Answered step by step

Verified Expert Solution

Question

1 Approved Answer

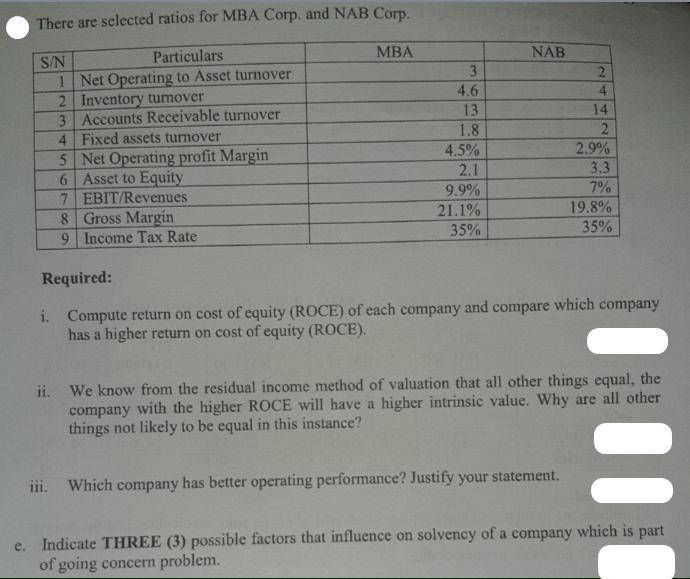

There are selected ratios for MBA Corp. and NAB Corp. S/N Particulars 1 Net Operating to Asset turnover 2 Inventory turnover 3 Accounts Receivable

There are selected ratios for MBA Corp. and NAB Corp. S/N Particulars 1 Net Operating to Asset turnover 2 Inventory turnover 3 Accounts Receivable turnover Fixed assets turnover 4 5 Net Operating profit Margin 6 Asset to Equity 7 EBIT/Revenues 8 Gross Margin 9 Income Tax Rate MBA 3 4.6 13 1.8 4.5% 2.1 9.9% 21.1% 35% iii. NAB 2 4 14 2 2.9% Which company has better operating performance? Justify your statement. 3.3 7% Required: i. Compute return on cost of equity (ROCE) of each company and compare which company has a higher return on cost of equity (ROCE). 19.8% 35% ii. We know from the residual income method of valuation that all other things equal, the company with the higher ROCE will have a higher intrinsic value. Why are all other things not likely to be equal in this instance? = e. Indicate THREE (3) possible factors that influence on solvency of a company which is part of going concern problem.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i To compute the return on cost of equity ROCE of each company we need to calculate the cost of equity first Assuming a riskfree rate of 3 and a market risk premium of 6 the cost of equity for MBA Cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started