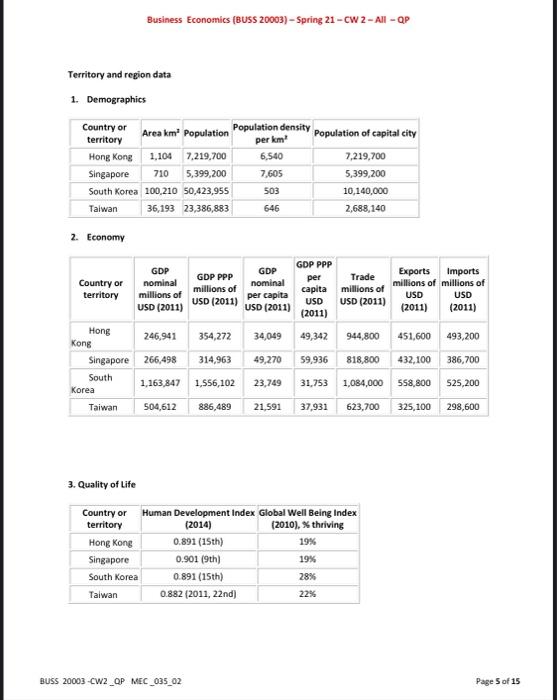

There are three questions to be attempted based on the case study and a MOOC course whose link is provided. The weightage of the answer is clearly indicated below each question. The Asian Tigers and Economic Growth Lessons The Asian Tigers or Asian Dragons is a term used in reference to the highly free and developed economies of Hong Kong, Singapore, South Korea, and Taiwan. These nations and areas were notable for maintaining exceptionally high growth rates (in excess of 7 percent a year) and rapid industrialization between the early 1960s and 1990s. By the 21st century, all four had developed into advanced and high-income economies, specializing in areas of competitive advantage. For example, Hong Kong and Singapore have become world- leading international financial centers, whereas South Korea and Taiwan are world leaders in manufacturing information technology. Their economic success stories have served as role models for many developing countries, especially the Tiger Cub Economies. Despite a World Bank report crediting neoliberal policies with the responsibility for the boom, including maintenance of export-led regimes, low taxes, and minimal welfare states, institutional analysis also states some state intervention was involved. The World Bank report acknowledged benefits from policies of the repression of the financial sector, such as state-imposed below-market interest rates for loans to specific exporting industries. However, it also pointed out free trade and less government spending were the driving force. As a result, these economies enjoyed extremely high growth rates sustained over decades. Other important aspects include major government investments in education, non-democratic and relatively authoritarian political systems during the early years of development, high levels of U.S. bond holdings, and high public and private savings rates. However this is highly debated, and many have argued that industrial policy had a much greater influence than the World Bank report suggested. A period of liberalization did occur, and the first major setback experienced by the Tiger economies was the 1997 Asian financial crisis. While Singapore and Taiwan were relatively unscathed, Hong Kong came under intense speculative attacks against its stock market and currency necessitating unprecedented market interventions by the state Hong Kong Monetary Authority, and South Korea underwent a major stock market crash brought on by high levels of non-performing corporate loans. As a result and in the years after the crisis, all four economies rebounded strongly. South Korea, the worst-hit of the Tigers, has managed to triple its per capita GDP in dollar terms since 1997. BUSS 20003 -CW2_QP MEC_035_02 Page 2 of 15 Business Economics (BUSS 20003) - Spring 21-CW 2-All-QP Overview Prior to the 1997 Asian financial crisis, the growth of these four Asian tiger economies (commonly referred to as, The Asian Miracle") has been attributed to export oriented policies and strong development policies. Unique to these economies were the sustained rapid growth and high levels of equal income distribution A World Bank report suggests two development policies among others as sources for the Asian miracle: factor accumulation and macroeconomic management. By the 1960s, levels in physical and human capital amongst the four countries far exceeded other countries at similar levels of development. This subsequently led to a rapid growth in per capita income levels. While high investments were essential to the economic growth of these countries, the role of human capital was also important. Education in particular is cited as playing a major role in the Asian miracle. The levels of education enrollment in the four Asian tigers were higher than predicted given their level of income. By 1965, all four nations had achieved universal primary education South Korea in particular had achieved a secondary education enrollment rate of 88% by 1987. There was also a notable decrease in the gap between male and female enrollments during the Asian miracle. Overall these progresses in education allowed for high levels of literacy and cognitive skills. The creation of stable macroeconomic environments was the foundation upon which the Asian miracle was built. Each of the four Asian tiger states managed to various degrees of success, three variables in: budget deficits, external debt and exchange rates. Each tiger nation's budget deficits were kept within the limits of their financial limits, as to not destabilize the macro-economy. South Korea in particular had deficits