There are three questions please solve all of them not just one, each question I miss one part.

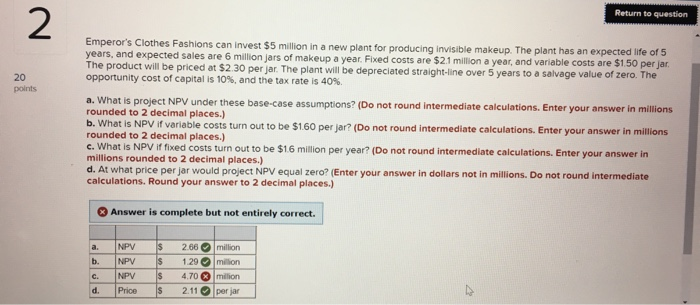

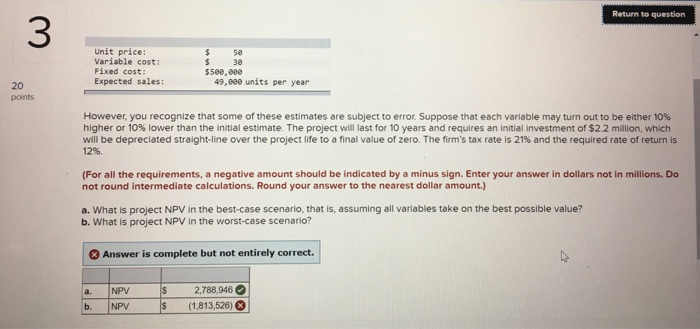

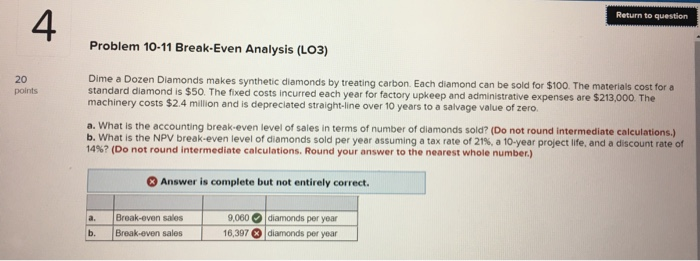

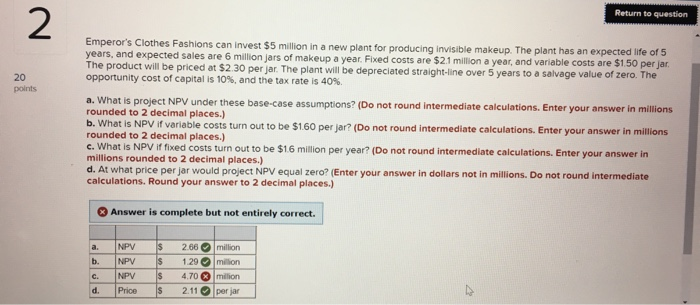

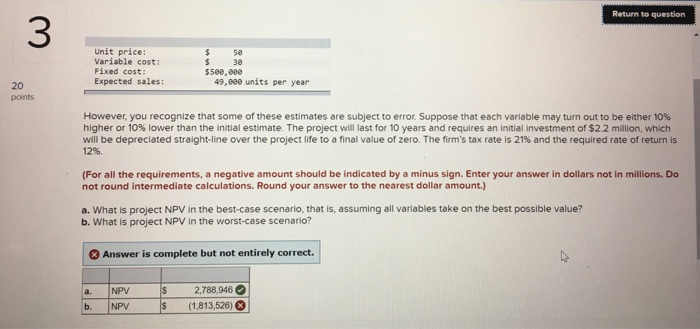

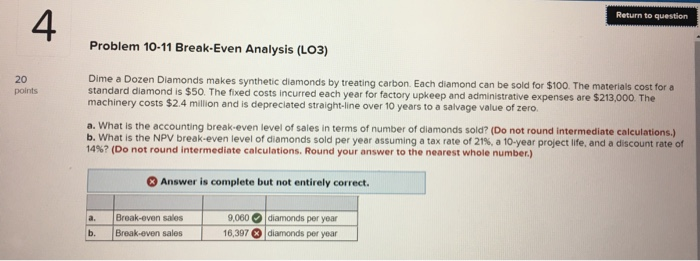

Return to question Emperor's Clothes Fashions can invest $5 million in a new plant for producing invisible makeup. The plant has an expected life of 5 years, and expected sales are 6 million jars of makeup a year. Fixed costs are $2.1 million a year, and variable costs are $1.50 per jar. The product will be priced at $2.30 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40% points a. What is project NPV under these base-case assumptions? (Do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is NPV if variable costs turn out to be $160 per jar? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) c. What is NPV if fixed costs turn out to be $1.6 million per year? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) d. At what price per jar would project NPV equal zero? (Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. a. b. c. d. NPV NPV NPV Price $ S S $ 200 1.29 4.70 2.11 million million milion perjar Return to question Unit price: Variable cost: Fixed cost: Expected sales: $500,000 49.eee units per year points However, you recognize that some of these estimates are subject to error Suppose that each variable may turn out to be either 10% higher or 10% lower than the initial estimate. The project will last for 10 years and requires an initial investment of $2.2 million, which will be depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 21% and the required rate of return is 12% (For all the requirements, a negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to the nearest dollar amount.) a. What is project NPV in the best-case scenario, that is, assuming all variables take on the best possible value? b. What is project NPV in the worst-case scenario? Answer is complete but not entirely correct. a. b. NPV NPV $ S 2,788,946 (1,813,526) Return to question Problem 10-11 Break-Even Analysis (L03) points Dime a Dozen Diamonds makes synthetic diamonds by treating carbon. Each diamond can be sold for $100. The materials cost for a standard diamond is $50. The fixed costs incurred each year for factory upkeep and administrative expenses are $213,000. The machinery costs $2.4 million and is depreciated straight-line over 10 years to a salvage value of zero. a. What is the accounting break even level of sales in terms of number of diamonds sold? (Do not round Intermediate calculations.) b. What is the NPV break-even level of diamonds sold per year assuming a tax rate of 21%, a 10-year project life, and a discount rate of 14%? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Answer is complete but not entirely correct. L a. b. Break-even sales Break-even sales 9,060 16,397 diamonds per year diamonds per year