capital Budgeting recommends which projects are to be undertaken each year. Your job is to analyze the assigned project and provide decision support by presenting your evaluation and recommendation to the committee.] o Assume your audience (your supervisor and colleagues) are knowledgeable with respect to project evaluation techniques. For example, state you performed a rate of return analysis, but do not explain what a rate of return analysis is. Assume they know. o Assume your audience is mostly unfamiliar with the project and needs the basic background to be summarized. Use two decision criteria to evaluate the project as follows: o Chapter 6 problem: use AW and ROR analysis. Business Memo o Use a Business Memo format. o Suggested Heading (To, From, Subject, Date) Budget Committee, ABC Company FROM:Ferris Buehler, Analyst SUBJECT: Analysis of Automobile Repair Alternatives DATE: Due Date for Assignment o 1-2 pages + attachment o Don't clutter the memo with a bunch of calculations. Instead, indicate what calculations were made (i.e., decision methods used) and state the result and recommendation. o Clearly relegate to an attachment as the last page of same document containing supporting information such as the setup of equations, cash flow summary, and calculation results. Indicate at the bottom of the memo that an Attachment follows. Label the attachment (e.g., "Attachment: Assumptions and Supporting Calculations for Auto Repair Analysis"). o Review course links and possibly other guides relating to writing effective business memos TO: Cash outflows Corn Algae Year 0 $1,900,000 $3,800,000 Year 1 $5,300,000 $7,100,000 Present value of cash flows Net cash flows Cash Inflows Annual O&M Corn Algae Corn Algae Corn Algae 1 $2,450,000 $2,800,000 $10,000,000 $10,000,000 $750,000 ($150,000) $652,173.91 ($130,434.78) $2,597,000.0 $2,968,000.0 0 0 2 $10,000,000 $10,000,000 $5,903,000 $4,463,516.0 $6,782,000 7 $5,128,166.3 5 $2,752,820.0 $3,146,080.0 0 0 3 $10,000,000 $10,000,000 $5,747,180 $6,603,920 $3,778,864.1 4 $4,342,184.6 0 $2,917,989.2 $3,334,844.8 $16,500,000. 0 0 00 4 $16,500,000 00 $11,962,01 $12,895,15 $6,839,318.5 1 5 0 $7,372,846.8 4 5 $3,093,068.5 $3,534,935.4 $16,500,000. 5 9 00 $16,500,000 00 $11,657,33 $12,673,46 $5,795,753.9 1 5 9 $6,300,951.7 1 $3,278,652.6 $3,747,031.6 $16,500,000. 7 2 00 6 $16,500,000 00 $11,331,77 9 $12,438,04 $4,899,040.9 0 2 $5,377,308.1 0 7 $3,475,371.8 $3,971,853.5 $16,500,000. 3 1 00 $16,500,000 00 $10,983,89 5 $12,188,02 $4,129,252.8 4 7 $4,581,929.7 6 $3,683,894.1 $4,210,164.7 $16,500,000. 3 3 00 $16,500,000 00 $10,612,11 $11,922,50 $3,469,118.8 4 3 1 $3,897,487.4 6 8 $3,904,927.7 $4,462,774.6 $16,500,000 8 1 00 9 $16,500,000. 00 $10,214,76 $11,640,50 $2,903,672.5 1 7 2 $3,308,958.5 4 $4,139,223.4 $4,730,541.0 $16,500,000 5 9 00 10 $16,500,000 00 $9,790,040 $11,341,00 $2,419,948.2 3 0 $2,803,322.4 6 11 $4,387,576.8 $5,014,373.5 $16,500,000 6 5 00 $16,500,000 00 $11,022,89 $2,006,715.9 4 1 $9,336,028 $2,369,296.3 4. 12 $4,650,831.4 $5,315,235.9 $16,500,000. 7 6 00 $16,500,000 00 $10,685,01 $1,654,251.9 3 4 $8,850,662 $1,997,105.3 1 $4,929,881.3 $5,634,150.1 6 2 13 $16,500,000 00 $16,500,000 00 $8,331,731 $10,326,11 9 $1,354,139.2 4 $1,678,282.9 6 Raw Material S I Year 1 $1,500,000 $250,000 $44,365,767 02 $49,027,405. 64 2 $1,500,000 $250,000 3 $1,500,000 $250,000 $1,620,000.0 0 4 $270,000.00 $1,749,600.0 0 5 $291,600.00 $1,889,568.0 0 6 $314,928.00 $2,040,733.4 4 7 $340,122.24 $2,203,992.1 2 8 $367,332.02 $2,380,311.4 8 9 $396,718.58 10 $2,570,736.4 0 $428,456.07 $2,776,395.3 2 11 $462,732.55 $2,998,506.9 4 + 12 $499,751.16 13 $3,238,387.5 0 $539,731.25 Net present value of Corn = -$ 1,900,000 + $44,365,767.02 + present value of salvage value present value of salvage value = - $ 3,000,000 / 1.15413 present value of salvage value(Corn) = $ 487,583.87 Net present value of Corn = -$ 1,900,000 + $44,365,767.02 +$ 487,583.87 Net present value of Corn = $ 42,953,350.89 present value of salvage value(Algae) = $ 3,600,000 / 1.15413 = present value of salvage value(Algae) = $ 585,100.64 Net present value of Algae = -$ 3,800,000 + $49,027,405.64 + $ 585,100.64 Net present value of Algae = $ 45,812,506.28 The company should use Algae method to produce Biofuels