lower than the OECD average in the 1980s. External debt was non-existent for Hong Kong Singapore and Taiwan, as they did not borrow from abroad. While South Korea was the exception to this as their debt levels during 1980-1985 was quite high compared to their GNP ratios, it was sustained by the country's high levels of export. Exchange rates in the four Asian tiger nations had been changed from long-term fixed rate regimes to fixed-but-adjustable rate regimes with the occasional steep devaluation of managed floating rate regimes. This active exchange rate management allowed the four tiger economies to avoid exchange rate appreciation and maintain a stable real exchange rate. Export policies have been the de facto reason for the rise of these four Asian tiger economies. The approach taken has been different among the four nations. Hong Kong, and Singapore introduced trade regimes that were neoliberal in nature and encouraged free trade, while South Korea and Taiwan adopted mixed regimes that accommodated their own export industries. In Hong Kong and Singapore, due to small domestic markets, domestic prices were linked to international prices. South Korea and Taiwan introduced export incentives for the traded-goods sector. The governments of Singapore, South Korea and Taiwan also worked to promote specific exporting industries, which were termed as an export push strategy. All these policies helped these four nations to achieve a growth averaging 7.5% each year for three decades and as such they achieved developed country status. 1997 Asian Crisis Business Economics (BUSS 20003) - Spring 21-CW 2-A - OP The 1997 Asian financial crisis had an impact on all of the four Asian tiger economies. South Korea was hit the hardest as its foreign debt burdens swelled resulting in its currency falling between 35-50%. By the beginning of 1997, the stock market in Hong Kong, Singapore, and South Korea also saw losses of at least 60% in dollar terms. However, four Asian tiger nations recovered from the 1997 crisis faster than other countries due to various economic advantages induding their high savings rate (except South Korea) and their openness to trade 2008 Financial crisis The export oriented economies of the four Asian tiger nations which benefited from American consumption, were hit hard by the financial crisis of 2007-2008. By the fourth quarter of 2008, the GDP of all four nations fell by an average annualized rate of around 15%.Exports also fell by a 50% annualized rate. Weak domestic demand also affected the recovery of these economies. In 2008, retail sales fell 3% in Hong Kong, 6% in Singapore and 11% in Taiwan As the world recovers from the financial crisis, the four Asian tiger economies have also rebounded strongly, This is due in no small part to each country's government fiscal stimulus measures. These fiscal packages accounted for more than 4% of each country's GDP in 2009. Another reason for the strong bounce back is the modest corporate and household debt in these four nations. A recent article published in Applied Economics Letters by Financial Economist Mete Feridun of University of Greenwich Business School and his international colleagues investigates the causal relationship between financial development and economic growth for Thailand, Indonesia, Malaysia, the Philippines, China, India and Singapore for the period between 1979 and 2009, using Johansen cointergration tests and vector error correction models. The results suggest that in the case of Indonesia, Singapore, the Philippines, China and India financial development leads to economic growth, whereas in the case of Thailand there exists a bidirectional causality between these variables. The results further suggest that in the case of Malaysia financial development does not seem to cause economic growth Cultural basis The role of Confucianism has been used to explain the success of the Four Asian Tigers. This conclusion is similar to the Protestant work ethic theory promoted by German sociologist Max Weber in his book The Protestant Ethic and the Spirit of Capitalism. The culture of Confucianism is said to have been compatible with industrialization because it valued stability, hard work, and loyalty and respect towards authority figures. There is a significant influence of Confucianism on the corporate and political institutions of the Asian Tigers. Confucianism was taught in Singaporean schools until the 1990s. Confucian seminars were offered by South Korean companies like Hyundai for company management. Prime Minister of Singapore Lee Kuan Yew advocated Asian values as an alternative to the