Answered step by step

Verified Expert Solution

Question

1 Approved Answer

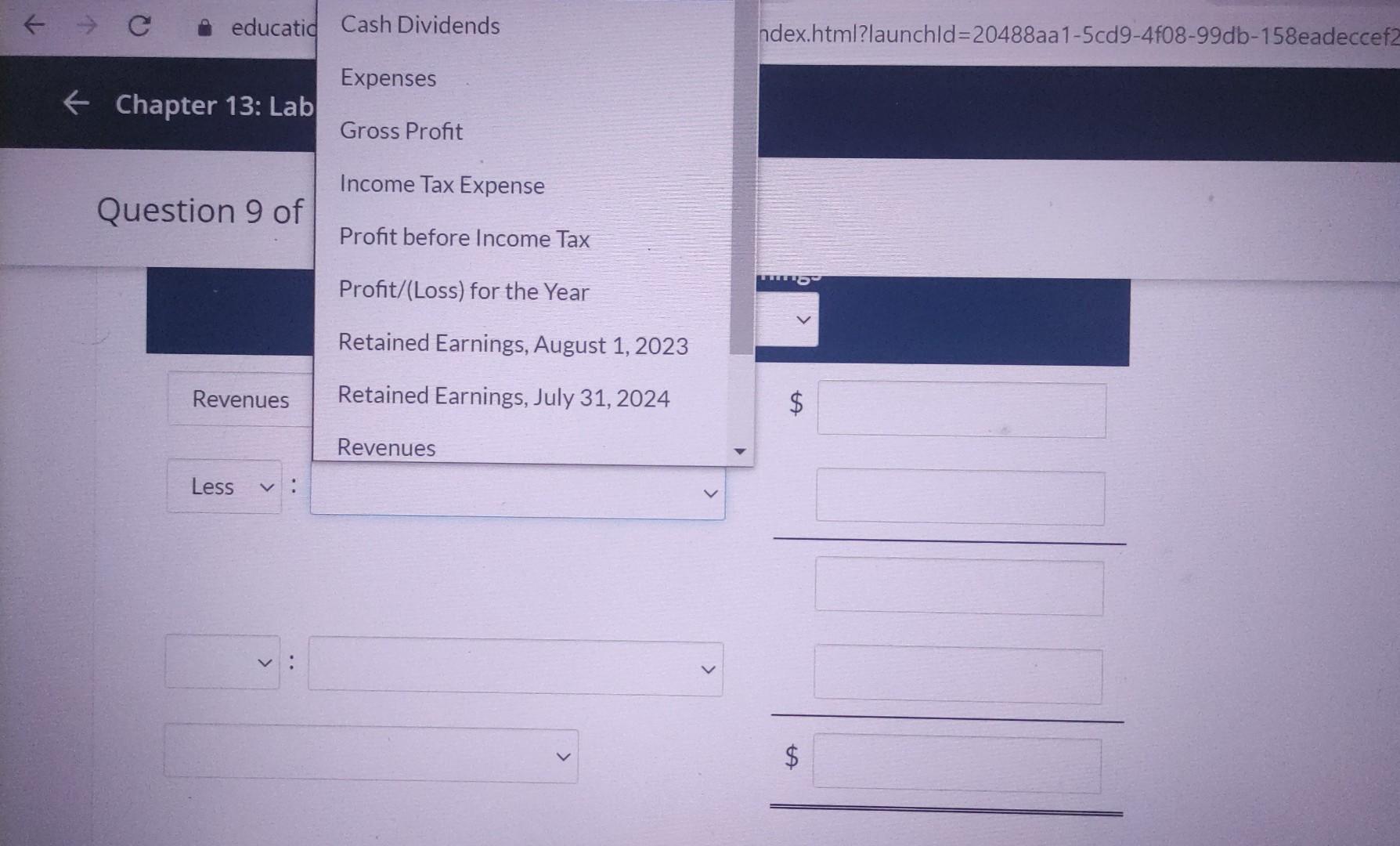

