Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*there are three required fields. Exercise 7-15 (Algo) Calculate uncollectible accounts using the aging method; record adjustments [LO75, 7-6] Zuo Software categorizes its accounts receivable

*there are three required fields.

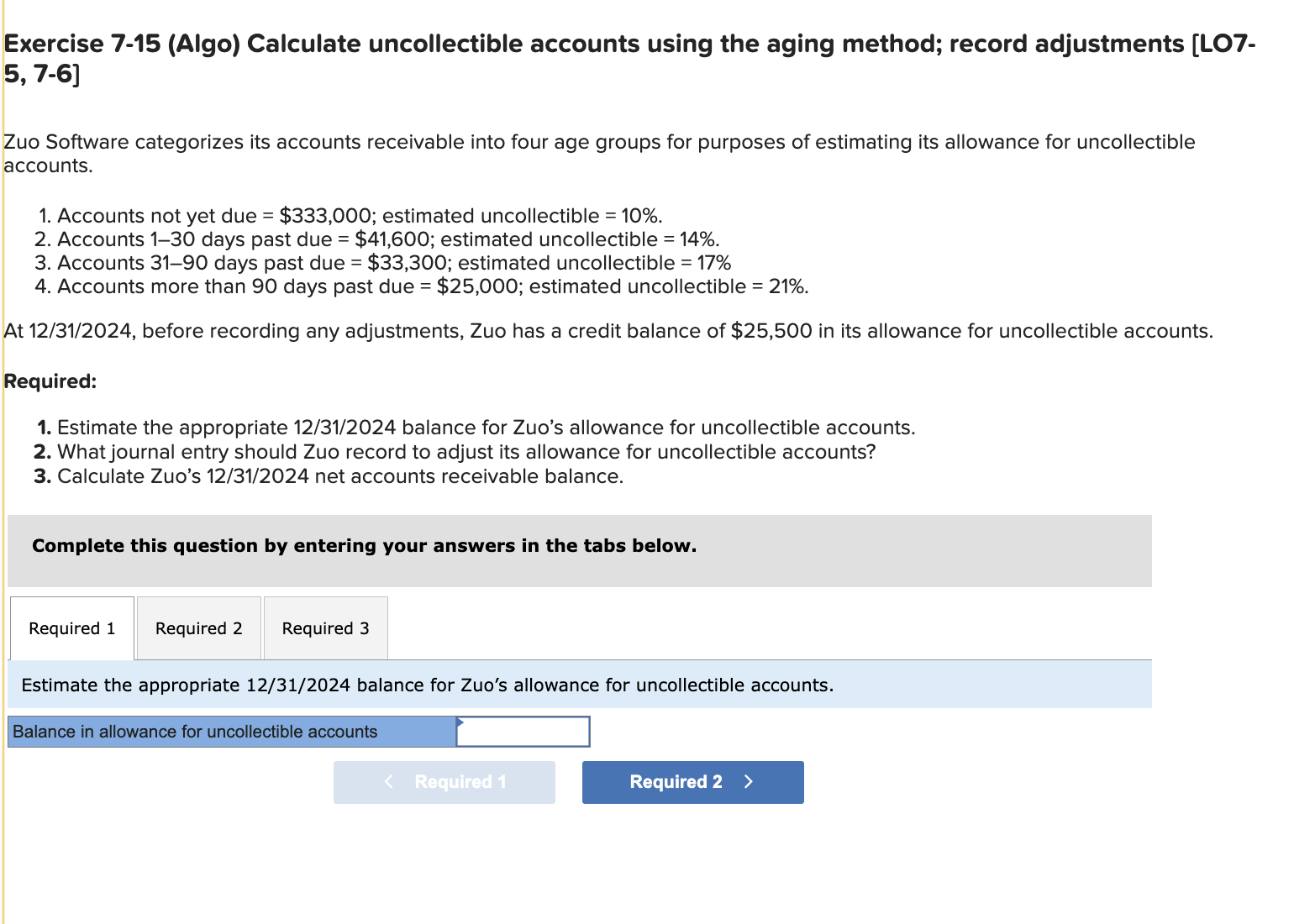

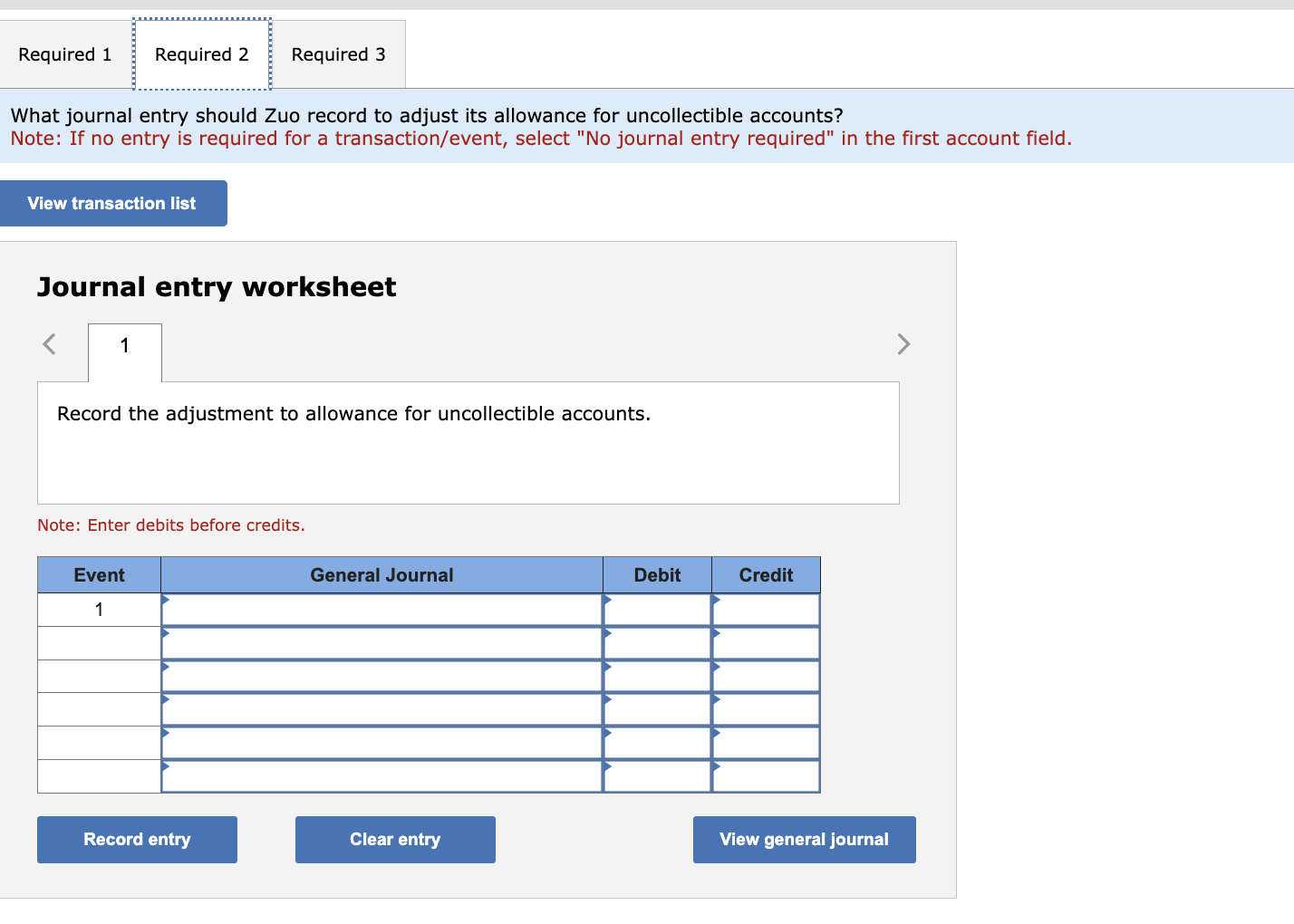

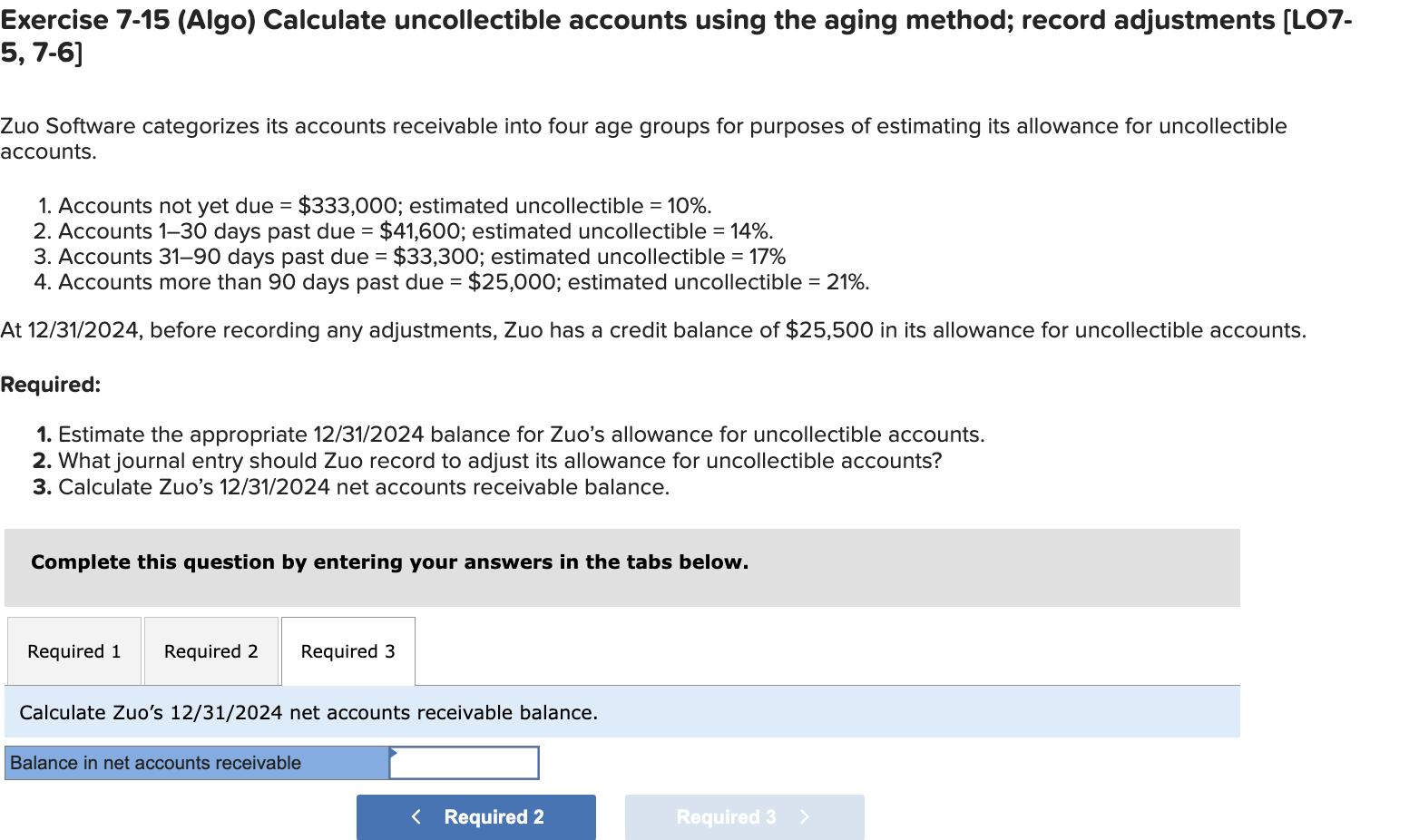

Exercise 7-15 (Algo) Calculate uncollectible accounts using the aging method; record adjustments [LO75, 7-6] Zuo Software categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due =$333,000; estimated uncollectible =10%. 2. Accounts 130 days past due =$41,600; estimated uncollectible =14%. 3. Accounts 3190 days past due =$33,300; estimated uncollectible =17% 4. Accounts more than 90 days past due =$25,000; estimated uncollectible =21%. At 