influence of Western culture in Asia. This theory was not without its critics. There was a lack of mainland Chinese economic success during the same time frame as the Four Tigers, and yet China was the birthplace of Confucianism. During the May Fourth Movement of 1919, Confucianism was blamed for China's inability to compete with Western powers. BUSS 20003-CW2_OP MEC_035_02 Page 4 of 15 Business Economics (BUSS 20003) Spring 21 -CW 2- All - OP Territory and region data 1. Demographics Country or territory Area km Population Population density Population of capital city per km Hong Kong 1.104 7,219,700 6.540 7,219,700 Singapore 710 5,399,200 7,605 5,399,200 South Korea 100,210 50,423,955 503 10,140,000 Taiwan 36,193 23,386,883 646 2,688,140 2. Economy GDP PPP GDP Trade Exports Imports millions of millions of nominal Country or territory GDP nominal millions of USD (2011) GDP PPP millions of USD (2011) millions of per capita USD (2011) per capita USD (2011) USD USD (2011) USD (2011) (2011) Hong Kong 246,941 354,272 34,049 49,342 944,800 451,600 493,200 Singapore 266,498 314,963 49,270 59,936 818,800 432,100 386,700 South 1,163,847 1,556,102 23,749 31,753 1,084,000 558,800 525,200 Korea Taiwan 504,612 886,489 21,591 37,931 623,700 325,100 298,600 3. Quality of Life Country or territory Human Development Index Global Well Being Index (2014) (2010), thriving Hong Kong 0.891 (15th) 19% Singapore 0.901 (9th) 19% South Korea 0.891 (15th) 28% Talwan 0.882 (2011, 22nd) 22% BUSS 20003-CW2_OP MEC_035_02 Page 5 of 15 Business Economics (BUSS 20003) - Spring 21 - CW 2 - All - QP Answer the following Questions: Question 1 (a) Explain the differences and similarities between economic growth and economic development, highlighting the aspects indicating Asian Tigers development with appropriate illustrations from the case context. (20 marks) (b) Discuss any four macro-economic indicators with some illustrations of the indicators from the case study. (15 marks) Question 2 Discuss the Gross Domestic Product (GDP), highlighting the components and methods of calculating GDP. (25 marks) Question 3 Discuss the theory of comparative advantage , highlighting the extent to which the Asian Tigers have benefited from exploiting national advantages and specialization of their countries in a bid to attain a high export drive. (25 marks) There are three questions to be attempted based on the case study and a MOOC course whose link is provided. The weightage of the answer is clearly indicated below each question. The Asian Tigers and Economic Growth Lessons The Asian Tigers or Asian Dragons is a term used in reference to the highly free and developed economies of Hong Kong, Singapore, South Korea, and Taiwan. These nations and areas were notable for maintaining exceptionally high growth rates (in excess of 7 percent a year) and rapid industrialization between the early 1960s and 1990s. By the 21st century, all four had developed into advanced and high-income economies, specializing in areas of competitive advantage. For example, Hong Kong and Singapore have become world- leading international financial centers, whereas South Korea and Taiwan are world leaders in manufacturing information technology. Their economic success stories have served as role models for many developing countries, especially the Tiger Cub Economies. Despite a World Bank report crediting neoliberal policies with the responsibility for the boom, including maintenance of export-led regimes, low taxes, and minimal welfare states, institutional analysis also states some state intervention was involved. The World Bank report acknowledged benefits from policies of the repression of the financial sector, such as state-imposed below-market interest rates for loans to specific exporting industries. However, it also pointed out free trade and less government spending were the driving force. As a result, these economies enjoyed extremely high growth rates sustained over decades. Other important aspects include major government investments in education, non-democratic and relatively authoritarian political systems during the early years of development, high levels of U.S. bond holdings, and high public and private savings rates. However this is highly debated, and many have argued that industrial policy had a much greater influence than the World Bank report suggested. A period of liberalization did occur, and the first major setback experienced by the Tiger economies was the 1997 Asian financial crisis. While Singapore and Taiwan were relatively unscathed, Hong Kong came under intense speculative attacks against its stock market and