There are simular questions with only different stats that has the template you need. I could not extend the module in the software.

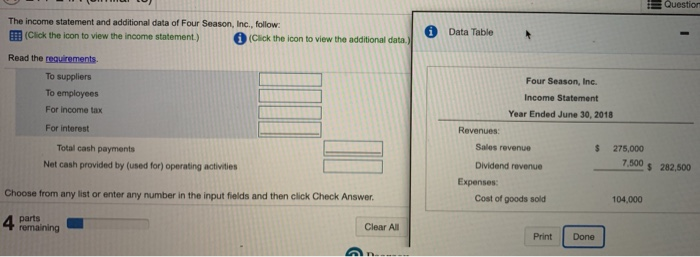

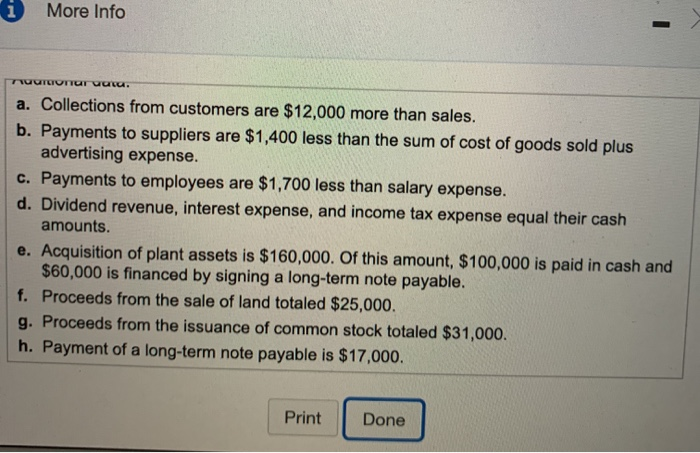

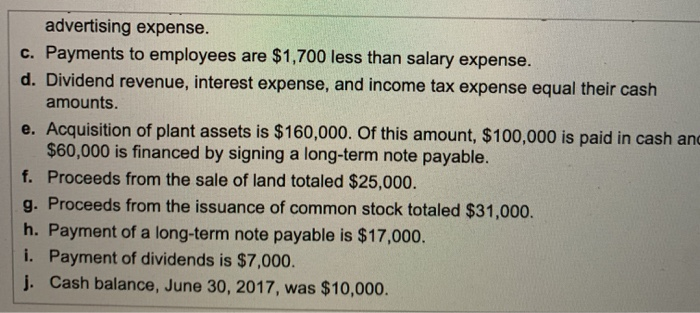

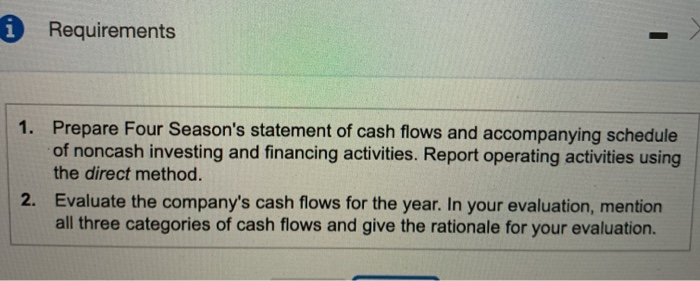

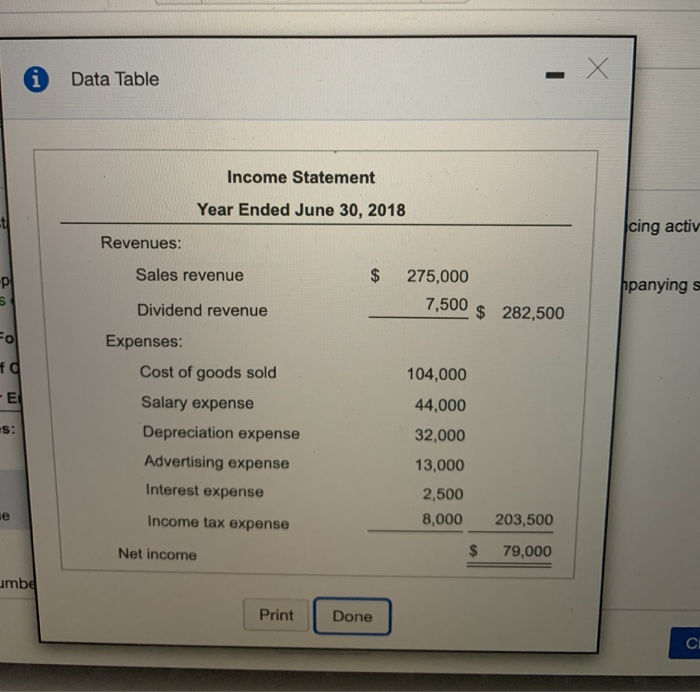

III Question The income statement and additional data of Four Season, Inc., follow: (Click the icon to view the income statement.) (Click the icon to view the additional data) * Data Table - Read the requirements To suppliers To employees For income tax Four Season, Inc. Income Statement Year Ended June 30, 2018 For interest Revenues: Sales revenue $ Total cash payments Net cash provided by used for) operating activities 275,000 7,500 $ 282,500 Dividend revenue Expenses Cost of goods sold Choose from any list or enter any number in the input fields and then click Check Answer 104.000 parts remaining Clear All Print Done 1 More Info TUTUNUT UU. a. Collections from customers are $12,000 more than sales. b. Payments to suppliers are $1,400 less than the sum of cost of goods sold plus advertising expense. c. Payments to employees are $1,700 less than salary expense. d. Dividend revenue, interest expense, and income tax expense equal their cash amounts. e. Acquisition of plant assets is $160,000. Of this amount, $100,000 is paid in cash and $60,000 is financed by signing a long-term note payable. f. Proceeds from the sale of land totaled $25,000. g. Proceeds from the issuance of common stock totaled $31,000. h. Payment of a long-term note payable is $17,000. Print Done advertising expense. c. Payments to employees are $1,700 less than salary expense. d. Dividend revenue, interest expense, and income tax expense equal their cash amounts. e. Acquisition of plant assets is $160,000. Of this amount, $100,000 is paid in cash and $60,000 is financed by signing a long-term note payable. f. Proceeds from the sale of land totaled $25,000. g. Proceeds from the issuance of common stock totaled $31,000. h. Payment of a long-term note payable is $17,000. i. Payment of dividends is $7,000. j. Cash balance, June 30, 2017, was $10,000. i Requirements 1. Prepare Four Season's statement of cash flows and accompanying schedule of noncash investing and financing activities. Report operating activities using the direct method. 2. Evaluate the company's cash flows for the year. In your evaluation, mention all three categories of cash flows and give the rationale for your evaluation. i Data Table Income Statement Year Ended June 30, 2018 cing activ Revenues: pl Sales revenue $ 275,000 7,500 hpanyings $ 282,500 Fol fa Dividend revenue Expenses: Cost of goods sold Salary expense Depreciation expense Advertising expense Interest expense 104,000 44,000 32,000 S: 13,000 2,500 8,000 e Income tax expense 203,500 Net income $ 79,000 umb Print Done CI