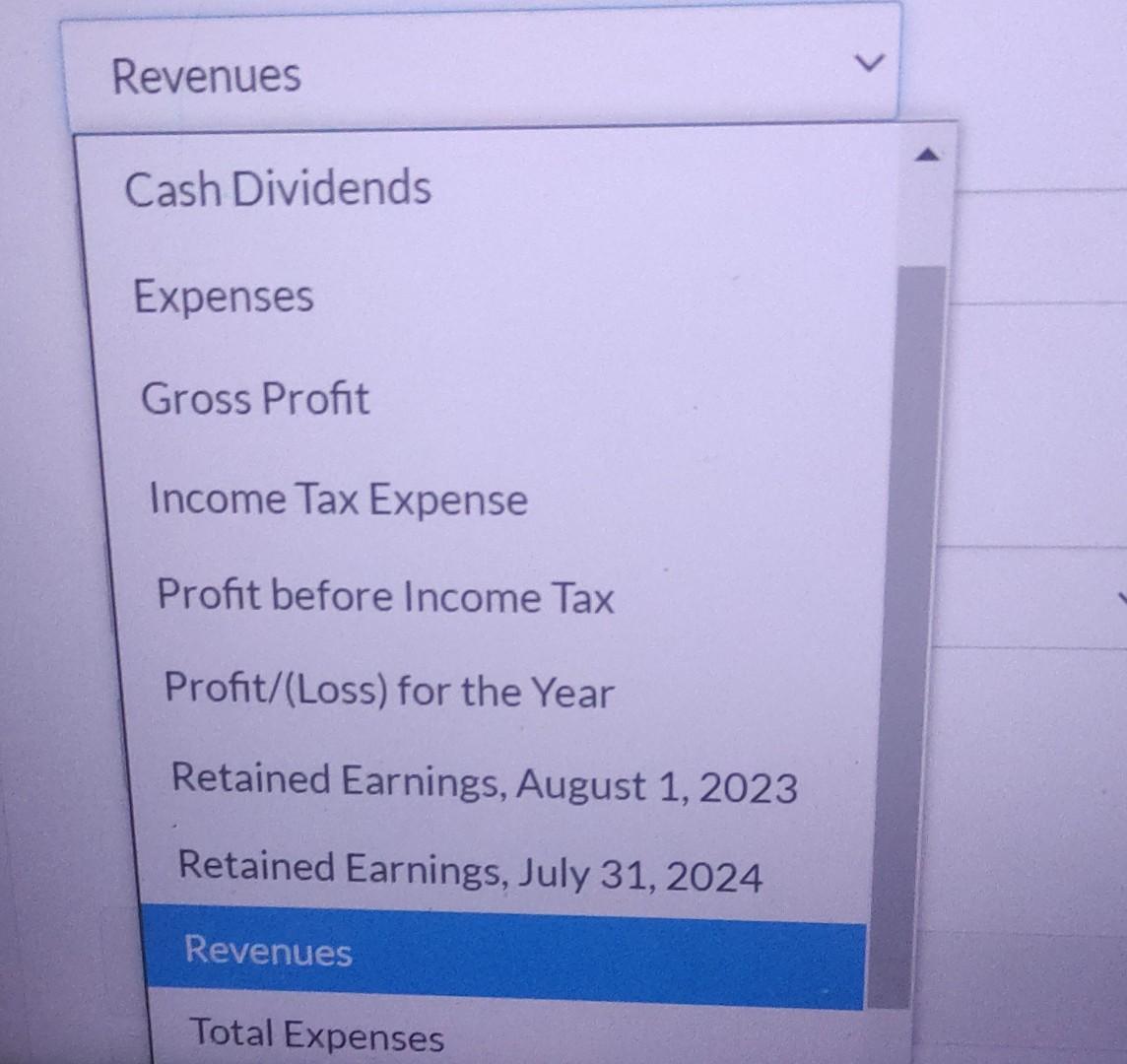

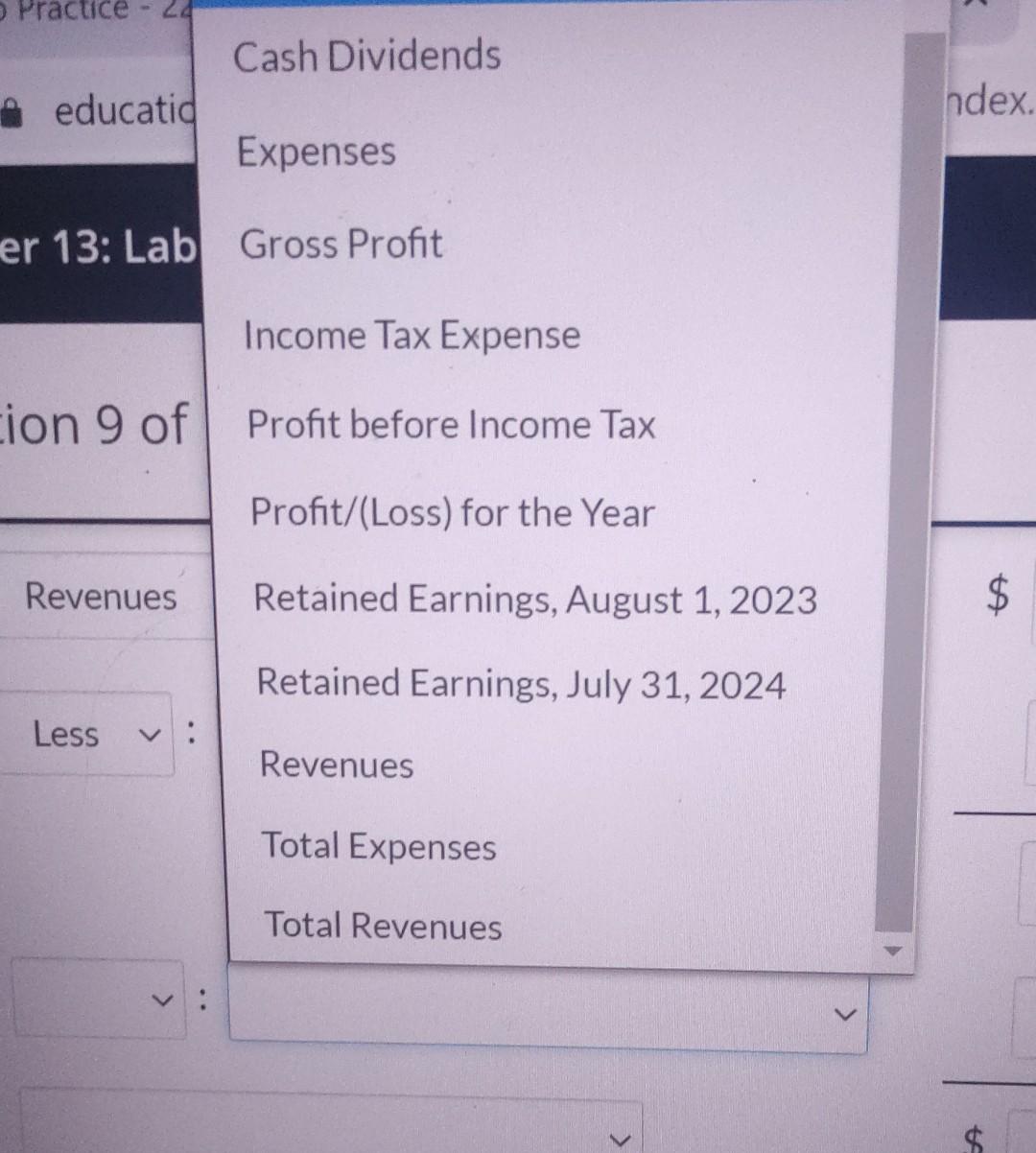

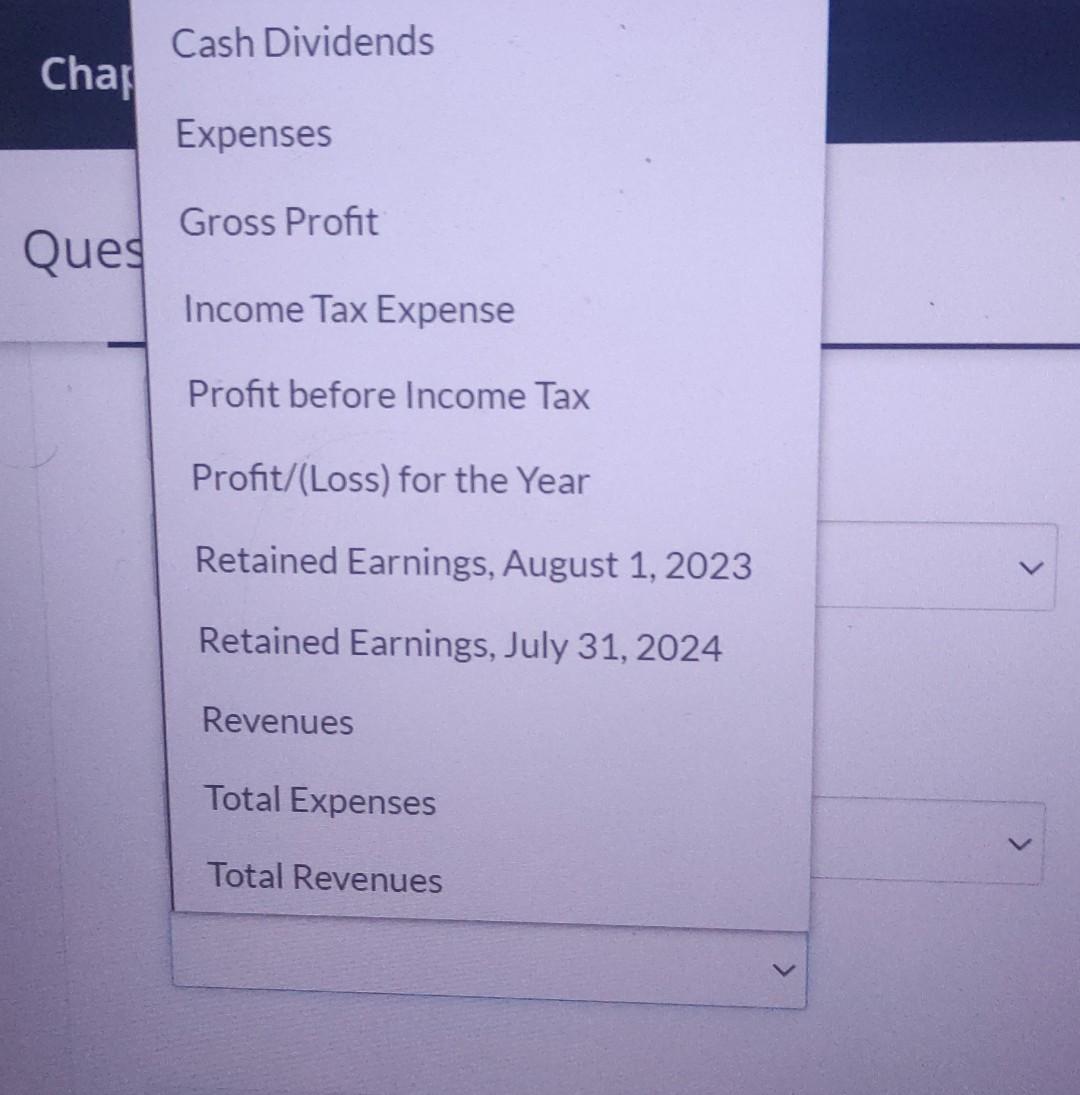

there are not many options as i found in other solution like cost of goods sold and sales etc. i am showing the options available

there are not many options as i found in other solution like cost of goods sold and sales etc. i am showing the options available for each. 45min pls.