currency necessitating unprecedented market interventions by the state Hong Kong Monetary Authority, and South Korea underwent a major stock market crash brought on by high levels of non-performing corporate loans. As a result and in the years after the crisis, all four economies rebounded strongly. South Korea, the worst-hit of the Tigers, has managed to triple its per capita GDP in dollar terms since 1997. BUSS 20003 -CW2_QP MEC_035_02 Page 2 of 15 Business Economics (BUSS 20003) - Spring 21-CW 2-All-QP Overview Prior to the 1997 Asian financial crisis, the growth of these four Asian tiger economies (commonly referred to as, The Asian Miracle") has been attributed to export oriented policies and strong development policies. Unique to these economies were the sustained rapid growth and high levels of equal income distribution A World Bank report suggests two development policies among others as sources for the Asian miracle: factor accumulation and macroeconomic management. By the 1960s, levels in physical and human capital amongst the four countries far exceeded other countries at similar levels of development. This subsequently led to a rapid growth in per capita income levels. While high investments were essential to the economic growth of these countries, the role of human capital was also important. Education in particular is cited as playing a major role in the Asian miracle. The levels of education enrollment in the four Asian tigers were higher than predicted given their level of income. By 1965, all four nations had achieved universal primary education South Korea in particular had achieved a secondary education enrollment rate of 88% by 1987. There was also a notable decrease in the gap between male and female enrollments during the Asian miracle. Overall these progresses in education allowed for high levels of literacy and cognitive skills. The creation of stable macroeconomic environments was the foundation upon which the Asian miracle was built. Each of the four Asian tiger states managed to various degrees of success, three variables in: budget deficits, external debt and exchange rates. Each tiger nation's budget deficits were kept within the limits of their financial limits, as to not destabilize the macro-economy. South Korea in particular had deficits lower than the OECD average in the 1980s. External debt was non-existent for Hong Kong Singapore and Taiwan, as they did not borrow from abroad. While South Korea was the exception to this as their debt levels during 1980-1985 was quite high compared to their GNP ratios, it was sustained by the country's high levels of export. Exchange rates in the four Asian tiger nations had been changed from long-term fixed rate regimes to fixed-but-adjustable rate regimes with the occasional steep devaluation of managed floating rate regimes. This active exchange rate management allowed the four tiger economies to avoid exchange rate appreciation and maintain a stable real exchange rate. Export policies have been the de facto reason for the rise of these four Asian tiger economies. The approach taken has been different among the four nations. Hong Kong, and Singapore introduced trade regimes that were neoliberal in nature and encouraged free trade, while South Korea and Taiwan adopted mixed regimes that accommodated their own export industries. In Hong Kong and Singapore, due to small domestic markets, domestic prices were linked to international prices. South Korea and Taiwan introduced export incentives for the traded-goods sector. The governments of Singapore, South Korea and Taiwan also worked to promote specific exporting industries, which were termed as an export push strategy. All these policies helped these four nations to achieve a growth averaging 7.5% each year for three decades and as such they achieved developed country status. 1997 Asian Crisis Business Economics (BUSS 20003) - Spring 21-CW 2-A - OP The 1997 Asian financial crisis had an impact on all of the four Asian tiger economies. South Korea was hit the hardest as its foreign debt burdens swelled resulting in its currency falling between 35-50%. By the beginning of 1997, the stock market in Hong Kong, Singapore, and South Korea also saw losses of at least 60% in dollar terms. However, four Asian tiger nations recovered from the 1997 crisis faster than other countries due to various economic advantages induding their high savings rate (except South Korea) and their openness to trade 2008 Financial crisis The export oriented economies of the four Asian tiger nations which benefited from American consumption, were hit hard by the financial crisis