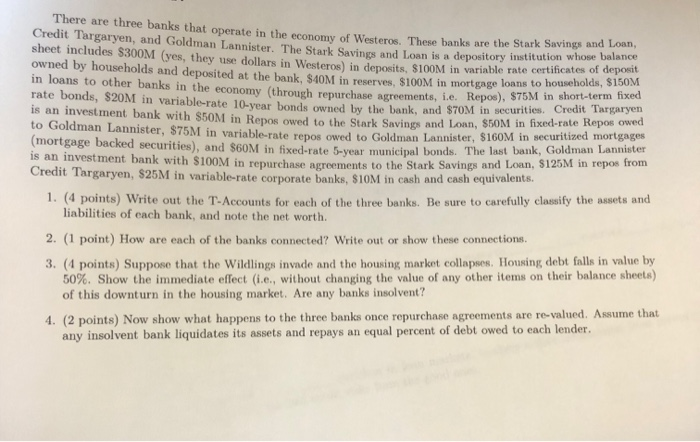

There are three banks that operate in the economy of Westeros. These banks are the Stark Savings and Loan, Credit Targaryen, and Goldman Lannister. The Stark Savings and Loan is a depository institution whose balance sheet includes $300M (yes, they use dollars in Westeros) in deposits, $100M in variable rate certificates of ae owned by households and deposited at the bank, $40M in reserves, $100M in mortgage loans to househo in loans to other banks in the economy (through repurchase agreements, i.e. Repos), S75 edit Targ rate bonds, $20M in variable-rate 10-year bonds owned by the bank, and $70M in securities. is an investment bank with S50M in Repos owed to the Stark Savings and Loan, to Goldman Lannist owed er, r in variable-rate repos owed to Goldman Lannister, $160M in securitized mortgages mortgage backed securities), and $60M in fixed-rate 5-year municipal bonds. The last bank, Goldman L.annister is an investment bank with $100M in repurchase agreements to the Stark Savings and Loan, $125M in repos from Credit Targaryen, $25M in variable-rate corporate banks, $10M in cash and cash equivalents. 1. (4 points) Write out the T-Accounts for each of the three banks. Be sure to carefully classify the assets and liabilities of each bank, and note the net worth 2. (1 point) How are each of the banks connected? Write out or show these connections. 3. (4 points) Suppose that the Wildlings invade and the housing market collapses. Housing debt falls in value by 50%. Show the immediate effect i without changing the value of any other items on their balance sheets of this downturn in the housing market. Are any banks insolvent? 4. (2 points) Now show what happens to the three banks once repurchase agreements are re-valued. Assume that any insolvent bank liquidates its assets and repays an equal percent of debt owed to each lender. There are three banks that operate in the economy of Westeros. These banks are the Stark Savings and Loan, Credit Targaryen, and Goldman Lannister. The Stark Savings and Loan is a depository institution whose balance sheet includes $300M (yes, they use dollars in Westeros) in deposits, $100M in variable rate certificates of ae owned by households and deposited at the bank, $40M in reserves, $100M in mortgage loans to househo in loans to other banks in the economy (through repurchase agreements, i.e. Repos), S75 edit Targ rate bonds, $20M in variable-rate 10-year bonds owned by the bank, and $70M in securities. is an investment bank with S50M in Repos owed to the Stark Savings and Loan, to Goldman Lannist owed er, r in variable-rate repos owed to Goldman Lannister, $160M in securitized mortgages mortgage backed securities), and $60M in fixed-rate 5-year municipal bonds. The last bank, Goldman L.annister is an investment bank with $100M in repurchase agreements to the Stark Savings and Loan, $125M in repos from Credit Targaryen, $25M in variable-rate corporate banks, $10M in cash and cash equivalents. 1. (4 points) Write out the T-Accounts for each of the three banks. Be sure to carefully classify the assets and liabilities of each bank, and note the net worth 2. (1 point) How are each of the banks connected? Write out or show these connections. 3. (4 points) Suppose that the Wildlings invade and the housing market collapses. Housing debt falls in value by 50%. Show the immediate effect i without changing the value of any other items on their balance sheets of this downturn in the housing market. Are any banks insolvent? 4. (2 points) Now show what happens to the three banks once repurchase agreements are re-valued. Assume that any insolvent bank liquidates its assets and repays an equal percent of debt owed to each lender