Answered step by step

Verified Expert Solution

Question

1 Approved Answer

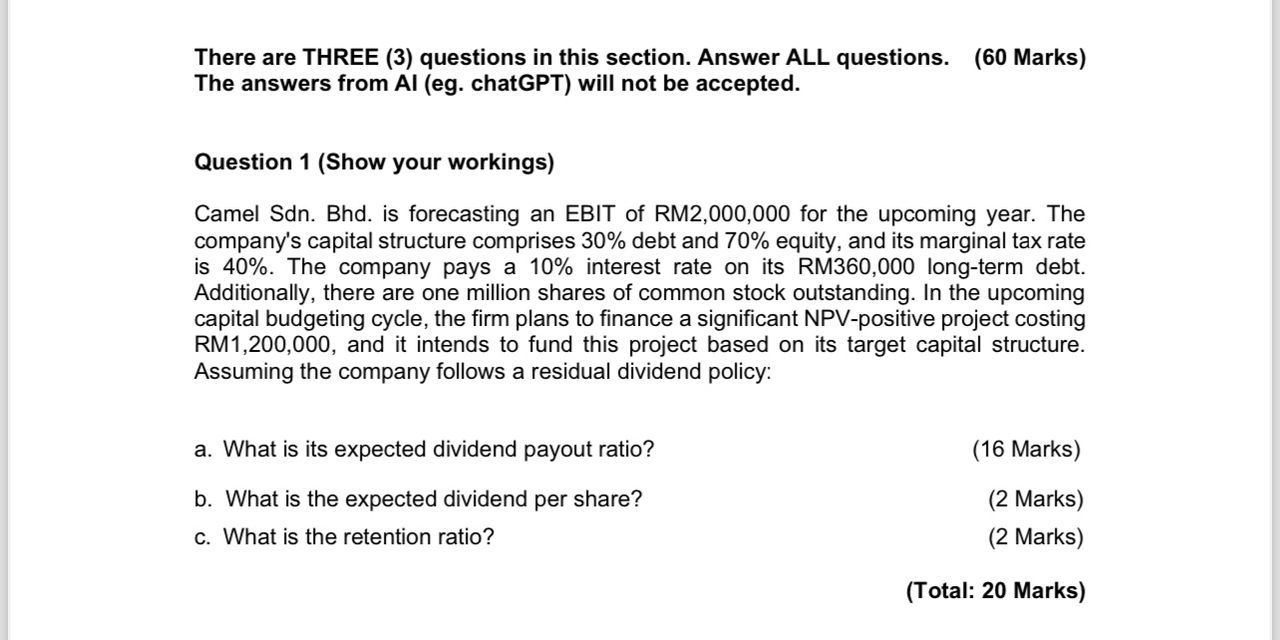

There are THREE ( 3 ) questions in this section. Answer ALL questions. ( 6 0 Marks ) The answers from Al ( eg .

There are THREE questions in this section. Answer ALL questions. Marks The answers from Al eg chatGPT will not be accepted.

Question Show your workings

Camel Sdn Bhd is forecasting an EBIT of RM for the upcoming year. The company's capital structure comprises debt and equity, and its marginal tax rate is The company pays a interest rate on its RM longterm debt. Additionally, there are one million shares of common stock outstanding. In the upcoming capital budgeting cycle, the firm plans to finance a significant NPVpositive project costing RM and it intends to fund this project based on its target capital structure. Assuming the company follows a residual dividend policy:

a What is its expected dividend payout ratio?

Marks

b What is the expected dividend per share?

Marks

c What is the retention ratio?

Marks

Total: Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started