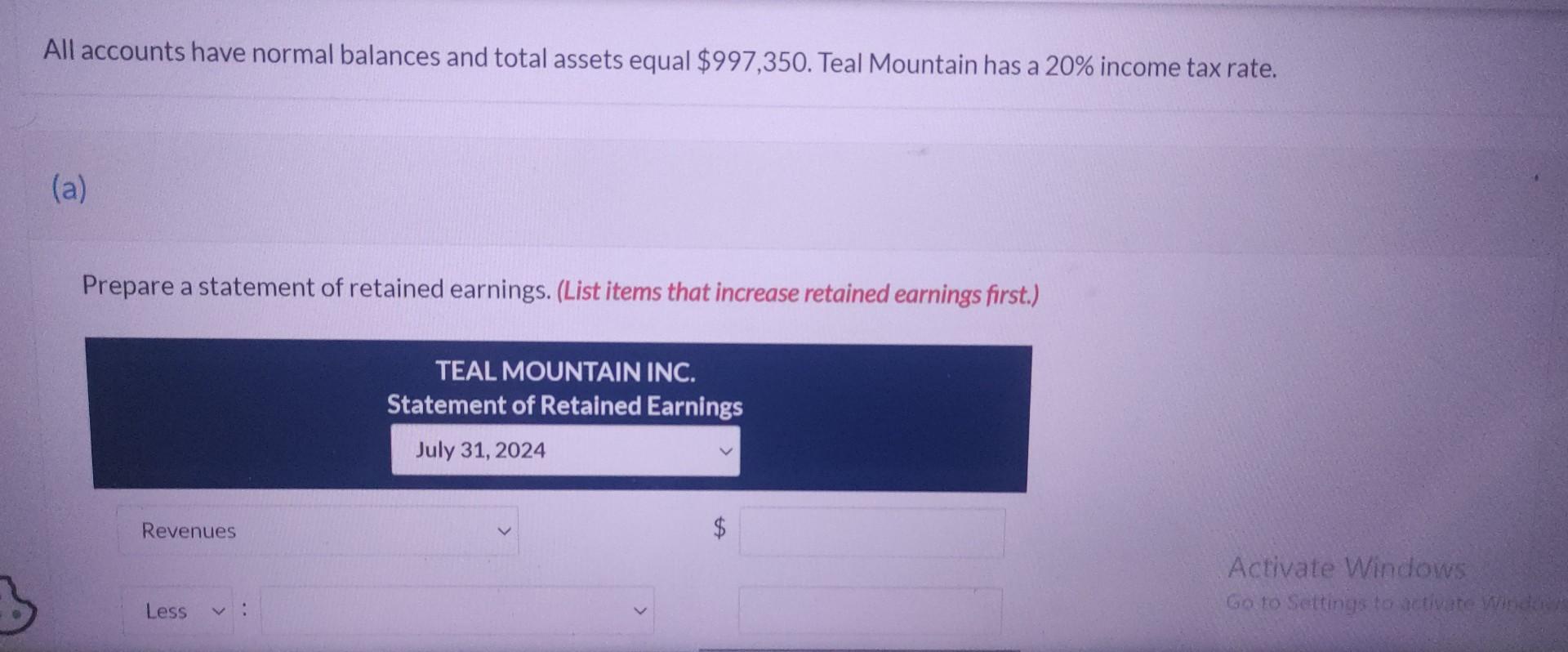

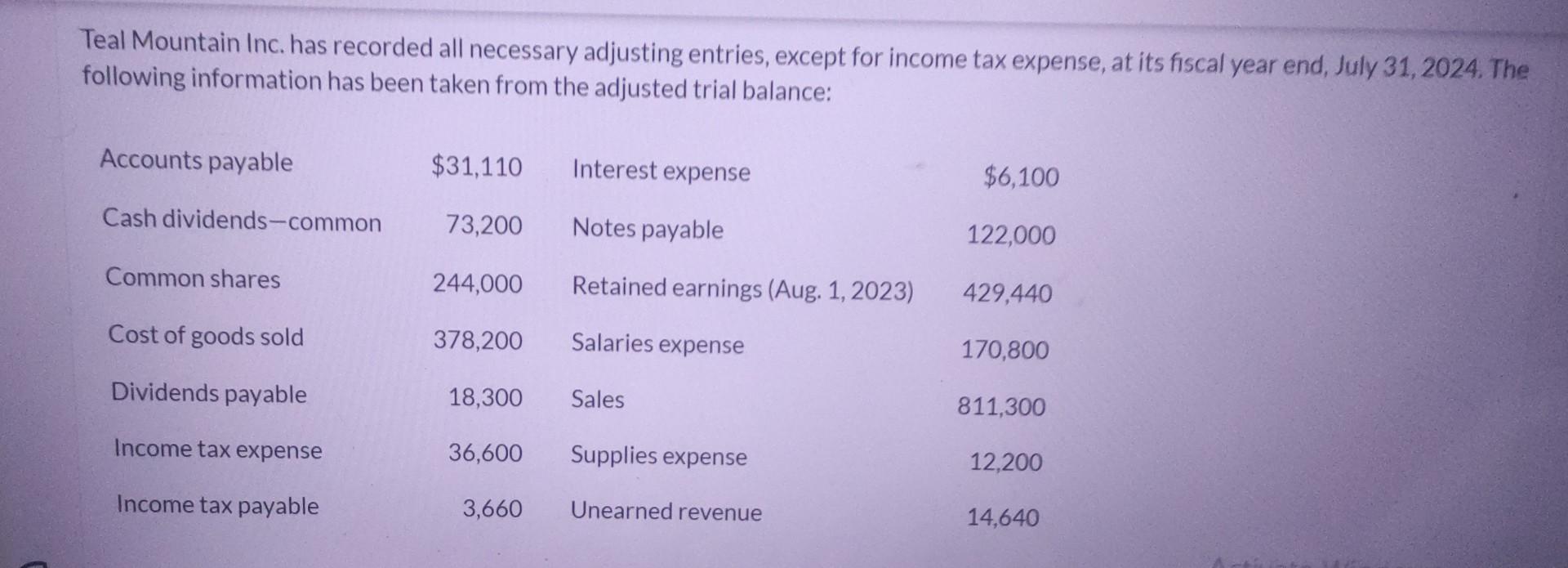

All accounts have normal balances and total assets equal $997,350. Teal Mountain has a 20% income tax rate. (a) Prepare a statement of retained earnings. (List items that increase retained earnings first.) Teal Mountain Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end, July 31,2024 . The following information has been taken from the adjusted trial balance: 4f0899db158 eadeccefz Revenues Cash Dividends Expenses Gross Profit Income Tax Expense Profit before Income Tax Profit/(Loss) for the Year Retained Earnings, August 1, 2023 Retained Earnings, July 31, 2024 Revenues Total Expenses Cash Dividends Expenses Gross Profit Income Tax Expense Profit before Income Tax Profit/(Loss) for the Year Retained Earnings, August 1, 2023 Retained Earnings, July 31, 2024 Revenues Total Expenses Total Revenues Cash Dividends Expenses Gross Profit Income Tax Expense Profit before Income Tax Profit/(Loss) for the Year Retained Earnings, August 1, 2023 Retained Earnings, July 31, 2024 Revenues Total Expenses Total Revenues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started