of 2007-2008. By the fourth quarter of 2008, the GDP of all four nations fell by an average annualized rate of around 15%.Exports also fell by a 50% annualized rate. Weak domestic demand also affected the recovery of these economies. In 2008, retail sales fell 3% in Hong Kong, 6% in Singapore and 11% in Taiwan As the world recovers from the financial crisis, the four Asian tiger economies have also rebounded strongly, This is due in no small part to each country's government fiscal stimulus measures. These fiscal packages accounted for more than 4% of each country's GDP in 2009. Another reason for the strong bounce back is the modest corporate and household debt in these four nations. A recent article published in Applied Economics Letters by Financial Economist Mete Feridun of University of Greenwich Business School and his international colleagues investigates the causal relationship between financial development and economic growth for Thailand, Indonesia, Malaysia, the Philippines, China, India and Singapore for the period between 1979 and 2009, using Johansen cointergration tests and vector error correction models. The results suggest that in the case of Indonesia, Singapore, the Philippines, China and India financial development leads to economic growth, whereas in the case of Thailand there exists a bidirectional causality between these variables. The results further suggest that in the case of Malaysia financial development does not seem to cause economic growth Cultural basis The role of Confucianism has been used to explain the success of the Four Asian Tigers. This conclusion is similar to the Protestant work ethic theory promoted by German sociologist Max Weber in his book The Protestant Ethic and the Spirit of Capitalism. The culture of Confucianism is said to have been compatible with industrialization because it valued stability, hard work, and loyalty and respect towards authority figures. There is a significant influence of Confucianism on the corporate and political institutions of the Asian Tigers. Confucianism was taught in Singaporean schools until the 1990s. Confucian seminars were offered by South Korean companies like Hyundai for company management. Prime Minister of Singapore Lee Kuan Yew advocated Asian values as an alternative to the influence of Western culture in Asia. This theory was not without its critics. There was a lack of mainland Chinese economic success during the same time frame as the Four Tigers, and yet China was the birthplace of Confucianism. During the May Fourth Movement of 1919, Confucianism was blamed for China's inability to compete with Western powers. BUSS 20003-CW2_OP MEC_035_02 Page 4 of 15 Business Economics (BUSS 20003) Spring 21 -CW 2- All - OP Territory and region data 1. Demographics Country or territory Area km Population Population density Population of capital city per km Hong Kong 1.104 7,219,700 6.540 7,219,700 Singapore 710 5,399,200 7,605 5,399,200 South Korea 100,210 50,423,955 503 10,140,000 Taiwan 36,193 23,386,883 646 2,688,140 2. Economy GDP PPP GDP Trade Exports Imports millions of millions of nominal Country or territory GDP nominal millions of USD (2011) GDP PPP millions of USD (2011) millions of per capita USD (2011) per capita USD (2011) USD USD (2011) USD (2011) (2011) Hong Kong 246,941 354,272 34,049 49,342 944,800 451,600 493,200 Singapore 266,498 314,963 49,270 59,936 818,800 432,100 386,700 South 1,163,847 1,556,102 23,749 31,753 1,084,000 558,800 525,200 Korea Taiwan 504,612 886,489 21,591 37,931 623,700 325,100 298,600 3. Quality of Life Country or territory Human Development Index Global Well Being Index (2014) (2010), thriving Hong Kong 0.891 (15th) 19% Singapore 0.901 (9th) 19% South Korea 0.891 (15th) 28% Talwan 0.882 (2011, 22nd) 22% BUSS 20003-CW2_OP MEC_035_02 Page 5 of 15 Business Economics (BUSS 20003) - Spring 21 - CW 2 - All - QP Answer the following Questions: Question 1 (a) Explain the differences and similarities between economic growth and economic development, highlighting the aspects indicating Asian Tigers development with appropriate illustrations from the case context. (20 marks) (b) Discuss any four macro-economic indicators with some illustrations of the indicators from the case study. (15 marks) Question 2 Discuss the Gross Domestic Product (GDP), highlighting the components and methods of calculating GDP. (25 marks) Question 3 Discuss the theory of comparative advantage , highlighting the extent to which the Asian Tigers have benefited from exploiting national advantages and specialization of their countries in a bid to attain a high export drive. (25 marks)