12/31/2024, before recording any adjustments, Zuo has a credit balance of $25,500 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2024 balance for Zuo's allowance for uncollectible accounts. 2. What journal entry should Zuo record to adjust its allowance for uncollectible accounts? 3. Calculate Zuo's 12/31/2024 net accounts receivable balance. Complete this question by entering your answers in the tabs below. Estimate the appropriate 12/31/2024 balance for Zuo's allowance for uncollectible accounts. What journal entry should Zuo record to adjust its allowance for uncollectible accounts? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjustment to allowance for uncollectible accounts. Note: Enter debits before credits. Exercise 7-15 (Algo) Calculate uncollectible accounts using the aging method; record adjustments [L075, 7-6] Zuo Software categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due =$333,000; estimated uncollectible =10%. 2. Accounts 130 days past due =$41,600; estimated uncollectible =14%. 3. Accounts 3190 days past due =$33,300; estimated uncollectible =17% 4. Accounts more than 90 days past due =$25,000; estimated uncollectible =21%. At 12/31/2024, before recording any adjustments, Zuo has a credit balance of $25,500 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2024 balance for Zuo's allowance for uncollectible accounts. 2. What journal entry should Zuo record to adjust its allowance for uncollectible accounts? 3. Calculate Zuo's 12/31/2024 net accounts receivable balance. Complete this question by entering your answers in the tabs below. Calculate Zuo's 12/31/2024 net accounts receivable balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started